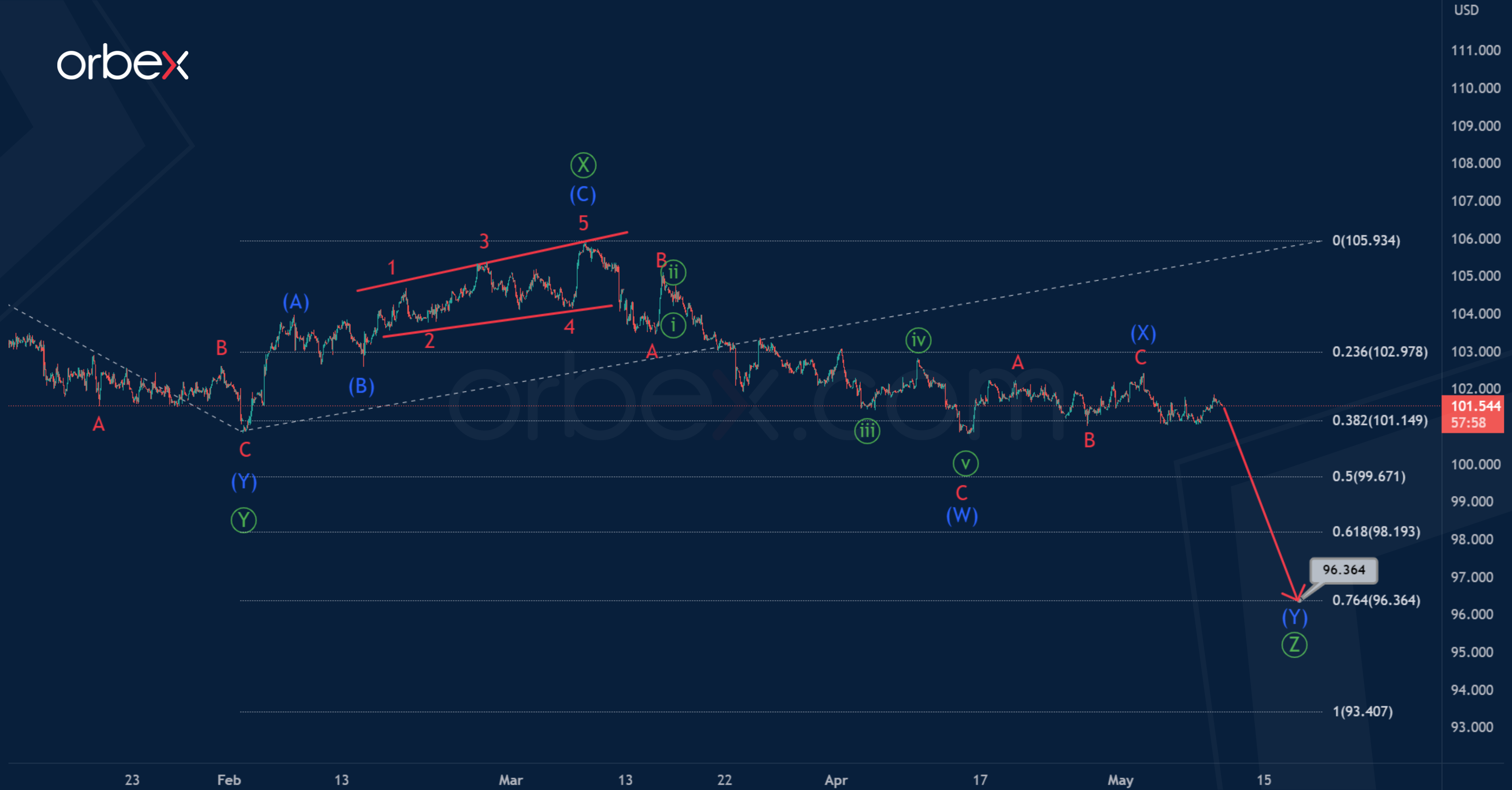

In the long term, the dollar index forms a triple zigzag. This consists of primary sub-waves Ⓦ-Ⓧ-Ⓨ-Ⓧ-Ⓩ. At the moment, the sub-waves Ⓦ-Ⓧ-Ⓨ-Ⓧ look complete. The second intervening wave Ⓧ is a standard zigzag.

Most likely, the price drop in the primary wave Ⓩ will continue in the next coming days. Judging by the internal structure, this wave can take the form of an intermediate double zigzag.

약세 패턴의 끝은 96.364 근처에서 예상됩니다. 해당 수준에서 기본 파동 Ⓩ은 파동 Ⓨ의 76.4%가 됩니다.

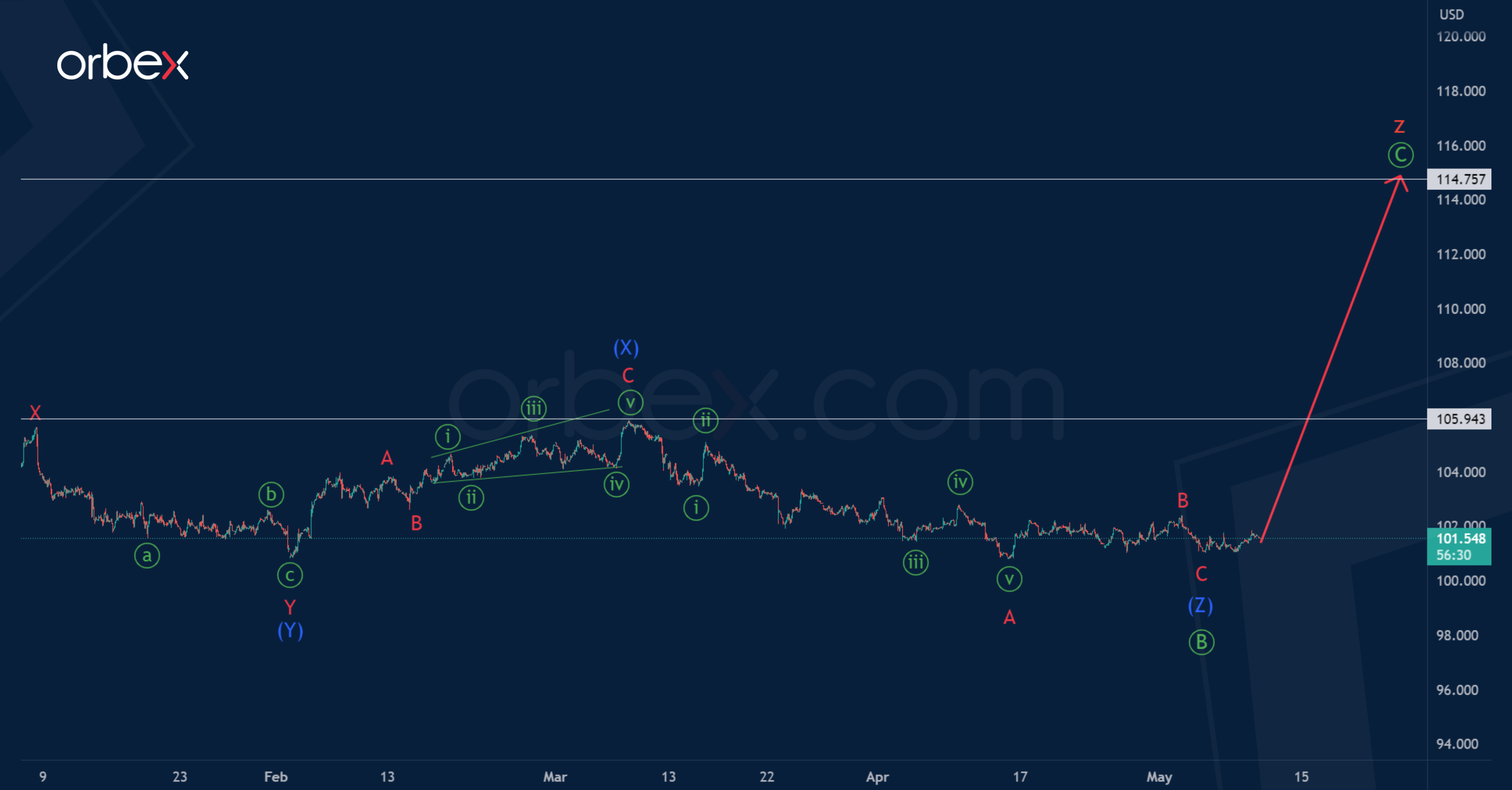

우리는 파동 z가 w-x-y-x-z 삼중 지그재그로 형성되는 대체 시나리오를 고려할 것을 제안합니다.

The structure of the wave z is similar to the zigzag Ⓐ-Ⓑ-Ⓒ. In its composition, the first impulse Ⓐ and the correction Ⓑ in the form of an intermediate double zigzag have ended. The entire wave z can end near 114.75, that is, at the maximum of the primary impulse wave Ⓐ.

However, the first target for bulls is the maximum of 105.94, which was marked by the intermediate intervening wave (X).

Orbex와 함께 DXY가 어떻게 작동할지 전략을 테스트해 보세요.

- SEO 기반 콘텐츠 및 PR 배포. 오늘 증폭하십시오.

- PlatoAiStream. Web3 데이터 인텔리전스. 지식 증폭. 여기에서 액세스하십시오.

- 미래 만들기 w Adryenn Ashley. 여기에서 액세스하십시오.

- PREIPO®로 PRE-IPO 회사의 주식을 사고 팔 수 있습니다. 여기에서 액세스하십시오.

- 출처: https://www.orbex.com/blog/en/2023/05/dxy-bearish-wave-y-breaks-100

![마스터클래스 728 x 90 [EN]](https://platoaistream.com/wp-content/uploads/2023/05/dxy-bearish-wave-y-breaks-100-1.png)