"라는 말Fintech" has become such a hype and such a widely used term, that it can actually mean anything today. Therefore when people ask for trends in the Fintech industry, this becomes harder and harder to answer, as anything even remotely

associated with financial services can be linked to Fintech.

Additionally traditional financial players (like banks, insurers, brokers, stock exchanges, but also traditional financial software vendors like Temenos, Sopra, Fiserv…) have also caught up in their digitalization and modernization roadmaps and have launched

Fintech innovation labs, meaning they can just as well be categorized under Fintech.

따라서 다음과 같이 말할 수 있습니다.

-

As 기술은 금융 서비스 산업에서 매우 중요해졌습니다., 금융 서비스 분야 전체를 핀테크로 분류할 수 있습니다.

-

으로 인해 생태계 및 임베디드 금융의 부상, financial services companies start to offer more and more services in adjacent sectors (like HR Tech, MarketingTech/MadTech, EdTech, AccountingTech…) and also players from other industries start to offer more and more financial services. E.g. big tech players like Apple (offering Apple Pay, Apple Pay Later and a credit card together with Goldman Sachs), Uber (offering Uber Wallet and Uber Debit and Credit card), Alibaba (with AliPay) or Grab (with GrabFin and products like Earn+), but also eCommerce players like Shopify (offering Shopify Capital to give fast business loans and cash advances) or TelCo players (like Safaricom’s M-Pesa, Turkcell’s Paycell, Telefónica Movistar Money or Orange Bank) have all entered the financial services sector. As a result, 핀테크 경계가 다른 분야로까지 모호해짐.

이 모든 것은 Fintech에 대해 전체적으로 말하기가 매우 어렵다는 것을 의미합니다.

상황이 너무 어수선해지면 분류 전형적인 인간의 반사입니다.

Unfortunately categorization is not that easy as you can categorize across multiples axes (based on product offering, type of customers serviced, region…) and obviously many players cannot be put in 1 category, as they provide different products and services

in different markets.

그럼에도 불구하고 분류는 여전히 전체 시장에 대한 몇 가지 흥미로운 통찰력을 제공할 수 있으므로 여전히 매우 흥미롭고 유용한 연습이 됩니다.

볼 때 분류의 다른 축, 다음 축을 식별했습니다(이 목록이 완전하지는 않지만).

도끼 1: 에 따라 분류 대상 고객군

이를 통해 핀테크 산업을 3개의 큰 그룹으로 분류할 수 있습니다.

-

직접 금융 서비스 제공자, which will target (end-) customers directly. This group can be split in B2C (e.g. neobanks like Revolut and Monzo), B2B (e.g. neobanks like Starling Bank) or even B2B2C players (i.e. offering a service to a private customer, but via a business paying for this service, e.g. Klarna) players. Often Fintech players will also target a specific customer niche, which is underserved or not sufficiently and personally addressed, e.g. freelancers (e.g. Lili), immigrants (e.g. Majority), women (e.g. Herconomy), the LGBTQ+ community (e.g. Pride bank or Daylight), specific professions (lawyers, doctors, artists…)…

-

(기타) 금융 서비스 회사를 위한 서비스 및 제품 제공업체 (like incumbent banks and insurers, but also other new (disruptive Fintech) players). This group can be split according to which companies they offer services to, i.e. services to incumbent banks, incumbent insurers, incumbent infrastructure players or new (Fintech) players. Examples in this group are the traditional financial software vendors like Temenos, Fiserv, SOPRA…, but also new players like e.g. ComplyAdvantage.

-

다른 부문의 회사에 서비스 및 제품을 제공하는 업체(고객에게 더 나은 사용자 경험을 제공하기 위해 재무 데이터 또는 서비스가 필요한 회사) 금융 서비스에 다리(통합)를 만들기 위해. Obviously this group can be split depending on which other sector they offer financial service integration services to, e.g. eCommerce, HR & Payroll Tech, MobilityTech, AccountingTech, MadTech, Real Estate Tech… Examples in this group are PSPs like Stripe, Paypal and Adyen.

도끼 2: 에 따라 분류 파괴적인 성격 회사의

-

기존 금융 서비스와 상품을 제공하는 핀테크. These are players that are typically challenging existing players by offering similar services and products but cheaper, more digital and/or with a better user experience. Often they target also specific groups which are excluded or underserved (e.g. products and services not adapted to their specific needs and desires) in the traditional financial landscape (i.e. financial inclusion). In this category, you can find the typical neo-banks or challenger banks (e.g. Revolut, Monzo, N26…), which still sell mainly traditional banking products, like current and saving accounts, credits, investments and/or debit and credit cards.

이 범주에서 예를 들어 Robinhood와 같은 거래/투자 플랫폼도 찾을 수 있습니다. -

기존 금융 서비스 상품에 가시적인 부가 가치 서비스를 제공하는 핀테크, typically offering a more guided advise and more embedded experiences. Typical examples are robo-advisors and personal financial management tools, but also financial marketplaces (e.g. Raisin for deposits) and price comparators (e.g. Financer.com).

-

핀테크는 전통적인 금융 플레이어에게 보이지 않는 백엔드 공급자 역할을 합니다.. 이 카테고리는 금융업체에 소프트웨어 및 비즈니스 처리 아웃소싱을 제공합니다.

-

대체 금융 서비스 및 제품을 제공하는 Fintechs, i.e. products and services which challenge the existing landscape in a more fundamental way, by redesigning the intermediation function of banks and insurers. Typical examples in this category are P2P lenders, crowdfunding, DeFi…

이 분류는 또한 Fintech 플레이어가 기존 플레이어의 경쟁자, 파트너 또는 공급업체.

Often Fintechs start in the first category (disrupting the market with large ambitions), but soon notice the difficulties and costs to attack the market directly and therefore pivot into partnering with existing players to profit from their existing reputation, expertise, financial means and customer basis. For the incumbent player, they offer a very quick and low risk way to offer additional innovative services to their customers.

도끼 3: 에 따라 분류 제공되는 서비스의 유형 및 확장 회사에서

분명히 소프트웨어는 항상 모든 Fintech 서비스 제공의 필수적인 부분이지만 이 소프트웨어는 다른 서비스를 제공하기 위한 주요 제품 또는 지원 도구가 될 수 있습니다.

다음을 기준으로 분할할 수 있습니다.

-

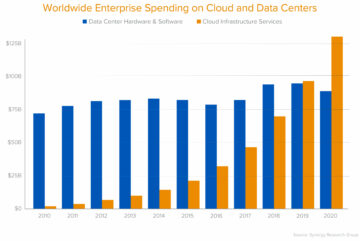

회사인가요 특정 제품 1개만 제공하거나 전체 범위 제공, e.g. a specific product could be a RegTech vendor (e.g. Chainalysis), while BaaS players (Banking as a Service, e.g. solarisBank, MangoPay, Marqeta…) typically offer a whole range of products?

-

에 중점을 두고 있습니다 소프트웨어를 판매하거나 다른 서비스를 판매할 수 있는 소프트웨어입니까?, i.e. financial services, business process outsourcing, legal/compliance/risk management…? E.g. traditional financial software providers (e.g. Temenos, SOPRA, FiServ, Infosys..) are still offering solutions deployed on-premise (or in private cloud) and via a licensing model, but more and more companies (including those traditional players) are offering their software in a SaaS (software as a service) model or even a BaaS model (Business/Banking as a Service).

-

회사도요 라이센스 사용 금융 규제 기관으로부터 취득(예: 은행 라이센스, 지불 기관 라이센스, 전자 화폐 기관 라이센스, 신용 기관 라이센스…) 상업적 제안으로?

도끼 4: 에 따라 분류 제공되는 서비스 및/또는 제품 유형

이것은 WealthTech, RegTech와 같이 Fintech라는 용어의 후속으로 매우 일반적으로 사용되며 특정 용어를 사용하는 일종의 분류입니다.

일반적인 카테고리는 다음과 같습니다.

-

뱅크테크 (Digital banking). This group contains on the one hand the disruptive neobanks like Chime, Nubank, Revolut, Monzo, Atom, N26 or Starling and on the other hand the BaaS (Banking as a Service) platforms like solarisBank, Bankable or Cambr. We could also include in this category (although often also put as a separate category) the PFM companies (Personal Financial Management), that offer advice and help with budgeting, e.g. Mint, Acorns, PocketGuard, Level Money, YNAB (You Need A Budget), Intuit, Wally…

-

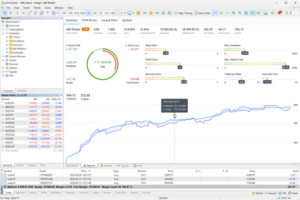

웰스 테크 (Digital Wealth Management): this contains a whole group of Fintech offerings to invest money in financial assets (like stocks, bonds…) in a better way (more user friendly, cheaper, more automated…). This category can be split-up in 2 sub-blocks, i.e.:

-

스마트 알고리즘 기술을 제공하여 투자 조언과 추천을 제공하는 RoboAdvisors. 예: Wealthfront, Acorns, Betterment, Wealthsimple, Charles Schwab, Vanguard…

-

소매 투자 플랫폼, 예: Robinhood, Tradier, E*Trade, Interactive Brokers, iCapital…

-

-

LendingTech 또는 LendTech (Credits): providing all types of new digital solutions to consumers and businesses (usually small businesses) for lending money in a more efficient and faster way (often using new technologies like AI/ML, digital identity management…). This space is enormous as well, going from P2P Lending (like LendingClub, Prosper or OnDeck) and Crowdlending platforms (like Indiegogo, Kickstarter, GoFundMe or Patreon), over BNPL (Buy Now Pay Later, like Affirm, Klarna or AfterPay) all the way to digital lenders (like Funding Circle, Kabbage, Lendio, Lending Club, SoFi or Better Mortgage), credits based on new collaterals like invoicing factoring (e.g. Bluevine, Resolve, altLine…) and alternative credit (scoring) systems (e.g. micro-lending) allowing to offer credits to the unbanked and underbanked (like Credit Karma, Nova Credit, Quizzle, Credit Sesame or Tala).

-

RegTech: this group of companies helps financial service firms via innovative technology to meet regulatory compliance and security rules, with a strong focus on AML (Anti-Money Laundering), KYC (Know Your Customer protocols) and all financial directives like Basel II/III/IV, FATCA, MiFID, Solvency II… Often those companies provide also access to large amounts of financial research and data, used to verify compliance of customers and transactions. Examples are companies like Alyne, Suade, DataGuard, ComplyAdvantage, Fenergo, Onfido, Chainalysis, Ascent Regtech, Hummingbird…

-

InsurTech: these companies seek to use technical innovation to simplify and streamline the insurance business model. Typically they focus on delivering insurance quotes online in a matter of minutes , digitize the whole claim management process and provide alternative insurance underwriting (using new data sources), e.g. Usage Based Insurance (UBI). Examples are companies like Oscar Health, Gusto, Clover Health, Lemonade, Qover, Digit Insurance, Policy Bazaar…

-

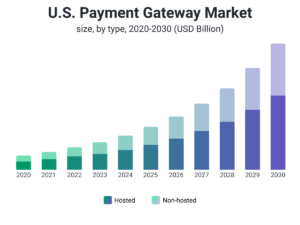

페이 텍 (Payment technology): these companies provide different tools to make payment transactions as secure and efficient (frictionless) as possible. A lot of well-known (Fintech) names are in this space, like Paypal, VISA, MasterCard, Stripe, Venmo, AliPay, Adyen, Mollie, Square, Wise, Ripple, iZettle… This category can be split in players that

-

POS 장치와 온라인(예: Stripe, Paypal, VIVA Wallet, Adyen, Mollie, SumUp…)을 통해 물리적으로 판매자를 위한 지불을 촉진합니다.

-

Venmo, Payconiq, AliPay와 같은 새로운 모바일 결제 솔루션(P2P 및 가맹점 포함) 제공…

-

Wise 또는 Ripple과 같은 국제 송금을 용이하게 합니다.

-

-

인프라 플레이어 who provide the underlying gateways and connectivity to other players in the industry (other banks, stock exchanges, data providers, regulatory instances…). Important in this group are the players offering services to enable and consume Open Banking, like Tink, Plaid or TrueLayer.

-

인프라 플레이어 who provide the underlying gateways and connectivity to other players in the industry (other banks, stock exchanges, data providers, regulatory instances…). Important in this group are the players offering services to enable and consume Open Banking, like Tink, Plaid or TrueLayer.

-

암호화폐, 블록체인 및 DeFi 플레이어: this group contains all companies building a new financial (eco)system, based on a distributed ledger technology (blockchain). This ecosystem is very disruptive, as it challenges the ground rules of our financial system. Companies like Coinbase, Alchemy, Ava Labs, Circle, Kraken, Binance, Gemini Cryptocurrency are most known in this space. Obviously this space can be split-up in multiple sub-categories like crypto-currency exchanges/trading platforms, crypto-wallet providers, NFT marketplaces, crypto-saving and crypto-lending players, players offering tooling to setup new blockchains…

도끼 5: 에 따라 분류 국가 및/또는 지역 회사가 주로 활동하는 곳(수익 창출).

분명히 우리는 대륙, 지역 및/또는 개별 국가를 기반으로 분할할 수 있지만 규제 및 문화의 공통된 특성을 기반으로 하는 혼합을 자주 봅니다.

먼저 몇 가지가 있습니다 국가 which due to their size (both in population and general economy, but often also more specifically due to their size of their financial services sector) and specifics. In the first place we identify here the US (main hubs in Silicon Valley, e.g. Stripe, Coinbase, Chime, Plaid, Paypal or Robinhood and New York, e.g. Better.com, Oscar, Chainalysis or Betterment), China (main hub: Beijing, e.g. Waterdrop, Ant Financial, Tencent or Lufax), India (main hub: Bengaluru, e.g. Razorpay, Digit Insurance or CRED) and Russia (main hub: Moscow, e.g. Tinkoff, Sber Bank or Yandex.Money), but we can also include Canada (main hub: Toronto, e.g. Wealthsimple, FreshBooks or Clearco), Australia (main hub: Melbourne, e.g. Afterpay or Airwallex), the UK (main hub: London, e.g. Checkout.com, Revolut, OakNorth or Blockchain.com) and even Israel(main hub: Tel Aviv, e.g. eToro) in this list.

그런 다음이 있습니다 지역, with a lot of commonalities, where often Fintechs active in one country will quite fast expand to other countries in that same region, e.g. South-East Asia (main hubs in Singapore, e.g. Arttha, Go-Jek or Coda Payments, Hong Kong, e.g. Amber Group or Babel Finance and Jakarta in Indonesia, e.g. OVO, Mandiri or Linkaja), the Middle East(main hubs in Dubai, e.g. Souqalmal.com or Beehive and Abu Dhabi, e.g. NymCard), LatAm (main hub: São Paulo Brasil, e.g. Nubank, C6 Bank or Creditas), the European Union (main hubs in Paris, e.g. Qonto, Sorare, Alan or Ledger, Amsterdam/The Hague, e.g. Adyen, Mollie, Mambu or Bunq, Berlin, e.g. N26, wefox or Trade Republic, Dublin, e.g. Stripeo or WordRemit and Vilnius Lithuania, e.g. Kevin, Nordigen or Bankera), Scandinavia (main hub: Stockholm, e.g. Klarna) or Africa (main hubs in Johannesburg South Africa, e.g. Prosperian Capital or Pineapple, LagosNigeria, e.g. Opay, Flutterwave or Paga and Nairobi Kenia, e.g. Abacus or CarePay).

이것이 Fintech 산업이 어떻게 분류될 수 있는지에 대한 아이디어를 제공할 수 있기를 바랍니다. 핀테크 스타트업으로서 자신이 어떤 범주에 속해 있는지 아는 것이 중요합니다. 오늘 그리고 중장기적으로 어떤 (인접한) 범주를 열망하고 있는지.

Opportunistic pivoting might also be required. E.g. many Fintechs start in a disruptive model (competing against incumbents), but gradually transform to a partner/supplier model with incumbents. E.g. A lot of neobanks are focusing strongly on a BaaS model (e.g.

Starling bank "Starling as a Service" or Fidor bank) or certain PFM apps have switched in offering infrastructure and value-added services directly to banks (e.g. Tink or Cake). But the opposite can exist as well, i.e. Fintechs offering value-added services

can become so successful, that they can start expanding to all banking services and products.

명백하게 각 범주에는 고유한 복잡성이 있습니다.. A business model based on an improving of existing products and services means a lot of competition and thus a lot of upfront investment to stand out of all other players (cfr. neobanks), while alternative or innovative products mean less competition, but require a challenging and pioneering journey (on technology, marketing and legal/regulatory domains) of convincing customers of the need of the product (shaping a new market).

내 모든 블로그를 확인하십시오. https://bankloch.blogspot.com/