If there’s a truth about the crypto market that rookie and experienced investors can agree upon, it’s confusing to grasp and full of surprises.

With external factors such as market sentiment and interest rates influencing how cryptocurrencies’ trajectories evolve, more is needed than price predictions and a basic understanding of the area to make better-informed decisions.

Bull runs have always been long-debated, with camps being split into two categories. Some attest that bull runs are inevitable, always following bear markets. On the other hand, other investors are put off by remarkable price declines, shifting their focus towards other alternatives when cryptocurrency values drop. While the market was marked by falling prices last year and saw investors rush to get rid of their crypto holdings, the same can’t be said about the current times.

Cryptocurrencies는 좋아한다. 비트코인 그리고 이더리움은 2023년에 강력한 출발을 했고, 많은 사람들이 연초부터 이미 도달한 심리적 지표를 다시 깨기 위해 고군분투하고 있습니다.

Experts consider the last year to be the worst bear market so far. While it may be difficult to believe that the next bull run will be the most explosive one so far, considering the market’s poor performance last year, some signs and upcoming events may prove the opposite.

Many experts believe the anticipated bull run will surpass the ones witnessed throughout history. Bitcoin halvings are generally connected to bull runs, while the launch of Ethereum 2.0 is poised to have a transformative impact on the market. Here’s what one should anticipate and the insights underpinning this brave prediction.

비트 코인 이분법

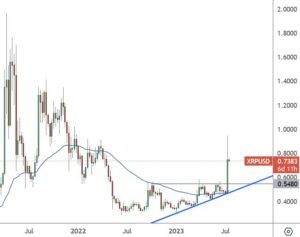

Generally, Bitcoin halvings have a history of preceding bull runs. They happened a year before remarkable bull markets emerged and tended to display different trends, with certain sectors overtaking others. So far, all three Bitcoin halvings, namely those in 2020, 2016, and 2012 have preceded bear markets in the following years, namely 2013, 2017, and 2021. If the pattern continues, we could expect another growth market by the end of 2024 and well into 2025, pushing investors and traders to accumulate cryptocurrencies and take a different approach than the one that’s been reticent and negative towards the cryptocurrency market. This increase may bring the cryptocurrencies’ values to staggering heights, improving market sentiment and rewarding those who have bought the dip in hopes of a market recovery.

Bear markets don’t emerge out of the blue, and it’s impossible to predict with complete accuracy whether they will retake place or when they may happen. Generally, they are a consequence of the fact that Bitcoin rewards are cut in half, which limits the selling pressure from miners and leads to supply scarcity. This may boost demand if investors think the minimized supply will bring prices up in the future. Additionally, halving events create a lot of buzz and are embraced by plenty of media coverage, which boosts the audience’s interest in digital currencies.

강세장에 반감기가 꼭 필요한가요?

While past bull markets are historically associated with the three Bitcoin halvings that have occurred so far, which have played a critical role in triggering significant price surges, these phenomena aren’t imperative for bullish momentum. The four-year cycle theory may be widely recognized as a catalyst for bull runs. Still, it’s critical to understand that more external factors regarding the market’s progress are coming into play.

오늘날 시장에는 비트코인의 활동 방식에 관계없이 작동하는 고유한 기능, 사용 사례 및 주기를 갖춘 다양한 토큰과 코인이 풍부합니다. 이러한 다양한 다양성은 NFT 및 DeFi 수확량 농업과 같은 다양한 하위 범주를 통해 선도적인 코인과 4년 주기를 넘어서 수익과 성장을 위한 길을 열었습니다.

Some cryptocurrencies may explode at the same time that others stagnate, so a bull run isn’t guaranteed to cover every asset. For instance, the meme coin Pepe has witnessed impressive, bullish momentum while most other cryptocurrencies stood still. This example outlines how market dynamics move, enabling different projects to evolve independently of Bitcoin’s evolution.

Therefore, it’s essential to stay up-to-date with changing regulatory landscapes, media coverage, investor sentiment, and other elements that impact how price trajectories are moving, as well as monitor the market and take advantage of the tools the DeFi world provides for better decision-making.

에테 리엄 2.0

While Ethereum 2.0 was projected to debut sometime now, the final technicalities are yet to be completed, postponing its launch to a later date expected in 2024 or by the end of 2023 in the best-case scenario. After sharding, Ethereum is expected to improve energy efficiency, security, and scalability significantly. Its roadmap includes adjustments and changes that will transform and make the network better performing and more accessible. On the contrary, despite all the enhancements, it is not anticipated that the transition will address the network’s high gas fees right away. Some upgrades’ effects are seen after a while, taking time to show results.

Analysts and pundits believe Ethereum 2.0 may kickstart a bull run and boost the coin’s appeal as the existent supply will be cut, and it will adopt a “net-deflationary” nature. The debut of Ethereum 2.0 may attract the attention of more investors and traders, including financial institutions and large Ethereum holders (whales). Large amounts may be accumulated in the pre-launch period, boosting demand and fueling prices.

The upcoming network improvements will likely draw in more users, developers, and investors, positively impacting the coin’s performance and the whole crypto market. Predictions are that Ethereum 2.0 may fuel a bull run similar to Bitcoin’s halving and that the two poster coins will pave the way for what’s expected to be the most remarkable bull runs in history.

최종 단어

Ethereum 2.0 represents a highly anticipated and transformative network upgrade aimed at solving long-standing scalability challenges while sending Ethereum into a new era of growth. Bitcoin’s halvings, on the other hand, have to date been linked to bull markets, validating the principles of the four-year cycle theory.

The two top-performing cryptocurrencies are set to undergo significant transformations that may potentially enhance the overall market’s dynamics, so keep an eye on the trends to better understand their performance.

고지 사항: 여기에 포함된 정보는 귀하의 개인적인 상황을 고려하지 않고 제공되므로 금융 조언, 투자 추천 또는 암호화폐 거래 제안 또는 권유로 해석되어서는 안 됩니다.

- SEO 기반 콘텐츠 및 PR 배포. 오늘 증폭하십시오.

- PlatoData.Network 수직 생성 Ai. 자신에게 권한을 부여하십시오. 여기에서 액세스하십시오.

- PlatoAiStream. 웹3 인텔리전스. 지식 증폭. 여기에서 액세스하십시오.

- 플라톤ESG. 자동차 / EV, 탄소, 클린테크, 에너지, 환경, 태양광, 폐기물 관리. 여기에서 액세스하십시오.

- PlatoHealth. 생명 공학 및 임상 시험 인텔리전스. 여기에서 액세스하십시오.

- 차트프라임. ChartPrime으로 트레이딩 게임을 향상시키십시오. 여기에서 액세스하십시오.

- BlockOffsets. 환경 오프셋 소유권 현대화. 여기에서 액세스하십시오.

- 출처: https://www.bitrates.com/news/p/bitcoins-halving-and-ethereum-20-may-catalyze-the-most-explosive-bull-run-to-date

- :있다

- :이다

- :아니

- $UP

- 2012

- 2013

- 2016

- 2017

- 2020

- 2021

- 2023

- 2024

- 2025

- 60

- a

- 소개

- 얻기 쉬운

- 모으다

- 누적 된

- 또한

- 주소

- 조정

- 채택

- 이점

- 조언

- 후

- 겨냥한

- All

- 이미

- 대안

- 항상

- 금액

- an

- 및

- 다른

- 예상

- 예상

- 어떤

- 항소

- 접근

- 있군요

- 지역

- AS

- 유산

- 관련

- At

- 주의

- 유치

- 청중

- 떨어져

- 기본

- BE

- 곰

- 시장 곰

- 베어 마켓

- 된

- 전에

- 처음

- 존재

- 믿으세요

- BEST

- 더 나은

- 그 너머

- 빈스

- 비트코인

- 비트 코인 보상

- blockchain

- 파란색

- 후원

- 증폭

- 향상

- 구입

- 무릅 쓰다

- 가져

- 황소

- 황소 실행

- Bullish

- by

- CAN

- 가지 경우

- 촉매

- 촉매

- 카테고리

- 어떤

- 과제

- 변경

- 변화

- 상황

- 동전

- 코인

- 오는

- 완전한

- 진행완료

- 혼란

- 연결

- 고려

- 치고는

- 포함

- 계속

- 반대로

- 수

- 엄호

- 적용 범위

- 만들

- 임계

- 암호화는

- 암호화 시장

- 크립토 통화를

- 암호 화폐

- cryptocurrency market

- 통화

- Current

- 절단

- 주기

- 주기

- 날짜

- 데뷔

- 의사 결정

- 결정

- 감소

- DeFi

- 전달

- 수요

- 무례

- 개발자

- 다른

- 어려운

- 디지털

- 디지털 통화

- 찍어

- 직접

- 디스플레이

- 특유의

- 하기

- 돈

- 무승부

- 드롭

- 역학

- 마다

- 효과

- 효율성

- 요소

- 이메일

- 포옹

- 벗어나 다

- 등장

- 가능

- end

- 에너지

- 에너지 효율

- 강화

- 향상

- 대

- 필수

- 이더리움

- 에테 리엄 2.0

- 이벤트

- 모든

- 진화

- 진화시키다

- 예

- 기대

- 기대하는

- 경험

- 전문가

- 전문가들은 믿는다.

- 외부

- 눈

- 사실

- 요인

- 전도

- 멀리

- 농업

- 특징

- 지우면 좋을거같음 . SM

- 최후의

- 금융

- 재정적 조언

- 금융 기관

- 먼저,

- 초점

- 수행원

- 럭셔리

- 무료

- 에

- 연료

- 가득 찬

- 미래

- 가스

- 가스 요금

- 일반적으로

- 얻을

- 점점

- 있어

- 파악

- 성장

- 보장

- 반

- 이등분

- 손

- 발생

- 일이

- 있다

- 높이

- 여기에서 지금 확인해 보세요.

- 여기

- 높은

- 고도로

- 역사적으로

- history

- 홀더

- 지주

- 희망

- 가장 인기있는

- 방법

- HTTPS

- if

- 영향

- 영향을주는

- 피할 수 없는

- 불가능한

- 인상

- 개선

- 개량

- 개선

- in

- 포함

- 포함

- 증가

- 독립하여

- 피할 수없는

- 영향을 미치는

- 정보

- 통찰력

- 예

- 기관

- 관심

- 금리

- 으로

- 투자

- 투자자

- 투자 심리

- 법률

- Isn

- IT

- 그

- 유지

- 넓은

- 성

- 작년

- 후에

- 시작

- 지도

- 오퍼

- 처럼

- 아마도

- 제한

- 연결

- 오랫동안 서있는

- 롯

- 확인

- .

- 두드러진

- 시장

- 시장 정서

- 시장

- XNUMX월..

- 미디어

- 언론 보도

- 뮘

- 밈 동전

- 광부

- 기세

- 모니터

- 배우기

- 가장

- 움직임

- 움직이는

- 즉

- 자연

- 필요

- 부정

- 네트워크

- 신제품

- news

- MMCC 뉴스레터

- 다음 것

- NFTs

- 지금

- 발생

- of

- 오프

- 제공

- on

- 일단

- ONE

- 사람

- 반대

- or

- 기타

- 기타

- 우리의

- 아웃

- 요점

- 전체

- 과거

- 무늬

- 포장길

- 페페

- 성능

- 실행할 수 있는

- 기간

- 확인

- 장소

- 플라톤

- 플라톤 데이터 인텔리전스

- 플라토데이터

- 연극

- 경기

- 많은

- 균형 잡힌

- 가난한

- 포스터

- 잠재적으로

- 예측

- 예측

- 예측

- 압박

- 가격

- 학비 안내

- 원칙

- 개인 정보 보호

- 이익

- 진행

- 돌출한

- 프로젝트

- 증명

- 제공

- 제공

- 미는

- 놓다

- 거주비용

- 도달

- 인정

- 추천

- 회복

- 에 관한

- 관계없이

- 규정하는

- 주목할 만한

- 대표

- 결과

- 보람

- 보상

- 구하다

- 연락해주세요

- 로드맵

- 직위별

- 달리기

- 실행

- 돌진

- s

- 가장 안전한 따뜻함

- 말했다

- 같은

- 본

- 확장성

- 부족

- 대본

- 섹션

- 부문

- 보안

- 본

- 판매

- 전송

- 감정

- 세트

- 샤딩

- 이동

- 영상을

- 표시

- 상당한

- 크게

- 안전표시

- 비슷한

- 이후

- So

- 지금까지

- 간원

- 해결

- 일부

- 분열

- 스타트

- 유지

- 아직도

- 이야기

- 강한

- 고민

- 가입

- 가입자

- 이러한

- 공급

- 서지

- 능가

- 놀라움

- T

- 받아

- 복용

- 보다

- 그

- XNUMXD덴탈의

- 지역

- 미래

- 그들의

- 이론

- 그곳에.

- 따라서

- Bowman의

- 그들

- 생각

- 이

- 그

- 세

- 도처에

- 시간

- 시대

- Title

- 에

- 토큰

- 검색을

- 에 대한

- 상인

- 거래 내역

- 변환

- 변환

- 변형

- 전이

- 트렌드

- 트리거링

- 진실

- 두

- 받다

- 토대

- 이해

- 이해

- 최신의

- 곧 출시

- 업그레이드

- 업그레이드

- ...에

- us

- 사용

- 사용자

- 검증

- 가치

- 마케팅은:

- 종류

- 필수

- 였다

- 방법..

- we

- 잘

- 고래

- 뭐

- 언제

- 여부

- 어느

- 동안

- 누구

- 모든

- 넓은

- 크게

- 의지

- 과

- 없이

- 목격

- 작업

- 세계

- 가장 나쁜

- 작가

- year

- 년

- 아직

- 수율

- 수확량 농업

- 너의

- 제퍼 넷