今後のイベント:

- 月曜日: 日本鉱工業生産、NZ CPI、人民銀行 MLF。

- 火曜日:RBA会議議事録、英国雇用統計、ドイツZEW、カナダCPI、米国小売売上高、米国製造業生産、米国NAHB住宅市場指数。

- Wednesday: 中国のGDP、中国の鉱工業生産、中国の小売売上高、中国の失業率、英国のCPIとPPI、米国の住宅着工件数と建築許可。

- 木曜日:オーストラリアの雇用統計、米国の失業保険申請状況、パウエルFRB議長が講演。

- 金曜日:日本のCPI、PBoC LPR、英国の小売売上高、カナダの小売売上高。

月曜日

The New Zealand CPI Y/Y is expected to

tick lower to 5.9% vs. 6.0% prior, while the Q/Q figure is seen at 2.0% vs.

1.1% prior. The elevated inflation rate is mainly due to the sharp rise in fuel

prices. Unless we get a big upside surprise, the RBNZ is unlikely to respond

with another rate hike as it has stated that it’s ready to look through the

short-term “noise”.

ニュージーランドCPI前年比

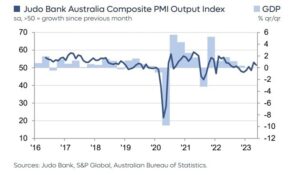

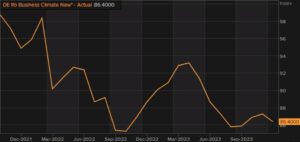

The PBoC is likely to keep the MLF and LPR

rates unchanged on Monday and Friday respectively as the economic outlook has

started to improve a little as seen with the latest PMI

図。 一方、 インフレ

図 last week disappointed, which might

give them space to go for another rate cut, although the monthly reading has

been positive for the last 3 months.

PBoC

火曜日

The UK employment change is expected at

-195K vs. -207K prior and the unemployment rate to remain unchanged at 4.3%.

The average earnings excluding bonus are seen at 7.8% vs. 7.8% prior, while the

average earnings including bonus are expected at 8.3% vs. 8.5% prior.

BoE has paused at the last meeting and, as 知事

Bailey has stated recently,

“future decisions are going to be tight”,

so strong readings might lead to another rate hike at the upcoming meeting,

especially if the inflation data surprises to the upside later in the week.

英国の失業率

カナダのCPI前年比は4.0%と予想される

vs. 4.0% prior, while the M/M figure is seen at 0.1% vs. 0.4% prior. There’s no

consensus at the moment for the Core measures, although those are the ones

that the BoC will look at to decide what to do at the next week’s meetingにつきましてはあまり気にしないでください。

a reminder, underlying inflation has been surprising to the upside and that’s

何か 可能性が高い

to trigger another rate hike

今週の数値が引き続き高ければ、BoC からの発表となる。

カナダのインフレ対策

米国小売売上高 M/M は、

rise 0.3% vs. 0.6% prior, while the Core measure is seen at 0.2% vs. 0.6%

prior. Watch out for the Control Group, which is seen as the best gauge of

個人消費。 This report is unlikely to change anything for the Fed as

the central bank is expected to keep rates unchanged at the November decision

同じように.

米国小売売上高前年比

Wednesday

英国のCPI前年比は6.5%と予想されています。

6.7% prior, while the M/M figure is seen at 0.4% vs. 0.3% prior. The Core CPI

Y/Y is expected at 6.0% vs. 6.2% prior, while there’s no consensus at the

moment for the monthly rate. The BoE is likely to look through an upside

surprise in the inflation data if the labour market report shows weakness.

On the other hand, if both the reports show strength, then we are likely to see

another rate hike at the upcoming meeting.

英国コアCPI前年比

木曜日

The US Jobless Claims have been showing

strength for several weeks. 姓

週間 though, we got a miss in Continuing

Claims, which measures ongoing unemployment benefits and can be viewed as an

indicator of how easily workers can find another job after getting unemployed. It

could be something or it could be nothing, but it’s certainly worth to keep an

目を向ける. This week the consensus sees Initial Claims at 213K vs. 209K prior,

while there’s no consensus on Continuing Claims at the time of writing.

米国の失業中の請求

金曜日

日本のコアCPI前年比は次のように予想されます。

2.7% vs. 3.1% prior, while there’s no consensus at the moment for the Core-Core

figure and the Headline CPI, which were previously 4.3% and 3.2% respectively.

The Tokyo CPI, which is seen as a leading indicator for national CPI,

disappointed recently and, although the 日銀

is going to revise its inflation forecasts higher,

they are unlikely to normalise their monetary policy unless they see

sustained wage growth or big upside surprises in the inflation data.

日本のコアコアCPI前年比

- SEO を活用したコンテンツと PR 配信。 今日増幅されます。

- PlatoData.Network 垂直生成 Ai。 自分自身に力を与えましょう。 こちらからアクセスしてください。

- プラトアイストリーム。 Web3 インテリジェンス。 知識増幅。 こちらからアクセスしてください。

- プラトンESG。 カーボン、 クリーンテック、 エネルギー、 環境、 太陽、 廃棄物管理。 こちらからアクセスしてください。

- プラトンヘルス。 バイオテクノロジーと臨床試験のインテリジェンス。 こちらからアクセスしてください。

- 情報源: https://www.forexlive.com/news/weekly-market-outlook-16-20-october-20231015/

- :持っている

- :は

- 1

- 2%

- 26

- 7

- 8

- a

- 後

- しかし

- an

- および

- 別の

- 何でも

- です

- AS

- At

- オーストラリア

- 平均

- ベイリー

- 銀行

- BE

- き

- 利点

- BEST

- ビッグ

- 中国銀行

- 英中銀

- ボーナス

- 両言語で

- 建物

- 焙煎が極度に未発達や過発達のコーヒーにて、クロロゲン酸の味わいへの影響は強くなり、金属を思わせる味わいと乾いたマウスフィールを感じさせます。

- 缶

- カナダ

- カナダCPI

- カナダの小売販売

- 中央の

- 中央銀行

- 確かに

- 椅子

- 変化する

- 中国

- 中国の小売販売

- クレーム

- コンセンサス

- consumer

- 連続

- コントロール

- 基本

- 可能性

- 消費者物価指数

- カット

- データ

- 決めます

- 決定

- 決定

- do

- 原因

- 利益

- 簡単に

- 経済

- 高い

- 雇用

- 特に

- 除外

- 予想される

- 目

- FRBは

- FRB議長

- 連邦準備制度理事会パウエル

- フィギュア

- フィギュア

- もう完成させ、ワークスペースに掲示しましたか?

- 予想

- 金曜日

- から

- ガソリンタンク

- ゲージ

- 国内総生産

- ドイツ語

- 取得する

- 受け

- 与える

- Go

- 行く

- だ

- グループ

- 成長性

- ハンド

- 持ってる

- 見出し

- ハイキング

- 住宅

- 住宅市場

- 認定条件

- HTTPS

- if

- 改善します

- in

- 含めて

- index

- インジケータ

- インダストリアル

- 工業生産

- インフレ

- インフレ率

- 初期

- IT

- ITS

- 日本

- 日本語

- ジョブ

- 失業中の請求

- Jobs > Create New Job

- ジョブレポート

- JPG

- キープ

- 労働

- 姓

- 後で

- 最新の

- つながる

- 主要な

- 可能性が高い

- 少し

- 見て

- 下側

- LPR

- 主に

- 製造業

- 市場

- 市場の見通し

- 市場レポート

- だけど

- 措置

- ご相談

- かもしれない

- 分

- ミス

- MLF

- 瞬間

- 月曜日

- 金銭的な

- 金融政策

- monthly

- ヶ月

- 国民

- 新作

- ニュージーランド

- 次の

- いいえ

- 何も

- 11月

- 10月

- of

- on

- もの

- 継続

- or

- その他

- でる

- Outlook

- 一時停止

- PBOC

- 人民銀行LPR

- 人民銀行MLF

- 許可

- プラトン

- プラトンデータインテリジェンス

- プラトデータ

- 方針

- 正の

- パウエル

- PPI

- 前に

- 価格、またオプションについて

- 事前の

- 生産

- レート

- 利上げ

- 価格表

- RBA

- RBNZ

- リーディング

- 準備

- 最近

- 残る

- リマインダー

- レポート

- レポート

- それぞれ

- 反応します

- 小売

- 小売売上高

- 修正します

- 上昇

- セールス

- 見て

- 見て

- いくつかの

- シャープ

- 短期

- 表示する

- 表示

- 作品

- So

- 何か

- スペース

- スピークス

- 支出

- 開始

- 開始

- 明記

- 力

- 強い

- 驚き

- 驚き

- 驚くべき

- 持続する

- それ

- 連邦機関

- アプリ環境に合わせて

- それら

- その後

- 彼ら

- この

- 今週

- しかし?

- 介して

- ダニ

- 時間

- 〜へ

- 東京

- 東京CPI

- トリガー

- Uk

- 英国の消費者物価指数

- 英国の雇用

- 英国の小売販売

- 根本的な

- 失業

- 失業率

- ありそうもない

- 今後の

- アップサイド

- us

- 米国の住宅

- 米国の住宅が始まる

- 米国の失業中の請求

- 米国NAHB住宅市場指数

- 米国の小売販売

- 閲覧

- vs

- 賃金

- よく見る

- we

- 週間

- weekly

- ウィークス

- した

- この試験は

- 何ですか

- which

- while

- 意志

- 労働者

- 価値

- 書き込み

- ニュージーランド

- ゼファーネット