- The dollar is on track for its most significant monthly gain since September.

- Investors will closely watch for any hints from Fed Chair Jerome Powell regarding the possibility of a rate cut in March.

- Analysts predict that Canadian GDP will show a 0.1% increase in November.

In today’s USD/CAD price analysis, the scales tilt slightly in favor of the bulls as the dollar edges higher in anticipation of the upcoming FOMC policy meeting. The greenback is gearing up for an impressive monthly surge, set to mark its most substantial gain since September.

-האם אתה מעוניין ללמוד עוד על ברוקרים של תעודות סל? עיין במדריך המפורט שלנו-

Meanwhile, Tuesday’s Canadian dollar reached a two-week high against its US counterpart. However, the gains were modest, occurring a day before domestic GDP data.

According to Kyle Chapman, an FX markets analyst at Ballinger & Co in London, the Canadian currency has been influenced positively by rallying equities and improved sentiment throughout the week. However, it faced resistance at the 1.34 level. Notably, with the looming Fed decision and GDP data, traders have been cautious about pushing it higher.

Markets expect the Fed to keep rates unchanged after its two-day policy meeting on Wednesday. Moreover, investors will closely watch for any hints from Fed Chair Jerome Powell regarding the possibility of a rate cut in March. Interest rate futures show a roughly 43% chance of a Fed rate cut in March. This is a decrease from 73% at the beginning of the year.

Meanwhile, analysts predict that Canadian GDP will show a 0.1% increase in November. As the domestic economy slows, the Bank of Canada is now shifting its focus towards the timing of potential rate cuts.

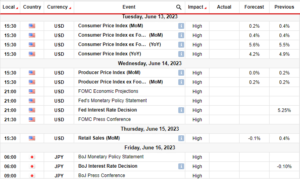

אירועי מפתח של USD/CAD היום

- שינוי תעסוקה ללא משק ADP בארה"ב

- תמ"ג קנדה מ/מ'

- Fed monetary policy meeting

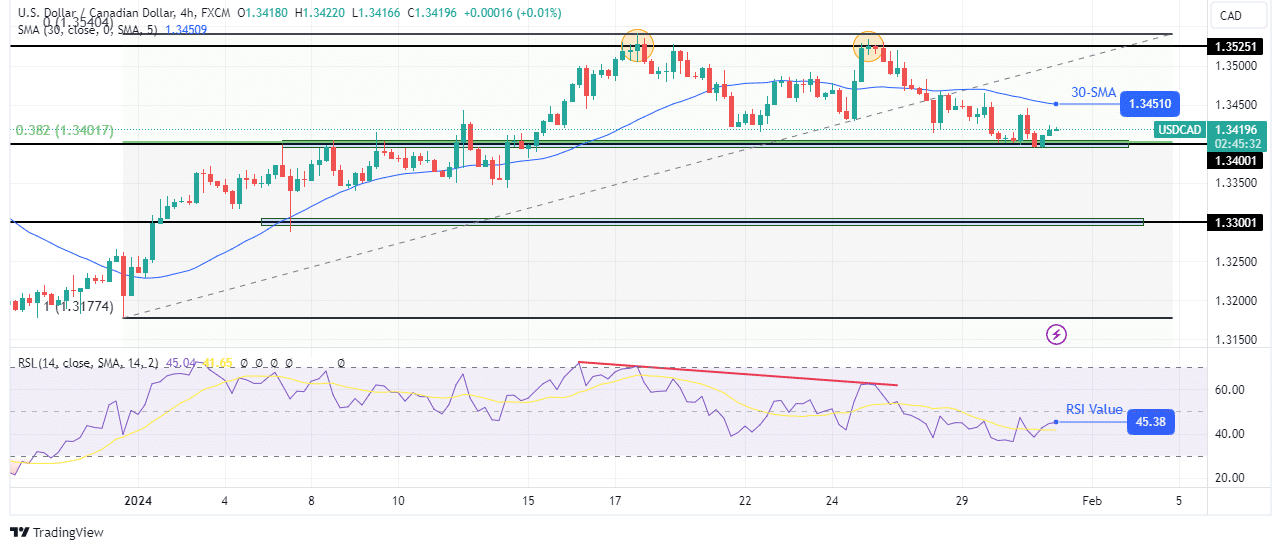

USD/CAD technical price analysis: Bears fight to reverse the trend

On the technical side, the USD/CAD price has fallen to the 1.3400 support level as the bearish RSI divergence plays out. The bias is bearish, with the price under the 30-SMA and the RSI in bearish territory.

-האם אתה מעוניין ללמוד עוד על ברוקרים במט"ח בקנדה? עיין במדריך המפורט שלנו-

Bears have taken over after the previous bullish trend paused at the 1.3525 resistance level. However, they are yet to find their footing below the 30-SMA. Moreover, to confirm a bearish trend, bears must start making lower lows and highs by breaking below the 1.3400 support level. However, if they fail to break below 1.3400, the price will likely climb to retest the 1.3525 resistance.

מעוניין לסחור במט"ח עכשיו? השקיע ב- eToro!

68% מחשבונות המשקיעים הקמעונאיים מפסידים כסף בעת מסחר ב-CFD עם ספק זה. עליך לשקול אם אתה יכול להרשות לעצמך לקחת את הסיכון הגבוה של אובדן כספך

- הפצת תוכן ויחסי ציבור מופעל על ידי SEO. קבל הגברה היום.

- PlatoData.Network Vertical Generative Ai. העצים את עצמך. גישה כאן.

- PlatoAiStream. Web3 Intelligence. הידע מוגבר. גישה כאן.

- PlatoESG. פחמן, קלינטק, אנרגיה, סביבה, שמש, ניהול פסולת. גישה כאן.

- PlatoHealth. מודיעין ביוטכנולוגיה וניסויים קליניים. גישה כאן.

- מקור: https://www.forexcrunch.com/blog/2024/01/31/usd-cad-price-analysis-dollar-poised-for-significant-monthly-gain/

- :יש ל

- :הוא

- $ למעלה

- 1

- a

- אודות

- חשבונות

- ADP

- לאחר

- נגד

- an

- אנליזה

- מנתח

- אנליסטים

- ו

- ציפייה

- כל

- ARE

- AS

- At

- בנק

- בנק קנדה

- דובי

- דובים

- היה

- לפני

- ההתחלה

- להלן

- הטיה

- לשבור

- שבירה

- Bullish

- בולס

- by

- CAN

- קנדה

- קנדי

- דולר קנדי

- זהיר

- חוזי הפרשים

- כִּסֵא

- סיכוי

- לבדוק

- לטפס

- מקרוב

- CO

- לאשר

- לשקול

- עמיתו

- מַטְבֵּעַ

- חותך

- קיצוצים

- נתונים

- יְוֹם

- החלטה

- להקטין

- מְפוֹרָט

- הסתעפות

- דוֹלָר

- ביתי

- כלכלה

- תעסוקה

- מניות

- Ether (ETH)

- אירועים

- לצפות

- מתמודד

- FAIL

- נָפוּל

- טובה

- הפד

- יו"ר פד

- יו"ר הפד ג'רום פאוול

- להלחם

- להתמקד

- ועדת שוק פתוח

- פגישת מדיניות FOMC

- בעד

- מט"ח

- החל מ-

- עתידים

- FX

- שוקי מט"ח

- לְהַשִׂיג

- רווחים

- תמ"ג

- הילוך

- גרינבק

- יש

- גָבוֹהַ

- גבוה יותר

- עליות

- רמזים

- אולם

- HTTPS

- if

- מרשים

- משופר

- in

- להגדיל

- מוּשׁפָע

- אינטרס

- גובה הריבית

- מעוניין

- להשקיע

- משקיע

- משקיעים

- IT

- שֶׁלָה

- ג'רום

- ג'רום פאוול

- שמור

- מפתח

- קייל

- למידה

- רמה

- סביר

- לונדון

- מתקרב

- להפסיד

- לאבד

- להוריד

- השפל

- עשייה

- צעדה

- סימן

- שוקי

- max-width

- מפגש

- צנוע

- מוניטרית

- מדיניות מוניטרית

- כסף

- אחת לחודש

- יותר

- יתר על כן

- רוב

- צריך

- בייחוד

- נוֹבֶמבֶּר

- עַכשָׁיו

- מתרחש

- of

- on

- שלנו

- הַחוּצָה

- יותר

- מושהה

- אפלטון

- מודיעין אפלטון

- אפלטון נתונים

- משחק

- שָׁקוּל

- מדיניות

- חיובי

- אפשרות

- פוטנציאל

- פאוול

- לחזות

- קודם

- מחיר

- ניתוח מחיר

- ספק

- דוחף

- התכנסות

- ציון

- תעריפים

- הגיע

- בדבר

- התנגדות

- קמעוני

- להפוך

- הסיכון

- בערך

- RSI

- מאזניים

- רגש

- סֶפּטֶמבֶּר

- סט

- הסטה

- צריך

- לְהַצִיג

- צד

- משמעותי

- since

- מאט

- התחלה

- ניכר

- תמיכה

- רמת תמיכה

- לְהִתְנַחְשֵׁל

- לקחת

- משימות

- טכני

- שטח

- זֶה

- השמיים

- הפד

- שֶׁלָהֶם

- הֵם

- זֶה

- בכל

- תזמון

- ל

- של היום

- לקראת

- לעקוב

- סחר

- סוחרים

- מסחר

- מְגַמָה

- תחת

- בקרוב ב

- us

- דולר / דולר קנדי

- שעון

- יום רביעי

- שבוע

- היו

- מתי

- אם

- יצטרך

- עם

- שנה

- עוד

- אתה

- זפירנט