הערת העורך: זהו חלק מסדרה בה אנו מראיינים משקיעים פעילים בבינה מלאכותית. ראיונות קודמים היו עם משקיעים ב זרז כללי, שותפי מיזם בסמר, אקסל, שותפים לתובנה ו אינדקס מיזמים.

A year ago, about 16% of סקויה קפיטל’s new investments were in artificial intelligence startups. So far in 2023, that number has jumped to nearly 60%.

“AI has brought new life to the investing ecosystem in the last year,” said סטפני ג'אן, a partner at the firm who invests in seed and early-stage companies.

Crunchbase News spoke with Zhan about Sequoia’s AI investments, which the firm says now span 70-plus portfolio companies.

השקעה מוקדמת

“We’ve seen more creation and formation of new AI companies,” said Zhan on the firm’s strategy to follow developers and talent. “We’ve seen the rise in early-stage AI investing — most notably, pre-seed and seed-stage AI companies that we’re actively investing in right now.”

“Every company will have some kind of AI angle around it, and it won’t be seen as an AI company,” Zhan said. “It will be seen as a company solving a particular domain or problem space that they’re focused on, with AI as an accelerator.”

AI in the Valley

Zhan has enjoyed a front-row seat to early developments in AI. While studying computer science at סטנפורד, she was advised by אנדרו נג, מייסד שותף ב Google Brain, adjunct professor at Stanford, and the current CEO and founder of נחיתה AI.

While a student, computer vision and self-driving cars were at the forefront of the industry, she said. קן, where she worked in product development, acquired דרופקאם, which had image detection technology to “identify the cat on the dropcam.”

Zhan joined Sequoia in 2015, the year OpenAI was founded. At the time, OpenAI rented office space from Sequoia above שוקולד שן הארי in San Francisco’s Mission District. She followed the startup’s research, tracking AI’s possibilities beyond computer vision.

Sequoia made a growth investment in OpenAI in 2021.

At the time, it seemed AGI (artificial general intelligence) — a hypothetical form of artificial intelligence with human-like cognitive abilities — wouldn’t be possible in the span of our lifetimes, Zhan said. Now, with the advent of large language models and ever-more advanced AI systems, AGI at least seems within striking distance.

“There are interesting areas of innovation beyond the current transformer architecture,” Zhan said. “Will there be players who do the same thing, but for other very specific domains?” To that end, the Sequoia team has seen companies focused on audio, multimodal inputs and biology.

Zhan is also excited by open-source initiatives such as LLaMA, the large language model owned by meta, and the company’s Code Llama tool for coding assistance — both comparable alternatives to OpenAI’s GPT-4.

Sequoia in AI

Sequoia says it has around 70 portfolio companies in the AI space, with 17 of those still in stealth. These span from seed to public companies across all industries from semiconductors — Nvidia is a portfolio company from the 1990s — to biotechnology, robotics to autonomous vehicles, and creation to collaboration tools.

The firm’s 2023 AI investments include הארווי, AI technology for legal teams; AI assistant אָבָק, ו לשכפל, a cloud technology to help developers run machine models important for the open-source movement.

Other notable investments the firm has made in recent years include backing generative video producer טווסים, פנים מחבקות, which operates a hub for building art models, and ללקט, which offers an AI workplace search product that allows employees to search across their company’s apps.

Zhan noted Sequoia was also an early investor in Google, co-leading its Series A in 1999. In 2011, Google founded Google Brain, its AI research effort, which was acquired by U.K.-based Deepmind in 2014. The company authored the transformer model, which revolutionized the output of large language models and ultimately led to the rise of generative AI technologies such as ChatGPT.

משתנה גאות

Sequoia has made some big changes to its structure in recent years. In November 2021, it changed to an evergreen fund model to continue to hold investments in leading public companies. In retrospect, it was a badly timed strategy shift announced within months of an extended downturn in technology stocks.

עם זאת, ב an interview with Crunchbase News in early 2021, Sequoia partner רואלוף בוטה noted how “patient” the firm is with distributions, often waiting years after a company has gone public to distribute.

The new structure codified this practice of maintaining stakes in “… these handful of companies that really surprised you to the upside,” he said then, citing the tens to hundreds of billions of dollars in value creation by public technology companies זום, Airbnb, דלתא, בצורת ריבוע, PayPal and Google — all Sequoia portfolio companies.

In June of this year, amid rising U.S.-China tensions, the firm announced it’s splitting from its China and South Asia division to refocus the team on the U.S. and European markets.

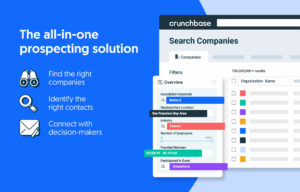

רשימת Crunchbase Pro קשורה

איור: דום גוזמן

חפש פחות. סגור עוד.

הגדל את ההכנסה שלך עם פתרונות חיפוש הכל-באחד המופעלים על ידי המוביל בנתונים של חברות פרטיות.

הישאר מעודכן בסבבי המימון האחרונים, ברכישות ועוד עם Crunchbase Daily.

- הפצת תוכן ויחסי ציבור מופעל על ידי SEO. קבל הגברה היום.

- PlatoData.Network Vertical Generative Ai. העצים את עצמך. גישה כאן.

- PlatoAiStream. Web3 Intelligence. הידע מוגבר. גישה כאן.

- PlatoESG. פחמן, קלינטק, אנרגיה, סביבה, שמש, ניהול פסולת. גישה כאן.

- PlatoHealth. מודיעין ביוטכנולוגיה וניסויים קליניים. גישה כאן.

- מקור: https://news.crunchbase.com/ai/sequoia-capital-growing-ai-portfolio-openai-stephanie-zhan/

- :יש ל

- :הוא

- :איפה

- $ למעלה

- 17

- 1999

- 2011

- 2014

- 2015

- 2021

- 2023

- a

- יכולות

- אודות

- מֵעַל

- מאיץ

- נרכש

- רכישות

- לרוחב

- פעיל

- באופן פעיל

- נלווה

- מתקדם

- הִתגַלוּת

- מומלץ

- לאחר

- AGI

- לִפנֵי

- AI

- עוזר בינה מלאכותית

- ai השקעות

- ai מחקר

- מערכות AI

- תעשיות

- All-in-One

- מאפשר

- גם

- חלופות

- בתוך

- an

- ו

- הודיע

- אפליקציות

- ארכיטקטורה

- ARE

- אזורים

- סביב

- אמנות

- מלאכותי

- בינה כללית מלאכותית

- בינה מלאכותית

- AS

- אסיה

- סיוע

- עוזר

- At

- אודיו

- מחבר

- אוטונומי

- כלי רכב אוטונומיים

- גיבוי

- רע

- BE

- מעבר

- גָדוֹל

- מיליארדים

- ביולוגיה

- ביוטכנולוגיה

- שניהם

- מוֹחַ

- מובא

- בִּניָן

- אבל

- by

- של הון

- מכוניות

- חָתוּל

- מנכ"ל

- מנכ"ל ומייסד

- השתנה

- שינויים

- סין

- בצטטו

- סְגוֹר

- ענן

- טכנולוגיית ענן

- מייסד שותף

- קוד

- קידוד

- סִמוּל

- קוגניטיבית

- שיתוף פעולה

- חברות

- חברה

- של החברה

- השוואה

- המחשב

- מדעי מחשב

- ראייה ממוחשבת

- להמשיך

- יצירה

- קראנץ '

- נוֹכְחִי

- יומי

- נתונים

- תַאֲרִיך

- איתור

- מפתחים

- צעצועי התפתחות

- התפתחויות

- מרחק

- לְהָפִיץ

- הפצות

- מחוז

- do

- דולר

- תחום

- תחומים

- מטה

- מוקדם

- בשלב מוקדם

- המערכת האקולוגית

- מאמץ

- עובדים

- סוף

- אֵירוֹפִּי

- ירוק עד

- נרגש

- רחוק

- פירמה

- מרוכז

- לעקוב

- בעקבות

- בעד

- בחזית

- טופס

- התהוות

- נוסד

- מייסד

- החל מ-

- קרן

- מימון

- סבבי מימון

- כללי

- אינטליגנציה כללית

- גנרטטיבית

- AI Generative

- נעלם

- גדל

- צמיחה

- היה

- קומץ

- יש

- he

- לעזור

- להחזיק

- איך

- HTTPS

- טבור

- מאות

- תמונה

- חשוב

- in

- לכלול

- תעשיות

- תעשייה

- יוזמות

- חדשנות

- תשומות

- בתוך

- מוֹדִיעִין

- מעניין

- ראיון אישי

- ראיונות

- השקעה

- השקעה

- השקעות

- משקיע

- משקיעים

- משקיע

- IT

- שֶׁלָה

- הצטרף

- jpg

- יוני

- סוג

- שפה

- גָדוֹל

- אחרון

- שנה שעברה

- מנהיג

- מוביל

- הכי פחות

- הוביל

- משפטי

- פחות

- החיים

- לאמה

- מכונה

- עשוי

- שמירה

- שוקי

- max-width

- משימה

- מודל

- מודלים

- חודשים

- יותר

- רוב

- תנועה

- כמעט

- חדש

- חדשות

- יַקִיר

- בייחוד

- הערות

- ציין

- נוֹבֶמבֶּר

- נובמבר 2021

- עַכשָׁיו

- מספר

- of

- המיוחדות שלנו

- Office

- לעתים קרובות

- on

- קוד פתוח

- OpenAI

- פועל

- or

- אחר

- שלנו

- תפוקה

- בבעלות

- חלק

- מסוים

- שותף

- אפלטון

- מודיעין אפלטון

- אפלטון נתונים

- שחקנים

- תיק עבודות

- אפשרויות

- אפשרי

- מופעל

- תרגול

- טרום זרע

- קודם

- מִקצוֹעָן

- בעיה

- יַצרָן

- המוצר

- פיתוח מוצר

- פרופסור

- ציבורי

- חברות ציבוריות

- בֶּאֱמֶת

- לאחרונה

- מימון אחרון

- מחקר

- הכנסה

- חוללה מהפכה

- תקין

- לעלות

- עולה

- רובוטיקה

- סיבובים

- הפעלה

- s

- אמר

- אותו

- סן

- אומר

- מדע

- חיפוש

- זרע

- נראה

- נראה

- לראות

- נהיגה עצמית

- סמיקונדקטורס

- סקויה

- סדרה

- סדרה א '

- היא

- משמרת

- So

- עד כה

- פתרונות

- פותר

- כמה

- דרום

- מֶרחָב

- משך

- ספציפי

- סטנפורד

- חברות סטארט

- להשאר

- התגנבות

- עוד

- מניות

- אִסטרָטֶגִיָה

- מִבְנֶה

- סטודנט

- לומד

- כזה

- הופתע

- מערכות

- כִּשָׁרוֹן

- נבחרת

- צוותי

- טכנולוגיות

- טכנולוגיה

- חברות טכנולוגיה

- עשרות

- מתחים

- זֶה

- השמיים

- שֶׁלָהֶם

- אז

- שם.

- אלה

- דבר

- זֶה

- השנה

- אלה

- זמן

- מתוזמן

- ל

- כלי

- כלים

- מעקב

- שנאי

- לָנוּ

- בסופו של דבר

- Upside

- ערך

- יצירת ערך

- כלי רכב

- מיזם

- מאוד

- וִידֵאוֹ

- חזון

- הַמתָנָה

- היה

- we

- היו

- אשר

- בזמן

- מי

- יצטרך

- עם

- בתוך

- עבד

- מקום עבודה

- שנה

- שנים

- אתה

- זפירנט