Elon Musk era in una serie di vittorie consecutive.

Dal 2019 al 2022, sembrava che ogni scommessa presa da Musk stesse dando i suoi frutti. Tesla era costantemente redditizia per la prima volta nella sua storia e le sue azioni sono aumentate vertiginosamente as its massive new Shanghai plant ramped up production. SpaceX rockets captivated the public’s attention — even when they blew up, everyone still clapped. Accusations of corruzione e autodifesa slid right off Musk’s back. Musk could do and say anything he wanted and success followed: He was even named Time’s 2021 Person of the Year.

Then Musk did what every risk-addicted blackjack player inevitably does: pushed his luck too far. Overconfidence, confirmation bias, and delusions of control led to a string of bad decisions — and BOOM — Elon’s empire is in trouble again.

The change of fortune was apparent at The New York Times Dealbook Conference last week. During an interview with host Andrew Ross Sorkin, the recognizable tells that Musk’s hand had gone cold were everywhere. He raged at the very people who will dictate Twitter’s fate, seemed baffled by key questions about the future of his companies, and offered non-apologies for his unhinged, antisocial behavior online. Sorkin suggested Musk’s brain is like a storm, but it sounded more like two cats fighting to get out of a duffle bag.

This, ladies and gentlemen, is what it looks like when Musk realizes he’s in a jam entirely of his own making. I know, because we’ve seen it before, including back in 2018, when he nearly flew Tesla in una montagna. Potrebbe trovare un modo per scongiurare la calamità, come fece allora, ma questo ingorgo è molto più difficile del precedente. Musk deve fare i conti con oltre 13 miliardi di dollari di debito che ancora gravano su Twitter in rapido affondamento, Tesla’s profits shrinking because of a lack of demand and new products, and a world that is generally sick of his schtick. In Muskland, everything is connected by money — problems at one business bleed into the others. That’s why Elon is being exceptionally obstinate. It’s not just your imagination — his luck has changed.

2018, il primo annus horribilis

If you want to understand Musk’s latest unhinged behavior, it’s helpful to understand the reasons he’s lashed out in the past. So let me take you back to the wild ride that was 2018: Musk had bet Tesla’s future on the Modello 3. With an intended starting price of $30,000, the car was supposed to make EVs accessible to drivers who couldn’t afford luxury prices. But Tesla’s investors got increasingly restless as the model became trapped in what Musk called “production hell.”

The pressure to get the Model 3 out clearly weighed on Musk, and he was not subtle about it. On Tesla’s first-quarter earnings call, he cut off one analyst’s basic financial question, saying that “boring, bonehead questions are not cool.” He got so frustrated that he ditched the analysts entirely and started taking questions from fans posting on YouTube. Eventually, he even implorò gli investitori scettici di Tesla to “please, sell our stock.” When Musk is at his most hungry for cash, he tends to mordere la mano che nutre.

Musk also became more active on Twitter around this time, often with erratic results. When a professional diver complained that Musk was distracting from efforts to rescue a children’s soccer team that had been trapped in a cave in Thailand, Musk ha chiamato il sub a “pedo guy” and harassed him on Twitter. He used the platform to whine about the media, attack investors betting against Tesla’s stock, and even tweeted that he would be privatizzare Tesla al prezzo di 420 dollari per azione quando non esisteva un accordo del genere. Tesla era – come ammise in seguito Musk – “near death,” and summer’s “production hell” was about to turn into autumn’s “logistics hell.”

Tesla’s salvation came in the form of the Chinese Communist Party. In 2019, as executives were fleeing Tesla and the company continued to bleed cash, Musk struck a deal to build a factory in Shanghai. From permitting to construction to opening, the Shanghai Gigafactory was built in just 168 giorni lavorativi. Skeptical observers — myself included — were blindsided. What we failed to appreciate was the staggering power of the CCP when it’s aggressively pushing to meet a single goal. When the party said Tesla could build the factory there, that meant immediately.

In generale, ci sono due diverse lezioni che una persona può imparare dal sopravvivere in un ambiente vicino alla rovina. Possono imparare a essere più cauti, oppure decidere di essere indistruttibili e sfidare il destino.

Senza Cina, Tesla would not have finally turned into a “real car company,” in Musk’s own words. He dodged destruction and started to settle down and focus on other projects, like Starlink. Sure, he was still wilding out on Twitter, but at least he wasn’t bawling a Rolling Stone su quanto abbia tanto bisogno di una ragazza per essere felice. Alla fine, sembrava che l’universo di Musk avesse trovato una sorta di equilibrio frenetico.

Generally, there are two different lessons a person can take from surviving a brush with near ruin. They can learn to be more cautious, or they can decide that they are indestructible and tempt fate. I don’t think I need to tell you which path Musk chose.

Tutto il mondo di Elon è connesso

Say what you want about him, but Elon Musk has ambition. On top of the world in early 2022, Musk decided that he had the power to single-handedly “fix” the entire concept of free speech. And given that he is hopelessly addicted to the adulation he gets from Twitter, that’s where he figured he would start.

We all know this part of the story. Musk started building a stake in Twitter in early 2022, then offered to buy it outright. He offered such a ridiculously high price that the board couldn’t say no. A consortium of banks — led by Morgan Stanley— gli prestò gran parte del denaro. E infine, dopo aver tentato e poi fallito di rinnegare l'accordo, ha comprato Twitter. Non molto tempo dopo aver completato l’accordo, Musk ha esaurito tutte le idee per ribaltare la piattaforma e si è ritrovato con ex dipendenti arrabbiati e scettici gli inserzionisti, un nuovo nome terribile e un enorme mucchio di debiti nei confronti dei boy scout di Wall Street.

Al giorno d'oggi, alcuni analisti, come Vicki Bryan, l'amministratore delegato della società di ricerca Angolo di legame, suspect that Twitter is spending much more than it’s able to generate or borrow.

“With the company still burning cash and $1.3-1.5 billion in annual interest due over the past year, I had expected Twitter to live on borrowed time,” Bryan wrote in a note to clients. She said that even if Twitter tapped the loans available to it at the beginning of the year, the company may be almost out of options. “The year is over, so Twitter’s cash may be nearly if not already dried up — along with Elon Musk’s options,” Bryan wrote.

Because of the way that Musk operates, the social-media company’s troubles pose a threat to his whole business empire. Despite being the second-wealthiest person in the world, Musk is curiously cash poor. He doesn’t take a salary from Tesla, and while he owns about 20% of the EV maker, public documents filed in March show that about il 63% di tali azioni are “pledged as collateral to secure certain personal indebtedness.” You know, like the private jets.

The year is over, so Twitter’s cash may be nearly if not already dried up—along with Elon Musk’s optionsVicki Bryan, CEO della società di ricerca Bond Angle

Ecco perché nello studio legale utilizzando le azioni Tesla per ottenere liquidità all the time gets hairy. If Tesla shares fall below a certain level, the banks can call in those personal loans — leaving Musk on the hook. And the quickest way for Tesla’s stock to drop off a cliff is for investors to get wind of a big Musk sale. And of course, he needs to make sure that he still holds on to all the Tesla stock he’s pledged as collateral to the banks. Unfortunately, though, the easiest way for Musk to fill the gaping hole in Twitter’s balance sheet is vendere azioni Tesla. Vedi come questo potrebbe essere un problema.

Sometimes, when he’s really hard up, Musk borrows money from SpaceX — a private company that ha perso complessivamente 1.5 miliardi di dollari nel 2021 e nel 2022. Lui preso in prestito 1 miliardi di dollari dalla società quando ha acquistato Twitter e ha ripagato il prestito entro un mese, ma per farlo ha dovuto vendere azioni Tesla per un valore di 4 miliardi di dollari. Usando la sua ricchezza e il suo potere, Musk si è costruito una realtà separata dove non ci sono conseguenze reali per i rischi che corre, ma tenere le luci accese su Twitter - scusa, X - sta mettendo alla prova i suoi limiti sempre di più ogni giorno.

La vita sulla Terra 1

All of this money-incinerating activity, from the beginning of the Twitter deal to this very moment, could not have come at a worse time. For decades, Musk has operated in a placid economy where interest rates were near zero. But Musk started buying Twitter right as central banks around the world began hiking rates in an effort to combat inflation. That means the cost of servicing his debt is getting more expensive, making it harder for him to get new loans. It’s a shift so dramatic that it could rip a hole in the universe through which Musk’s reality collapses into our own.

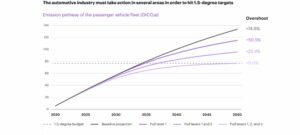

The outlook for Tesla’s business doesn’t help him much either. The company’s share of the EV market has fallen as competitors have swarmed in. The new entrants prompted Musk to start tagliando i prezzi per le sue auto all'inizio del 2023 e, di conseguenza, Tesla’s profitability è sotto forte pressione. L'azienda ha in programma di espandere la propria capacità produttiva, ma non prevede di aggiornare la sua vecchia flotta di veicoli. A meno che, ovviamente, non si contino i Cybertuck, cosa che la maggior parte non lo fa. Il mese scorso, Tesla ha organizzato un evento di lancio per celebrare la consegna di 10 Cybertruck. Dieci. Il modello meno costoso, al prezzo di 60,000 dollari, non sarà disponibile fino al 2025, secondo l’azienda. Bryan mi ha detto che si aspetta che Musk continui a sottrarre denaro a Tesla in modi oscuri, ma la domanda è: quanti soldi ci saranno da sottrarre, esattamente? E per quanto tempo dovrà farlo?

Ci sono soldi che sono stati dati alle fiamme e che non torneranno mai piùVicky Bryan

“The only thing we’re waiting on is for Elon to cry uncle,” said Bryan. In her view — which is based on 30 years of investing in distressed assets — any equity in the company has already been erased by Musk’s antics. As for the debt, the banks have been unable to unload it at 85 cents on the dollar, and she thinks they’ll be lucky to get 40 cents. By all accounts, Twitter has a credit problem, and Bryan said that calls for a run-of-the-mill restructuring solution: bankruptcy. When Musk tires of robbing Peter to pay Paul, he will default on his Twitter loans. Then the consortium of banks that own the debt can accelerate it — standard debt agreements come with clauses that allow lenders to force a borrower to pay all of an outstanding loan back if certain requirements (like payment) are not met. Once that wire is tripped, Twitter can declare bankruptcy.

“There is money that has been set on fire that is never coming back,” Bryan said. “We’re in the salvage business with Twitter. In a restructuring, with Elon gone, you can have people looking at it. They can foresee that Elon didn’t do anything that can’t be reversed and offer instant relief.”

Will it be enough to save Twitter/X? Maybe not, but it’s the company’s only and best hope.

Wall Street dovrebbe essere completamente imbarazzata. Secondo ai rapporti, the banks holding Twitter’s debt are already expecting to take a $2 billion hit when they can finally sell it off. It’s not hard to see why. I’ve said from the jump that there was niente soldi in questa impresa di Twittere nemmeno alcun principio. Il muschio lo era trasformerà sempre Twitter into a reflection of his limited view, his “Earth” — as he put it during his manic rambling at Dealbook — not a place for the average user. I never expected Musk’s fanboys to understand that, but I did expect bankers who are supposed to understand who pays for what in a media business to get it. In the end, there’s a real chance Wall Street investors will wind up owning the shambolic mess that is Twitter/X. One of the few blessings to come from this fiasco is that when that happens, at least they’ll know what non a che fare con esso.

Linette Lopez è un corrispondente senior di Business Insider.

- Distribuzione di contenuti basati su SEO e PR. Ricevi amplificazione oggi.

- PlatoData.Network Generativo verticale Ai. Potenzia te stesso. Accedi qui.

- PlatoAiStream. Intelligenza Web3. Conoscenza amplificata. Accedi qui.

- PlatoneESG. Carbonio, Tecnologia pulita, Energia, Ambiente, Solare, Gestione dei rifiuti. Accedi qui.

- Platone Salute. Intelligence sulle biotecnologie e sulle sperimentazioni cliniche. Accedi qui.

- Fonte: https://www.autoblog.com/2023/12/16/elon-musk-is-cracking-under-the-pressure-of-the-biggest-gamble-he-s-ever-taken-in-his-life/

- :ha

- :È

- :non

- :Dove

- $ SU

- 000

- 1

- 10

- 11

- 12

- 13

- 14

- 15%

- 16

- 17

- 19

- 20

- 2018

- 2019

- 2021

- 2022

- 2023

- 2025

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 40

- 7

- 8

- 9

- a

- capace

- WRI

- a proposito

- accelerare

- accessibile

- Secondo

- conti

- Accuse

- attivo

- attività

- ammesso

- Dopo shavasana, sedersi in silenzio; saluti;

- ancora

- contro

- aggressivo

- INVECCHIAMENTO

- accordi

- Tutti

- consentire

- quasi

- lungo

- già

- anche

- ambizione

- an

- analista

- Gli analisti

- ed

- Andrea

- Andrew Ross Sorkin

- annuale

- in qualsiasi

- nulla

- apparente

- apprezzare

- SONO

- in giro

- articolo

- AS

- Attività

- At

- attacco

- attenzione

- disponibile

- media

- precedente

- Vasca

- male

- Bags

- Equilibrio

- Bilancio patrimoniale

- banchieri

- Fallimento

- Banche

- basato

- basic

- BE

- è diventato

- perché

- stato

- prima

- ha iniziato

- Inizio

- comportamento

- essendo

- sotto

- MIGLIORE

- Scommettere

- Scommesse

- pregiudizio

- Big

- Maggiore

- Miliardo

- Bloomberg

- tavola

- legame

- boom

- Noioso

- prendere in prestito

- preso in prestito

- mutuatario

- comprato

- Cervello

- Bryan

- costruire

- Costruzione

- costruito

- ardente

- affari

- ma

- Acquistare

- Acquisto

- by

- chiamata

- detto

- Bandi

- è venuto

- Materiale

- capacità

- auto

- Contanti

- Gatti

- cauto

- grotta

- ccp

- festeggiare

- centrale

- Banche centrali

- ceo

- certo

- possibilità

- il cambiamento

- cambiato

- Bambini

- Cinese

- Partito comunista cinese

- ha scelto

- chiaramente

- clienti

- freddo

- crolli

- Collaterale

- COM

- combattere

- combinato

- Venire

- arrivo

- Aziende

- azienda

- concorrenti

- completando

- concetto

- Convegno

- conferma

- collegato

- Conseguenze

- costantemente

- consorzio

- costruzione

- continua

- continua

- di controllo

- Froids

- Costo

- potuto

- non poteva

- corso

- screpolatura

- credito

- taglio

- giorno

- affare

- Morte

- Debito

- decenni

- decide

- deciso

- decisioni

- Predefinito

- consegna

- Richiesta

- Nonostante

- dettare

- DID

- didn

- diverso

- afflitto

- do

- documenti

- effettua

- doesn

- Dollaro

- don

- giù

- drammaticamente

- driver

- Cadere

- dovuto

- durante

- Presto

- Guadagni

- guadagni chiamano

- terra

- più semplice

- economia

- sforzo

- sforzi

- o

- Olmo

- Elon

- Elon Musk

- Impero

- dipendenti

- fine

- abbastanza

- Intero

- interamente

- arrivo

- equilibrio

- equità

- Etere (ETH)

- EV

- Anche

- Evento

- alla fine

- EVER

- Ogni

- tutti

- qualunque cosa

- ovunque

- evs

- di preciso

- eccezionalmente

- dirigenti

- Espandere

- attenderti

- previsto

- aspetta

- aspetta

- costoso

- fabbrica

- fallito

- in mancanza di

- Autunno

- Caduto

- fan

- lontano

- destino

- pochi

- lotta

- capito

- depositata

- riempire

- Infine

- finanziario

- Trovate

- Antincendio

- Impresa

- Nome

- prima volta

- Fissare

- FLOTTA

- Focus

- seguito

- Nel

- per gli investitori

- forza

- prevedere

- modulo

- Ex

- Fortune

- essere trovato

- Gratis

- Discorso libero

- da

- frustrato

- futuro

- Giocare

- generalmente

- generare

- ottenere

- ottenere

- dato

- scopo

- andando

- andato

- ha ottenuto

- Tipo

- ha avuto

- cura

- accade

- contento

- Hard

- Più forte

- Avere

- he

- Aiuto

- utile

- suo

- Alta

- escursionismo

- lui

- lui stesso

- il suo

- storia

- Colpire

- possesso

- detiene

- Foro

- speranza

- host

- HOT

- Come

- HTTPS

- Affamato

- i

- idee

- if

- immaginazione

- subito

- in

- incluso

- Compreso

- sempre più

- inevitabilmente

- inflazione

- Insider

- immediato

- destinato

- interesse

- Tassi di interesse

- Colloquio

- ai miglioramenti

- investire

- Investitori

- IT

- SUO

- Jets

- saltare

- ad appena

- conservazione

- Le

- Genere

- Sapere

- Dipingere

- grandi

- Cognome

- dopo

- con i più recenti

- lanciare

- IMPARARE

- meno

- partenza

- Guidato

- a sinistra

- istituti di credito

- Lezioni

- lasciare

- Livello

- Vita

- piace

- Limitato

- limiti

- vivere

- ll

- prestito

- Prestiti e finanziamenti

- logistica

- Lunghi

- cerca

- SEMBRA

- fortuna

- Il luxury

- make

- creatore

- Fare

- consigliato per la

- Marzo

- Rappresentanza

- massiccio

- Maggio..

- può essere

- me

- si intende

- significava

- Media

- Soddisfare

- di cartone

- modello

- momento

- soldi

- Mese

- Scopri di più

- maggior parte

- La Montagna

- molti

- Muschio

- me

- Nome

- Detto

- Vicino

- quasi

- Bisogno

- esigenze

- mai

- New

- prodotti nuovi

- New York

- New York Times

- no

- Nota

- osservatori

- of

- MENO

- offrire

- offerto

- di frequente

- on

- una volta

- ONE

- online

- esclusivamente

- apertura

- operato

- opera

- Opzioni

- or

- i

- Altro

- Altri

- nostro

- su

- Outlook

- a titolo definitivo

- eccezionale

- ancora

- overconfidence

- dovuto

- proprio

- possedere

- possiede

- pagato

- parte

- partito

- passato

- sentiero

- Paul

- Paga le

- pagamento

- Pagamento

- paese

- Persone

- persona

- cronologia

- Prestiti personali

- Peter

- posto

- piani

- impianto

- piattaforma

- Platone

- Platone Data Intelligence

- PlatoneDati

- giocatore

- per favore

- povero

- porzione

- PoS

- energia

- pressione

- prezzo

- Prezzi

- principi

- un bagno

- Problema

- problemi

- Produzione

- Prodotti

- professionale

- profitti

- progetti

- la percezione

- spinto

- spingendo

- metti

- domanda

- Domande

- più veloce

- RE

- Leggi

- di rose

- Realtà

- veramente

- motivi

- riflessione

- sollievo

- Requisiti

- salvataggio

- riparazioni

- ristrutturazione

- colpevole

- Risultati

- VIAGGIO

- destra

- rischi

- rotolamento

- rovina

- s

- Suddetto

- stipendio

- vendita

- Risparmi

- dire

- detto

- SEC

- sicuro

- vedere

- sembrava

- visto

- venda

- anziano

- separato

- grave

- revisione

- set

- risolvere

- shanghai

- Condividi

- azioni

- lei

- foglio

- spostamento

- dovrebbero

- mostrare attraverso le sue creazioni

- singolo

- sifone

- scettico

- So

- Calcio

- soluzione

- alcuni

- suonava

- Fonte

- SpaceX

- discorso

- Spendere

- barcollante

- palo

- Standard

- stanley

- StarLink

- inizia a

- iniziato

- Di partenza

- Ancora

- azione

- Tempesta

- Storia

- strada

- Corda

- il successo

- tale

- estate

- suppone

- sicuro

- rapidamente

- T

- Fai

- preso

- prende

- presa

- Filettato

- team

- dire

- dice

- carnagione

- tende

- terribile

- Tesla

- Stock di Tesla

- Testing

- Tailandia

- di

- che

- Il

- Il Partito Comunista Cinese

- Il futuro

- Il New York Times

- il mondo

- poi

- Là.

- di

- cosa

- think

- pensa

- questo

- a fondo

- quelli

- anche se?

- minaccia

- Attraverso

- stretto

- tempo

- volte

- pneumatici

- a

- detto

- pure

- ha preso

- top

- intrappolati

- guaio

- cerca

- TURNO

- Turned

- Accordo su Twitter

- seconda

- incapace

- per

- capire

- purtroppo

- Universo

- fino a quando

- utilizzato

- Utente

- utilizzando

- Ve

- Veicoli

- molto

- Visualizza

- In attesa

- Muro

- Wall Street

- volere

- ricercato

- Prima

- non lo era

- Modo..

- modi

- we

- Ricchezza

- settimana

- pesatura

- sono stati

- Che

- quando

- quale

- while

- OMS

- tutto

- perché

- Selvaggio

- volere

- vento

- Wire

- con

- entro

- parole

- lavoro

- mondo

- peggio

- valore

- sarebbe

- ha scritto

- WSJ

- X

- anno

- anni

- York

- Tu

- Trasferimento da aeroporto a Sharm

- youtube

- zefiro

- zero