According to Fenergo estimates “poor customer experience” is costing financial institutions $10 billion in revenue per year. 36% of financial institutions have lost customers due to inefficient or slow onboarding, and 81% believe poor data management lengthens

onboarding and negatively affects customer experience.

How do you encourage users to not only rank your app with 5 stars in the Apple Store and Google Play but also gain their loyalty and trust? It’s no secret that the digital customer experience today is what differentiates demanded financial brands. The main

struggle is keeping up by creating a digital banking customer experience that WOWs.

Financial services customer experience refers to customer interactions with their bank, typically including online and mobile banking services, visiting a physical branch, or speaking with customer service representatives. The digital banking customer experience

(digital banking CX or UX – user experience) consists of all the emotions, thoughts and behavior of a customer triggered in using a digital banking service. A banking customer experience is generated by all digital products and brand ecosystems, including

previous customer engagements and future expectations.

The goal of improving customer experience in financial services is to make banking services as convenient, efficient, and pleasant as possible for the customer. This can be achieved through various means, such as offering an appropriate range of services

and features, providing clear and helpful information and assistance, and ensuring that the customer’s interactions with the bank are smooth and hassle-free. Make sure that financial service customer experience aligns with brand identity and business strategy.

At the same time, remember that in the digital age, brand reputation is no longer a guarantee of loyalty and can be instantly damaged by a problem with a mobile application caused by poor CX / UX design since the customer experience is a highly dynamic process.

Saya ingin menjelaskan 5 cara untuk meningkatkan CX digital layanan keuangan pada tahun 2024:

1. Membangun Pola Pikir Pengalaman

The development of digital technology is disrupting all the industries. What has been proven to work for decades, like traditional marketing and product approach, has stopped working. The world is making new demands on businesses, and the financial industry

tidak terkecuali.

Saat ini, nasabah memiliki lusinan alternatif baru setiap tahun karena rendahnya hambatan masuk dan perbankan terbuka. Oleh karena itu, agar dapat bertahan di era digital, merek keuangan diharuskan mengadopsi cara berpikir dan menjalankan bisnis yang benar-benar baru.

Social networks, information transparency and demand for sustainability challenge businesses to put the people first by becoming customer-centered and deliver experiences instead of manipulating customers to reap profits. That’s why the future of the banking

industry depends entirely on how the new generation of bankers can bring their mindset in line with the digital age to provide the best possible banking customer experience.

Terdapat lima sikap utama yang dapat diintegrasikan ke dalam DNA perusahaan dengan tujuan menjadikan pola pikir tim berorientasi pada tujuan dan menggeser budaya bisnis menuju kesuksesan di era digital.

- Melayani Daripada Menjual. The “sell” priority is all about focusing on marketing and looking at people as numbers behind conversion. Design, in this case, is only about using attractive packaging to sell more, and UX is just one more tool

to manipulate user behavior. To focus the business team on customer needs, feelings and behaviors, we need to prioritize “Serve.” In this case, conversion became just a metric to evaluate product clarity, because the main aim is to provide real benefit for

the customer. And, a lot of customers will appreciate it, using the digital space to express their gratitude and attract more users. - Emosi Atas Informasi. People often forget information but remember experiences, and those are created from emotions. That’s why information should be integrated into a context of usage. It should become an organic part of the banking

user experience that is based on emotions, because emotions are the main language to communicate with the customers and understand their needs and expectations. - Solusi, Bukan Fitur. Don’t make your users have to think about how to use hundreds of offered features. Instead, provide them with an easy to use solution. According to psychology experiments, too many options can cause decision

paralysis. Users don’t come to you for the hundreds of options you can offer. They have a specific problem and goal in mind that your financial product has to help to achieve. - Gangguan Atas Perlindungan. Traditional banks and other well-established businesses are focused on protecting their legacy and maintaining the corporate image. That’s why change comes slowly and painfully. Instead of thinking about how

to protect their products from the digital challenge and prevent customers from leaving, banks have to figure out how to stop self-deception and disrupt themselves and their competitors. In the experience age, self-disruption is the only way to provide meaningful

and pleasant products for users. - Ciptakan Aliran, Hindari Fragmentasi. It is a common mistake to view services and products as separate parts. But, the human brain perceives experiences holistically – as a whole entity. Customers see the product as a continuous experience

flow, even lasting for years. Transition to the same thinking is the only way for businesses to ensure a delightful user journey. We need to detect links among user needs, emotions, behavior and service features, design and strategy. Separation of service

elements by different departments caused by organizational silos fills the customer experience with friction. We need to defragment business and ensure a frictionless flow that makes service pleasant.

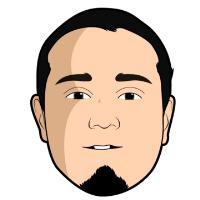

2. Fokus pada Proposisi Nilai Produk yang Unik

Perusahaan pembiayaan yang secara aktif menerapkan prinsip kerja pola pikir yang berorientasi pada tujuan bertujuan untuk memberikan nilai maksimal kepada pengguna. Sebagai imbalannya, pelanggan dengan senang hati memberi penghargaan kepada perusahaan dengan loyalitas dan mendukung perkembangannya dengan merekomendasikan layanan mereka.

The central question in the creation of any financial product is WHY it is needed. What exactly makes the product valuable and unique to the users? What problems will it solve, and what benefits will it provide? By not treating all of these questions with

dignity, the financial company is risking its product quickly sinking into the “red ocean” of competition.

There are concrete product growth stages that depend on the level of competition and the demand from the customers. Understanding these stages helps to define and create the perfect match between the financial product’s value proposition and the market demand,

leading to success.

Persaingan inilah yang mengharuskan pengusaha keuangan untuk keluar dari kebiasaan dan mengidentifikasi ekspektasi pelanggan. Semakin besar persaingan maka semakin besar pula kebutuhan akan keunggulan pasar untuk menaklukkan pesaing.

If financial product functionality is not enough to compete, provide usability. If all the competitors have the same functionality and usability, add aesthetics. If you need even more of an advantage, connect the product with the customer’s lifestyle by

personalizing it and making it a symbol of their status. And, finally, you can go even further and state the mission to deliver the ultimate value that will change the world and gain followers who look up to you.

Menargetkan proposisi Nilai Produk yang unik melalui Misi, Status, Estetika, dan Kegunaan membantu memaksimalkan kebutuhan pengguna melalui desain produk yang berpusat pada pelanggan.

Bank modern telah menyediakan fungsionalitas layanan dasar kepada pelanggannya. Inovasi dalam industri perbankan digital telah berpindah dari tahap Fungsionalitas ke tahap Kegunaan dan Estetika untuk menciptakan ikatan emosional dengan nasabah.

Despite that, there are still many traditional banks that struggle with Usability. Meanwhile, progressive FinTechs are quickly climbing up the ladder, reaching the Status stage by personalizing and providing digital financial services that are enjoyable,

attractive and serve the needs of specific audiences.

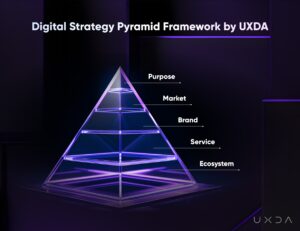

3. Mengintegrasikan Pendekatan Desain di Semua Tingkat

By focusing on the usability, aesthetics and status of the product, you can engage digital users, but this is not enough. To ensure a long-term market need for your product, it is necessary to integrate customer-centricity into all levels and processes of

the company, putting the user at the forefront.

In many cases, incorrect design integration in the process of product creation leads to harmful consequences. It’s like in construction: a skyscraper can’t stand without a well-thought-out and grounded architectural plan. The financial product with amateur

UX will lack demand in the market, could be rejected by the users, often exceeds the development budget or doesn’t even get launched at all.

Ada lima area yang saling terhubung di mana pendekatan desain dapat diintegrasikan untuk memastikan pengalaman pelanggan terbaik dalam jangka panjang. Secara umum kelima bidang ini sesuai dengan unsur utama pengembangan usaha.

Ketika Anda memiliki ide bisnis yang kuat, Anda perlu membuat model bisnis dengan menentukan Proses utama yang akan membantu Anda mencapai tujuan yang Anda inginkan. Di sini Anda dapat membuat pendekatan desain yang memberdayakan bahan bakar dalam semua proses bisnis keuangan Anda.

Pada langkah selanjutnya, Anda memerlukan Tim spesialis yang memenuhi syarat untuk melaksanakan ide Anda. Pada titik ini, pastikan untuk menambahkan keahlian desain UX keuangan dari orang-orang yang menguasai produk digital di bidang keuangan.

Ketika Anda telah menemukan profesional yang sesuai dengan tantangan Anda, Anda memerlukan mereka untuk mengambil Tindakan tepat yang mendekatkan Anda pada realisasi produk. Mempercepat dampak desain dengan menentukan tindakan yang berorientasi pada hasil.

Untuk memastikan Anda bergerak ke arah yang benar, Anda harus mengevaluasi Hasil yang dihasilkan tim Anda. Anda harus mengukur kualitas desain dari cara desain tersebut melayani pelanggan Anda.

Pada akhirnya, jika semua langkah sebelumnya telah berhasil dilakukan, Anda dapat memahami Nilai unik yang akan diberikan produk keuangan Anda kepada pelanggan, sehingga mengubah produk digital menjadi kisah sukses.

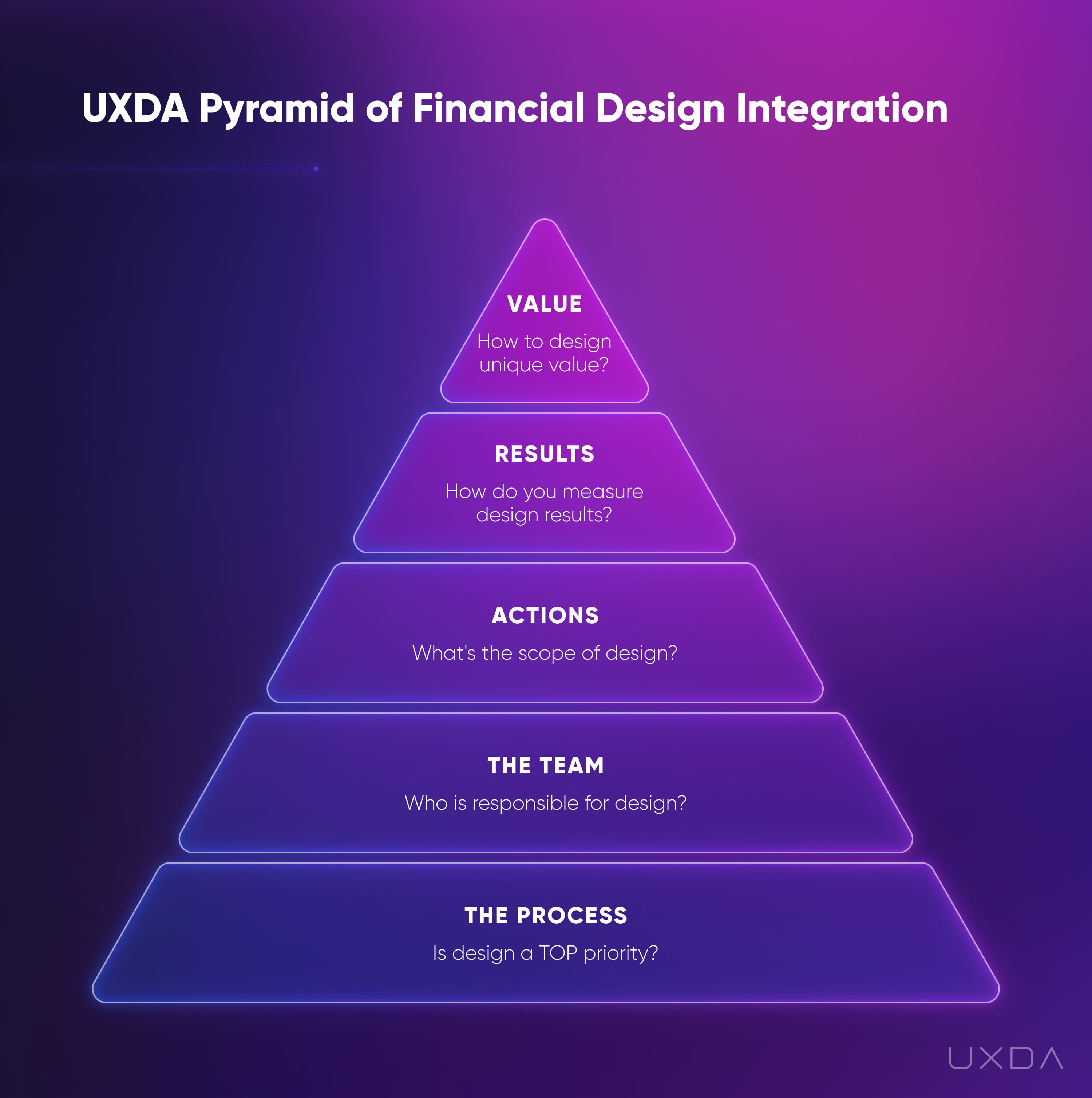

4. Gunakan Metodologi Desain CX yang Tepat

As a typical business delivery starts with Process and ends with Value to customer, then the easiest way to design the best possible digital experience is to do it in reverse. We should start with defining the ultimate Value for the customer and only then

move on to an action plan.

Kita dapat membandingkan rekayasa balik dengan labirin yang memiliki banyak pintu masuk dan hanya satu pintu keluar. Pintu masuknya adalah berbagai jenis konfigurasi produk, fungsionalitas, dan fitur, dan pintu keluarnya adalah tingginya permintaan dan kesuksesan di pasar.

Usually, entrepreneurs try to guess which configuration they should develop to gain success. They look around to identify what products are trending, code a lot of features to impress customers and finally pack all this into a vibrant design to grab attention.

Then they spend tons of money on advertising to convince consumers that they need this.

In reverse engineering, you significantly reduce uncertainty by starting from the maze exit and moving to the correct entry point. In this case, the exit of the maze is the point at which the product is highly demanded because of the value it provides to

customers. By using the CX / UX design approach, we are exploring the value that’s significant to customers and putting the focus of the product and the entire business on the needs of customers.

Though CX and UX design is trending today, only a few financial product experts are capable of successfully translating it into architecture and the user interface of a particular product because it requires knowledge in human psychology, behavior and design

arts. Perhaps this explains why most of the financial solutions around us still look outdated and amateur, despite the multiple designers involved in the product development teams.

Merancang produk keuangan yang berpusat pada pelanggan yang didasarkan pada nilai bagi pengguna terdiri dari tiga elemen utama: Pemikiran desain, kerangka Bisnis/Pengguna/Produk, dan alat desain UX.

Pemikiran desain adalah dasar dari Metodologi UX Keuangan. Ini memberikan pendekatan metodis dan berulang untuk mengeksplorasi dan melayani kebutuhan utama pengguna melalui lima tahap – Empati, Definisikan, Ide, Prototipe, dan Uji.

Untuk memastikan kesuksesan secara keseluruhan, kita harus menerapkan kelima bagian proses berpikir Desain melalui perspektif Bisnis, Pengguna, dan Produk. Dengan cara ini, kami menemukan, menentukan, dan mewujudkan nilai dan keuntungan maksimum untuk masing-masingnya.

Terakhir, alat desain UX memberikan cara terbaik untuk menjalankan seluruh proses untuk memastikan transformasi produk keuangan berbasis hasil yang efektif.

5. Jelajahi Konteks Pelanggan Anda

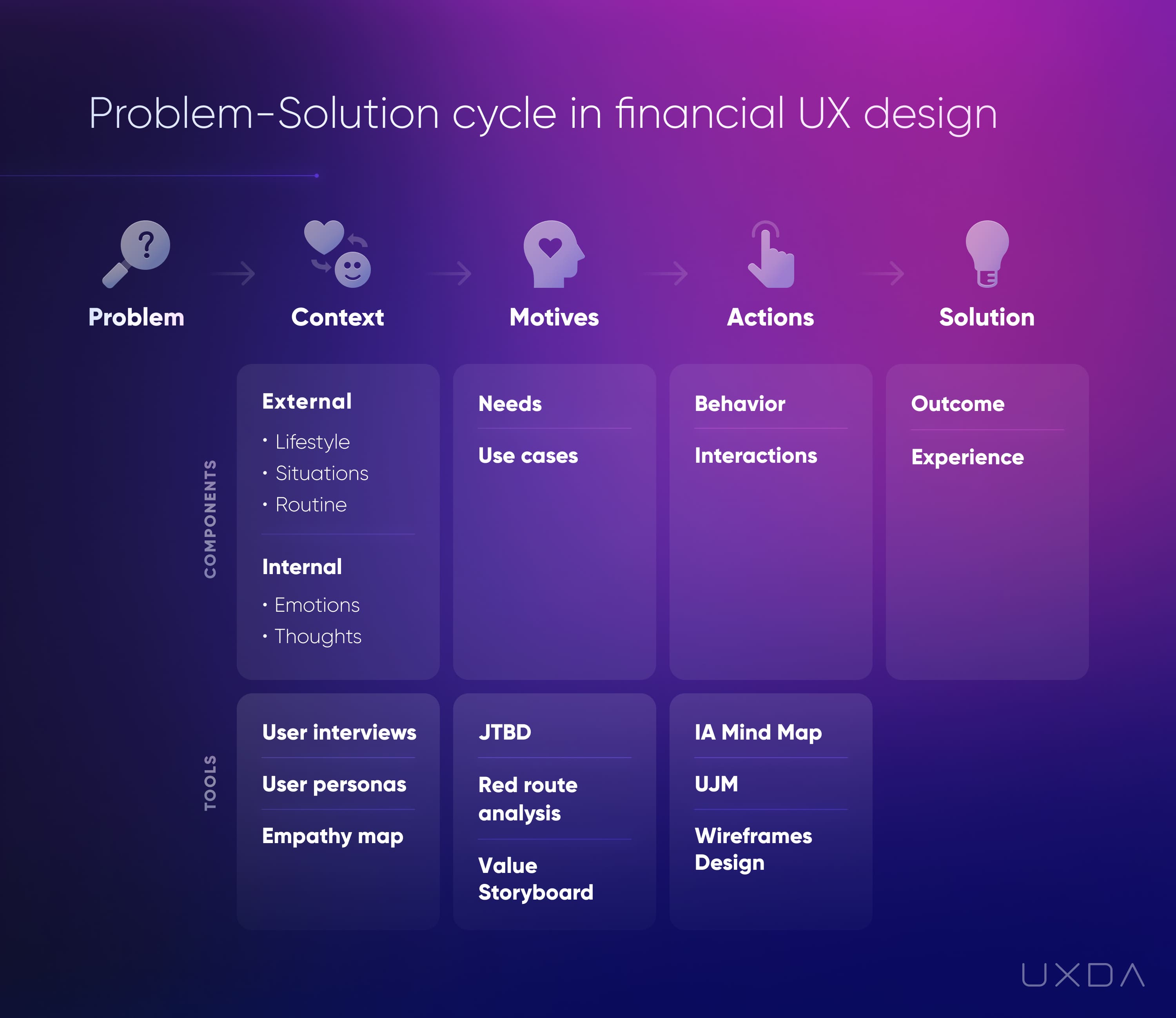

At this point, you might feel like you have enough powerful knowledge to go straight to addressing your customer problems with your financial service experience design. Yes, it all starts with a good solution to an important problem. But, between the problem

and the solution, there are three crucial conditions that differentiate whether or not a product will match real users’ needs.

Untuk menciptakan layanan keuangan digital yang diminati dan disukai nasabah, kita mulai dari masalahnya.

Untuk mendefinisikan masalah dan tugas dengan jelas, kami mengeksplorasi dampak siklus solusi masalah terhadap pengalaman nasabah perbankan dengan menciptakan persona pengguna dan menentukan tugas yang harus dilakukan.

Sepanjang proses ini, kami mengkristalkan konteks di mana masalah terjadi, motif pengguna yang menentukan tindakan, dan orang-orang yang diperlukan untuk menerapkan solusi yang tepat.

Selama proses ini, Metodologi Desain UX Keuangan dan alat UX seperti peta Empati, Peta Rute Merah, UJM, alur pengguna, gambar rangka, desain dan pengujian UI digunakan.

- Konten Bertenaga SEO & Distribusi PR. Dapatkan Amplifikasi Hari Ini.

- PlatoData.Jaringan Vertikal Generatif Ai. Berdayakan Diri Anda. Akses Di Sini.

- PlatoAiStream. Intelijen Web3. Pengetahuan Diperkuat. Akses Di Sini.

- PlatoESG. Karbon, teknologi bersih, energi, Lingkungan Hidup, Tenaga surya, Penanganan limbah. Akses Di Sini.

- PlatoHealth. Kecerdasan Uji Coba Biotek dan Klinis. Akses Di Sini.

- Sumber: https://www.finextra.com/blogposting/25474/five-ways-to-improve-customer-experience-in-financial-services-in-2024?utm_medium=rssfinextra&utm_source=finextrablogs

- :memiliki

- :adalah

- :bukan

- $NAIK

- 2024

- a

- Tentang Kami

- benar

- mempercepat

- dicapai

- Menurut

- Mencapai

- dicapai

- di seluruh

- Tindakan

- tindakan

- aktif

- menambahkan

- menangani

- mengambil

- Keuntungan

- pengiklanan

- usia

- tujuan

- Rata

- Semua

- sudah

- juga

- alternatif

- amatir

- antara

- an

- dan

- Apa pun

- aplikasi

- Apple

- Aplikasi

- Mendaftar

- menghargai

- pendekatan

- sesuai

- arsitektur

- arsitektur

- ADALAH

- daerah

- sekitar

- Seni

- AS

- Bantuan

- At

- perhatian

- menarik

- menarik

- dengar pendapat

- menghindari

- Bank

- bankir

- Perbankan

- industri perbankan

- Bank

- hambatan

- berdasarkan

- dasar

- dasar

- BE

- menjadi

- karena

- menjadi

- menjadi

- menjadi

- laku

- di belakang

- Percaya

- manfaat

- Manfaat

- TERBAIK

- antara

- lebih besar

- Milyar

- ikatan

- Kotak

- Otak

- Cabang

- merek

- merek

- membawa

- anggaran belanja

- bisnis

- pengembangan bisnis

- model bisnis

- proses bisnis

- strategi bisnis

- bisnis

- tapi

- by

- CAN

- mampu

- kasus

- kasus

- Menyebabkan

- disebabkan

- pusat

- menantang

- perubahan

- kejelasan

- jelas

- Jelas

- Pendakian

- lebih dekat

- kode

- kesadaran

- bagaimana

- datang

- Umum

- menyampaikan

- Perusahaan

- perusahaan

- membandingkan

- bersaing

- kompetisi

- pesaing

- beton

- Kondisi

- konfigurasi

- Terhubung

- terhubung

- menaklukkan

- Konsekuensi

- terdiri

- konstruksi

- Konsumen

- konteks

- kontinu

- Mudah

- Konversi

- meyakinkan

- Timeline

- benar

- bisa

- membuat

- dibuat

- membuat

- penciptaan

- sangat penting

- budaya

- pelanggan

- pengalaman pelanggan

- Layanan Pelanggan

- pelanggan

- CX

- siklus

- data

- manajemen data

- dekade

- keputusan

- menetapkan

- mendefinisikan

- menyenangkan

- menyampaikan

- pengiriman

- Permintaan

- menuntut

- tuntutan

- departemen

- tergantung

- tergantung

- menggambarkan

- Mendesain

- desain pemikiran

- desainer

- diinginkan

- Meskipun

- menemukan

- mengembangkan

- Pengembangan

- tim pengembangan

- mendikte

- berbeda

- membedakan

- digital

- era digital

- perbankan digital

- ruang digital

- teknologi digital

- arah

- Mengganggu

- dna

- do

- doesn

- don

- dilakukan

- puluhan

- dua

- dinamis

- setiap

- termudah

- Mudah

- Ekosistem

- Efektif

- efisien

- elemen

- emosi

- empati

- memberdayakan

- mendorong

- akhir

- berakhir

- mengikutsertakan

- Pertunangan

- Teknik

- nikmat

- cukup

- memastikan

- memastikan

- Seluruh

- sepenuhnya

- entitas

- pengusaha

- masuk

- menetapkan

- Eter (ETH)

- mengevaluasi

- Bahkan

- Setiap

- persis

- melebihi

- pengecualian

- Pasar Valas

- menjalankan

- Exit

- harapan

- pengalaman

- Pengalaman

- eksperimen

- keahlian

- ahli

- Menjelaskan

- menyelidiki

- Menjelajahi

- ekspres

- Fitur

- merasa

- perasaan

- Fenergo

- beberapa

- Angka

- mengisi

- Akhirnya

- keuangan

- keuangan

- Lembaga keuangan

- servis keuangan

- jasa keuangan

- Menemukan

- fintechs

- Pertama

- lima

- aliran

- Mengalir

- Fokus

- terfokus

- berfokus

- pengikut

- Untuk

- garis terdepan

- ditemukan

- fragmentasi

- FRAME

- gesekan

- tanpa gesekan

- dari

- Bahan bakar

- fungsi

- lebih lanjut

- masa depan

- Mendapatkan

- Keuntungan

- Umum

- dihasilkan

- generasi

- mendapatkan

- dengan senang hati

- Go

- tujuan

- baik

- Google Play

- merebut

- memahami

- terima kasih

- lebih besar

- Pertumbuhan

- menjamin

- berbahaya

- Memiliki

- membantu

- bermanfaat

- membantu

- di sini

- High

- sangat

- Seterpercayaapakah Olymp Trade? Kesimpulan

- How To

- HTTPS

- manusia

- Ratusan

- ide

- mengenali

- identitas

- if

- gambar

- Dampak

- melaksanakan

- penting

- memperbaiki

- meningkatkan

- in

- Termasuk

- industri

- industri

- tidak efisien

- informasi

- inovasi

- segera

- sebagai gantinya

- lembaga

- mengintegrasikan

- terpadu

- integrasi

- interaksi

- Antarmuka

- ke

- terlibat

- IT

- NYA

- Jobs

- perjalanan

- jpg

- hanya

- hanya satu

- pemeliharaan

- kunci

- pengetahuan

- Kekurangan

- tangga

- bahasa

- abadi

- diluncurkan

- terkemuka

- Memimpin

- meninggalkan

- Warisan

- Tingkat

- adalah ide yang bagus

- gaya hidup

- 'like'

- baris

- link

- Panjang

- jangka panjang

- lagi

- melihat

- mencari

- kalah

- Lot

- dicintai

- Rendah

- Loyalitas

- Utama

- mempertahankan

- membuat

- MEMBUAT

- Membuat

- pengelolaan

- memanipulasi

- banyak

- peta

- Pasar

- Marketing

- Cocok

- mewujudkan

- Maksimalkan

- maksimum

- berarti

- cara

- Sementara itu

- mengukur

- metodis

- Metodologi

- metrik

- mungkin

- keberatan

- Mindset

- Misi

- kesalahan

- mobil

- Mobile banking

- model

- uang

- lebih

- paling

- pindah

- terharu

- bergerak

- beberapa

- saling

- perlu

- Perlu

- dibutuhkan

- kebutuhan

- negatif

- jaringan

- New

- berikutnya

- tidak

- nomor

- of

- menawarkan

- ditawarkan

- menawarkan

- sering

- on

- Onboarding

- ONE

- secara online

- hanya

- Buka

- perbankan terbuka

- operasi

- Opsi

- or

- urutan

- organik

- organisatoris

- Lainnya

- di luar

- lebih

- secara keseluruhan

- pak

- pengemasan

- bagian

- tertentu

- bagian

- Konsultan Ahli

- untuk

- sempurna

- mungkin

- perspektif

- fisik

- Tempat

- rencana

- plato

- Kecerdasan Data Plato

- Data Plato

- Bermain

- Titik

- miskin

- mungkin

- kuat

- mencegah

- sebelumnya

- prinsip-prinsip

- Prioritaskan

- prioritas

- Masalah

- solusi masalah

- masalah

- proses

- proses

- memproduksi

- Produk

- desain produk

- pengembangan produk

- Produk

- profesional

- keuntungan

- progresif

- tepat

- dalil

- melindungi

- melindungi

- perlindungan

- prototipe

- terbukti

- memberikan

- disediakan

- menyediakan

- menyediakan

- Psikologi

- menempatkan

- Puting

- Piramida

- berkualitas

- kualitas

- pertanyaan

- Pertanyaan

- segera

- jarak

- peringkat

- mencapai

- mencapai

- nyata

- realisasi

- menuai

- merekomendasikan

- Merah

- menurunkan

- mengacu

- Ditolak..

- ingat

- Perwakilan

- reputasi

- wajib

- membutuhkan

- Hasil

- pendapatan

- membalikkan

- Hadiah

- benar

- mempertaruhkan

- Rute

- s

- sama

- Rahasia

- melihat

- menjual

- terpisah

- melayani

- melayani

- layanan

- Layanan

- bergeser

- harus

- penting

- signifikan

- silo

- sejak

- pencakar langit

- lambat

- Perlahan

- kelancaran

- padat

- larutan

- Solusi

- MEMECAHKAN

- Space

- berbicara

- spesialis

- tertentu

- menghabiskan

- Tahap

- magang

- berdiri

- Bintang

- awal

- Mulai

- dimulai

- Negara

- Status

- Langkah

- Tangga

- Masih

- berhenti

- terhenti

- menyimpan

- Cerita

- lurus

- Penyelarasan

- Perjuangan

- sukses

- cerita sukses

- berhasil

- seperti itu

- Mendukung

- yakin

- bertahan

- Keberlanjutan

- simbol

- T

- Mengambil

- Dibutuhkan

- tugas

- tim

- tim

- Teknologi

- istilah

- uji

- pengujian

- bahwa

- Grafik

- Masa depan

- Dunia

- mereka

- Mereka

- diri

- kemudian

- Sana.

- Ini

- mereka

- berpikir

- Pikir

- ini

- itu

- tiga

- Melalui

- waktu

- untuk

- hari ini

- Nada

- terlalu

- alat

- alat

- terhadap

- tradisional

- Transformasi

- transisi

- Transparansi

- mengobati

- trending

- dipicu

- Kepercayaan

- mencoba

- Putar

- jenis

- khas

- khas

- ui

- terakhir

- Ketidaktentuan

- memahami

- pemahaman

- unik

- us

- kegunaan

- penggunaan

- menggunakan

- bekas

- Pengguna

- Pengguna Pengalaman

- User Interface

- perjalanan pengguna

- Pengguna

- menggunakan

- ux

- Desain UX

- Berharga

- nilai

- proposisi nilai

- berbagai

- bersemangat

- View

- Cara..

- cara

- we

- Apa

- apakah

- yang

- SIAPA

- seluruh

- mengapa

- akan

- dengan

- tanpa

- Kerja

- kerja

- dunia

- akan

- tahun

- tahun

- iya nih

- kamu

- Anda

- zephyrnet.dll