- Canada’s economy likely slowed in December after expanding modestly in November.

- The number of new jobs in the US jumped by 517,000.

- Investors are awaiting employment data from Canada.

The USD/CAD weekly forecast is slightly bullish as the dollar will likely continue rising in the wake of a massive jobs report.

USD/CAD hullámvölgyei

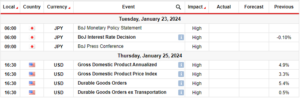

USD/CAD was volatile last week following the FOMC meeting, jobs, and PMI data from the US. There was also a GDP report from Canada.

- Ha érdekel forex demo számlák, tekintse meg részletes útmutatónkat -

Data released on Tuesday suggested that Canada’s economy likely slowed in December after expanding modestly in November, in line with forecasts.

The US central bank decreased its Wednesday rate hike to a quarter percentage point after a year of bigger rate increases. It disregarded the extensive list of variables driving up prices, such as the pandemic and the Ukraine war.

The number of new jobs in the US increased significantly in January, jumping by 517,000, well above the expected 185,000 increase in nonfarm payrolls. The unemployment rate of 3.4% was a more than 53-and-a-half-year low.

Another measure of the economy’s strength was the uptick in activity in the US services sector in January.

A jövő hét legfontosabb USD/CAD eseményei

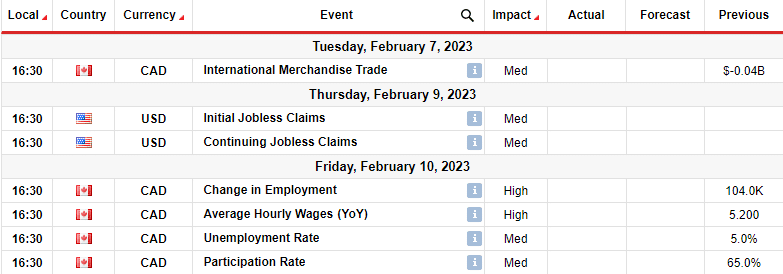

Next week, investors will pay attention to employment data from Canada and the US. In December, the Canadian economy added many jobs, and the unemployment rate surprisingly fell. Another positive jobs report would show a resilient labor market.

USD/CAD weekly technical forecast: On the verge of a bullish takeover

The daily chart shows USD/CAD trading at the 22-SMA, a pivotal level. The RSI trades at the 50-level, showing bulls and bears have almost equal momentum. With a strong bullish candle, the price has pushed off the 1.3303 support level. It has, however, paused at the 22-SMA resistance. A break above the SMA in the coming week could mean a bullish takeover.

- Ha érdekel Iszlám forex brókerek, tekintse meg részletes útmutatónkat -

This comes after a bearish move characterized by many pullbacks, with the price sticking close to the 22-SMA. This shows that the bears were not fully committed to the move.

If bulls take control, they will have to face the 1.3501 resistance. A break above this level would then lead to 1.3701 resistance. On the other hand, if bulls cannot trade above the 22-SMA, the bearish trend will likely continue.

Forex kereskedést keres most? Fektessen be az eToro-ba!

A lakossági befektetői számlák 67% -a pénzt veszít, amikor CFD-vel kereskedik ezzel a szolgáltatóval. Meg kell fontolnia, hogy megengedheti-e magának, hogy vállalja a pénz elvesztésének nagy kockázatát.

- SEO által támogatott tartalom és PR terjesztés. Erősödjön még ma.

- Platoblockchain. Web3 metaverzum intelligencia. Felerősített tudás. Hozzáférés itt.

- Forrás: https://www.forexcrunch.com/usd-cad-weekly-forecast-upbeat-nfp-to-trigger-bullishness/

- 000

- 1

- a

- felett

- Fiókok

- tevékenység

- hozzáadott

- Után

- Között

- és a

- Másik

- figyelem

- váró

- Bank

- esetlen

- Medvék

- nagyobb

- szünet

- Bullish

- Bulls

- Kanada

- Kanadai

- nem tud

- központi

- Központi Bank

- A CFD-k

- jellemzett

- Táblázatos

- ellenőrizze

- közel

- érkező

- elkötelezett

- Fontolja

- Konténer

- folytatódik

- ellenőrzés

- tudott

- napi

- dátum

- december

- Demó

- részletes

- Dollár

- vezetés

- gazdaság

- gazdaságé

- foglalkoztatás

- események

- bővülő

- várható

- kiterjedt

- Arc

- következő

- FOMC

- Előrejelzés

- forex

- ból ből

- teljesen

- GDP

- Magas

- Túra

- azonban

- HTTPS

- in

- Növelje

- <p></p>

- Növeli

- érdekelt

- befektet

- befektető

- Befektetők

- IT

- január

- Állások

- munkahelyek jelentése

- Kulcs

- munkaerő

- munkaerőpiac

- keresztnév

- vezet

- szint

- Valószínű

- vonal

- Lista

- veszít

- vesztes

- Elő/Utó

- sok

- piacára

- tömeges

- max-width

- intézkedés

- találkozó

- Lendület

- pénz

- több

- mozog

- Új

- NFP

- Nem mezőgazdasági

- Nonfarm bérszámfejtés

- november

- szám

- Más

- járvány

- Fizet

- munkatársakat

- százalék

- döntő

- Plató

- Platón adatintelligencia

- PlatoData

- délután

- pont

- pozitív

- ár

- Áraink

- ellátó

- meglökött

- Negyed

- Arány

- Érdemes megnézni

- felszabaduló

- jelentést

- rugalmas

- Ellenállás

- kiskereskedelem

- felkelő

- Kockázat

- SOR

- RSI

- szektor

- Szolgáltatások

- kellene

- előadás

- Műsorok

- jelentősen

- SMA

- ragasztás

- erő

- erős

- ilyen

- támogatás

- támogatási szintet

- SVG

- Vesz

- átvenni

- Műszaki

- A

- nak nek

- kereskedelem

- szakmák

- Kereskedés

- tendencia

- kiváltó

- Kedd

- Ukrajna

- ukrajnai háború

- munkanélküliség

- munkanélküliségi ráta

- UPS

- us

- USA Központi Bank

- nekünk NFP

- USD / CAD

- küszöbén

- illó

- Ébred

- háború

- Szerda

- hét

- heti

- vajon

- lesz

- lenne

- év

- A te

- zephyrnet