- The ECB claimed that EU lenders are properly capitalized and liquid.

- On Wednesday, the Fed increased interest rates for the ninth consecutive time.

- Investors believe the Fed may soon pause rate hikes.

The EUR/USD weekly forecast is bullish as the ECB is determined to continue its battle against inflation despite the financial instability.

Az EUR/USD hullámvölgyei

EUR/USD had a volatile week fueled by macroeconomic events and economic data. On Friday, European Union officials and the ECB presented a unified front on the banking industry to ease market anxieties. They claimed that EU lenders are properly capitalized and liquid due to the lessons learned from the 2008 Lehman Brothers collapse.

-Szeretne többet megtudni? STP brókerek? Tekintse meg részletes útmutatónkat -

Lagarde defended the ECB’s efforts to raise interest rates during financial instability to combat high inflation. She claimed there was no trade-off between fighting inflation and keeping the banking sector stable.

On Wednesday, the Fed increased interest rates for the ninth consecutive time, this time by a quarter of a percentage point.

Investors believe it was the last rate increase, and Fed Chair Jerome Powell mentioned there was discussion about pausing now.

On the data front, jobless claims in the US fell in another sign of labor market tightness. The housing sector had fairly upbeat data while core durable goods orders fell.

A jövő hét legfontosabb EUR/USD eseményei

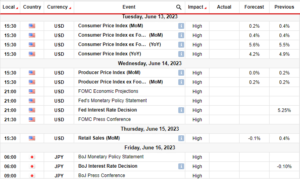

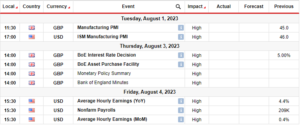

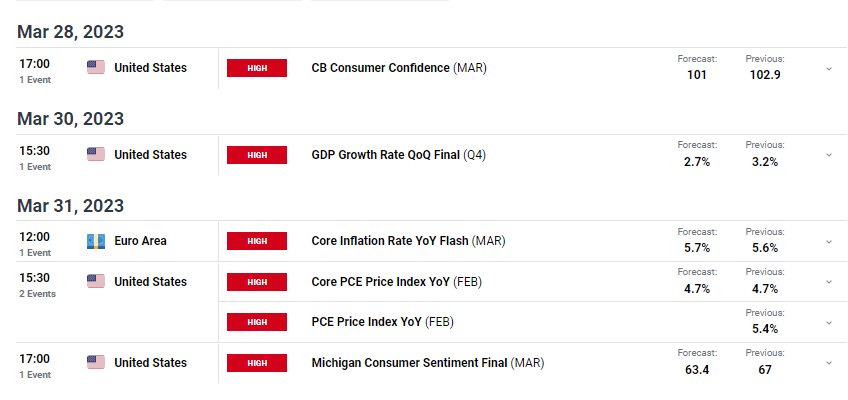

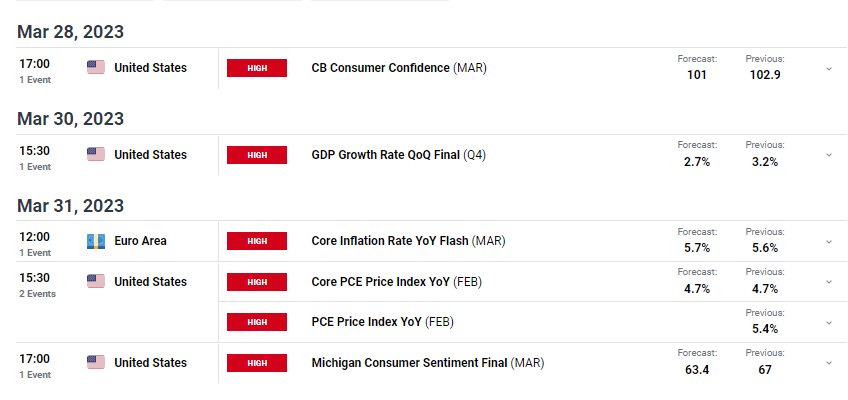

Investors will pay more attention to inflation data from the US and the Eurozone in the coming week. These reports influence the rating outlook for the ECB and the Fed. The focus will also be on the US GDP data that will give a clear picture of the economy in Q4.

EUR/USD weekly technical forecast: Rejection at the 1.0900-1.1004 resistance zone

The daily chart shows EUR/USD pulling back after touching the 1.0900 resistance. This resistance level and the 1.1004 level make up a strong resistance zone that has stopped the bullish trend before, leading to a reversal.

-Szeretne többet megtudni? forex robotok? Tekintse meg részletes útmutatónkat -

The price trades above the 22-SMA with the RSI above 50, indicating that bulls are still in control. The pullback might find support at the 22-SMA, leading to a retest of the resistance zone.

The bullish trend will strengthen if the price breaks above the resistance zone. However, if it holds firm, we might get a reversal leading to a retest and likely break below the 1.0543 support.

Forex kereskedést keres most? Fektessen be az eToro-ba!

A lakossági befektetői számlák 68%-a veszít pénzt, amikor CFD-vel kereskedik ezzel a szolgáltatóval. Meg kell fontolnia, hogy megengedheti-e magának a pénz elvesztésének nagy kockázatát

- SEO által támogatott tartalom és PR terjesztés. Erősödjön még ma.

- Platoblockchain. Web3 metaverzum intelligencia. Felerősített tudás. Hozzáférés itt.

- Forrás: https://www.forexcrunch.com/eur-usd-weekly-forecast-ecb-defends-hikes-despite-instability/

- :is

- $ UP

- 1

- a

- Rólunk

- felett

- Fiókok

- Után

- ellen

- és a

- Másik

- VANNAK

- AS

- At

- figyelem

- vissza

- Banking

- bankipar

- bankszektor

- Csata

- BE

- előtt

- Hisz

- lent

- között

- szünet

- szünetek

- testvérek

- Bullish

- Bulls

- by

- TUD

- nagybetűs

- A CFD-k

- Szék

- Táblázatos

- ellenőrizze

- azt állította,

- követelések

- világos

- Összeomlás

- elleni küzdelem

- érkező

- folyamatos

- Fontolja

- Konténer

- folytatódik

- ellenőrzés

- Mag

- napi

- dátum

- Ellenére

- részletes

- eltökélt

- vita

- mélypontok

- alatt

- EKB

- Gazdasági

- gazdaság

- erőfeszítések

- EU

- EUR / USD

- európai

- európai unió

- Eurózóna

- események

- meglehetősen

- Fed

- Fed elnöke

- Jerome Powell szövetségi elnök

- harcoló

- pénzügyi

- Találjon

- Cég

- Összpontosít

- A

- Előrejelzés

- forex

- Péntek

- ból ből

- front

- GDP

- kap

- Ad

- áruk

- Magas

- Magas infláció

- Kirándulások

- tart

- ház

- azonban

- HTTPS

- in

- Növelje

- <p></p>

- jelezve

- ipar

- infláció

- befolyás

- instabilitás

- kamat

- Kamat-

- érdekelt

- befektet

- befektető

- IT

- ITS

- jerome powell

- munkanélküli állítások

- tartás

- Kulcs

- munkaerő

- munkaerőpiac

- keresztnév

- vezető

- tanult

- tanulás

- Lehman

- hitelezők

- Tanulságok

- Tanulságok

- szint

- Valószínű

- Folyadék

- veszít

- vesztes

- makrogazdasági

- csinál

- piacára

- max-width

- említett

- esetleg

- pénz

- több

- of

- on

- rendelés

- Outlook

- Fizet

- százalék

- kép

- Plató

- Platón adatintelligencia

- PlatoData

- pont

- Powell

- bemutatott

- ár

- megfelelően

- ellátó

- vissza húzni

- vontatás

- Negyed

- emel

- Arány

- kamatemelések

- Az árak

- értékelés

- Jelentések

- Ellenállás

- kiskereskedelem

- megfordítás

- Kockázat

- SOR

- RSI

- szektor

- kellene

- Műsorok

- <p></p>

- Nemsokára

- stabil

- Még mindig

- megállt

- Meg kell erősíteni

- erős

- támogatás

- SVG

- Vesz

- Műszaki

- hogy

- A

- a Fed

- Ezek

- idő

- nak nek

- megható

- kereskedelem

- szakmák

- Kereskedés

- tendencia

- egységes

- unió

- us

- USA GDP

- illó

- Szerda

- hét

- heti

- vajon

- míg

- lesz

- val vel

- A te

- zephyrnet