- China relaxed its import regulations for Australian coal.

- The Fed’s December policy meeting minutes revealed that officials were committed to reducing inflation.

- US manufacturing activity contracted once more in December.

Today’s AUD/USD forecast is bearish. On Thursday, the dollar struggled to gain ground despite the fact that Federal Reserve officials’ commitment to fighting inflation was reaffirmed last month.

-Keresel automatizált kereskedési? Tekintse meg részletes útmutatónkat -

In contrast, the Australian currency gained strength due to China relaxing its import regulations for Australian coal.

The Fed’s December policy meeting minutes, which were made public overnight, revealed that although officials agreed that the central bank should reduce the rate at which it raises interest rates, they remained committed to reducing inflation and were wary of any “misperception” in the financial markets to the contrary.

Neel Kashkari, president of the Minneapolis Fed, added on Wednesday that he believes the Federal Reserve’s target interest rate would peak at 5.4%, which is higher than the current market consensus of slightly under 5%. However, the value of the US dollar did not increase as a result.

Although a survey from the Institute for Supply Management (ISM) revealed that US manufacturing activity contracted once more in December, economic figures also released on Wednesday showed that job vacancies in the country declined less than anticipated in November.

The revelation that China’s state planner has permitted three utilities sponsored by the central government and the country’s largest steelmaker to begin importing coal from Australia was the catalyst for a 1.7% increase in the Australian dollar overnight. This is the first such action since Beijing unofficially banned coal trading with Canberra in 2020.

Az AUD/USD legfontosabb eseményei ma

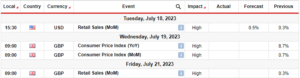

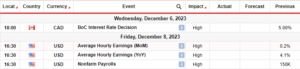

Investors will pay attention to jobs data from the US, including the ADP nonfarm payrolls and the initial jobless claims report.

AUD/USD technical forecast: The 0.6800 support might see the return of bulls

The 4-hour chart shows that AUD/USD is pulling back after a strong bullish move that paused at the 0.6875 resistance level. At this point, bears came in for a retracement toward the 30-SMA. The bearish move has paused at the 0.6800 level, a strong support.

- Ha érdekel forex napi kereskedés majd olvassa el útmutatónkat az induláshoz –

There is also support from the 30-SMA below. If bears can gather enough momentum, the price might break below and reach the 0.6750 level. However, if 0.6800 holds strong, the price will likely retest the 0.6875 resistance.

Forex kereskedést keres most? Fektessen be az eToro-ba!

A lakossági befektetői számlák 67% -a pénzt veszít, amikor CFD-vel kereskedik ezzel a szolgáltatóval. Meg kell fontolnia, hogy megengedheti-e magának, hogy vállalja a pénz elvesztésének nagy kockázatát.

- SEO által támogatott tartalom és PR terjesztés. Erősödjön még ma.

- Platoblockchain. Web3 metaverzum intelligencia. Felerősített tudás. Hozzáférés itt.

- Forrás: https://www.forexcrunch.com/aud-usd-forecast-china-relaxes-import-regulations-for-australian-coal/

- 1

- 2020

- a

- Fiókok

- Akció

- tevékenység

- hozzáadott

- adp

- Után

- Bár

- és a

- várható

- figyelem

- AUD / USD

- Ausztrália

- ausztrál

- Ausztrál dollár

- Automatizált

- Automatizált kereskedés

- vissza

- Bank

- betiltották

- esetlen

- Medvék

- Peking

- úgy gondolja,

- lent

- szünet

- Bullish

- Katalizátor

- központi

- Központi Bank

- A CFD-k

- Táblázatos

- ellenőrizze

- Kína

- kínai

- követelések

- Szén

- elkötelezettség

- elkötelezett

- megegyezés

- Fontolja

- Konténer

- ellentétes

- kontraszt

- ország

- ország

- Valuta

- Jelenlegi

- dátum

- nap

- december

- Ellenére

- részletes

- DID

- Dollár

- Gazdasági

- elég

- események

- Fed

- Szövetségi

- Federal Reserve

- Federal Reserve's

- harc

- harcoló

- ábrák

- pénzügyi

- vezetéknév

- Előrejelzés

- forex

- ból ből

- Nyereség

- szerzés

- Kormány

- Földi

- útmutató

- Magas

- <p></p>

- tart

- azonban

- HTTPS

- importál

- importáló

- in

- Beleértve

- Növelje

- infláció

- kezdetben

- Intézet

- kamat

- KAMATLÁB

- Kamat-

- érdekelt

- befektet

- befektető

- IT

- Munka

- munkanélküli állítások

- Állások

- Kulcs

- legnagyobb

- keresztnév

- szint

- Valószínű

- keres

- veszít

- vesztes

- készült

- vezetés

- gyártási

- piacára

- piacok

- max-width

- találkozó

- esetleg

- jegyzőkönyv

- Lendület

- pénz

- Hónap

- több

- mozog

- Nem mezőgazdasági

- Nonfarm bérszámfejtés

- november

- Outlook

- éjszakai

- Fizet

- munkatársakat

- Csúcs

- Plató

- Platón adatintelligencia

- PlatoData

- pont

- politika

- elnök

- ár

- ellátó

- nyilvános

- vontatás

- emelés

- Arány

- Az árak

- el

- Olvass

- megerősítette

- csökkenteni

- csökkentő

- előírások

- felszabaduló

- maradt

- maradványok

- jelentést

- Tartalék

- tartalékok

- Ellenállás

- eredményez

- kiskereskedelem

- visszakövetés

- visszatérés

- Revealed

- Kockázat

- SOR

- kellene

- Műsorok

- óta

- Szponzorált

- Állami

- erő

- erős

- ilyen

- kínálat

- támogatás

- Felmérés

- SVG

- Vesz

- cél

- Műszaki

- A

- a Fed

- három

- nak nek

- mai

- felé

- kereskedelem

- Kereskedés

- alatt

- us

- Amerikai dollár

- segédprogramok

- érték

- Szerda

- vajon

- ami

- lesz

- lenne

- A te

- zephyrnet