ECB Follows With 50bps Hike

Markets turned lower after the Federal Reserve raised benchmark U.S. interest rates by 0.50% on Dec. 14 and the European Central Bank followed suit on Dec. 15.

Bitcoin is down 1.2% in the last 24 hours. Ether, the second-largest crypto asset, is down 1%, and Binance’s BNB is down 0.6%.

ETH Price + BTC Price + BNB Price, स्रोत: द डिफेंट टर्मिनल

Major U.S. stock indices also took a bearish turn, with the Nasdaq, Dow Jones Industrials, and S&P 500 all closing down over 2% on the day.

It’s been a rollercoaster week that started off in the green, with BTC and ETH hitting four-week highs after U.S. inflation numbers came in अपेक्षा से कम दिसंबर 13 पर

The Fed’s 50 basis point hike comes after four straight raises of 0.75% this year, which have depressed crypto prices as liquidity has dried up and acted as an increasingly powerful magnet to attract capital away from DeFi to assets like U.S. Treasuries.

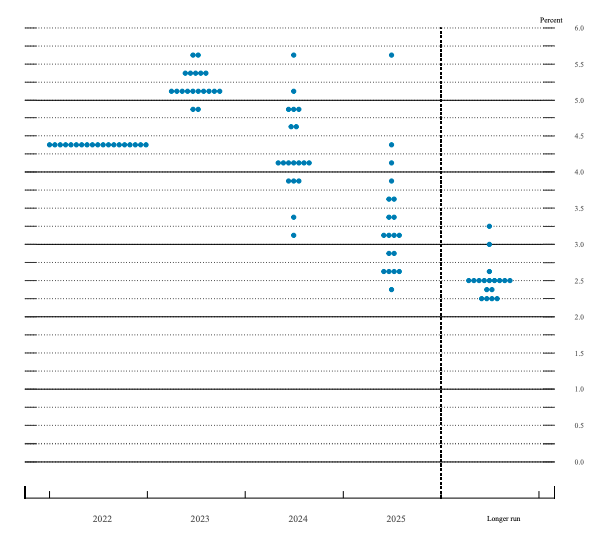

While few were caught off guard by the 50 basis point raise, the most notable bearish signal was the Fed’s आर्थिक अनुमानों का सारांश, which showed that 17 of 19 Fed officials anticipated the Federal Funds Rate to stay above 5% during 2023.

This indicates that the central bank isn’t shying away from keeping rates elevated at levels last seen in 2007. That’s an intimidating prospect for crypto investors who have never navigated an environment where the federal funds rate is above 3%, let alone 5%.

Not everyone is taking the Fed’s predictions so seriously, however. “The Fed voters are the worst predictors of their own future votes,” Jordi Alexander, the CIO at Selini Capital, चुटकी ली.

चेनैलिसिस रिपोर्ट

And still, despite the economic headwinds and FTX’s collapse, crypto investors may have already taken harder lumps earlier in the year — a Dec. 14 रिपोर्ट from Chainalysis shows that realized losses from FTX का पतन came in at $9B, compared with $20.5B stemming from the Terra/UST collapse and $33B after सेल्सियस and Three Arrows Capital बिखर गया.

Looking forward to the next Federal Open Market Committee meeting, CME FedWatch पता चलता है a 75% probability of a 25 basis point hike in February 2023.

- एसईओ संचालित सामग्री और पीआर वितरण। आज ही प्रवर्धित हो जाओ।

- प्लेटोब्लॉकचैन। Web3 मेटावर्स इंटेलिजेंस। ज्ञान प्रवर्धित। यहां पहुंचें।

- स्रोत: https://thedefiant.io/markets-slide-on-hawkish-fed/

- 1

- 2%

- 50 एमबी

- a

- ऊपर

- बाद

- अलेक्जेंडर

- सब

- अकेला

- पहले ही

- amp

- और

- प्रत्याशित

- आस्ति

- संपत्ति

- बैंक

- आधार

- मंदी का रुख

- बेंचमार्क

- bnb

- BTC

- बीटीसी मूल्य

- राजधानी

- पकड़ा

- केंद्रीय

- सेंट्रल बैंक

- काइनालिसिस

- सीआईओ

- समापन

- सीएमई

- संक्षिप्त करें

- तुलना

- क्रिप्टो

- क्रिप्टो संपत्ति

- क्रिप्टो निवेशक

- दिन

- Defi

- के बावजूद

- DOT

- डो

- डॉव जोन्स

- नीचे

- दौरान

- पूर्व

- आर्थिक

- बुलंद

- वातावरण

- ETH

- ईथर

- यूरोपीय

- यूरोपीय केंद्रीय बैंक

- हर कोई

- फेड

- संघीय

- संघीय धन की दर

- फेडरल ओपन मार्केट समिति

- फेडरल रिजर्व

- कुछ

- पीछा किया

- इस प्रकार है

- आगे

- से

- धन

- भविष्य

- हरा

- गार्ड

- विपरीत परिस्थितियों

- यहाँ उत्पन्न करें

- उच्चतर

- highs

- वृद्धि

- मार

- घंटे

- तथापि

- एचटीएमएल

- HTTPS

- in

- इंगित करता है

- Indices

- मुद्रास्फीति

- ब्याज

- ब्याज दर

- डराना

- निवेशक

- रखना

- पिछली बार

- स्तर

- चलनिधि

- हानि

- बाजार

- Markets

- बैठक

- अधिकांश

- प्रतिभूति व्यापारी स्वचालित दर राष्ट्रीय संघ

- अगला

- प्रसिद्ध

- संख्या

- खुला

- अपना

- पीडीएफ

- प्लेटो

- प्लेटो डेटा इंटेलिजेंस

- प्लेटोडाटा

- बिन्दु

- शक्तिशाली

- भविष्यवाणियों

- मूल्य

- संभावना

- उठाना

- उठाया

- उठाता

- मूल्यांकन करें

- दरें

- एहसास हुआ

- रिज़र्व

- एस एंड पी

- S & P 500

- दूसरा सबसे बड़ा

- दिखाता है

- संकेत

- स्लाइड

- So

- स्रोत

- शुरू

- रहना

- फिर भी

- स्टॉक

- सीधे

- सूट

- ले जा

- RSI

- लेकिन हाल ही

- इस वर्ष

- तीन

- तीन तीर

- तीन तीर राजधानी

- सेवा मेरे

- भंडारों

- मोड़

- बदल गया

- हमें

- अमेरिकी मुद्रास्फीति

- अमेरिका के खजाने

- मतदाता

- वोट

- सप्ताह

- कौन कौन से

- कौन

- वर्स्ट

- वर्ष

- जेफिरनेट