- Eurozone consumer confidence fell in January.

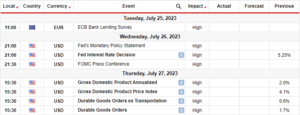

- The ECB will likely pause interest rate hikes in the upcoming meeting.

- Investors will scrutinize ECB chief Christine Lagarde’s press conference for indications of the future direction of rates.

Wednesday witnessed a slight bullish tilt in the EUR/USD price analysis ahead of the pivotal European Central Bank rate decision. Additionally, investors were awaiting key PMI data from the Eurozone and the US.

-Êtes-vous intéressé à en savoir plus sur le groupe de télégrammes de signaux forex? Cliquez ici pour plus de détails-

On Thursday, investors will focus on the ECB chief Christine Lagarde’s press conference, seeking crucial clues about the future trajectory of interest rates.

There’s a consensus that the ECB will likely pause interest rate hikes in the upcoming meeting. However, traders foresee potential cuts totaling approximately 130 basis points throughout the year. Moreover, the likelihood of the first cut in June is nearly 97%.

Elsewhere, data released on Tuesday revealed a decline in Eurozone consumer confidence for January compared to December.

Meanwhile, the dollar pulled back slightly but remained firm due to the Fed’s cautious approach towards interest rate cuts. In her last remarks before the January 31 policy decision blackout period, San Francisco Fed President Mary Daly stated that monetary policy is in a “good place,” and it’s premature to expect imminent rate cuts.

Similarly, Fed Governor Christopher Waller emphasized a “careful and slow” approach to rate cuts. James Kniveton, senior corporate FX dealer at Convera, noted that markets no longer expect imminent rate cuts, which is supporting the dollar.

This trend aligns with a broader resistance to rate cuts among major central banks. Kniveton added, “We have seen ECB officials push back on rate cut expectations as well, just like the Federal Reserve.”

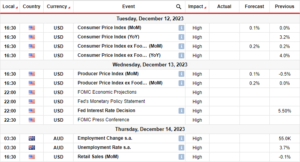

Principaux événements EUR/USD aujourd'hui

- German flash manufacturing and services PMI

- Indice PMI américain de fabrication et de services flash

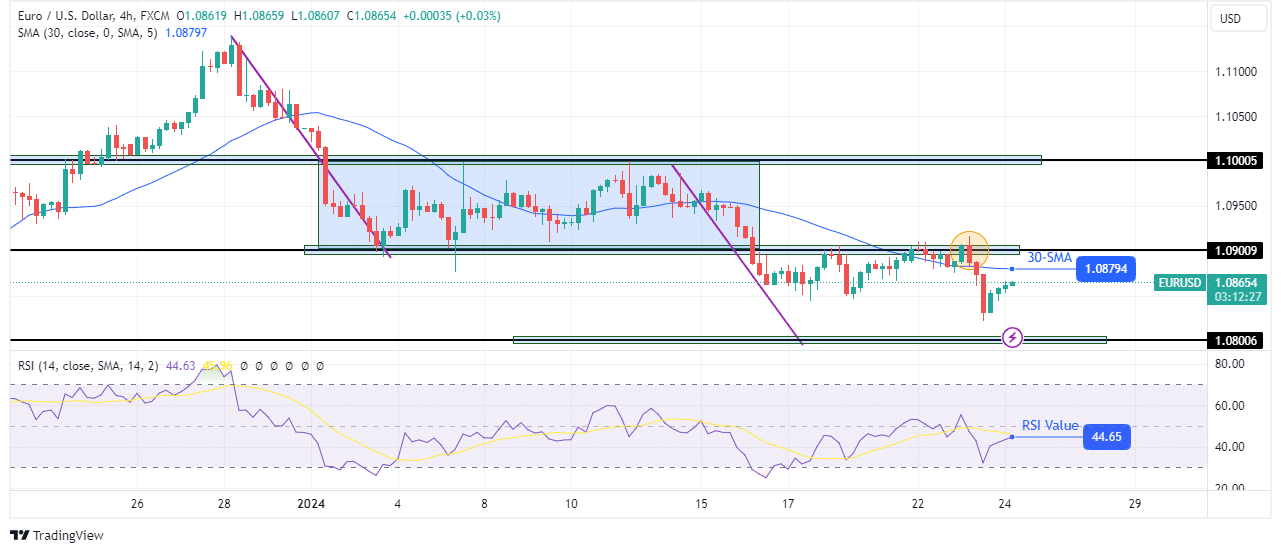

EUR/USD technical price analysis: Price edges closer to crucial 1.0800 support

On the technical side, EUR/USD has made a lower low after respecting the 1.0900 key resistance level. Consequently, the price is getting closer to retesting the 1.0800 support level. After breaking below 1.0900, the price lingered near the level, pulling back every time bears tried to push it lower.

-Souhaitez-vous en savoir plus sur gagner de l'argent avec le forex? Consultez notre guide détaillé-

However, a significant decline came when the price made a bearish engulfing candle at the 1.0900 level. Currently, the price is rebounding and might retest the 30-SMA as resistance. If the SMA holds firm, EUR/USD could soon touch the 1.0800 support.

Vous cherchez à trader le forex maintenant ? Investissez chez eToro !

67% des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devriez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent.

- Contenu propulsé par le référencement et distribution de relations publiques. Soyez amplifié aujourd'hui.

- PlatoData.Network Ai générative verticale. Autonomisez-vous. Accéder ici.

- PlatoAiStream. Intelligence Web3. Connaissance Amplifiée. Accéder ici.

- PlatonESG. Carbone, Technologie propre, Énergie, Environnement, Solaire, La gestion des déchets. Accéder ici.

- PlatoHealth. Veille biotechnologique et essais cliniques. Accéder ici.

- La source: https://www.forexcrunch.com/blog/2024/01/24/eur-usd-price-analysis-euro-rises-on-eve-of-ecb-rate-decision/

- :possède

- :est

- 1

- 130

- 31

- a

- Qui sommes-nous

- hybrides

- ajoutée

- En outre

- Après

- devant

- Aligne

- parmi

- selon une analyse de l’Université de Princeton

- ainsi que les

- une approche

- d'environ

- AS

- At

- attente

- RETOUR

- Banque

- Le taux bancaire

- Banks

- base

- baissier

- Ours

- before

- ci-dessous

- Rupture

- plus large

- Haussier

- mais

- venu

- CAN

- prudent

- central

- Banque centrale

- Banques centrales

- CFD

- vérifier

- chef

- Christine

- Christopher

- Christopher Waller

- cliquez

- plus

- par rapport

- Congrès

- confiance

- Consensus

- par conséquent

- Considérer

- consommateur

- Entreprises

- pourriez

- crucial

- Lecture

- Cut/Taille

- coupes

- données

- concessionnaire

- Décembre

- décision

- Refuser

- détaillé

- direction

- Dollar

- deux

- BCE

- Décision de taux de la BCE

- souligné

- EUR / USD

- euro

- du

- Banque centrale européenne

- Eurozone

- veille

- événements

- Chaque

- attendre

- attentes

- Fed

- National

- Réserve fédérale

- Ferme

- Prénom

- Flash

- Focus

- Pour

- prévoir

- forex

- Francisco

- de

- avenir

- FX

- obtention

- Gouverneur

- Vous avez

- ici

- ici

- Haute

- Randonnées

- détient

- Cependant

- HTTPS

- if

- in

- les indications

- intérêt

- TAUX D'INTÉRÊT

- HAUSSES DES TAUX D'INTÉRÊT

- Taux d'intérêt

- intéressé

- Investir

- investor

- Investisseurs

- IT

- Jacques

- Janvier

- juin

- juste

- ACTIVITES

- résistance clé

- Nom de famille

- apprentissage

- Niveau

- comme

- probabilité

- Probable

- plus long

- perdre

- pas à perdre

- Faible

- baisser

- LES PLANTES

- majeur

- fabrication

- Marchés

- Marie

- largeur maximale

- réunion

- pourrait

- Monétaire

- Politique monétaire

- de l'argent

- PLUS

- Par ailleurs

- Près

- presque

- aucune

- noté

- maintenant

- of

- fonctionnaires

- on

- nos

- pause

- période

- pivot

- Place

- Platon

- Intelligence des données Platon

- PlatonDonnées

- pmi

- des notes bonus

- politique

- défaillances

- Prématuré

- président

- Press

- prix

- Analyse des prix

- de voiture.

- tirant

- Push

- repousser

- Tarif

- hausses de taux

- Tarifs

- libéré

- resté

- Réserver

- Résistance

- respectant

- détail

- Révélé

- Monte

- Analyse

- San

- San Francisco

- recherche

- vu

- supérieur

- Services

- devrait

- côté

- signaux

- significative

- SMA

- disponible

- A déclaré

- Support

- niveau de soutien

- Appuyer

- Prenez

- Technique

- Telegram

- qui

- Les

- El futuro

- this

- tout au long de

- Jeudi

- fiable

- à

- soit un total de

- -nous

- vers

- commerce

- Les commerçants

- Commerce

- trajectoire

- Trend

- essayé

- Mardi

- prochain

- us

- WELL

- ont été

- quand

- que

- qui

- sera

- comprenant

- témoin

- an

- you

- Votre

- zéphyrnet