- The fourth-quarter US gross domestic product will likely reveal a 2% annualized growth.

- On Wednesday, the Bank of Canada maintained its key overnight rate at 5%.

- Money markets fully anticipate a 25 basis point BoC rate cut in June.

Thursday’s USD/CAD forecast hinted at bullish prospects, with the dollar standing resilient near a six-week high. Investors eagerly awaited GDP and other critical data, seeking valuable insights that could give clues on the outlook for US interest rates.

-آیا شما علاقه مند به کسب اطلاعات بیشتر در مورد معاملات گزینه های فارکس? راهنمای دقیق ما را بررسی کنید-

The initial report on the fourth-quarter US gross domestic product will likely reveal a 2% annualized growth. Moreover, the report might show that the US avoided a recession in 2023. Furthermore, it will likely indicate a slowdown in inflation during the last quarter. This could fuel expectations of potential rate cuts in the first half of 2024.

Meanwhile, the Canadian dollar weakened after the Bank of Canada held its key overnight rate at 5% on Wednesday. Additionally, it emphasized a shift in focus from concerns about underlying inflation to considering when to cut rates.

Canadian money markets expect a 25 basis point cut in June. The BoC removed language from previous policy statements on possible rate hikes. However, Governor Macklem later mentioned that the possibility of additional rate hikes had not been ruled out.

Furthermore, the BoC adjusted its growth outlook, anticipating weak growth in the first quarter, followed by a gradual pickup. Inflation will likely stay around 3% in the first half of 2024, easing to 2.5% in the second half. Meanwhile, a return to the 2% target will likely happen sometime in 2025.

رویدادهای کلیدی USD/CAD امروز

- Advance US GDP q/q

- ادعای بیکاری آمریکا

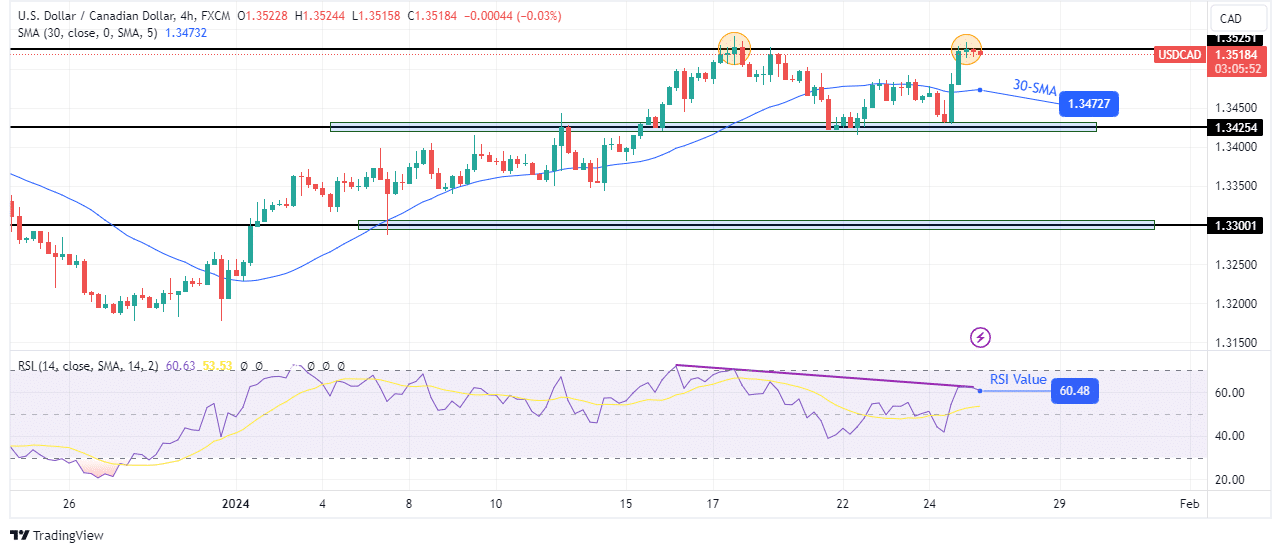

USD/CAD technical forecast: Bulls make a comeback

On the technical side, USD/CAD has retested the 1.3525 resistance level after the bearish takeover failed at the 1.3425 support level. At the moment, bulls are attempting to resume the previous bullish trend. They have pushed the price above the 30-SMA, and the RSI is above 50.

-اگر علاقه مند به دانستن در مورد اسکالپینگ کارگزاران فارکس، سپس دستورالعمل های ما را برای شروع بخوانید-

Initially, bears had attempted to take control when the price broke below the 30-SMA. However, they were not strong enough to continue below the 1.3425 support level, allowing bulls to regain control.

Now, bulls are facing strong resistance. At the same time, the RSI is showing weaker bullish momentum at this resistance. If it holds, the price will fall back to the 1.3425 support. Meanwhile, the bullish trend will continue if bulls regain momentum.

اکنون به دنبال تجارت فارکس هستید؟ در eToro سرمایه گذاری کنید!

68٪ از حساب های سرمایه گذاران خرده فروشی در هنگام معامله CFD با این ارائه دهنده ضرر می کنند. شما باید فکر کنید که آیا توانایی پرداخت خطر بالای از دست دادن پول خود را دارید یا خیر.

- محتوای مبتنی بر SEO و توزیع روابط عمومی. امروز تقویت شوید.

- PlatoData.Network Vertical Generative Ai. به خودت قدرت بده دسترسی به اینجا.

- PlatoAiStream. هوش وب 3 دانش تقویت شده دسترسی به اینجا.

- PlatoESG. کربن ، CleanTech، انرژی، محیط، خورشیدی، مدیریت پسماند دسترسی به اینجا.

- PlatoHealth. هوش بیوتکنولوژی و آزمایشات بالینی. دسترسی به اینجا.

- منبع: https://www.forexcrunch.com/blog/2024/01/25/usd-cad-forecast-dollar-holds-near-6-week-high-ahead-of-gdp/

- : دارد

- :است

- :نه

- 1

- 2%

- 2023

- 2024

- 2025

- 25

- 50

- a

- درباره ما

- بالاتر

- حساب ها

- اضافی

- علاوه بر این

- تنظیم شده

- پس از

- پیش

- اجازه دادن

- و

- سالانه

- سبقت جستن

- پیش بینی

- هستند

- دور و بر

- At

- تلاش

- تلاش

- اجتناب کنید

- منتظر

- به عقب

- بانک

- بانک کانادا

- اساس

- نقطه پایه

- بی تربیت

- خرس

- بوده

- در زیر

- BoC

- شکست

- سرسخت کله شق

- بولز

- by

- CAN

- Canada

- کانادایی

- دلار کانادایی

- CFDs

- بررسی

- نگرانی ها

- در نظر بگیرید

- با توجه به

- ادامه دادن

- کنترل

- میتوانست

- بحرانی

- برش

- کاهش

- داده ها

- دقیق

- دلار

- داخلی

- در طی

- مشتاقانه

- تسکین دهنده

- تاکید

- کافی

- حوادث

- انتظار

- انتظارات

- نما

- ناموفق

- سقوط

- نام خانوادگی

- تمرکز

- به دنبال

- برای

- پیش بینی

- فارکس

- از جانب

- سوخت

- کاملا

- بعلاوه

- GDP

- دریافت کنید

- دادن

- فرماندار

- فرماندار مکلم

- تدریجی

- درشت

- رشد

- دستورالعمل ها

- بود

- نیم

- رخ دادن

- آیا

- برگزار شد

- زیاد

- پیاده روی

- مرموز

- دارای

- اما

- HTTPS

- if

- in

- نشان دادن

- تورم

- اول

- بینش

- علاقه

- نرخ بهره

- علاقه مند

- سرمایه گذاری

- سرمایه گذار

- سرمایه گذاران

- IT

- ITS

- ژوئن

- کلید

- دانا

- زبان

- نام

- بعد

- یاد گرفتن

- سطح

- احتمالا

- از دست دادن

- شکست

- ماکلم

- ساخت

- بازارها

- حداکثر عرض

- در ضمن

- ذکر شده

- قدرت

- لحظه

- حرکت

- پول

- بیش

- علاوه بر این

- نزدیک

- اکنون

- of

- on

- گزینه

- دیگر

- ما

- خارج

- چشم انداز

- شبانه

- پیکاپ

- افلاطون

- هوش داده افلاطون

- PlatoData

- نقطه

- سیاست

- امکان

- ممکن

- پتانسیل

- قبلی

- قیمت

- محصول

- چشم انداز

- ارائه دهنده

- تحت فشار قرار دادند

- یک چهارم

- نرخ

- افزایش نرخ

- نرخ

- خواندن

- بحران اقتصادی

- به دست آوردن مجدد

- حذف شده

- گزارش

- انعطاف پذیر

- مقاومت

- ادامه

- خرده فروشی

- برگشت

- فاش کردن

- خطر

- RSI

- حکومت

- همان

- دوم

- به دنبال

- تغییر

- باید

- نشان

- نمایش

- طرف

- کاهش سرعت

- ایستاده

- اظهارات

- ماندن

- قوی

- پشتیبانی

- سطح پشتیبانی

- گرفتن

- تصاحب

- هدف

- فنی

- که

- La

- سپس

- آنها

- این

- زمان

- به

- تجارت

- تجارت

- روند

- اساسی

- بی کاری

- us

- تولید ناخالص داخلی آمریکا

- USD / CAD

- ارزشمند

- ضعیف تر

- چهار شنبه

- بود

- چه زمانی

- چه

- اراده

- با

- شما

- شما

- زفیرنت