As every investor and their French Bulldog scrambles to get in on the AI action, we look to the data for answers.

Ironically, we can’t even define “AI” as a sector per se since almost every startup looking for some coin or decent press suddenly identifies as an “AI-centered-something-or-other.”

But for the purists, the numbers don’t lie — or in the very least they tell a clearer story than the prevalent “AI will save the world” narrative.

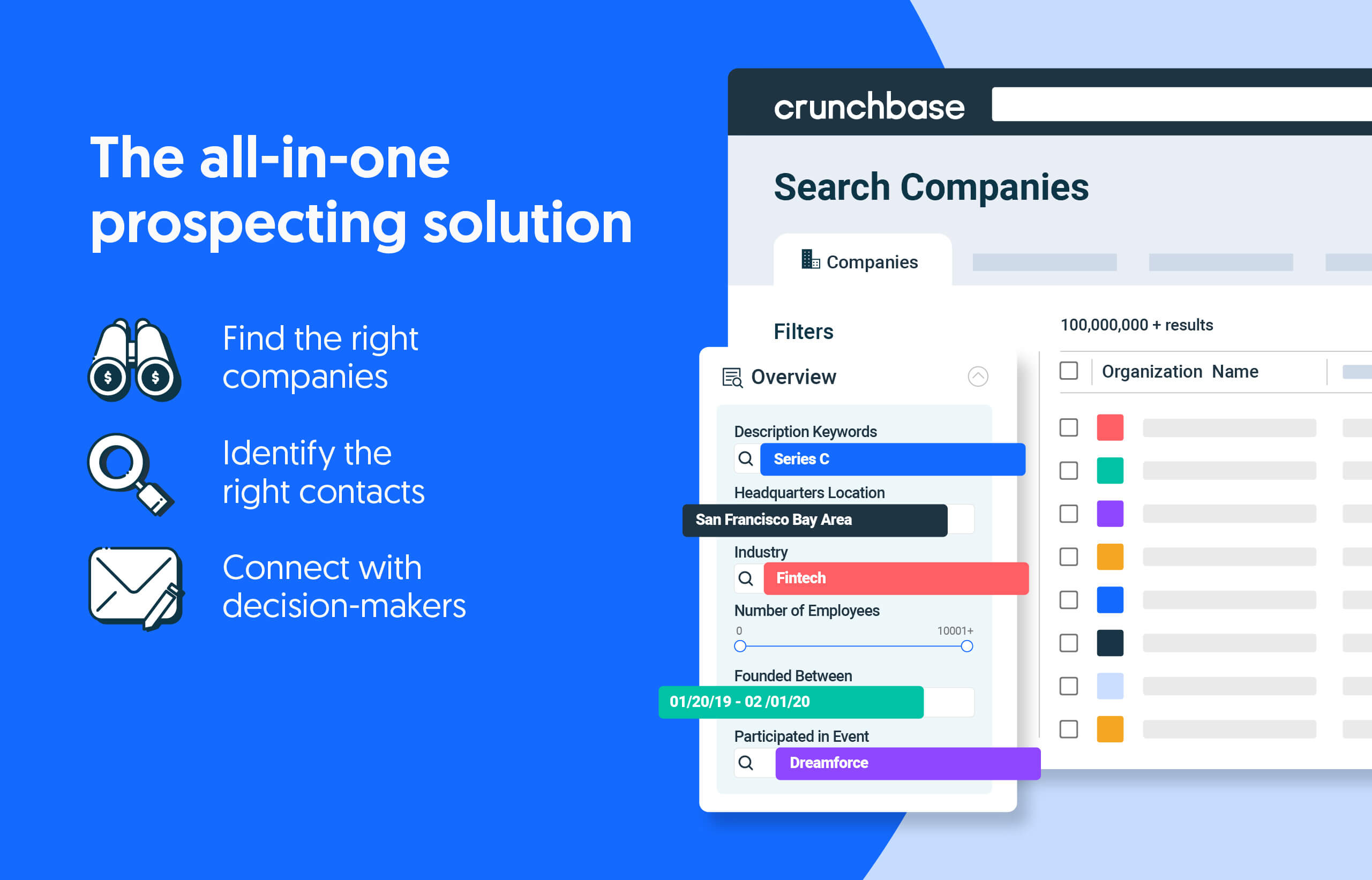

Otsige vähem. Sulgege rohkem.

Suurendage oma tulusid kõikehõlmavate potentsiaalsete potentsiaalsete lahenduste abil, mille jõuallikaks on eraettevõtete andmete liider.

In fact, early this week investors poured $700 million into two AI startups — Builder.ai ja Antroopne — and followed up mid-week with another $ 105 miljonit to AI marketing platform Insider. It seems we’ve reached another level of the AI craze that has dominated the private markets since late last year.

Overall, $20 billion has been raised by startups using “AI” in 2023. (Fun fact: $20 billion could pay the salaries of 307,266 teachers for one year.) But let’s definitely keep making those AI-generated selfies.

So much buzz

Are startups worried about the downturn? We guess it depends on who writes their checks.

Tegelikult Bessemer Venture Partnerid, one of the oldest and more established venture firms in the U.S., earlier this year said it is earmarking $1 billion of its most recent fund solely for investments in artificial intelligence.

And that’s just one firm.

See nädal we published an interview with Bessemer partner Sameer Dholakia, who aptly said of the AI movement: “Literally trillions of dollars of value gets created when you have these massive tectonic shifts.”

And what about AI IPOs?

But it’s not all unicorns and rainbows for AI. Just because funding to the sector is hot, that doesn’t mean the appetite on the public markets is at the same level.

If we look at public markets (and we did) it’s clear that an AI focus hasn’t been a recipe for stock market gains. This is evident looking at recent performance of the most highly valued AI-oriented companies to go public in the quarters leading up to the market peak.

Tagasi tulevikku

Let’s circle back to those trillions that Bessemer’s Dholakia was talking about. While we aren’t seeing the fruit of those hefty AI investments just yet, the promise (or at least the hope) among investors and the journalists that cover them is that these startups will deliver sooner rather than later.

According to Dholakia, the “adoption curve on this one will be mind-blowingly fast.”

Seotud Crunchbase Pro päring

Seotud lugemine:

Illustratsioon: Dom Guzman

Olge Crunchbase Daily abil kursis viimaste rahastamisvoorude, omandamiste ja muuga.

Worldcoini arendaja Tools For Humanity, mille kaasasutaja oli OpenAI Sam Altman, kogus Blockchain Capitali juhtimisel 115 miljonit dollarit C-seeria.

Despite some recent debt rounds from well-known startups that garnered headlines, VC-backed startups in the U.S. have raised about $5.5 billion on…

Turkey-based AI marketing platform Insider locked up another $105 million and plans to use the new cash for M&A dealmaking.

ElevateBio, a Massachusetts-based gene therapy startup, announced $401 million in Series D funding.

- SEO-põhise sisu ja PR-levi. Võimenduge juba täna.

- PlatoAiStream. Web3 andmete luure. Täiustatud teadmised. Juurdepääs siia.

- Tuleviku rahapaja Adryenn Ashley. Juurdepääs siia.

- Ostke ja müüge IPO-eelsete ettevõtete aktsiaid koos PREIPO®-ga. Juurdepääs siia.

- Allikas: https://news.crunchbase.com/ai-robotics/ai-venture-funding-ipo-startups/

- :on

- :on

- :mitte

- $ 1 miljardit

- $ UP

- 2023

- 60

- a

- MEIST

- ülevõtmised

- tegevus

- AI

- ai investeeringud

- AI turundus

- Materjal: BPA ja flataatide vaba plastik

- kõik ühes

- vahel

- an

- ja

- teatas

- Teine

- vastuseid

- söögiisu

- kunstlik

- AS

- At

- tagasi

- BE

- sest

- olnud

- bessemer

- Miljard

- blockchain

- Blockchain Capital

- kuid

- by

- kapital

- Raha

- Kontroll

- Ring

- selge

- selgemaks

- lähedal

- Münt

- Ettevõtted

- võiks

- cover

- loodud

- CrunchBase

- kõver

- iga päev

- andmed

- kuupäev

- Võlg

- kindlasti

- tarnima

- sõltub

- arendaja

- DID

- Ei tee

- dollarit

- Ära

- ALLAKS

- Ajalugu

- Varajane

- ed

- lõpp

- asutatud

- Isegi

- Iga

- ilmne

- asjaolu

- KIIRE

- Firma

- ettevõtetele

- Keskenduma

- Järgneb

- eest

- prantsuse

- Alates

- lõbu

- fond

- rahastamise

- rahastamisvoorud

- Kasum

- saama

- Go

- Olema

- Pealkirjad

- kõrgelt

- lootus

- KUUM

- HTML

- HTTPS

- Inimkond

- hype

- identifitseerib

- in

- Insider

- sisse

- Investeeringud

- investor

- Investorid

- IPO

- IT

- ITS

- Ajakirjanikud

- jpg

- lihtsalt

- ainult üks

- hoidma

- viimane

- Eelmisel aastal

- Hilja

- pärast

- juht

- juhtivate

- kõige vähem

- Led

- vähem

- Tase

- lukus

- Vaata

- otsin

- Ühinemised ja ülevõtmised

- Turg

- Turundus

- turud

- suur

- keskmine

- miljon

- rohkem

- kõige

- liikumine

- palju

- NARRATIIVNE

- Uus

- numbrid

- of

- vanim

- on

- ONE

- or

- partner

- Maksma

- tipp

- jõudlus

- plaanid

- inimesele

- Platon

- Platoni andmete intelligentsus

- PlatoData

- sisse

- vajutage

- levinud

- era-

- eraturud

- Pro

- lubadus

- avalik

- avaldatud

- tõstatatud

- pigem

- jõudis

- Lugemine

- reaalne

- hiljuti

- Hiljutine rahastamine

- retsept

- tulu

- voorud

- s

- Ütlesin

- palgad

- Sam

- sama

- Säästa

- ütleb

- sektor

- nägemine

- tundub

- Seeria

- Seeria C

- Vahetused

- alates

- Lahendused

- mõned

- käivitamisel

- Alustavatel

- jääma

- varu

- aktsiaturg

- Lugu

- rääkimine

- Tektooniline

- öelda

- kui

- et

- .

- oma

- Neile

- ravi

- Need

- nad

- see

- sel nädalal

- Sel aastal

- need

- et

- töövahendid

- triljoneid

- kaks

- meie

- ükssarved

- kasutama

- kasutamine

- väärtus

- hinnatud

- ettevõtmine

- väga

- oli

- we

- nädal

- hästi tuntud

- M

- millal

- kuigi

- WHO

- will

- koos

- mures

- aasta

- jah

- veel

- sa

- Sinu

- sephyrnet