- Gold is bearish, and a new lower low activates more declines.

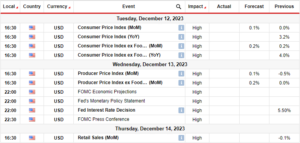

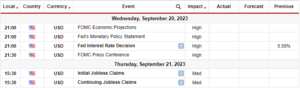

- The US CB Consumer Confidence data is due later today.

- The channel’s downside line stands as a potential target.

The price of gold is trading in the red at $1,811 at the time of writing. The bias remains bearish despite temporary rebounds.

-Kas olete huvitatud rohkem teada saada ECNi maaklerid? Vaadake meie üksikasjalikku juhendit -

After its massive drop, a rebound was natural. However, the bearish trend could resume anytime. The gold bounced back as the USD depreciated in the last trading session. Now, the greenback started to rise again. So, the yellow metal turned to the downside again.

Fundamentally, the US reported mixed data. Pending Home Sales and Core Durable Goods Orders came in better than expected, while Durable Goods Orders reported poor data.

Today, the US CB Consumer Confidence is considered the most important event and is expected to jump from 107.1 to 108.5 points. Also, the Canadian GDP could have a big impact in the short term. The economic indicator could report a 0.0% growth versus the 0.1% growth in the previous reporting period.

Furthermore, the US Richmond Manufacturing Index, Chicago PMI, HPI, Prelim Wholesale Inventories, and Goods Trade Balance data will also be released.

Tomorrow, the Australian CPI, GDP, and the US ISM Manufacturing PMI should move the rate. Positive US data during the week should lift the USD and could force the XAU/USD to drop towards new lows.

Kullahinna tehniline analüüs: karune eelarvamus

Technically, XAU/USD rebounded after finding support on the 1,807. Now, it has found strong resistance and supply at $1,818 and has turned to the downside again.

-Kas olete huvitatud rohkem teada saada raha teenimine forexis? Vaadake meie üksikasjalikku juhendit -

The $1,807 stands as critical support. The bias remains bearish as long as it stays under the downtrend line. Gold signaled strong downside pressure after failing to reach and retest the downtrend line. A new lower low activates more declines and brings new selling opportunities.

The weekly S1 (1,797) and the channel’s downside line represent downside targets. The 50% (1,788) retracement level also represents a downside target. Staying above $1,807 after a false breakout may indicate a bullish reversal.

Kas soovite praegu Forexiga kaubelda? Investeerige eTorosse!

Selle pakkujaga CFD-dega kauplemisel kaotavad 67% jaeinvestorite kontost raha. Peaksite kaaluma, kas saate endale lubada suure riski kaotada oma raha.

- SEO-põhise sisu ja PR-levi. Võimenduge juba täna.

- Platoblockchain. Web3 metaversiooni intelligentsus. Täiustatud teadmised. Juurdepääs siia.

- Allikas: https://www.forexcrunch.com/gold-price-supported-by-1807-level-focus-on-key-data/

- 1

- 107

- a

- MEIST

- üle

- Kontod

- pärast

- analüüs

- ja

- Austraalia

- Austraalia CPI

- tagasi

- Saldo

- ebaviisakas

- Parem

- erapoolikus

- Suur

- Breakout

- Toob

- Bullish

- Kanada

- CFD-dega

- kontrollima

- chicago

- Chicago PMI

- usaldus

- Arvestama

- kaaluda

- tarbija

- Konteiner

- tuum

- võiks

- THI

- kriitiline

- andmed

- Keeldub

- Vaatamata

- üksikasjalik

- miinus

- Drop

- ajal

- Majanduslik

- sündmus

- oodatav

- leidmine

- Keskenduma

- Sundida

- forex

- avastatud

- Alates

- SKP

- Kuldne

- kulla hind

- kaubad

- Greenback

- Kasv

- Suur

- Avaleht

- aga

- HTTPS

- mõju

- oluline

- in

- indeks

- näitama

- Indikaator

- huvitatud

- Investeeri

- investor

- IT

- hüppama

- Võti

- viimane

- Õppida

- Tase

- joon

- Pikk

- kaotama

- kaotamine

- Madal

- Lehed

- tootmine

- suur

- max laiuse

- metall

- segatud

- raha

- rohkem

- kõige

- liikuma

- Natural

- Uus

- Võimalused

- tellimuste

- kuni

- periood

- Platon

- Platoni andmete intelligentsus

- PlatoData

- pmi

- võrra

- vaene

- positiivne

- potentsiaal

- surve

- eelmine

- hind

- tarnija

- määr

- jõudma

- tagasilöök

- Red

- vabastatud

- jäänused

- aru

- Teatatud

- Aruandlus

- esindama

- esindab

- Vastupidavus

- Jätka

- jaemüük

- retracement

- Ümberpööramine

- Tõusma

- Oht

- ROW

- müük

- Müük

- istung

- Lühike

- peaks

- So

- seisab

- alustatud

- tugev

- varustama

- toetama

- Toetatud

- SVG

- Võtma

- sihtmärk

- eesmärgid

- Tehniline

- Tehniline analüüs

- ajutine

- .

- aeg

- et

- täna

- suunas

- kaubelda

- Kauplemine

- Trend

- Pöördunud

- all

- us

- USA CB tarbijate usaldus

- USA ISM tootmine

- USA ISMi tootmise PMI

- USD

- Versus

- nädal

- iga nädal

- kas

- kuigi

- hulgimüük

- will

- kirjutamine

- XAU / USD

- Sinu

- sephyrnet