<!–

<!–

->

Krüptoturu uudised: USA föderaalreserv‘s target rate decision may likely come on the expected lines but the market would be keenly looking at whether the Federal Open Market Committee (FOMC) shows any signs of cooling down the monetary policy. Amid pressure from the ongoing US regional banking crisis, the markets are expecting that the central bank implements a 25 bps rate hike for the last time in a series of target rate raises. This would take the current target of 475-500 bps to the 500-525 bps range.

Samuti loe: USA SEC-il on halb pretsedent XRP kohtuasja kohtuniku Analisa Torrese käest

The CME FedWatch Tool indicates that 85% of respondents feel the Fed go for a 25 bps hike. Meanwhile, if Fed Chair Jerome Powell announces any indication of slowing down the rate hikes in upcoming meetings, the Bitcoini hind may climb at the back of some correction in recent times.

Samuti loe: SUI hind langeb keskvõrgu käivitamise ajal 72%.

<!–

->

Elama

2023-05-03T00:00:00+5:30

S&P500 & Crypto Markets Turn Green Following FED Hike

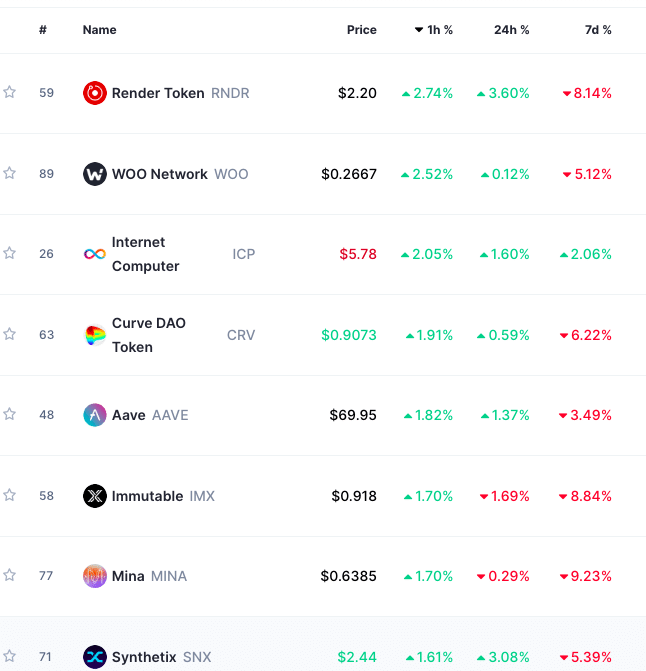

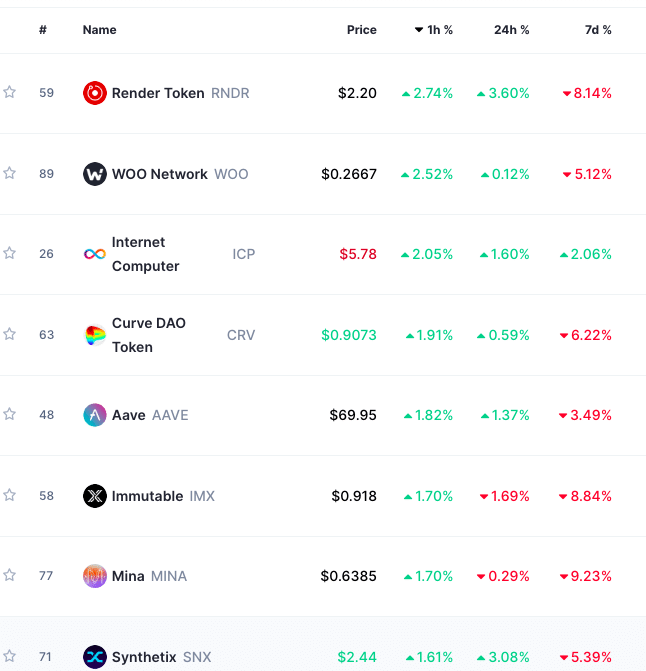

Both S&P 500 and crypto markets are steady following FED rate hike of 25 bps. Bitcoin price is hovering at $28,600 while S&P500 index is up by 20 basis points at the time of reporting. In crypto markets top gainers are Render Token, Woo Network and Curve Dao.

Jaga seda värskendust:

2023-05-03T23:41:00+5:30

Rate Cuts In September

In the wake of a 25 bps rate hike, traders are pricing in rate cut possibility in September 2023, as per US interest rate futures.

Jaga seda värskendust:

2023-05-03T23:35:00+5:30

Bitcoini hinna reaktsioon

As an initial reaction, the Bitcoin price showed a 0.50 rise to the news of Fed rate hike on expected lines. However, the scenario could change after Jerome Powell’s speech.

Jaga seda värskendust:

2023-05-03T23:30:00+5:30

Fed intressimäära tõus

The FOMC hiked the Federal funds target rate by 25 bps, on expected lines. The hike effectively brings the current target rate to 500-525 bps range.

Jaga seda värskendust:

2023-05-03T23:15:00+5:30

USA dollari indeks

The US Dollar Index (DXY) has been on a declining path in the lead up to the Fed rate hike decision announcement, with a 0.53% drop in the day.

Jaga seda värskendust:

2023-05-03T22:45:00+5:30

Peter Brandt nõustub

Peter Brandt, teine veterananalüütik, kokkulepitud koos Tomi analüüsiga Fedi intressitõusuplaanide kohta.

Jaga seda värskendust:

2023-05-03T22:30:00+5:30

Rohkem hinnatõusu on viga

Tom McClellan, veterananalüütik, kommenteeris et intressimäära edasine tõstmine saaks turgudele saatuslikuks. Selle asemel peaksid nad kohe kärpima 4 protsendini, ütles ta.

Jaga seda värskendust:

Kaebused

- SEO-põhise sisu ja PR-levi. Võimenduge juba täna.

- PlatoAiStream. Web3 andmete luure. Täiustatud teadmised. Juurdepääs siia.

- Tuleviku rahapaja Adryenn Ashley. Juurdepääs siia.

- Allikas: https://coingape.com/fomc-jerome-powell-fed-interest-rate/

- :on

- :on

- ][lk

- $ UP

- 1

- 20

- 2023

- 30

- 50

- 500

- a

- MEIST

- kuulutused

- pärast

- Keset

- an

- analüüs

- analüütik

- ja

- Teadaanne

- teatab

- Teine

- mistahes

- OLEME

- AS

- At

- auto

- tagasi

- tagapõhi

- Halb

- Pank

- Pangandus

- panganduskriis

- alus

- BE

- olnud

- Bitcoin

- Bitcoin Hind

- tühi

- Toob

- kuid

- by

- keskus

- kesk-

- Keskpank

- Tool

- muutma

- ronima

- CM laiendus

- Coingape

- värv

- Tulema

- komitee

- võiks

- kriis

- krüpto

- Krüptoturg

- Krüpto turud

- Praegune

- kõver

- Kõver DAO

- lõigatud

- kärped

- DAO

- päev

- otsus

- Langevad

- lauaarvuti

- Ekraan

- dollar

- dollari indeks

- alla

- Drop

- Dxy

- tõhusalt

- Eeter (ETH)

- oodatav

- ootab

- Toidetud

- Fed õppetool

- Fed esimees Jerome Powell

- Föderaal-

- Saksamaa avatud turu komitee

- tundma

- Float

- Järel

- FOMC

- eest

- Alates

- raha

- edasi

- Futuurid

- Gainerid

- Go

- Green

- he

- kõrgus

- Matk

- Matkad

- matkamine

- aga

- HTTPS

- if

- kohe

- tööriistad

- in

- indeks

- näitab

- näidustus

- esialgne

- selle asemel

- huvi

- INTRESS

- Jerome

- jerome powell

- kohtunik

- viimane

- kohtuasi

- viima

- lahkus

- Tõenäoliselt

- liinid

- elama

- otsin

- mainnet

- Varu

- Turg

- turud

- turud pöörduvad

- turud muutuvad roheliseks

- mai..

- Vahepeal

- koosolekul

- kohtumised

- mobiilne

- Rahaline

- Rahapoliitika

- võrk

- uudised

- of

- on

- jätkuv

- avatud

- tee

- plaanid

- Platon

- Platoni andmete intelligentsus

- PlatoData

- võrra

- poliitika

- positsioon

- võimalus

- Powell

- Powelli omad

- Pretsedent

- surve

- hind

- hinnapoliitika

- tõstab

- valik

- määr

- Hinda matka

- määrade tõus

- reaktsioon

- Lugenud

- hiljuti

- piirkondlik

- Aruandlus

- vastanutest

- Tõusma

- S&P

- S&P 500

- S & P500

- Ütlesin

- stsenaarium

- SEC

- September

- Seeria

- Jaga

- peaks

- Näitused

- Märgid

- Aeglustub

- mõned

- kõne

- stabiilne

- Võtma

- sihtmärk

- et

- .

- Fed

- nad

- see

- aeg

- korda

- et

- sümboolne

- tööriist

- ülemine

- Ettevõtjad

- läbipaistev

- Pöörake

- tulemas

- Värskendused

- us

- US dollar

- USA dollari indeks

- meid toideti

- veteran

- Ärka

- kas

- kuigi

- koos

- kosima

- woo võrk

- oleks

- xrp

- xrp kohtuasi

- sephyrnet

✓ Jaga: