According to Fenergo estimates “poor customer experience” is costing financial institutions $10 billion in revenue per year. 36% of financial institutions have lost customers due to inefficient or slow onboarding, and 81% believe poor data management lengthens

onboarding and negatively affects customer experience.

How do you encourage users to not only rank your app with 5 stars in the Apple Store and Google Play but also gain their loyalty and trust? It’s no secret that the digital customer experience today is what differentiates demanded financial brands. The main

struggle is keeping up by creating a digital banking customer experience that WOWs.

Financial services customer experience refers to customer interactions with their bank, typically including online and mobile banking services, visiting a physical branch, or speaking with customer service representatives. The digital banking customer experience

(digital banking CX or UX – user experience) consists of all the emotions, thoughts and behavior of a customer triggered in using a digital banking service. A banking customer experience is generated by all digital products and brand ecosystems, including

previous customer engagements and future expectations.

The goal of improving customer experience in financial services is to make banking services as convenient, efficient, and pleasant as possible for the customer. This can be achieved through various means, such as offering an appropriate range of services

and features, providing clear and helpful information and assistance, and ensuring that the customer’s interactions with the bank are smooth and hassle-free. Make sure that financial service customer experience aligns with brand identity and business strategy.

At the same time, remember that in the digital age, brand reputation is no longer a guarantee of loyalty and can be instantly damaged by a problem with a mobile application caused by poor CX / UX design since the customer experience is a highly dynamic process.

Me gustaría describir cinco formas en las que se puede mejorar la CX digital de los servicios financieros en 5:

1. Establecer una mentalidad de experiencia

The development of digital technology is disrupting all the industries. What has been proven to work for decades, like traditional marketing and product approach, has stopped working. The world is making new demands on businesses, and the financial industry

no es una excepción.

Hoy en día, los clientes tienen docenas de nuevas alternativas cada año debido a las bajas barreras de entrada y la banca abierta. Por eso, para sobrevivir en la era digital, las marcas financieras deben adoptar una forma absolutamente nueva de pensar y operar un negocio.

Social networks, information transparency and demand for sustainability challenge businesses to put the people first by becoming customer-centered and deliver experiences instead of manipulating customers to reap profits. That’s why the future of the banking

industry depends entirely on how the new generation of bankers can bring their mindset in line with the digital age to provide the best possible banking customer experience.

Hay cinco actitudes clave que pueden integrarse en el ADN de una empresa con el objetivo de hacer que la mentalidad del equipo esté impulsada por un propósito y cambiar la cultura empresarial hacia el éxito en la era digital.

- Servir en lugar de vender. The “sell” priority is all about focusing on marketing and looking at people as numbers behind conversion. Design, in this case, is only about using attractive packaging to sell more, and UX is just one more tool

to manipulate user behavior. To focus the business team on customer needs, feelings and behaviors, we need to prioritize “Serve.” In this case, conversion became just a metric to evaluate product clarity, because the main aim is to provide real benefit for

the customer. And, a lot of customers will appreciate it, using the digital space to express their gratitude and attract more users. - Emociones sobre información. People often forget information but remember experiences, and those are created from emotions. That’s why information should be integrated into a context of usage. It should become an organic part of the banking

user experience that is based on emotions, because emotions are the main language to communicate with the customers and understand their needs and expectations. - Solución en lugar de funciones. Don’t make your users have to think about how to use hundreds of offered features. Instead, provide them with an easy to use solution. According to psychology experiments, too many options can cause decision

paralysis. Users don’t come to you for the hundreds of options you can offer. They have a specific problem and goal in mind that your financial product has to help to achieve. - Interrupción sobre protección. Traditional banks and other well-established businesses are focused on protecting their legacy and maintaining the corporate image. That’s why change comes slowly and painfully. Instead of thinking about how

to protect their products from the digital challenge and prevent customers from leaving, banks have to figure out how to stop self-deception and disrupt themselves and their competitors. In the experience age, self-disruption is the only way to provide meaningful

and pleasant products for users. - Cree flujo, evite la fragmentación. It is a common mistake to view services and products as separate parts. But, the human brain perceives experiences holistically – as a whole entity. Customers see the product as a continuous experience

flow, even lasting for years. Transition to the same thinking is the only way for businesses to ensure a delightful user journey. We need to detect links among user needs, emotions, behavior and service features, design and strategy. Separation of service

elements by different departments caused by organizational silos fills the customer experience with friction. We need to defragment business and ensure a frictionless flow that makes service pleasant.

2. Centrarse en la propuesta de valor única del producto

Las empresas financieras que implementan activamente los principios de trabajo de la mentalidad basada en un propósito tienen como objetivo aportar el máximo valor al usuario. A cambio, el cliente recompensa gustosamente a la empresa con su fidelidad y apoya su desarrollo recomendando sus servicios.

The central question in the creation of any financial product is WHY it is needed. What exactly makes the product valuable and unique to the users? What problems will it solve, and what benefits will it provide? By not treating all of these questions with

dignity, the financial company is risking its product quickly sinking into the “red ocean” of competition.

There are concrete product growth stages that depend on the level of competition and the demand from the customers. Understanding these stages helps to define and create the perfect match between the financial product’s value proposition and the market demand,

leading to success.

La competencia es lo que requiere que los empresarios financieros salgan de lo convencional e identifiquen las expectativas de los clientes. Cuanto mayor es la competencia, mayor es la necesidad de obtener una ventaja en el mercado para conquistar a los competidores.

If financial product functionality is not enough to compete, provide usability. If all the competitors have the same functionality and usability, add aesthetics. If you need even more of an advantage, connect the product with the customer’s lifestyle by

personalizing it and making it a symbol of their status. And, finally, you can go even further and state the mission to deliver the ultimate value that will change the world and gain followers who look up to you.

Dirigirse a la propuesta única de valor del producto a través de la misión, el estado, la estética y la usabilidad ayuda a maximizar las necesidades de los usuarios a través del diseño de productos centrado en el cliente.

Los bancos modernos ya han proporcionado a sus clientes una funcionalidad de servicio básica. Las innovaciones en la industria de la banca digital han pasado de la etapa de Funcionalidad a las etapas de Usabilidad y Estética para crear un vínculo emocional con los clientes.

Despite that, there are still many traditional banks that struggle with Usability. Meanwhile, progressive FinTechs are quickly climbing up the ladder, reaching the Status stage by personalizing and providing digital financial services that are enjoyable,

attractive and serve the needs of specific audiences.

3. Integrar el enfoque de diseño en todos los niveles

By focusing on the usability, aesthetics and status of the product, you can engage digital users, but this is not enough. To ensure a long-term market need for your product, it is necessary to integrate customer-centricity into all levels and processes of

the company, putting the user at the forefront.

In many cases, incorrect design integration in the process of product creation leads to harmful consequences. It’s like in construction: a skyscraper can’t stand without a well-thought-out and grounded architectural plan. The financial product with amateur

UX will lack demand in the market, could be rejected by the users, often exceeds the development budget or doesn’t even get launched at all.

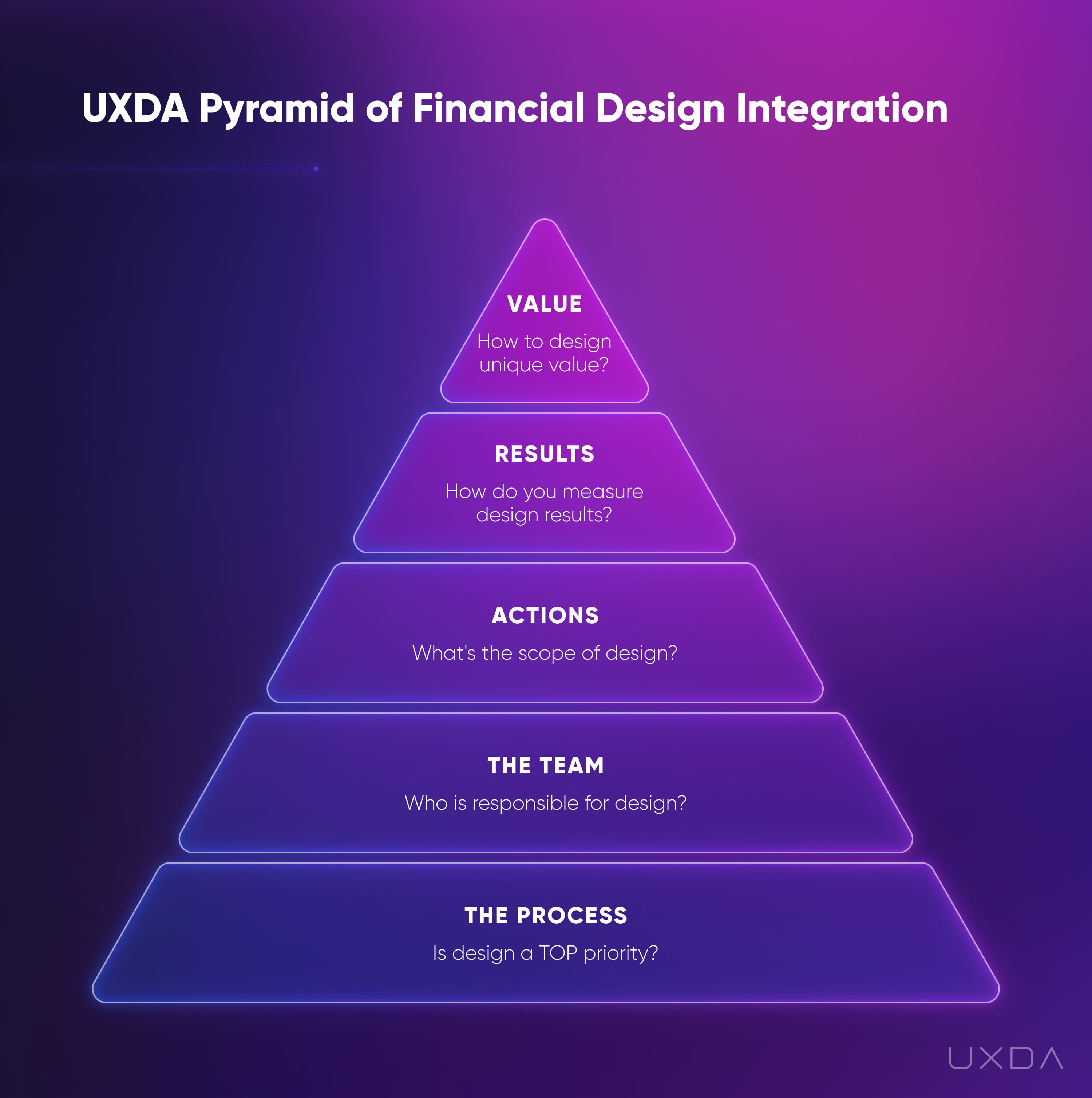

Hay cinco áreas interconectadas en las que se puede integrar el enfoque de diseño para garantizar la mejor experiencia posible del cliente a largo plazo. En general, estas cinco áreas coinciden con los principales elementos del desarrollo empresarial.

Cuando tienes una idea de negocio sólida, necesitas crear un modelo de negocio definiendo los Procesos clave que te ayudarán a alcanzar el objetivo deseado. Aquí puede crear un enfoque de diseño que potencie el combustible en todos sus procesos comerciales financieros.

En el siguiente paso, necesita un equipo de especialistas calificados para ejecutar su idea. En este punto, asegúrese de agregar experiencia en diseño de UX financiero de personas que dominen los productos digitales en finanzas.

Cuando haya encontrado profesionales que se ajusten a su desafío, necesitará que tomen las acciones correctas que lo acerquen a la realización del producto. Acelere el impacto del diseño definiendo acciones basadas en resultados.

Para estar seguro de que avanza en la dirección correcta, debe evaluar los resultados que está produciendo su equipo. Debes medir la calidad del diseño por la forma en que sirve a tus clientes.

Al final, si todos los pasos anteriores se han realizado con éxito, podrá captar el valor único que su producto financiero proporcionará a los clientes, convirtiendo el producto digital en una historia de éxito.

4. Utilice la metodología de diseño CX adecuada

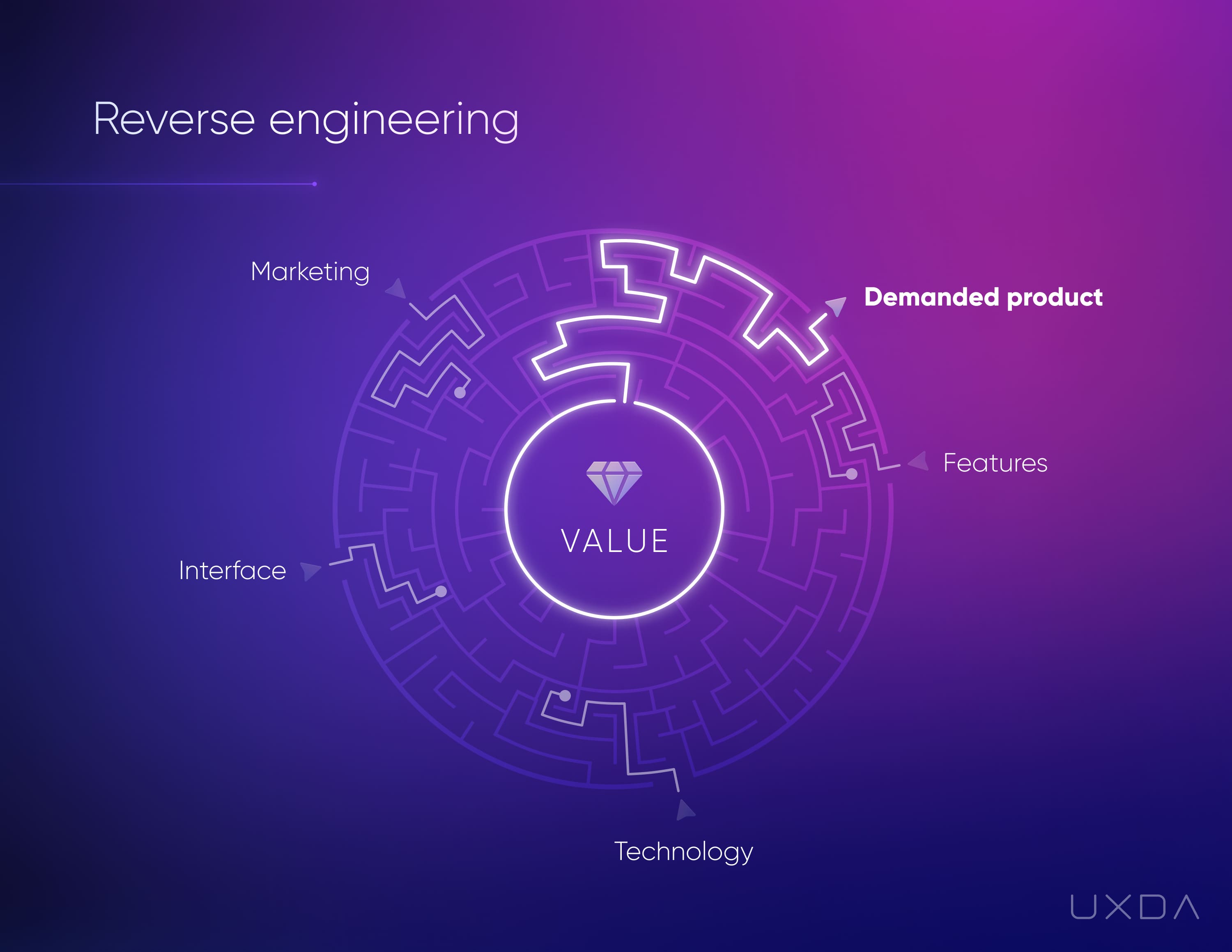

As a typical business delivery starts with Process and ends with Value to customer, then the easiest way to design the best possible digital experience is to do it in reverse. We should start with defining the ultimate Value for the customer and only then

move on to an action plan.

Podemos comparar la ingeniería inversa con un laberinto que tiene múltiples entradas y una sola salida. Las entradas son diferentes tipos de configuración, funcionalidad y características del producto, y la salida es la alta demanda y el éxito en el mercado.

Usually, entrepreneurs try to guess which configuration they should develop to gain success. They look around to identify what products are trending, code a lot of features to impress customers and finally pack all this into a vibrant design to grab attention.

Then they spend tons of money on advertising to convince consumers that they need this.

In reverse engineering, you significantly reduce uncertainty by starting from the maze exit and moving to the correct entry point. In this case, the exit of the maze is the point at which the product is highly demanded because of the value it provides to

customers. By using the CX / UX design approach, we are exploring the value that’s significant to customers and putting the focus of the product and the entire business on the needs of customers.

Though CX and UX design is trending today, only a few financial product experts are capable of successfully translating it into architecture and the user interface of a particular product because it requires knowledge in human psychology, behavior and design

arts. Perhaps this explains why most of the financial solutions around us still look outdated and amateur, despite the multiple designers involved in the product development teams.

El diseño de un producto financiero centrado en el cliente y basado en el valor para los usuarios consta de tres elementos clave: pensamiento de diseño, marco de negocio/usuario/producto y herramientas de diseño de UX.

El pensamiento de diseño es la base de la metodología Financial UX. Proporciona un enfoque metódico e iterativo para explorar y satisfacer las necesidades clave del usuario a través de sus cinco etapas: empatizar, definir, idear, crear prototipos y probar.

Para garantizar el éxito general, debemos implementar las cinco partes del proceso de pensamiento de diseño a través de una perspectiva de negocio, usuario y producto. De esta manera encontramos, definimos y materializamos el máximo valor y ganancia para cada uno de ellos.

Finalmente, las herramientas de diseño de UX brindan la mejor manera de ejecutar todo el proceso asegurando una transformación efectiva de los productos financieros basada en resultados.

5. Explore el contexto de sus clientes

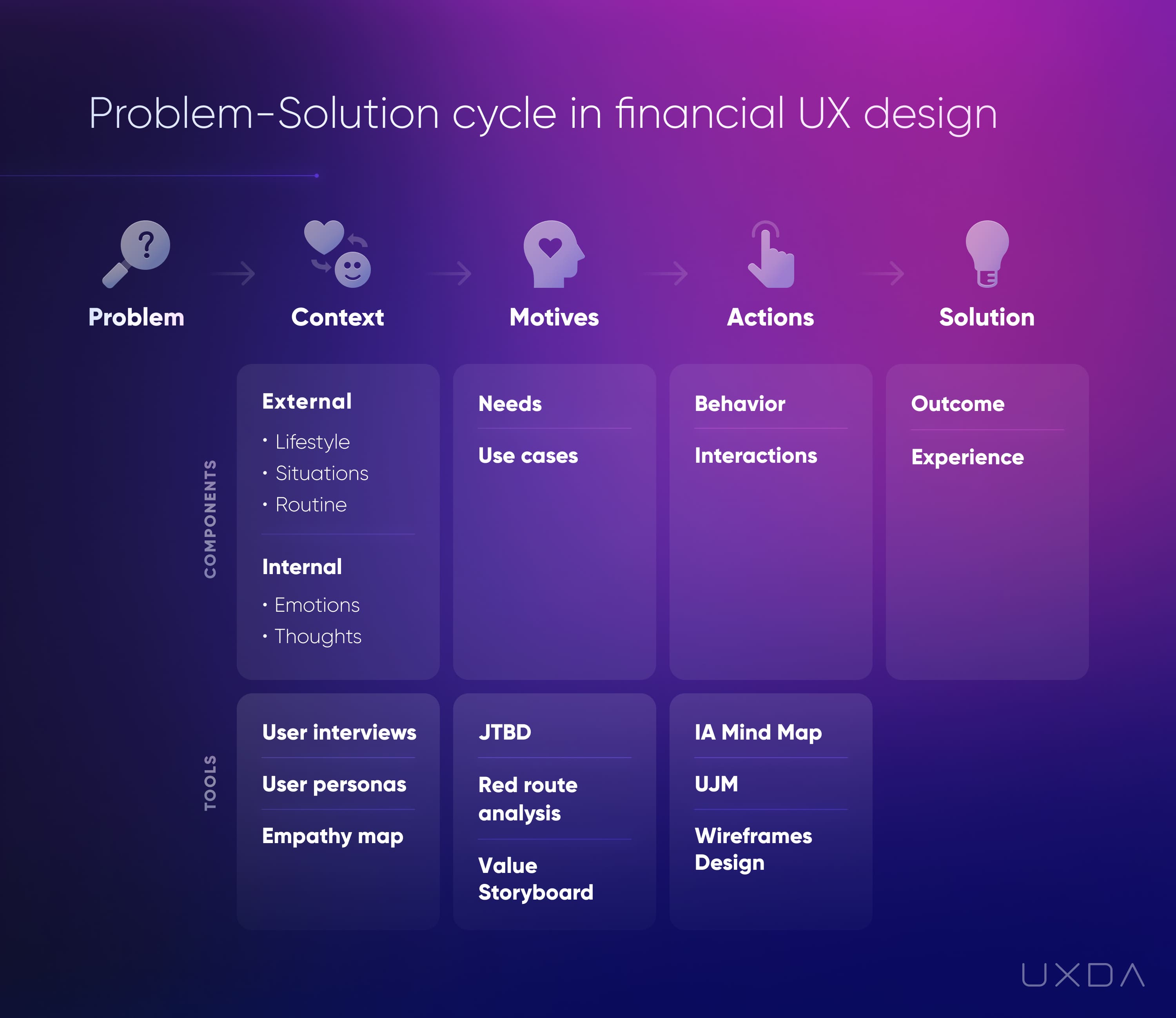

At this point, you might feel like you have enough powerful knowledge to go straight to addressing your customer problems with your financial service experience design. Yes, it all starts with a good solution to an important problem. But, between the problem

and the solution, there are three crucial conditions that differentiate whether or not a product will match real users’ needs.

Para crear un servicio financiero digital demandado que atraiga a los clientes, comenzamos con el problema.

Para definir claramente el problema y las tareas, exploramos el impacto del ciclo problema-solución en la experiencia del cliente bancario mediante la creación de personajes de usuario y la definición de sus trabajos a realizar.

A lo largo de este proceso, cristalizamos el contexto en el que se produce el problema, los motivos de los usuarios que dictan las acciones y las personas que se necesitarán para aplicar la solución correcta.

Durante este proceso, se utilizan la metodología de diseño de UX financiero y herramientas de UX como un mapa de empatía, un mapa de ruta roja, UJM, flujos de usuarios, estructuras alámbricas, diseño y pruebas de UI.

- Distribución de relaciones públicas y contenido potenciado por SEO. Consiga amplificado hoy.

- PlatoData.Network Vertical Generativo Ai. Empodérate. Accede Aquí.

- PlatoAiStream. Inteligencia Web3. Conocimiento amplificado. Accede Aquí.

- PlatoESG. Carbón, tecnología limpia, Energía, Ambiente, Solar, Gestión de residuos. Accede Aquí.

- PlatoSalud. Inteligencia en Biotecnología y Ensayos Clínicos. Accede Aquí.

- Fuente: https://www.finextra.com/blogposting/25474/five-ways-to-improve-customer-experience-in-financial-services-in-2024?utm_medium=rssfinextra&utm_source=finextrablogs

- :posee

- :es

- :no

- $ UP

- 2024

- a

- Nuestra Empresa

- absolutamente

- acelerar

- logrado

- Conforme

- Lograr

- alcanzado

- a través de

- la columna Acción

- acciones

- activamente

- add

- direccionamiento

- adoptar

- Ventaja

- Publicidad

- edad

- objetivo

- Alinea

- Todos

- ya haya utilizado

- también

- alternativas

- aficionado

- entre

- an

- y

- cualquier

- applicación

- Apple

- Aplicación

- Aplicá

- apreciar

- enfoque

- adecuado

- arquitectónico

- arquitectura

- somos

- áreas

- en torno a

- Artes

- AS

- Ayuda

- At

- atraer

- atractivo

- audiencias

- evitar

- Banca

- banqueros

- Bancario

- industria bancaria

- Bancos

- las barreras

- basado

- básica

- base

- BE

- se convirtió en

- porque

- a las que has recomendado

- cada vez

- esto

- comportamiento

- detrás de

- CREEMOS

- es el beneficio

- beneficios

- MEJOR

- entre

- más grande

- mil millones

- bonos

- Box

- Cerebro

- Rama

- marca

- marcas

- llevar

- presupuesto

- desarrollo de negocios

- modelo de negocio

- Procesos de negocios

- estrategia de negocios

- negocios

- pero

- by

- PUEDEN

- capaz

- case

- cases

- Causa

- causado

- central

- Reto

- el cambio

- transparencia

- limpiar

- con claridad.

- Alpinismo

- más cerca

- código

- cognición

- cómo

- proviene

- Algunos

- Comunicarse

- Empresas

- compañía

- comparar

- competir

- competencia

- competidores

- hormigón

- condiciones

- Configuración

- Contacto

- conectado

- conquistar

- Consecuencias

- consiste

- construcción

- Clientes

- contexto

- continuo

- Conveniente

- Conversión

- convencer

- Sector empresarial

- correcta

- podría

- Para crear

- creado

- Creamos

- creación

- crucial

- Cultura

- cliente

- experiencia del cliente

- Servicio al Cliente

- Clientes

- CX

- Cycle

- datos

- datos de gestión

- décadas

- Koops

- definir

- definir

- encantador

- entregamos

- entrega

- Demanda

- exigido

- demandas

- departamentos

- depender

- depende

- describir

- Diseño

- pensamiento de diseño

- diseñadores

- deseado

- A pesar de las

- detectar

- desarrollar

- Desarrollo

- equipos de desarrollo

- dictar

- una experiencia diferente

- diferenciar

- digital

- era digital

- banca digital

- espacio digital

- la tecnología digital

- dirección

- Interrumpir

- ADN

- do

- doesn

- don

- hecho

- decenas

- dos

- lugar de trabajo dinámico

- cada una

- fácil

- de forma sencilla

- ecosistemas

- Eficaz

- eficiente

- elementos

- emociones

- Empatía

- empoderamiento

- fomentar

- final

- termina

- y conseguir de esta manera

- compromisos

- Ingeniería

- agradables

- suficientes

- garantizar

- asegurando que

- Todo

- enteramente

- entidad

- empresarios

- entrada

- establecer

- Éter (ETH)

- evaluar

- Incluso

- Cada

- exactamente

- excede

- excepción

- Intercambio

- ejecutar

- Exit

- las expectativas

- experience

- Experiencias

- experimentos

- Experiencia

- expertos

- Explica

- explorar

- Explorar

- expreso

- Caracteristicas

- sentir

- sentimientos

- Fenergo

- pocos

- Figura

- rellenos

- Finalmente

- financiar

- financiero

- Instituciones financieras

- servicios financieros

- servicios financieros

- Encuentre

- Fintechs

- Nombre

- Digital XNUMXk

- de tus señales

- Flujos

- Focus

- centrado

- enfoque

- seguidores

- primer plano

- encontrado

- fragmentación

- FRAME

- fricción

- sin fricción

- Desde

- Combustible

- a la fatiga

- promover

- futuras

- Obtén

- Ganancias

- General

- generado

- generación de AHSS

- obtener

- con alegría

- Go

- objetivo

- candidato

- Google Play

- agarrar

- agarrar

- gratitud

- mayor

- Crecimiento

- garantizamos

- perjudicial

- Tienen

- ayuda

- serviciales

- ayuda

- esta página

- Alta

- altamente

- Cómo

- Como Hacer

- HTTPS

- humana

- Cientos

- idea

- Identifique

- Identidad

- if

- imagen

- Impacto

- implementar

- importante

- mejorar

- la mejora de

- in

- Incluye

- industrias

- energético

- ineficiente

- información

- innovaciones

- instantáneamente

- instituciones

- integrar

- COMPLETAMENTE

- integración

- interacciones

- Interfaz

- dentro

- involucra

- IT

- SUS

- Empleo

- jpg

- solo

- tan siquiera solo una

- acuerdo

- Clave

- especialistas

- Falta

- ladder

- idioma

- perdurable

- lanzado

- líder

- Prospectos

- dejarlo

- Legado

- Nivel

- estilo de vida

- como

- línea

- enlaces

- Largo

- compromiso a largo plazo

- por más tiempo

- Mira

- mirando

- perdido

- Lote

- ser querido

- Baja

- Lealtad

- Inicio

- el mantenimiento de

- para lograr

- HACE

- Realizar

- Management

- manipulando

- muchos

- mapa

- Mercado

- Marketing

- Match

- materializar

- Maximizar

- máximas

- significativo

- significa

- Mientras tanto

- medir

- metódico

- Metodología

- métrico

- podría

- mente

- Mentalidad

- misión

- Error

- Móvil

- La banca móvil

- modelo

- dinero

- más,

- MEJOR DE TU

- movimiento

- emocionado

- emocionante

- múltiples

- mutuamente

- necesario

- ¿ Necesita ayuda

- negativamente

- telecomunicaciones

- Nuevo

- Next

- no

- números

- of

- LANZAMIENTO

- Ofrecido

- que ofrece

- a menudo

- on

- Inmersión

- ONE

- en línea

- , solamente

- habiertos

- open banking

- funcionamiento

- Opciones

- or

- solicite

- ecológicos

- organizativo

- Otro

- salir

- Más de

- total

- .

- embalaje

- parte

- particular

- partes

- Personas

- para

- perfecto

- quizás

- la perspectiva

- los libros físicos

- Colocar

- plan

- Platón

- Inteligencia de datos de Platón

- PlatónDatos

- Jugar

- punto

- pobre

- posible

- poderoso

- evitar

- anterior

- principios

- priorizar

- lista de prioridades

- Problema

- solución del problema

- problemas

- en costes

- productor

- Producto

- diseño de producto

- desarrollo de productos

- Productos

- profesionales

- beneficios.

- progresivo

- apropiado

- valor.

- proteger

- protector

- Protección

- prototipo

- probado

- proporcionar

- previsto

- proporciona un

- proporcionando

- Psicología

- poner

- Poniendo

- Pirámide

- calificado

- calidad

- pregunta

- Preguntas

- con rapidez

- distancia

- clasificar

- en comunicarse

- alcanzando

- real

- realización

- recoger

- recomendando

- Rojo

- reducir

- se refiere

- Rechazado..

- recordarlo

- Representantes

- reputación

- Requisitos

- requiere

- Resultados

- ingresos

- marcha atrás

- Recompensas

- Derecho

- arriesgando

- Ruta

- s

- mismo

- Secreto

- ver

- venta

- separado

- ayudar

- sirve

- de coches

- Servicios

- Turno

- tienes

- importante

- significativamente

- silos

- desde

- rascacielos

- lento

- Despacio

- sencillo.

- sólido

- a medida

- Soluciones

- RESOLVER

- Espacio

- hablar

- especialistas

- soluciones y

- pasar

- Etapa

- etapas

- stand

- Estrellas

- comienzo

- Comience a

- comienza

- Estado

- Estado

- paso

- pasos

- Sin embargo

- Detener

- detenido

- tienda

- Historia

- recto

- Estrategia

- Luchar

- comercial

- historia de éxito

- Con éxito

- tal

- soportes

- seguro

- sobrevivir

- Sostenibilidad

- símbolo

- T

- ¡Prepárate!

- toma

- tareas

- equipo

- equipos

- Tecnología

- término

- test

- Pruebas

- esa

- El proyecto

- El futuro de las

- el mundo

- su

- Les

- sí mismos

- luego

- Ahí.

- Estas

- ellos

- pensar

- Ideas

- así

- aquellos

- Tres

- A través de esta formación, el personal docente y administrativo de escuelas y universidades estará preparado para manejar los recursos disponibles que derivan de la diversidad cultural de sus estudiantes. Además, un mejor y mayor entendimiento sobre estas diferencias y similitudes culturales permitirá alcanzar los objetivos de inclusión previstos.

- equipo

- a

- hoy

- TONS

- demasiado

- del IRS

- hacia

- tradicional

- transición

- Transparencia

- tratar

- tendencias

- desencadenados

- Confía en

- try

- Turning

- tipos

- principiante

- típicamente

- ui

- superior

- Incertidumbre

- entender

- comprensión

- único

- us

- usabilidad

- Uso

- utilizan el

- usado

- Usuario

- experiencia como usuario

- Interfaz de usuario

- viaje del usuario

- usuarios

- usando

- ux

- Diseño UX

- Valioso

- propuesta de

- propuesta de valor

- diversos

- vibrante

- Ver

- Camino..

- formas

- we

- ¿

- sean

- que

- QUIENES

- todo

- porque

- seguirá

- sin

- Actividades:

- trabajando

- mundo

- se

- año

- años

- si

- Usted

- tú

- zephyrnet