Via a note from UBS Wealth Management on the S&P500, noting the stalling rally this week after a strong YTD.

In brief from the note:

- the market is too upbeat about the prospect that the Fed can achieve a soft landing for the US economy

Risks remain that the Fed could hike more than markets are expecting.- The delayed effects of prior hikes are still feeding through, adding to headwinds for the economy.

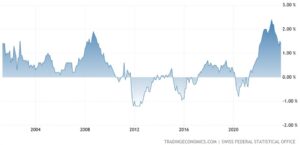

- nominal yield on the 10-year Treasury … rose … to … the highest level since the collapse of Silicon Valley Bank in early March.

- nominal yield on the 10-year Treasury … rose … to … the highest level since the collapse of Silicon Valley Bank in early March.

Equity market valuations leave little room for policy error.- The US equity market is trading at 19.3 times 12-month projected earnings, a roughly 19% premium to the 15-year average …Such multiples have historically been associated with periods in which 10-year US Treasury yields have been below 2%, rather than close to 4% as at present, and also periods of robust earnings growth. Given that 12-month trailing earnings per share growth has remained above the post-1960 trend rate, we see little potential for a swift bounce—even if the Fed succeeds in guiding the US economy to a soft landing.

UBS conclude:

- So, against this backdrop, we see a better risk-reward outlook for fixed income over equities.

-

- Distribución de relaciones públicas y contenido potenciado por SEO. Consiga amplificado hoy.

- PlatoData.Network Vertical Generativo Ai. Empodérate. Accede Aquí.

- PlatoAiStream. Inteligencia Web3. Conocimiento amplificado. Accede Aquí.

- PlatoESG. Automoción / vehículos eléctricos, Carbón, tecnología limpia, Energía, Ambiente, Solar, Gestión de residuos. Accede Aquí.

- Desplazamientos de bloque. Modernización de la propiedad de compensaciones ambientales. Accede Aquí.

- Fuente: https://www.forexlive.com/centralbank/ubs-says-us-equity-market-is-too-upbeat-on-the-fed-achieving-a-soft-landing-for-economy-20230706/

- :posee

- :es

- 19

- 2%

- a

- Nuestra Empresa

- arriba

- Lograr

- el logro de

- la adición de

- Después

- en contra

- también

- y

- somos

- AS

- asociado

- At

- promedio

- fondo

- Banca

- esto

- a continuación

- mejores

- PUEDEN

- Cerrar

- Colapso

- concluye

- podría

- Retrasado

- Temprano en la

- Ganancias

- economia

- los efectos

- Renta variable

- equidad

- error

- esperando

- Fed

- alimentación

- fijas

- ingreso fijo

- Desde

- dado

- Crecimiento

- Tienen

- viento en contra

- más alto

- Caminata

- Caminatas

- históricamente

- HTTPS

- if

- in

- por

- jpg

- aterrizaje

- Abandonar

- Nivel

- pequeño

- Management

- Marzo

- Mercado

- Valoraciones de mercado

- Industrias

- más,

- señalando

- of

- on

- Outlook

- Más de

- para

- períodos

- Platón

- Inteligencia de datos de Platón

- PlatónDatos

- política

- posible

- Premium

- presente

- Anterior

- proyectado

- perspectiva

- reunir

- Rate

- más bien

- permanecer

- se mantuvo

- riesgos

- robusto

- Conferencia

- ROSE

- aproximadamente

- S y P500

- dice

- ver

- Compartir

- Silicio

- Silicon Valley

- banco de Silicon Valley

- desde

- Soft

- Sin embargo

- fuerte

- tal

- SWIFT

- que

- esa

- La

- la Reserva Federal

- así

- esta semana

- A través de esta formación, el personal docente y administrativo de escuelas y universidades estará preparado para manejar los recursos disponibles que derivan de la diversidad cultural de sus estudiantes. Además, un mejor y mayor entendimiento sobre estas diferencias y similitudes culturales permitirá alcanzar los objetivos de inclusión previstos.

- veces

- a

- demasiado

- Plataforma de

- tesorería

- Rendimientos de tesorería

- Tendencia

- ubs

- us

- Economía estadounidense

- Tesoro de los Estados Unidos

- Rendimientos del Tesoro de EE. UU.

- Valle

- Valoraciones

- we

- Gestión de Patrimonio

- gestión de patrimonios

- semana

- que

- Rendimiento

- los rendimientos

- zephyrnet