Stärkung der nächsten Generation der Verbraucherfinanzierung

Medium, JC Bahr-de Stefano | 31. März 2023

Building the next decade of consumer finance

- Last week in Las Vegas, I had the great pleasure of moderating a panel at Fintech Meetup re: building the next decade of consumer finance by leveraging real-time data and cash flow forecasting. I wanted to share some of the key insights shared during the session by our amazing panelists, Jose Bethancourt (Co-Founder of Methode Finanz), Ema Rouf (Co-Founder of Pave.dev), and Zane Salim (Co-Founder of Atlas)!

Siehe: CFPB stellt Auskunftsersuchen zu „Datenbrokern“ heraus

- 1/ Alternative data augments FICO across the entire credit spectrum — this is about FICO+ NOT replacing FICO.

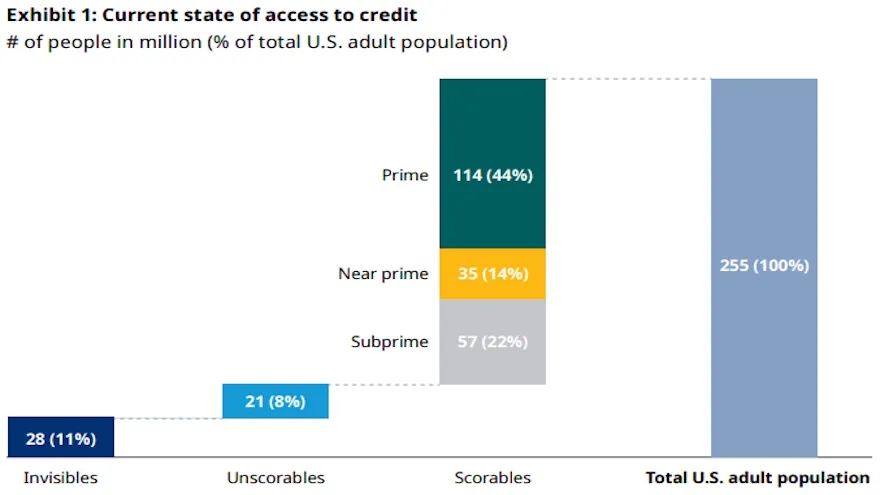

- Das problem of credit invisibility in the US is growing, with an estimated 28 million adult Americans credit invisible and 21 million unscorable. To make decisions about these consumers and offer them financial services and products, alternative data, such as income and employment, can be used. This data can also help lenders make better risk-weighted decisions for many segments of users, not just credit invisible ones, and is particularly important during periods of economic stress.

- 2/ Real time data powers better products and outcomes by enabling greater access and improving the quality of risk management.

- Credit bureaus can take up to 45 days to report data, so lenders may not have the most up-to-date information on a borrower’s behavior. Atlas, a payroll-powered credit card, uses real-time data to monitor users’ financial health and adjust credit limits, allowing for better risk management and loss prevention.

- 3/ The movement to make alternative data mainstream has to happen outside of the credit bureaus.

- Credit reports do not provide a complete view of a consumer’s debt obligations as there is a lot of data that is not furnished to the credit bureaus, including most BNPL loans. However, companies like Method collect data from over 60k institutions to provide lenders with a more comprehensive view of a person’s debt obligations, combining data from credit bureaus with financial institutions’ core banking systems.

Siehe: Kanadas Open Banking Journey: Interview mit Abe Karar, Chief Product Officer, Fintech Galaxy

- 4/ Recent innovation in infrastructure has made this data far more accessible than it has been in the past.

- Recent advancements in infrastructure and tools have made it easier to access and enrich the data. Companies such as Method and Pave are providing infrastructure that helps fintechs and banks adopt and use this data, leading to accelerated adoption.

- 5/ Mature lenders don’t want scores, they want raw data or attributes.

- Understanding the data is crucial for them to explain it to originating banks or capital providers, and the use of attribute generation can speed up model development. Pave is an example of a company offering transaction cleaning, enrichment, and their own attributes toolbox for lenders to use in their proprietary models.

Weiter zum vollständigen Artikel -> hier

Das National Crowdfunding & Fintech Association (NCFA Canada) ist ein Ökosystem für Finanzinnovationen, das Tausenden von Community-Mitgliedern Bildung, Marktinformationen, Branchenverantwortung, Networking- und Finanzierungsmöglichkeiten sowie Dienstleistungen bietet und eng mit Industrie, Regierung, Partnern und verbundenen Unternehmen zusammenarbeitet, um ein lebendiges und innovatives Fintech und Finanzmittel zu schaffen Industrie in Kanada. NCFA ist dezentralisiert und verteilt und arbeitet mit globalen Stakeholdern zusammen. Es hilft bei der Inkubation von Projekten und Investitionen in den Bereichen Fintech, alternative Finanzierungen, Crowdfunding, Peer-to-Peer-Finanzierungen, Zahlungen, digitale Vermögenswerte und Token, Blockchain, Kryptowährung, Regtech und Insurtech. Bewirb dich bei uns! Kanadas Fintech & Funding Community heute KOSTENLOS! Oder werde ein beitragendes Mitglied und Vergünstigungen bekommen. Für weitere Informationen, besuchen Sie bitte: www.ncfacanada.org

Das National Crowdfunding & Fintech Association (NCFA Canada) ist ein Ökosystem für Finanzinnovationen, das Tausenden von Community-Mitgliedern Bildung, Marktinformationen, Branchenverantwortung, Networking- und Finanzierungsmöglichkeiten sowie Dienstleistungen bietet und eng mit Industrie, Regierung, Partnern und verbundenen Unternehmen zusammenarbeitet, um ein lebendiges und innovatives Fintech und Finanzmittel zu schaffen Industrie in Kanada. NCFA ist dezentralisiert und verteilt und arbeitet mit globalen Stakeholdern zusammen. Es hilft bei der Inkubation von Projekten und Investitionen in den Bereichen Fintech, alternative Finanzierungen, Crowdfunding, Peer-to-Peer-Finanzierungen, Zahlungen, digitale Vermögenswerte und Token, Blockchain, Kryptowährung, Regtech und Insurtech. Bewirb dich bei uns! Kanadas Fintech & Funding Community heute KOSTENLOS! Oder werde ein beitragendes Mitglied und Vergünstigungen bekommen. Für weitere Informationen, besuchen Sie bitte: www.ncfacanada.org

Möchten Sie Insider-Zugang zu einigen der innovativsten Fortschritte in #fintech erhalten. Registrieren Sie sich für #FFCON23 und hören Sie von globalen Vordenkern, was als nächstes kommt! Klicken Sie unten, um Open-Access-Tickets für alle virtuellen Programme und On-Demand-Inhalte von FFCON23 zu erhalten.Unterstützen Sie NCFA, indem Sie uns auf Twitter folgen! |

Verwandte Artikel

- SEO-gestützte Content- und PR-Distribution. Holen Sie sich noch heute Verstärkung.

- Platoblockkette. Web3-Metaverse-Intelligenz. Wissen verstärkt. Hier zugreifen.

- Quelle: https://ncfacanada.org/empowering-the-next-iteration-of-consumer-finance/

- :Ist

- $UP

- 10

- 100

- 2018

- 28

- 39

- a

- Über Uns

- beschleunigt

- Zugang

- zugänglich

- über

- adoptieren

- Adoption

- Erwachsenen-

- Fortschritte

- Vorschüsse

- Mitgliedsorganisationen

- AI / ML

- Alle

- Zulassen

- Alternative

- Alternative Finanzierung

- erstaunlich

- Amerikaner

- und

- April

- SIND

- Artikel

- AS

- Details

- At

- Atlas

- Attribute

- Bankinggg

- Bankensysteme

- Banken

- BD

- BE

- werden

- unten

- Besser

- Blockchain

- BNPL-Erweiterung

- Kreditnehmer

- Building

- by

- Cache-Speicher

- CAN

- Kanada

- Hauptstadt

- Karte

- Bargeld

- Cash-Flow-

- Kategorie

- CFPB

- Chef

- Chief Product Officer

- Reinigung

- klicken Sie auf

- eng

- Co-Gründer

- sammeln

- COM

- Vereinigung

- community

- Unternehmen

- Unternehmen

- abschließen

- umfassend

- Verbraucher

- Konsumentenkredite

- KUNDEN

- Inhalt

- Kernbereich

- Core-Banking

- erstellen

- Kredit

- Kreditkarte

- Crowdfunding

- kryptowährung

- technische Daten

- Tage

- Schulden

- Jahrzehnte

- dezentralisiert

- Entscheidungen

- Demand

- Entwicklung

- digital

- Digitale Assets

- verteilt

- Nicht

- im

- einfacher

- Wirtschaftlich

- Ökosystem

- Bildungswesen

- EMA

- Beschäftigung

- Empowerment

- ermöglichen

- beschäftigt

- bereichern

- Ganz

- Eintrag

- geschätzt

- Äther (ETH)

- Veranstaltungen

- Beispiel

- Erklären

- FICO

- Finanzen

- Revolution

- finanzielle Gesundheit

- finanzielle Eingliederung

- finanzielle Innovation

- Finanzinstitutionen

- Finanzdienstleistungen

- FinTech

- Fintech-Galaxie

- FinTechs

- Fluss

- Folgende

- Aussichten für

- für

- voller

- Finanzierung

- Finanzierungsmöglichkeiten

- Galaxis

- Generation

- bekommen

- Global

- der Regierung

- groß

- mehr

- GV

- passieren

- Los

- Haben

- Gesundheit

- hören

- Hilfe

- hilft

- hi

- aber

- HP

- hr

- http

- HTTPS

- i

- wichtig

- Verbesserung

- in

- Einschließlich

- Aufnahme

- Einkommen

- Energiegewinnung

- Information

- Infrastruktur

- Innovation

- innovativ

- Insider

- Einblicke

- Institutionen

- Versicherungen

- Intelligenz

- Interview

- Investition

- Probleme

- IT

- Iteration

- Januar

- join

- Reise

- jpg

- Wesentliche

- grosse

- LAS

- Las Vegas

- Führung

- führenden

- Kreditgeber

- Darlehen

- Nutzung

- Gefällt mir

- Grenzen

- leben

- Live-Events

- Kredite

- Verlust

- Los

- gemacht

- Mainstream

- um

- Management

- viele

- März

- Markt

- reifen

- max-width

- Kann..

- Meetup

- Mitglied

- Mitglieder

- Methode

- Million

- Modell

- für

- Überwachen

- mehr

- vor allem warme

- Bewegung

- NEO

- Vernetzung

- Newsletter

- weiter

- Verbindlichkeiten

- of

- bieten

- bieten

- Offizier

- on

- On-Demand

- Online

- XNUMXh geöffnet

- Open Banking

- Entwicklungsmöglichkeiten

- aussen

- besitzen

- Tafel

- besonders

- passt

- Zahlungen

- Peer to Peer

- Zeiträume

- Vergünstigungen

- person

- Plato

- Datenintelligenz von Plato

- PlatoData

- Bitte

- Vergnügen

- Kräfte

- abwehr

- Produkt

- Produkte

- Programmierung

- Projekte

- Eigentums-

- die

- bietet

- Bereitstellung

- Qualität

- Roh

- Rohdaten

- RE

- echt

- Echtzeit

- Echtzeitdaten

- kürzlich

- Registrieren

- Regtech

- berichten

- Meldungen

- Anforderung

- Risiko

- Risikomanagement

- s

- Sektoren

- Segmente

- Lösungen

- Sitzung

- Teilen

- von Locals geführtes

- Schild

- So

- einige

- Geschwindigkeit

- Stakeholder

- Verwaltung

- Der Stress

- so

- nachhaltiger

- Systeme und Techniken

- TAG

- Nehmen

- zur Verbesserung der Gesundheitsgerechtigkeit

- Das

- ihr

- Sie

- Diese

- dachte

- Vordenker

- Tausende

- Tickets

- Zeit

- Titel

- zu

- heute

- Tokens

- Tools

- Werkzeuge

- Transaktion

- was immer dies auch sein sollte.

- auf dem neusten Stand

- us

- -

- Nutzer

- VEGAS

- lebendig

- Anzeigen

- Assistent

- Besuchen Sie

- wollte

- Woche

- mit

- Werk

- Zephyrnet