More real estate agents believe their client shortfall has begun to stabilize, an indication of rising home demand in the new year, according to new results from the latest Inman Intel Index survey.

Dieser Bericht steht ausschließlich Abonnenten von zur Verfügung Inman Intel, der Daten- und Forschungszweig von Inman, der tiefe Einblicke und Marktinformationen zum Geschäft mit Wohnimmobilien und Proptech bietet. Bestellen Sie jetzt.

Real estate agents waiting for the levee of pent-up demand to break have been getting increasingly optimistic news.

Neue Daten aus dem Inman Intel Index survey, or Triple-I, reinforces that one of the worst housing cycles in decades might be hitting an inflection point.

TAKE THE JANUARY INMAN INTEL INDEX

Client pipelines are slowly filling back up after being depleted for much of the last two years, according to 586 agent responses to the December Triple-I. What’s more, many real estate professionals expect this slow trickle of new clients to only speed up in the months to come, the survey suggests.

Among this month’s findings:

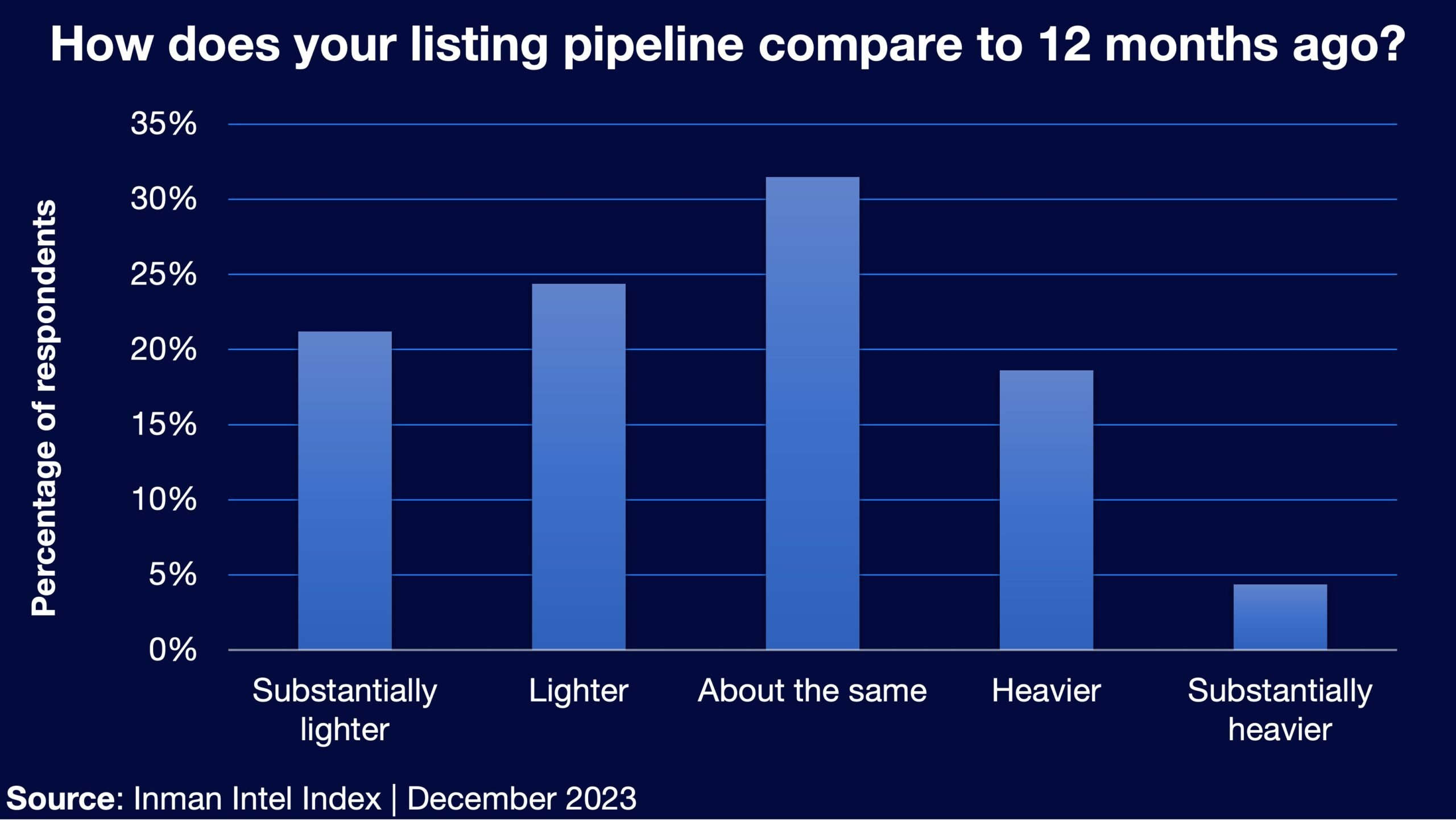

- Fast Einer von fünf Agenten said they were working with more listing clients in December than at the same time the previous year — up from Einer von fünf Agenten who said the same in October.

- These gains, however, were mostly moderate: 19 Prozent of agent respondents described their listing pipelines as “heavier” year over year, while only 4 Prozent said instead that they were “substantially heavier.”

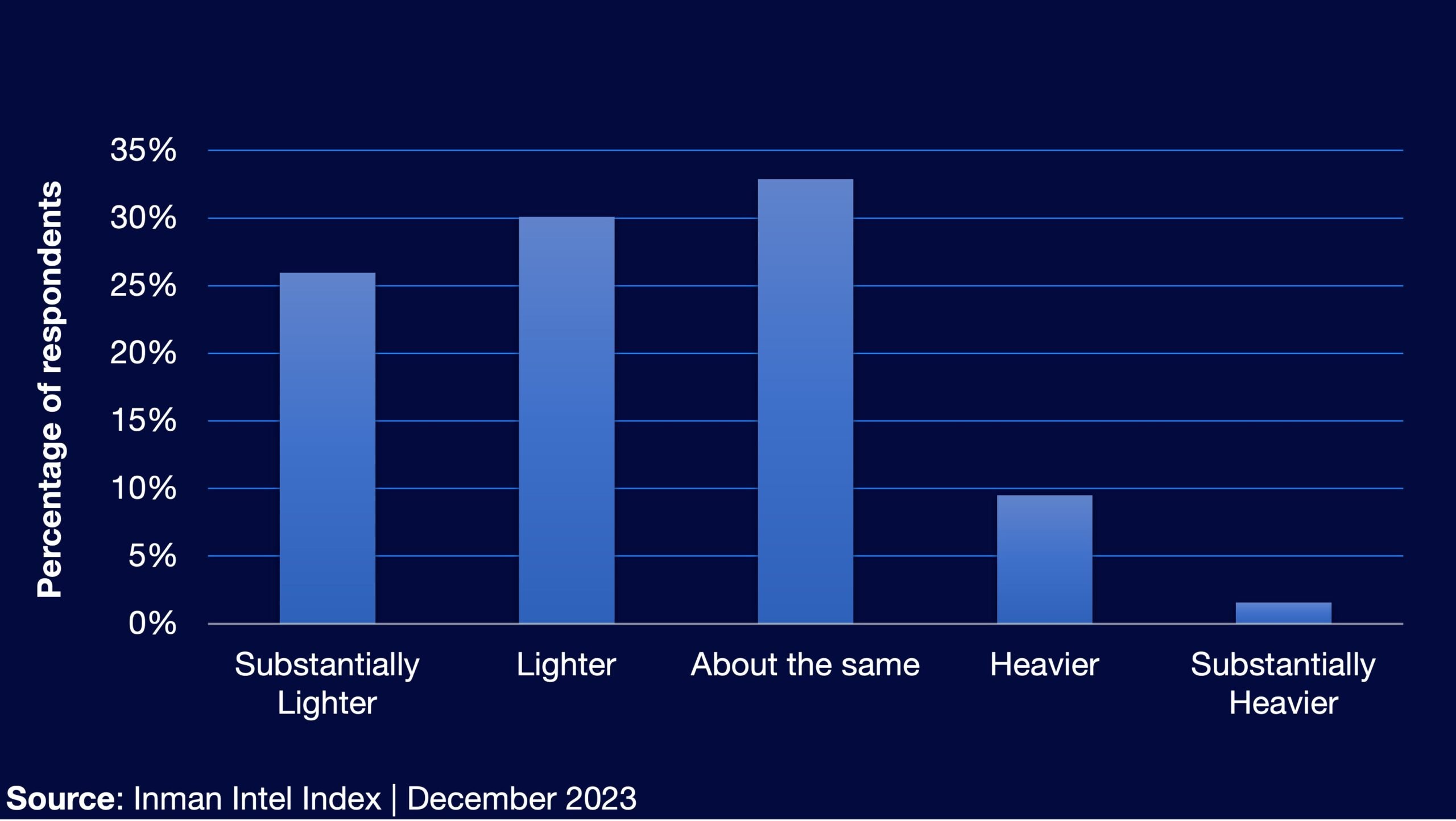

Auf der anderen Seite, buyer clients remained harder to come by.

- Nur 1 in 9 Agenten told the Triple-I that their buyer pipelines were better off than last year.

- Still, that’s up from 1 in 17 respondents who said the same two months before.

These industry findings are consistent with big-picture transaction data that suggests the housing market may have started to find its footing in the second half of 2023.

Read more below on how real estate professionals are feeling about the current market — and how they’re preparing for the months to come.

A stabilizing market

As a growing number of agents report year-over-year improvement in their listing pipelines, an even greater share now says that their listing clientele have stabilized, even if things aren’t yet improving much.

This is a relatively recent development, the Triple-I suggests.

- For the first time since the Triple-I debuted in September, agents described their listing pipeline as “ungefähr gleich” as 12 months ago more often than any other response choice.

- ca. 33 Prozent der Agenten chose that option, which climbed from third place to second to first in the preceding 90 days.

These results come on the heels of several data releases that show a year-over-year uptick in sales and inventory at the end of 2023. This period joins 1995 and 2008 as one of the hardest in recent real estate memory.

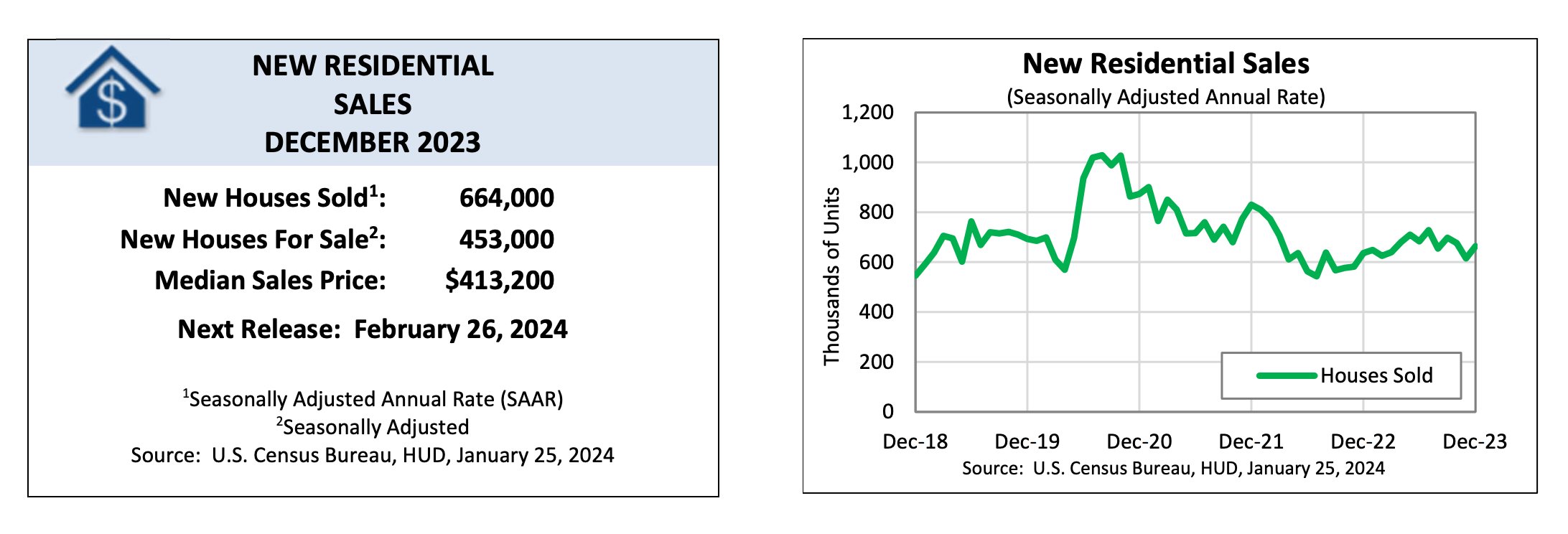

If there was a bright spot, it was a strong year for new-home sales. That’s one area where recent data adds to growing confidence.

- Data published last week by the U.S. Census Bureau and the Department of Housing and Urban Development showed new-home sales in December were up 4.5 Prozent Jahr für Jahr.

Source: U.S. Census Bureau and the U.S. Department of Housing and Urban Development

As it becomes clearer that the broader market freefall has slowed to a halt, real estate professionals are beginning to eye the prospect of growth once more, the Triple-I finds.

Dampf abholen

For a true market turnaround to gain traction, mortgage rates will likely have to continue on their recent downward trajectory.

That’s exactly what an increasingly broad consensus is beginning to expect will happen as the Federal Reserve winds down its inflation-fighting efforts and begins to lower interest rates.

Forward-looking sentiment among agents largely tracks with this improving outlook, the Triple-I finds.

- Forty-seven percent of agents in December’s Triple-I expected a heavier pipeline of buyers 12 months from now.

- If we include the share of agents who expect “about the same” number of buyer clients, 85 Prozent of agent respondents expect their buyer pipelines to at least remain the same or improve im kommenden Jahr.

- Nearly the same share of agents predicted their number of listing clients would either be the same or heavier 12 months from now — up from 63 Prozent of agents who said this in September.

But ultimately, the recovery will still rely on factors that are difficult to predict — rooted deeply in the attitudes of potential clients.

Hinging on buyers

While more momentum has gathered in the new-home market, industry observers have stressed that the breadth and speed of a potential recovery will rely on factors that are difficult to measure.

Ali Wolf, chief economist at housing data company Zonda, focuses on the new home space but characterized the start to 2024 as “better than expected” during a state-of-the-market presentation at Inman Connect.

Wolf went on to literally sound a note of caution, though.

“We asked builders to describe the market in three words,” Wolf said, adding, “and the number one most commonly cited word was ‘cautious.’ So while they are seeing that foot traffic, there still is just that sense of, ‘OK, how deep is this demand pool of buyers?’”

Hinweise zur Methodik: Der Inman dieses Monats Intel Index Umfrage wurde vom 21. bis 31. Dezember 2023 durchgeführt. Die gesamte Inman-Lesergemeinschaft war zur Teilnahme eingeladen Intel Insgesamt gingen 808 Antworten ein. Befragte hierfür Umfrage wurden zur SurveyMonkey-Plattform weitergeleitet, wo sie ihre Profile auf dem Wohnimmobilienmarkt selbst identifizierten. Die Befragten waren auf eine Antwort pro Gerät beschränkt, es gab jedoch keine Beschränkung auf IP-Adressen. Sobald ein Profil (Wohnimmobilienmakler, Hypothekenmakler/Banker, Unternehmensleiter/Investor/Proptech oder anderes) ausgewählt wurde, beantworteten die Befragten eine einzigartige Reihe von Fragen für dieses spezifische Profil. Weil das Umfrage Da keine demografischen Informationen zu Alter, Geschlecht oder Geografie abgefragt wurden, gab es keine Datengewichtung. Das Umfrage wird monatlich durchgeführt, mit wiederkehrenden und einzigartigen Fragen für jeden Profiltyp.

- SEO-gestützte Content- und PR-Distribution. Holen Sie sich noch heute Verstärkung.

- PlatoData.Network Vertikale generative KI. Motiviere dich selbst. Hier zugreifen.

- PlatoAiStream. Web3-Intelligenz. Wissen verstärkt. Hier zugreifen.

- PlatoESG. Kohlenstoff, CleanTech, Energie, Umwelt, Solar, Abfallwirtschaft. Hier zugreifen.

- PlatoHealth. Informationen zu Biotechnologie und klinischen Studien. Hier zugreifen.

- Quelle: https://www.inman.com/2024/01/31/client-pipelines-tick-back-up-as-agents-eye-2024-gains-triple-i/

- :hast

- :Ist

- :nicht

- :Wo

- $UP

- 1

- 10

- 12

- 12 Monate

- 17

- 1995

- 2008

- 2023

- 2024

- 32

- 90

- a

- Über uns

- Nach

- Hinzufügen

- Adressen

- Fügt

- Nach der

- Alter

- Makler

- Agenten

- vor

- unter

- an

- machen

- jedem

- SIND

- Bereich

- ARM

- AS

- At

- verfügbar

- Zurück

- BE

- weil

- wird

- war

- Bevor

- Anfang

- beginnt

- begonnen

- Sein

- Glauben

- unten

- Besser

- beide

- Breite

- Break

- Hell

- breit

- breiteres

- Bauherren

- Büro

- Geschäft

- aber

- KÄUFER..

- Käufer

- by

- Vorsicht

- Volkszählung

- Statistik Amt

- dadurch gekennzeichnet

- Chef

- Wahl

- wählten

- Chris

- zitiert

- klarer

- Auftraggeber

- Klientel

- Kunden

- Kletterte

- COM

- wie die

- Kommen

- häufig

- community

- Unternehmen

- durchgeführt

- Vertrauen

- Konsens

- konsistent

- fortsetzen

- Unternehmen

- Strom

- Zyklen

- technische Daten

- Tage

- debütierte

- Dez

- Jahrzehnte

- Dezember

- tief

- tief

- Demand

- demographisch

- Abteilung

- beschreiben

- beschrieben

- Entwicklung

- Gerät

- DID

- schwer

- gerichtet

- nach unten

- nach unten

- im

- jeder

- Ökonom

- Bemühungen

- entweder

- Ende

- Ganz

- Sommer

- Sogar

- genau

- ausschließlich

- erwarten

- erwartet

- Auge

- Faktoren

- Bundes-

- federal reserve

- Gefühl

- Füllung

- Finden Sie

- Befund

- findet

- Vorname

- erstes Mal

- konzentriert

- Fuß

- Aussichten für

- für

- Gewinnen

- Gewinne

- gesammelt

- Geschlecht

- Geographie

- bekommen

- mehr

- persönlichem Wachstum

- Wachstum

- Hälfte

- Pflege

- passieren

- Schwerer

- Haben

- schlagen

- Startseite

- Gehäuse

- Immobilienmarkt

- Ultraschall

- aber

- HTTPS

- if

- Verbesserung

- Verbesserung

- in

- das

- zunehmend

- Index

- Indikation

- Energiegewinnung

- Flexion

- Wendepunkt

- Information

- Einblicke

- beantragen müssen

- Intel

- Intelligenz

- Interesse

- Zinsen

- Inventar

- eingeladen

- IP

- IP-Adressen

- IT

- SEINE

- Januar

- Joins

- jpg

- nur

- weitgehend

- Nachname

- Letztes Jahr

- neueste

- am wenigsten

- wahrscheinlich

- Einschränkung

- Limitiert

- listing

- senken

- viele

- Markt

- max-width

- Kann..

- messen

- Memory

- könnte

- moderieren

- Schwung

- monatlich

- Monat

- mehr

- Darlehen

- vor allem warme

- meist

- viel

- Neu

- Neujahr

- News

- nicht

- beachten

- Notizen

- jetzt an

- Anzahl

- Beobachter

- Oktober

- of

- WOW!

- bieten

- vorgenommen,

- on

- einmal

- EINEM

- einzige

- Optimistisch

- Option

- or

- Andere

- Outlook

- übrig

- teilnehmen

- für

- Prozent

- Zeit

- Pipeline

- Ort

- Plattform

- Plato

- Datenintelligenz von Plato

- PlatoData

- Points

- Pool

- Potenzial

- potentielle Kunden

- mögliche Genesung

- vor

- vorhersagen

- vorhergesagt

- Vorbereitung

- presentation

- früher

- Profis

- Profil

- Profil

- PropTech

- Aussicht

- veröffentlicht

- Fragen

- Honorar

- Leser

- echt

- Immobilien

- Immobilienmarkt

- Received

- kürzlich

- Erholung

- wiederkehrend

- verstärkt

- verhältnismäßig

- Mitteilungen

- verlassen

- blieb

- berichten

- Anforderung

- Forschungsprojekte

- RESERVE

- Wohn

- Befragte

- Antwort

- Antworten

- Die Ergebnisse

- Anstieg

- verwurzelt

- s

- Said

- Vertrieb

- gleich

- sagt

- Zweite

- Sehen

- ausgewählt

- Sinn

- Gefühl

- September

- kompensieren

- mehrere

- Teilen

- Fehlbetrag

- erklären

- zeigte

- da

- langsam

- Langsam

- So

- Klingen

- Raumfahrt

- spezifisch

- Geschwindigkeit

- Spot

- stabilisieren

- Anfang

- begonnen

- Immer noch

- stark

- weltweit

- Schlägt vor

- Umfrage

- SurveyMonkey

- als

- zur Verbesserung der Gesundheitsgerechtigkeit

- Das

- ihr

- Dort.

- vom Nutzer definierten

- Dritte

- fehlen uns die Worte.

- obwohl?

- nach drei

- Tick

- Zeit

- zu

- sagte

- Gesamt

- Spuren

- Zugkraft

- der Verkehr

- Flugbahn

- Transaktion

- was immer dies auch sein sollte.

- XNUMX

- tippe

- uns

- Letztlich

- einzigartiges

- URBAN

- Warten

- wurde

- we

- Woche

- ging

- waren

- Was

- welche

- während

- WHO

- werden wir

- Winde

- mit

- .

- Wolf

- Word

- Worte

- arbeiten,

- Wurst

- würde

- Jahr

- Jahr

- noch

- Zephyrnet

- Zonda