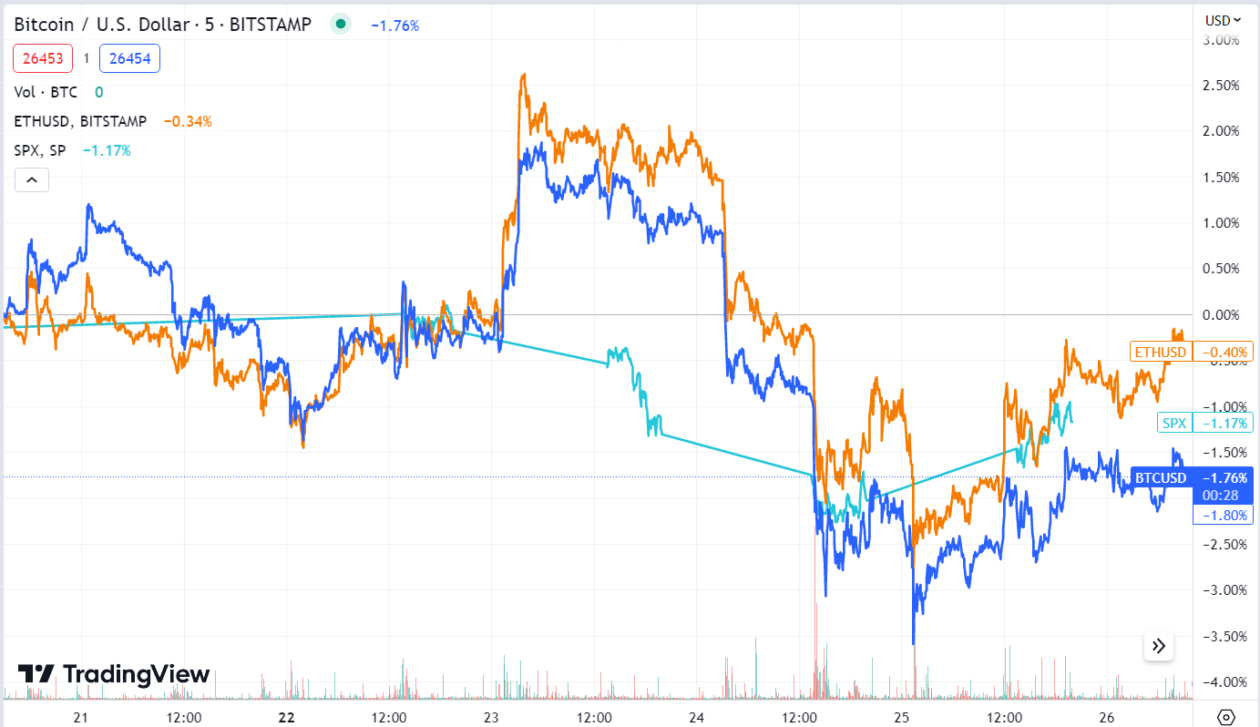

Bitcoin fell 1.40% from May 19 to May 26 to trade at US$26,451 at 7:00 p.m. Friday in Hong Kong. The world’s largest cryptocurrency by market capitalization has been trading under US$30,000 since April 19. Ether rose 0.34% over the week to US$1,813 recapturing US$1,800 on Thursday.

The lack of progress in U.S. debt ceiling negotiations continued to erode risk appetite as the June 1 deadline neared. On Wednesday, Fitch Ratings placed the U.S.’ AAA rating on a negative rating watch, saying that debt ceiling negotiations raised the risks of the government missing payments on some of its obligations.

“Bitcoin and Ether have shrugged off the U.S. debt ceiling negotiations and the potential ripple effects for crypto. President Biden has already declared the country will not default on its debt,” Lucas Kiely, the chief investment officer of digital asset platform Yield App , said . “With liquidity tight, the crypto market doesn’t seem to be too concerned over these macro events. It will take something much more substantial to move these markets.”

Johnny Louey, a crypto research analyst at trading platform LiquidityTech Protocol , disagreed, saying that the debt ceiling negotiations are the main factors weighing down Bitcoin price.

“Although the debt ceiling has been raised and revised 78 times since 1960, investors are aware of the default risk if negotiations fail. This is the first time Bitcoin encountered such an economic incident and it’s reasonable to assume a risk-off approach would be appropriate,” said Louey .

The global crypto market capitalization stood at US$1.11 trillion on Friday at 7:00 p.m. in Hong Kong, down 0.89% from US$1.12 trillion a week ago, according to CoinMarketCap data. With a market cap of US$512 billion, Bitcoin represented 46.1% of the market, while Ether, valued at US$218 billion, accounted for 19.6%.

“加密货币的整个市值在一年内基本保持不变,”Kiely 说。 “Tether 扩大其比特币持有量的计划可能会暂时提振价格,但总体而言不太可能产生重大影响。 比特币 2024 年减半可能会导致价格上涨,但是,我们尚未开始看到其影响。”

On May 17, Tether , the company behind the world’s largest stablecoin USDT, revealed its plans to “regularly allocate” as much as 15% of its net operational profits to buy Bitcoin, aiming to boost its reserves portfolio. Tether held approximately US$1.5 billion in Bitcoin reserves, at the time of the announcement.

休眠比特币创历史新高

The amount of Bitcoin that has been inactive for at least a year rose to an all-time high of 68.46% on Wednesday, according to data aggregator MacroMicro .

“It could mean short-term selling pressure decreases if the Bitcoin holdings in short-term holdings shift to longer-term holders. However, we will not be able to tell whether the addresses belong to institutional investors or not,” Tom Wan, a research analyst at 21.co , the parent company of 21Shares, an issuer of crypto exchange-traded products, said.

根据 Yield App 的 Kiely 的说法,这表明全球越来越多的投资者打算长期持有比特币。

Kiely 说:“考虑到与不断变化的监管环境相关的不确定性以及人们对比特币作为一种价值储存手段的日益认可,这种趋势可能会持续甚至加速——甚至可能达到超级比特币化的地步。”

“超级比特币化”是一个推测比特币最终会崛起成为世界上无处不在的货币形式的概念。

值得注意的推动者:RNDR 和 KAVA

The Render Network’s native cryptocurrency was this week’s biggest gainer among the top 100 coins by market capitalization listed on CoinMarketCap, rallying 16.55% to US$2.83. The token started picking up momentum last Saturday, after the announcement of the new Render Foundation website. This is Render’s second consecutive week as the biggest gainer in the top 100 cryptos.

The Render Network leverages idle graphics processing units for digital rendering purposes, catering to areas such as 3D modeling, gaming imagery, and virtual reality.

Kava, the governance token of a layer-1 blockchain of the same name, was this week’s second-biggest gainer, rising 10.70% to US$1.09. The coin started picking up momentum on Monday, following the launch of the Kava mainnet last week.

下周:债务上限协议能否打破比特币的螃蟹行走?

U.S. President Joe Biden and House Speaker Kevin McCarthy are reportedly closing in on a deal that would raise the government’s debt ceiling for two years while capping spending on most items. Yet, the June 1 deadline is fast approaching, causing investor concerns about a potential default.

根据 WuuTrade 的 Kenjaev 的说法,债务上限谈判的不确定性将继续拖累加密货币市场,直到达成协议。

“The sideways [movement] of Bitcoin is very much related to the current market risks and the fear. Investors’ activity during any economic risk talks is rather cautious. Hence the sideways in US$26,000 – US$30,000,” wrote Kenjaev, adding that positive news surrounding the U.S. economy will break the crab walk .

投资者正在等待下周发布的美国 195,000 月份就业报告,其中包括重要的非农就业数据。 此信息通常用作预测美联储下一步利率调整措施的晴雨表。 ING Economics 预计 3.5 月份非农就业人数将增加 3.4。 此外,他们预计 XNUMX 月份的失业率将小幅上升至 XNUMX%,而上个月为 XNUMX%。

在加密货币领域,以太坊第 2 层网络 Optimism 计划在下周三增加其治理代币 (OP) 的流通供应,即代币推出一年后。 此次扩张是 Optimism 扩大 Token House 内可投票代币池战略的一部分,其 OP 持有者群体负责对治理问题提出建议和投票。

See related article: Big buys fail to lift NFT markets as regulatory uncertainty weighs heavy on crypto

- SEO 支持的内容和 PR 分发。 今天得到放大。

- 柏拉图爱流。 Web3 数据智能。 知识放大。 访问这里。

- 与 Adryenn Ashley 一起铸造未来。 访问这里。

- 使用 PREIPO® 买卖 PRE-IPO 公司的股票。 访问这里。

- Sumber: https://bitrss.com/news/309885/weekly-market-wrap-bitcoin-weighed-down-by-debt-ceiling-uncertainty

- :具有

- :是

- :不是

- ][p

- $UP

- 000

- 1

- 10

- 100

- 11

- 12

- 15%

- 17

- 195

- 2024

- 21分享

- 26

- 3d

- 3D建模

- 7

- a

- AAA

- Able

- 关于

- 根据

- 活动

- 添加

- 另外

- 地址

- 调整

- 后

- 聚合

- 前

- 致力

- 已经

- 其中

- 量

- an

- 分析人士

- 和

- 公告

- 预料

- 任何

- 应用

- 食欲

- 的途径

- 接近

- 适当

- 约

- 四月

- 保健

- 地区

- 围绕

- 刊文

- AS

- 财富

- At

- 等待

- 察觉

- BE

- 成为

- 很

- 背后

- 拜登

- 大

- 最大

- 亿

- 比特币

- 比特币价格

- 比特币储备

- blockchain

- 促进

- 午休

- 但是

- 购买

- 买比特币

- 收购

- by

- 帽

- 大写

- 造成

- 谨慎

- 天花板

- 首席

- 循环

- 关闭

- CO

- CoinMarketCap

- 硬币

- 公司

- 相比

- 概念

- 关心

- 关注

- 连续

- 继续

- 持续

- 可以

- 国家

- 关键

- 加密

- 加密市场

- 加密空间

- cryptocurrencies

- cryptocurrency

- cryptos

- 电流

- data

- 处理

- 债务

- 减少

- 默认

- 数字

- 数字资产

- 不会

- 向下

- ,我们将参加

- 经济

- 经济学

- 经济

- 影响

- 整个

- 本质上

- 以太币

- 醚(ETH)

- 复仇

- 甚至

- 事件

- 最终的

- 演变

- 交易所交易

- 扩大

- 扩张

- 因素

- 失败

- 高效率

- 恐惧

- 联邦

- 美联储

- 姓氏:

- 第一次

- 惠誉

- 以下

- 针对

- 申请

- 基金会

- 周五

- 止

- 赌博

- 特定

- 全球

- 全球加密货币

- 治理

- 政府

- 图像

- 团队

- 成长

- 减半

- 有

- 重

- 保持

- 于是

- 高

- 点击

- 举行

- 持有人

- 控股

- 香

- 香港

- 别墅

- 但是

- HTTPS

- Hyperbitcoinization

- 空闲

- if

- 影响力故事

- in

- 不活跃

- 事件

- 包括

- 增加

- 日益

- 信息

- ING

- 机构

- 机构投资者

- 打算

- 兴趣

- 利率

- 成

- 投资

- 投资者

- 投资者

- 发行者

- 问题

- IT

- 项目

- 它的

- 工作机会

- 工作报告

- 拜登

- 六月

- KAVA

- 保持

- 香港

- 缺乏

- 景观

- 大

- 最大

- 名:

- 发射

- 铅

- 最少

- 杠杆

- 容易

- 流动性

- 已发布

- 长

- 宏

- 主要

- mainnet

- 市场

- 市值

- 市值

- 市场包装

- 市场

- 可能..

- 意味着

- 失踪

- 造型

- 动力泉源

- 周一

- 钱

- 月

- 更多

- 最先进的

- 移动

- 运动

- 搬家公司

- 许多

- 姓名

- 本地人

- 负

- 谈判

- 净

- 网络

- 全新

- 消息

- 下页

- NFT

- NFT市场

- 非农

- 非农就业人数

- 债券

- of

- 折扣

- 官

- 经常

- on

- OP

- 操作

- 乐观

- or

- 超过

- 最划算

- 母公司

- 部分

- 支付

- 工资单

- 计划

- 规划行程

- 计划

- 平台

- 柏拉图

- 柏拉图数据智能

- 柏拉图数据

- 点

- 池

- 个人档案

- 积极

- 潜力

- 可能

- 预测

- 总统

- 比登总统

- 总统乔比登

- 压力

- 车资

- 价格

- 处理

- 热销产品

- 利润

- 进展

- 预计

- 协议

- 目的

- 提高

- 凸

- 率

- 宁

- 等级

- 评分

- 达到

- 现实

- 合理

- 承认

- 关于

- 监管

- 监管环境

- 有关

- 释放

- 保持

- 翻译

- 报告

- 代表

- 研究

- 储备

- 提供品牌战略规划

- 揭密

- 纹波

- 上升

- 上升

- 风险

- 风险偏好

- 风险

- 粉色

- s

- 说

- 同

- 星期六

- 说

- 其次

- 看到

- 似乎

- 卖房

- 服务

- 转移

- 短期的

- 侧身

- 自

- 一些

- 东西

- 太空

- 喇叭

- 花费

- stablecoin

- 稳定币 USDT

- 开始

- 开始

- 步骤

- 商店

- 存储的价值

- 策略

- 大量

- 这样

- 提示

- 供应

- 周围

- 采取

- 会谈

- 展示

- 术语

- 系链

- 这

- 其

- 博曼

- 他们

- Free Introduction

- 星期四

- 次

- 时

- 至

- 象征

- 令牌

- 也有

- 最佳

- 贸易

- 交易

- 交易平台

- 趋势

- 兆

- 二

- 我们

- 美国经济

- 普及

- 不确定

- 下

- 失业

- 失业率

- 单位

- 直到

- USDT

- 折扣值

- 价值

- 非常

- 在线会议

- 虚拟现实

- 表决

- 是

- 了解

- we

- 您的网站

- 周三

- 周

- 每周

- 衡

- 重量

- 是否

- 这

- 而

- 将

- 中

- 世界

- 全世界

- 将

- 包装

- 年

- 年

- 但

- 产量

- 收益应用

- 和风网