- MON:荷兰合作银行会议纪要(12 月);德国贸易平衡表(10 月)、瑞士 CPI(11 月)、EZ Sen tix(12 月)、美国工厂订单(10 月)、日本 CPI(11 月)、澳大利亚最终 PMI(11 月)。

- 您:澳洲联储政策公告;中国财新服务业 PMI(11 月)、欧元区/英国/美国综合/服务业 PMI 终值(11 月)、欧元区生产者价格(10 月)、美国 ISM 服务业 PMI(11 月)。

- 星期三: 加拿大银行政策公告;德国工业订单(10 月)、英国/欧元区建筑业 PMI(11 月)、欧元区零售销售(10 月)、美国 ADP(11 月)、国际贸易(10 月)、加拿大贸易平衡(10 月)、Ivey PMI(11 月)。

- THU: 中欧峰会 (1/2),挪威银行区域网络 (LON:{{1128674|NETW}}) 调查(第四季度);中国贸易平衡(4 月)、瑞士失业率(3 月)、德国工业产出(XNUMX 月)、欧元区就业最终(第三季度)、美国 IJC、日本贸易平衡(XNUMX 月)、中国外汇储备(XNUMX 月)。

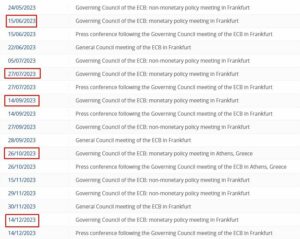

- FRI: 中欧峰会(2/2),欧洲央行TLTRO III还款公告;德国 HICP 决赛(XNUMX 月)、美国 NFP(XNUMX 月)、大学。密歇根预赛。 (十二月)。

注意:预览按日期顺序列出

瑞典央行纪要(周一): 在 4.00 月的会议上,荷兰合作银行选择将利率维持在 25% 不变,会议前的预期是加息 50 个基点或维持不变。此次会议最终可以被描述为中立立场(考虑到维持政策预测),从而令那些在利率不变的情况下寻求更明确鹰派语言的人感到失望;尽管如此,QT 的点头增添了一点鹰派的色彩,但同样,这也挑战了 SEB 等寻求公布销量增长的公司。从会议纪要来看,我们希望了解行长 Thedeen 的会后评论,他暗示再次加息的可能性为 50/40,尽管央行自己的利率路径暗示进一步紧缩的可能性为 XNUMX%。

瑞士消费者物价指数(周一): 目前尚不清楚瑞士央行在 1.75 月份将利率维持在 2023% 不变后,是否会在 1 月份加息,但如果确实加息,也可能是最后一次加息。做出决定的一个关键因素将是 10 月通胀报告,该报告将是包含 3 年中期租金参考利率上涨的一读。与此相关,主席乔丹2024月2.0日表示,由于租金和能源价格上涨,未来几个月国内通胀可能会上升,而施莱格尔XNUMX日则表示,由于租金上涨,通胀可能“暂时”上升。需要提醒的是,尽管瑞士央行在 XNUMX 月份维持利率不变,但从 XNUMX 年第三季度开始逐步下调通胀预测,但将近期观点维持在略高于 XNUMX% 的目标水平。

澳洲联储公告(周二): 预计澳洲联储将在下周的会议上维持利率不变,货币市场定价的现金利率目标(纽约证券交易所股票代码:{{97|TGT}})维持在 8180% 的可能性为 4.35%,现金利率目标维持在 3% 的可能性只有 25%上涨 4.60 个基点至 25%。继央行在 3.5 月最后一次会议上决定将现金利率上调 2024 个基点之后,人们对澳大利亚央行将维持按兵不动的预期,这一决定符合预期,尽管它调整了前瞻性指引,指出是否需要进一步收紧货币政策以确保通胀在合理的时间内恢复到目标水平将取决于数据和不断变化的风险评估。这被认为比澳大利亚央行之前的措辞(即可能需要进一步收紧货币政策)要温和一些,但它重申,在合理的时间范围内将通胀恢复到目标水平仍然是董事会的首要任务,并将采取必要措施来实现这一结果。央行还表示,澳大利亚的通胀已经过了峰值,但仍然过高,并且比几个月前的预期更加持久,目前预计 CPI 通胀到 2 年底将达到 3% 左右,处于 2025 年的最高水平。到 2025 年底实现 XNUMX-XNUMX% 的目标范围。此外,利率决定几天后发布的澳大利亚央行季度货币政策声明指出,他们考虑继续保持政策利率稳定,但决定加息为通胀提供更多保证,同时它也承认近几个月的数据表明国内经济比之前预期的要强一些,通胀仍然很高,预计下降速度将比三个月前的预期更加缓慢。尽管前瞻性指引略有调整,但澳大利亚央行的言论继续走强硬路线,因为会议纪要指出,防止通胀预期小幅上升也很重要,而且工作人员对通胀的预测假设还会加息一两次。同时还表示,到XNUMX年底CPI未能回到目标水平的风险有所增加。澳洲联储行长布洛克最近还重申,更大幅度的货币政策紧缩是正确的应对措施,并承认通货膨胀的范围远不止汽油、电力和租金价格上涨,大多数商品和服务的价格都在强劲上涨。尽管如此,最近发布的数据好坏参半,表明央行不太可能连续进行利率调整,而最近低于预期的月度消费者物价指数指标几乎保证了即将举行的会议暂停。

澳大利亚国内生产总值(周二): Q3 GDP Q/Q is seen at 0.3% (vs 0.4% previously), with Y/Y growth forecast at 1.7% (from 2.1% in Q2). Analysts at Westpac expect the Q3 Q/Q metrics to match the Q2 number and say “we assess that Australia’s economy grew by 0.4% in the September quarter, following outcomes of 0.4% for both March and June.” The desk also suggests that “the economy is stuck in the slow lane, as the intense headwinds of high inflation and higher interest rates impact. Domestic demand growth likely cooled, from a near 3% annualised pace over 2023H1 to a forecast 1.8% annualised pace in Q3.” In the latest RBA monetary policy statement (7th November), Governor Bullock said “while the economy is experiencing a period of below-trend growth, it has been stronger than expected over the first half of the year.” However, the latest Statement on Monetary Policy flagged overseas risks – “The near-term outlook is for relatively weak output growth in Australia’s major trading partners, with risks tilted to the downside. Growth is expected to slow from 3½ per cent in 2023 to 3 per cent in 2024, well below average growth in the decade prior to the pandemic.”

自由区零售销售(周三): 0.2 月零售销售月率预计为 0.3%(此前为-2.9%),而此前同比为-2%。 XNUMX月月度指标连续第三个月出现收缩,其中德国和意大利的销售额下降,但法国和西班牙的销售额有所增加,表明整个欧元区的私人消费趋势不平衡。 XNUMX月份非食品销售额下降近XNUMX%,而食品采购量的大幅增加缓解了销售额的整体下降。受欧洲央行加息的影响,私人消费预计将继续低迷,欧洲央行加息增加了偿债成本并鼓励更多储蓄。牛津经济研究院的分析师表示,预计私人消费要到明年才会出现增长,可能是因为通胀下降以及实际收入随之改善。

中国银行公告(周三): The Bank of Canada is expected to keep rates unchanged on December 6th. Governor Macklem recently said that rates might now be restrictive enough, which helped support expectations that the central bank has concluded its hiking cycle. While Macklem has warned that it was still not the time to be thinking about rate cuts, most analysts are looking for around 100bps worth of rate cuts in 2024, beginning in Q2. “It’s readily apparent in the past two quarters, interest rates in the 5% range are a significant headwind to growth, one that is desirable now while the BoC seeks to cool inflation, but too much of a drag to be sustained for a full year ahead,” CIBC Capital Markets said; the bank looks for a bigger gap between US and Canadian rates, but says that is consistent with the evidence at hand that shows the US economy, due to lower household debt levels and locked-in long-term mortgages, is better able to withstand interest rates near 5%.

欧盟-中国峰会(周四/周五): European Commission President von der Leyen and European Council President Michel are poised to travel to China for a summit between December 7th to 8th, although the meeting is not likely to lead to any meaningful shift in relations. No joint statement is yet planned at the summit – the first to be held in four years. The summit follows several high-level talks between the EU and China, while the EU’s top diplomat also visited Beijing in mid-October. However, one area of potential focus for markets could be the EU’s stance on Chinese firms helping to circumvent Russian sanctions. SCMP sources recently reported that EU leaders will push the Chinese President to act against 13 companies, “and may name and shame the firms if they do not secure a firm commitment”. SCMP added that action on sanctions and a commitment for China to re-engage with Ukraine’s peace formula are seen as two potential gains at a summit in Beijing next week.

日本东京消费物价指数(周四): 核心 CPI 预计将从 2.4% 放缓至 2.7%。 3.3 月份东京总体通胀率上升 2.8%,高于 2.9 月份的 2.1%,超出预期。 CapEco 分析师预计 2.3 月份的数字将降至 XNUMX%,恢复今年大部分时间的下降趋势。十月份的主要驱动因素包括不稳定的新鲜食品价格大幅上涨以及公用事业补贴的减少。由于批发价格显着下降,预计 XNUMX 月份生鲜食品价格将有所放缓,远离 XNUMX 月份的七年高点。 CapEco 表示,加工食品和制成品通胀可能已达到顶峰,预计 XNUMX 月份将进一步下降。 CapEco 表示:“服务业通胀是我们预计会进一步上升的领域,我们预计上个月通胀率将从 XNUMX% 加速至 XNUMX%。”

中国贸易平衡(周四): 此次发布将根据国内外需求进行衡量。从上月公布的数据来看,出口走弱,同比下降3.1%,但仍较6.2月份的-6.4%有所改善。进口走强,增长 0.8%,而 4 月份则下降-2%。部门一直警告称,出口下降可能会对第四季度净出口的 GDP 增长产生负面影响,而中国在下半年宣布的刺激措施仍需要充分落实。报告以最新的财新PMI为指标,指出“需求小幅扩张,但新订单总量指标创今年以来最低……经济出现触底回升迹象,但复苏基础并不牢固。”需求疲软,内外部诸多不确定因素依然存在,预期仍相对疲软”。继上个月的 GDP 指标之后,ING 分析师表示:“在我们更好地了解这里发生的情况之前,我们不会修改今年的 GDP 数据,我们最近将 5.4 年全年的 GDP 数据上调至 2023%疲软的外部环境和坚挺的国内经济之间是否开始建立权衡是一个有吸引力的假设,但目前还没有足够的支持来作为核心预测。需要更多数据。”

中国消费者物价指数(周五): Last month’s report stated thatCPI Y/Y was at -0.2%, M/M at -0.1%, and PPI Y/Y at -2.6%. Using the Caixin PMI data as a proxy for prices, the release suggested “Prices rose moderately. Although the gauge for input costs remained in expansionary territory for 40 months in a row, the reading in October was the lowest since June 2022, as the increases in the costs of labour, raw materials and transportation were limited. Part of the input cost increase was passed on to customers, with the gauge for output prices remaining above 50 for 18 consecutive months… companies continued to raise their own selling prices. Though modest, the rate of charge inflation was only fractionally slower than September’s 18-month high.” Last month, consumer prices fell back into deflation with desks highlighting sluggish domestic demand. That being said, it’s also worth noting that the data could be influenced by the Chinese Singles Day shopping festival which ended on November 11th, although some analysts expect the impact to be muted.

印度储备银行公告(周五): 印度储备银行预计将在下周结束为期三天的会议时将回购利率维持在 6.50% 不变,最近的一项民意调查显示,所有 3 名经济学家一致预测央行将维持利率不变,同时也可能维持这一立场仍将重点放在撤回住宿上。需要提醒的是,MPC 在 64 月份的最后一次会议上一致投票维持利率不变,六分之五的成员投票赞成外部成员 Varma 继续对决议的这一部分表示保留的政策立场,并指出连续承诺取消宽松但实际上保持利率不变的会议并不能提高货币政策委员会的可信度。上次会议的言论继续强调央行对通胀的关注,印度储备银行行长达斯指出,他们认为通胀是宏观经济稳定的主要风险,并继续致力于将通胀率调整至 5% 的目标水平。达斯还表示,预计近期通胀将会疲软,潜在通胀压力正在缓和,但他补充说,食品通胀压力可能不会持续缓解,他们将积极采取行动维持金融稳定。尽管如此,最近通胀疲软并在过去两个月回到了印度储备银行 6-4% 的容忍范围内,这表明央行不太可能恢复紧缩周期。

美国就业报告(周五): Analysts expect 175k nonfarm payrolls will be added to the US economy in November; while that would be an acceleration in the rate of job additions vs the 150k added in October, it would still be cooler than recent averages (3-month average 204k, 6-month 206k, 12-month 243k). The unemployment rate is expected to remain unchanged at 3.9% (Fed projections in September saw the rate closing out the year at 3.8%, and its forecasts have pencilled in a rise to 4.1% in 2024). “All signs point to an ongoing cooldown across various measures of labour market activity,” Moody’s writes, explaining that the tick up in November jobs growth will be a function the impact of the United Auto Workers strikes in October rather than a resurgence in the labour market. That would be in keeping with reports in the Fed’s recent Beige Book, which noted that demand for labour continued to ease. Still, Fed officials do not seem concerned; Fed’s Waller notes that while the labour market is cooling, it still remains tight. Before the November jobs data on Friday, traders will note the October JOLTs data out on Tuesday; this is likely to show a continuation of the pullback in job openings as firms refine hiring plans given current economic conditions, Moody’s says.

- :具有

- :是

- :不是

- :在哪里

- $UP

- 1

- 10日

- 13

- 1

- 2%

- 2022

- 2023

- 2024

- 2025

- 35%

- 40

- 50

- 6日

- 7日

- 8日

- a

- Able

- 关于

- 以上

- 加速

- 促进

- 住所

- 承认

- 横过

- 法案

- 操作

- 活动

- 通

- 添加

- 增加

- 调整

- ADP

- 影响

- 后

- 驳

- 前

- 向前

- 对齐

- 所有类型

- 还

- 尽管

- an

- 分析师

- 和

- 公布

- 公告

- 另一个

- 预期

- 任何

- 明显的

- 吸引人的

- 保健

- 国家 / 地区

- 围绕

- AS

- 评估

- 评定

- 假定

- 保证

- At

- 澳大利亚

- 澳大利亚人

- 汽车

- 远离

- 背部

- 当前余额

- 银行

- 加拿大银行

- BE

- 很

- before

- 开始

- 北京

- 作为

- 如下。

- 更好

- 之间

- 大

- 位

- 中行

- 书

- 都

- 更广泛

- 建筑物

- 但是

- by

- CAN

- 加拿大

- 加拿大

- 资本

- 资本市场

- 现金

- 一分钱

- 中央

- 中央银行

- 主席

- 机会

- 充

- 中国

- 中国消费物价指数

- 中文

- CIBC

- 规避

- 明晰

- 关闭

- 未来

- 评论

- 佣金

- 承诺

- 公司

- 关心

- 总结

- 总结

- 条件

- 连续

- 考虑

- 一贯

- 施工

- 消费者

- 消费

- 延续

- 继续

- 持续

- 继续

- 收缩

- Cool

- 核心

- 价格

- 成本

- 可以

- 评议会

- CPI

- 可信性

- 电流

- 目前

- 合作伙伴

- 裁员

- 周期

- data

- 天

- 一年中的

- 债务

- 十

- 十二月

- 决定

- 决定

- 拒绝

- 下降

- 减少

- 下降

- 蔑视

- 放气

- 交付

- 需求

- 依赖

- 描述

- 台

- 电竞桌

- 尽管

- 令人失望

- do

- 不

- 运输(国内)

- 缺点

- 向下

- 驱动程序

- 下降

- 下降

- 两

- 缓解

- 宽松

- 欧洲央行

- 经济

- 经济情况

- 经济学

- 经济学家

- 经济

- 经济增长

- 当选

- 电力

- 雇用

- 鼓励

- 结束

- 截至

- 能源

- 能源价格

- 提高

- 更多

- 确保

- 环境

- 一样

- EU

- 欧洲

- 欧盟委员会

- 欧元区

- 甚至

- 匀

- 证据

- 演变

- 扩大

- 期望

- 期望

- 预期

- 经历

- 说明

- 出口

- 特快

- 外部

- 因素

- 工厂

- 秋季

- 远

- 美联储

- 节

- 少数

- 图

- 最后

- 金融

- 金融稳定

- 公司

- 企业

- 姓氏:

- 已标记

- 专注焦点

- 重点

- 遵循

- 以下

- 如下

- 食品

- 针对

- 收益预测

- 预测

- 国外

- 公式

- 向前

- 基金会

- 四

- 法国

- 新鲜

- 周五

- 止

- ,

- 充分

- 功能

- 进一步

- 此外

- FX

- 收益

- 差距

- 搜集

- 测量

- 国内生产总值

- 国内生产总值增长

- 德语

- 德国

- 得到

- 特定

- 去

- 货

- 管理者

- 麦克勒姆州长

- 渐渐

- 增长

- 事业发展

- 保证

- 指导

- 民政事务总署

- 半

- 手

- 事件

- 有

- 强硬

- 标题

- 标题

- 逆风

- 保持

- 帮助

- 帮助

- 此处

- 高

- 高通胀

- 高水平

- 更高

- 突出

- 亮点

- 远足

- 远足

- 徒步旅行

- 招聘

- 举行

- 家庭

- 但是

- HTTPS

- 主意

- 确定

- if

- 三

- 影响力故事

- 默示

- 重要

- 进口

- 改进

- in

- 包括

- 包括

- 增加

- 增加

- 增加

- 表示

- 说明

- 产业

- 通货膨胀

- 通胀预期

- 影响

- ING

- 输入

- 兴趣

- 利率

- 内部

- 国际

- 国际贸易

- 成

- IT

- 意大利

- 它的

- 日文

- 工作

- 工作机会

- 工作报告

- 联合

- 约旦

- JPG

- 六月

- 只是

- 保持

- 保持

- 键

- 关键因素

- Labour

- 车道

- 语言

- 名:

- 最新

- 铅

- 领导人

- 离开

- 离开

- 左

- 减

- Level

- 各级

- 容易

- 喜欢

- 有限

- Line

- 已发布

- 长期

- 寻找

- LOOKS

- 降低

- 最低

- 麦克莱姆

- 宏观经济

- 主要

- 保持

- 主要

- 多数

- 制成的

- 许多

- 三月

- 标

- 市场

- 市场

- 匹配

- 物料

- 可能..

- 有意义的

- 措施

- 会议

- 会议

- 会员

- 成员

- 公

- 指标

- 密歇根州

- 可能

- 分钟

- 杂

- 谦虚

- 货币

- 货币政策

- 钱

- 月

- 每月一次

- 个月

- 穆迪

- 更多

- 抵押贷款

- 最先进的

- 移动

- MPC

- 许多

- 姓名

- 近

- 几乎

- 必要

- 需求

- 打印车票

- 负

- 净

- 网络

- 全新

- 下页

- 下周

- NFP

- 没有

- 非农

- 非农就业人数

- 显着

- 注意

- 注意到

- 注意

- 十一月

- 十一月

- 现在

- 数

- 纽约证券交易所

- 观察

- 发生

- 十月

- 十月

- 可能性

- of

- 官员

- on

- 一

- 正在进行

- 仅由

- 向前

- 开口

- 附加选项

- or

- 订单

- 我们的

- 输出

- 成果

- 结果

- Outlook

- 产量

- 超过

- 最划算

- 海外

- 己

- 牛津

- 步伐

- 流感大流行

- 部分

- 伙伴

- 通过

- 过去

- 径

- 暂停

- 工资单

- 和平

- 高峰

- 为

- 期间

- 计划

- 计划

- 柏拉图

- 柏拉图数据智能

- 柏拉图数据

- 采购经理人指数

- 点

- 准备

- 政策

- 英寸

- 可能

- 潜力

- PPI

- 总统

- 防止

- 预览

- 先前

- 价格

- 价格

- 先

- 优先

- 私立

- 可能性

- 处理

- 制片人

- 热销产品

- 预测

- 承诺

- 提供

- 证明

- 代理

- 出版物

- 拉回

- 购买

- 推

- Q2

- Q3

- QT

- 季

- 提高

- 范围

- 率

- 加息

- 价格表

- 宁

- 原

- RBA

- 澳洲联储货币政策声明

- RBI

- 达到

- 容易

- 阅读

- 真实

- 合理

- 最近

- 最近

- 记录

- 恢复

- 减少

- 参考

- 提炼

- 区域性

- 关系

- 关系

- 相对

- 释放

- 发布

- 发布

- 留

- 保持

- 其余

- 遗迹

- 提醒

- 出租

- 还款

- 报告

- 报道

- 业务报告

- 必须

- 储备

- 分辨率

- 响应

- 限制性

- 简历

- 零售

- 零售销售

- 返回

- 回报

- 右

- 上升

- 升起

- 上升

- 风险

- 风险

- 粉色

- 行

- 运行

- 俄语

- 俄罗斯制裁

- s

- 说

- 销售

- 制裁

- 储

- 锯

- 对工资盗窃

- 说

- 脚本

- 安全

- 看到

- 寻求

- 似乎

- 看到

- 卖房

- 九月

- 特色服务

- 维修

- 几个

- 转移

- 购物

- 显示

- 显示

- 如图

- 作品

- 显著

- 迹象

- 自

- 放慢

- 放缓

- 呆滞

- SNB

- So

- 至今

- 固体

- 一些

- 来源

- 西班牙

- 分裂

- 稳定性

- 团队

- 姿态

- 说

- 个人陈述

- 稳定

- 仍

- 刺激物

- 加强

- 罢工

- 强

- 非常

- 大量

- 建议

- 提示

- 首脑会议

- SUPPORT

- 超越

- 调查

- 持续

- 瑞士人

- 瑞士CPI

- 会谈

- 目标

- 条款

- 领土

- 比

- 这

- 美联储

- 其

- 那里。

- 他们

- 思维

- 第三

- Free Introduction

- 那些

- 虽然?

- 思想

- 三

- 通过

- 从而

- 蜱

- 紧缩

- 次

- 时间表

- 特克斯

- 至

- 东京

- 东京CPI

- 公差

- 也有

- 最佳

- 合计

- 贸易

- 交易商

- 交易

- 交通运输或是

- 旅行

- 趋势

- 趋势

- 周二

- 拧

- 捻

- 二

- 乌克兰

- 最终

- 一致地

- 不确定性

- 不明

- 下

- 相关

- 下划线

- 失业

- 失业率

- UNI

- 联合的

- 不会

- 直到

- 即将上市

- 上

- us

- 美国经济

- 美国工厂订单

- 美国 ISM 服务业采购经理人指数

- 美国就业报告

- 美国非农

- 运用

- 公用事业

- 各个

- 查看

- 参观

- 挥发物

- 的

- 投

- vs

- 警告

- 警告

- 是

- we

- 较弱

- 周

- 提前一周

- 井

- 为

- 西太平洋银行

- 什么是

- 什么是

- ,尤其是

- 是否

- 这

- 而

- WHO

- 批发

- 将

- 退出

- 退出

- 中

- 工人

- 价值

- 将

- 年

- 年

- 但

- 和风网