Silicon Valley investing giant 梅菲尔德1 has raised two funds totaling almost $1 billion targeted for early-stage investment.

The Menlo Park-based firm — known as an early backer of such startups as Lyft, Marketo 和 ServiceNow — announced its $580 million Mayfield XVII and the $375 million Mayfield Select III funds.

The firm last announced new funds in March 2020, when it raised $750 million across two funds. The firm now has $3 billion in total assets under management.

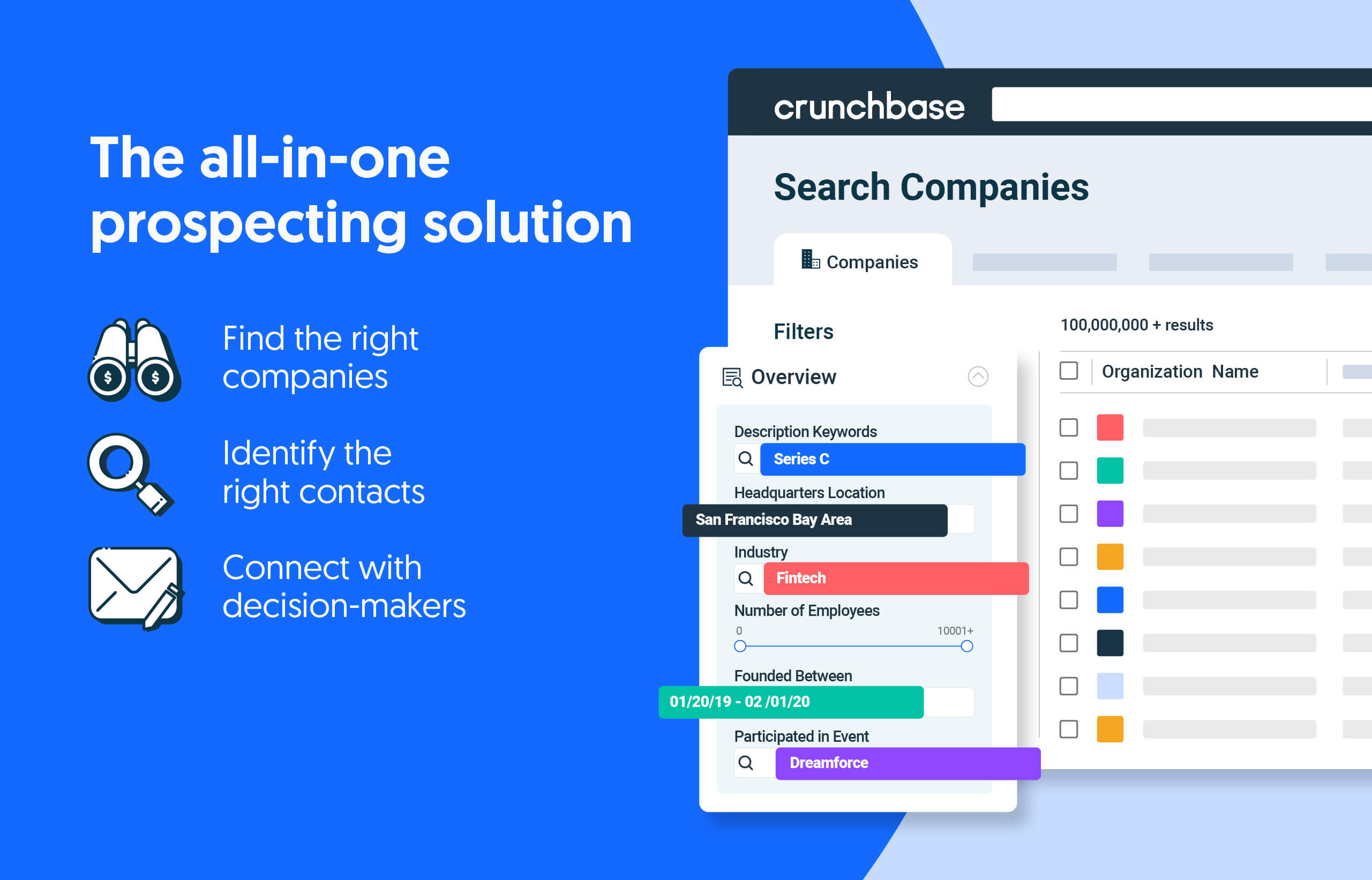

少搜索。关闭更多。

通过由私营公司数据领导者提供支持的一体化勘探解决方案来增加您的收入。

The Mayfield XVII fund will primarily be used for early-stage investing — mainly seed and Series A rounds. The Mayfield Select III will be for follow-on rounds, as well as investments in new companies, primarily at the Series B stage.

Some themes the firm is looking to invest in include human-centered AI, the developer-first technologies, semiconductors, cybersecurity and more.

“We are grateful for the continued support of our limited partners and for the fortitude of entrepreneurs which brings us to work every day,” said Managing Partner 纳文·查达(Navin Chaddha) in a statement. “We believe that the current economic uncertainty presents an opportunity for the bold and a time to lean forward into the next era of innovation. We are excited about partnering with inception and early-stage founders looking for a people-first investor to build a bright future together.”

Recent dealmaking

While some big-name firms such as 老虎环球, 洞察合作伙伴 and many more significantly slowed their investment pace last year, Mayfield continued a deliberate and consistent cadence.

According to Crunchbase data, the firm completed 26 financing deals in the salad days of 2021, and 23 last year — when the venture and investing market was substantially easing.

So far this year, Mayfield’s pace has been a little slower, with just five deals announced. Those deals include participating in a $27 million Series A for India-based mobility platform Blu-Smart Mobility and a $51 million Series E for San Francisco-based database developer 流入数据.

插图: 唐·古兹曼

通过Crunchbase Daily随时了解最新的融资,收购等信息。

2022 年 16 月,10 家公司向美国初创企业进行了至少 XNUMX 笔或更多投资,其中两家公司为首:Y Combinator 和 Techstars,这两家公司合并了……

老牌企业的持续成功可能会让雄心勃勃的初创企业更难赶上独角兽群。

- SEO 支持的内容和 PR 分发。 今天得到放大。

- 柏拉图爱流。 Web3 数据智能。 知识放大。 访问这里。

- 与 Adryenn Ashley 一起铸造未来。 访问这里。

- 使用 PREIPO® 买卖 PRE-IPO 公司的股票。 访问这里。

- Sumber: https://news.crunchbase.com/venture/mayfield-early-stage-funding-seed-series-a/

- :具有

- :是

- 的美元1亿元

- $3

- $UP

- 10

- 2020

- 2021

- 2022

- 23

- 26

- a

- 关于

- 收购

- 横过

- AI

- 一体

- 有雄心

- an

- 和

- 公布

- 四月

- 保健

- AS

- 办公室文员:

- At

- BE

- 很

- 相信

- 亿

- 无所畏惧

- 光明

- 带来

- 建立

- by

- Cadence公司

- 摔角

- 关闭

- 结合

- 公司

- 完成

- 一贯

- 持续

- 外壳

- 的CrunchBase

- 电流

- 网络安全

- 每天

- data

- 数据库

- 日期

- 天

- 一年中的

- 交易

- 开发商

- e

- 早

- 早期

- 宽松

- 经济

- 经济的不确定性

- 结束

- 企业家

- 时代

- 成熟

- 所有的

- 每天

- 兴奋

- 远

- 融资

- 公司

- 企业

- 针对

- 向前

- 创始人

- 基金

- 资金

- 融资回合

- 资金

- 未来

- 巨人

- 感谢

- HTTPS

- in

- 成立

- 包括

- 創新

- 成

- 投资

- 投资

- 投资

- 投资

- 投资者

- IT

- 它的

- JPG

- 只是

- 已知

- 名:

- 去年

- 领导者

- 最少

- 导致

- 减

- 有限

- 小

- 寻找

- 制成

- 主要

- 使

- 颠覆性技术

- 管理的

- 管理伙伴

- 许多

- 三月

- 行军2020

- 市场

- 梅菲尔德

- 可能

- 百万

- 流动性

- 更多

- 几乎

- 全新

- 新基金

- 下页

- 现在

- of

- ZAP优势

- or

- 我们的

- 步伐

- 参与

- 合伙人

- 伙伴关系

- 伙伴

- 平台

- 柏拉图

- 柏拉图数据智能

- 柏拉图数据

- 球员

- 供电

- 礼物

- 主要

- 凸

- 提高

- 最近

- 最近的资金

- 收入

- 轮

- s

- 说

- 圣

- 种子

- 半导体

- 系列

- A系列

- B系列

- 显著

- 解决方案

- 一些

- 阶段

- 初创企业

- 个人陈述

- 留

- 基本上

- 成功

- 这样

- SUPPORT

- 针对

- 技术

- TechStars的

- 这

- 其

- Free Introduction

- 今年

- 那些

- 次

- 至

- 一起

- 合计

- 二

- 不确定

- 下

- 独角兽

- us

- 用过的

- 谷

- 冒险

- 是

- we

- 井

- ,尤其是

- 这

- 将

- 工作

- Y组合

- 年

- 您一站式解决方案

- 和风网