赋能下一代消费金融

Medium, JC Bahr-de Stefano | 31 年 2023 月 XNUMX 日

Building the next decade of consumer finance

- Last week in Las Vegas, I had the great pleasure of moderating a panel at Fintech Meetup re: building the next decade of consumer finance by leveraging real-time data and cash flow forecasting. I wanted to share some of the key insights shared during the session by our amazing panelists, Jose Bethancourt (Co-Founder of Method Financial), Ema Rouf (Co-Founder of Pave.dev), and Zane Salim (Co-Founder of Atlas)!

请参见: CFPB 发出有关“数据经纪人”的信息请求

- 1/ Alternative data augments FICO across the entire credit spectrum — this is about FICO+ NOT replacing FICO.

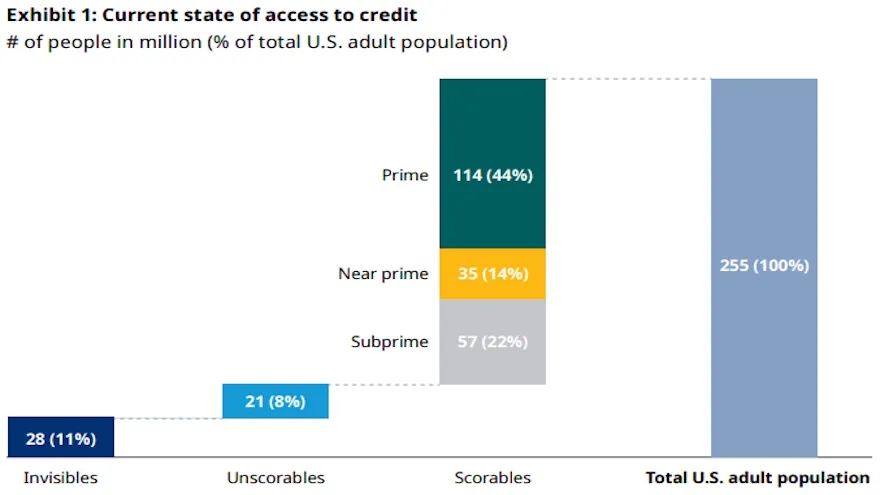

- problem of credit invisibility in the US is growing, with an estimated 28 million adult Americans credit invisible and 21 million unscorable. To make decisions about these consumers and offer them financial services and products, alternative data, such as income and employment, can be used. This data can also help lenders make better risk-weighted decisions for many segments of users, not just credit invisible ones, and is particularly important during periods of economic stress.

- 2/ Real time data powers better products and outcomes by enabling greater access and improving the quality of risk management.

- Credit bureaus can take up to 45 days to report data, so lenders may not have the most up-to-date information on a borrower’s behavior. Atlas, a payroll-powered credit card, uses real-time data to monitor users’ financial health and adjust credit limits, allowing for better risk management and loss prevention.

- 3/ The movement to make alternative data mainstream has to happen outside of the credit bureaus.

- Credit reports do not provide a complete view of a consumer’s debt obligations as there is a lot of data that is not furnished to the credit bureaus, including most BNPL loans. However, companies like Method collect data from over 60k institutions to provide lenders with a more comprehensive view of a person’s debt obligations, combining data from credit bureaus with financial institutions’ core banking systems.

请参见: 加拿大的开放银行之旅:专访 Fintech Galaxy 首席产品官 Abe Karar

- 4/ Recent innovation in infrastructure has made this data far more accessible than it has been in the past.

- Recent advancements in infrastructure and tools have made it easier to access and enrich the data. Companies such as Method and Pave are providing infrastructure that helps fintechs and banks adopt and use this data, leading to accelerated adoption.

- 5/ Mature lenders don’t want scores, they want raw data or attributes.

- Understanding the data is crucial for them to explain it to originating banks or capital providers, and the use of attribute generation can speed up model development. Pave is an example of a company offering transaction cleaning, enrichment, and their own attributes toolbox for lenders to use in their proprietary models.

继续阅读全文–>这里

全国众筹和金融科技协会 (NCFA加拿大)是一个金融创新生态系统,可为成千上万的社区成员提供教育,市场情报,行业管理,网络和融资机会和服务,并与行业,政府,合作伙伴和分支机构紧密合作,以创建充满活力的创新金融科技和资金加拿大的工业。 NCFA是分散式和分布式的,与全球利益相关者合作,并帮助孵化金融科技,替代金融,众筹,对等金融,支付,数字资产和代币,区块链,加密货币,regtech和保险科技领域的项目和投资。 加入 加拿大的金融科技与融资社区今天免费! 或成为 贡献成员 并获得津贴。 有关更多信息,请访问: www.ncfacanada.org

全国众筹和金融科技协会 (NCFA加拿大)是一个金融创新生态系统,可为成千上万的社区成员提供教育,市场情报,行业管理,网络和融资机会和服务,并与行业,政府,合作伙伴和分支机构紧密合作,以创建充满活力的创新金融科技和资金加拿大的工业。 NCFA是分散式和分布式的,与全球利益相关者合作,并帮助孵化金融科技,替代金融,众筹,对等金融,支付,数字资产和代币,区块链,加密货币,regtech和保险科技领域的项目和投资。 加入 加拿大的金融科技与融资社区今天免费! 或成为 贡献成员 并获得津贴。 有关更多信息,请访问: www.ncfacanada.org

想要深入了解#fintech 中发生的一些最具创新性的进步。 注册#FFCON23 并听取全球思想领袖的意见! 点击下方获取 FFCON23 的所有虚拟节目和点播内容的开放访问门票。通过在 Twitter 上关注我们来支持 NCFA! |

相关文章

- SEO 支持的内容和 PR 分发。 今天得到放大。

- 柏拉图区块链。 Web3 元宇宙智能。 知识放大。 访问这里。

- Sumber: https://ncfacanada.org/empowering-the-next-iteration-of-consumer-finance/

- :是

- $UP

- 10

- 100

- 2018

- 28

- 39

- a

- 关于

- 加速

- ACCESS

- 无障碍

- 横过

- 采用

- 采用

- 成人

- 进步

- 进步

- 分支机构

- AI / ML

- 所有类型

- 允许

- 替代

- 另类金融

- 惊人

- 美国人

- 和

- 四月

- 保健

- 刊文

- AS

- 办公室文员:

- At

- 舆图

- 属性

- 银行业

- 银行系统

- 银行

- BD

- BE

- 成为

- 如下。

- 更好

- blockchain

- 国民银行

- 借款人

- 建筑物

- by

- 缓存

- CAN

- 加拿大

- 资本

- 卡

- 现金

- 现金周转

- 产品类别

- CFPB

- 首席

- 首席产品官

- 清洁

- 点击

- 密切

- 联合创始人

- 收集

- COM的

- 结合

- 社体的一部分

- 公司

- 公司

- 完成

- 全面

- 消费者

- 消费金融

- 消费者

- 内容

- 核心

- 核心银行

- 创建信息图

- 信用

- 信用卡

- 众筹

- cryptocurrency

- data

- 一年中的

- 债务

- 十

- 分散

- 决定

- 需求

- 研发支持

- 数字

- 数字资产

- 分布

- 别

- ,我们将参加

- 更容易

- 经济

- 生态系统

- 教育

- EMA

- 雇用

- 授权

- 使

- 从事

- 丰富

- 整个

- 条目

- 估计

- 醚(ETH)

- 事件

- 例子

- 说明

- FICO

- 金融

- 金融

- 财务健康

- 金融包容性

- 金融创新

- 金融机构

- 金融服务

- fintech

- 金融科技银河

- fintechs

- 流

- 以下

- 针对

- 止

- ,

- 资金

- 资助机会

- 星系

- 代

- 得到

- 全球

- 政府

- 大

- 更大的

- GV

- 发生

- 事件

- 有

- 健康管理

- 听

- 帮助

- 帮助

- hi

- 但是

- HP

- hr

- HTTP

- HTTPS

- i

- 重要

- 改善

- in

- 包含

- 包容

- 收入

- 行业中的应用:

- 信息

- 基础设施

- 創新

- 创新

- 内幕

- 可行的洞见

- 机构

- Insurtech

- 房源搜索

- 专属采访

- 投资

- 问题

- IT

- 迭代

- 一月三十一日

- 加入

- 旅程

- JPG

- 键

- 大

- LAS

- 拉斯维加斯

- 领导人

- 领导

- 贷款人

- 贷款

- 借力

- 喜欢

- 范围

- 生活

- 现场活动

- 贷款

- 离

- 占地

- 制成

- 主流

- 使

- 颠覆性技术

- 许多

- 三月

- 市场

- 成熟

- 最大宽度

- 可能..

- Meetup网站

- 会员

- 成员

- 方法

- 百万

- 模型

- 模型

- 显示器

- 更多

- 最先进的

- 运动

- 近地天体

- 工业网络

- 订阅电子邮件

- 下页

- 债券

- of

- 提供

- 提供

- 官

- on

- 点播

- 在线

- 打开

- 开放银行

- 机会

- 学校以外

- 己

- 面板

- 尤其

- 伙伴

- 过去

- 支付

- 对等

- 期

- 津贴

- 人

- 柏拉图

- 柏拉图数据智能

- 柏拉图数据

- 请

- 乐趣

- 权力

- 预防

- 产品

- 核心产品

- 代码编程

- 项目

- 所有权

- 提供

- 提供

- 优

- 质量

- 原

- 原始数据

- RE

- 真实

- 实时的

- 实时数据

- 最近

- 寄存器

- Regtech

- 报告

- 业务报告

- 请求

- 风险

- 变更管理

- s

- 行业

- 中模板

- 特色服务

- 会议

- Share

- 共用的,

- 签署

- So

- 一些

- 速度

- 利益相关者

- 管理

- 应力

- 这样

- 可持续发展

- 产品

- 行李牌

- 采取

- 这

- 其

- 他们

- 博曼

- 思想

- 思想领袖

- 数千

- 门票

- 次

- 标题

- 至

- 今晚

- 令牌

- 工具箱

- 工具

- 交易

- true

- 跟上时代的

- us

- 使用

- 用户

- VEGAS

- 充满活力

- 查看

- 在线会议

- 参观

- 通缉

- 周

- 合作

- 和风网