رہن payments are decreasing, which has some house hunters returning to the real estate market. According to the latest data from Redfin, for the four weeks ended Dec. 31, 2023, the median mortgage payment was down 14% compared to October’s all-time high. Meanwhile, the weekly average شرح in early January 2024 was at 6.66% for a 30-year fixed-rate mortgage, compared to 7.79% in October.

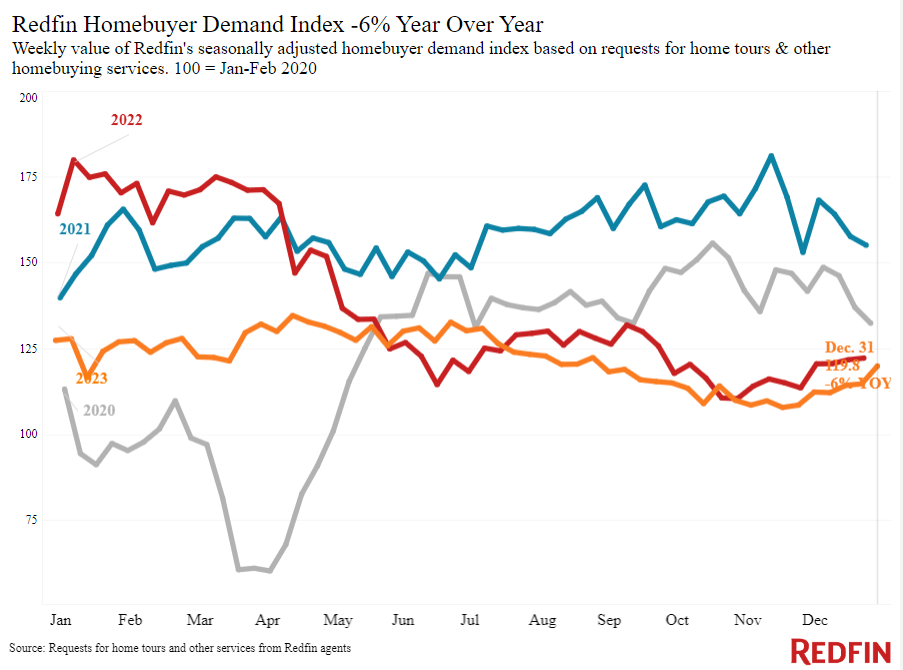

This means homebuyers are finally getting a break from skyrocketing interest rates. And as rates start to dip, some house hunters are taking advantage of an uptick in listings. Redfin’s Homebuyer Demand Index, which measures requests for tours and homebuying services, was up 10% at the end of December from the previous month to its highest level since August, although it was down 6% year over year.

“It’s all about perspective,” said Las Vegas-based Redfin agent Shay Stein in a press release. “Two years ago, buyers would have cried about a 6% mortgage rate. Now, they’re happy they’ve dropped down to the mid-6’s.”

ڈیٹا کیا کہتا ہے۔

The dip in mortgage rates is having an impact on the housing market. Pending sales were down 3.3% year over year, the smallest decline since January 2022. Meanwhile, new listings were up 9.5% year over year, with active listings falling 3.9% in the same period.

Of course, the data isn’t the same across the country. In some metro areas, sales fell while pending sales increased. Regions of Florida had some of the most significant sales price increases over the year, which is قطار میں ساتھ دوسرے کوائف, as the Sunshine State remains a popular homeowner destination.

| Metros With Biggest Year-Over-Year Increase in Pending Sales | Metros With Biggest Year-Over-Year Decrease in Pending Sales |

|---|---|

| Dallas (11.3%) | Providence, Rhode Island (-15.4%) |

| ملواکی (9.3%) | New Brunswick, New Jersey (-13.6%) |

| Cleveland (6.3%) | Newark, New Jersey (-12.5%) |

| San Jose, California (5.6%) | New York City (-10.8%) |

| Chicago (5.6%) | اٹلانٹا (-10%) |

Meanwhile, home prices in some areas like Austin, Texas, and San Francisco are on the decline as more people are starting to leave some once-popular metro areas.

| Metros With Biggest Year-Over-Year Increase in Median Sale Price | Metros With Biggest Year-Over-Year Decrease in Median Sale Price |

|---|---|

| Newark, New Jersey (18.2%) | Fort Worth, Texas (-3.1%) |

| Anaheim, California (18.1%) | آسٹن، ٹیکساس (-1.7%) |

| West Palm Beach, Florida (15.2%) | سان فرانسسکو (-1.1%) |

| Fort Lauderdale, Florida (15.1%) | ڈینور (-0.4%) |

New listings have also declined in 11 metro areas, including San Francisco (-35.3%), Atlanta (-11.5%), and Providence, Rhode Island (-9.8%). However, they’ve jumped in some major cities, including Phoenix (23.5%), as well as Austin, San Antonio, and Dallas, Texas (all up 20.9%, 18.3%, and 16.4%, respectively).

سرمایہ کاروں کے لیے اس کا کیا مطلب ہے؟

So, what does all this data mean for real estate investors? First, the decline in mortgage rates is encouraging, even if it’s still relatively high overall. And کچھ ماہرین think it could encourage more house hunters to start searching for homes again.

Shri Ganeshram, founder and CEO of real estate site Awning, told Bankrate he expects an increase in activity at the start of the year, which “could lead to a more dynamic market than usual for this period.”

Meanwhile, Rick Sharga, founder and CEO of CJ Patrick, also told Bankrate he anticipates a modest first quarter of weak sales and modest price increases. But dropping mortgage rates “will probably continue to decline through the first quarter—bringing more prospective buyers back into the market.”

Still, it’s possible that rates won’t drop far enough for current owners to put their homes on the market, which means house hunters could continue facing a supply crunch.

نیچے کی لکیر

Mortgage rates are still high, but the recent decline has been welcoming for homebuyers. And while sellers are generally still not tempted to put their homes on the market given the current rates, keeping supply low, there are opportunities for house hunters.

This is especially true in metro areas with falling demand. In Texas, prices are falling, even as new listings increase. With signs that the Federal Reserve could cut rates this year, that means mortgages could get cheaper, which would likely increase demand for real estate.

In other words, if you find a home you can afford, now might be the time to buy—before the competition increases.

BiggerPockets سے مزید: 2024 اسٹیٹ آف رئیل اسٹیٹ انویسٹنگ رپورٹ

After more than a decade of clearly favorable investing conditions, market dynamics have shifted. Conditions for investment are now more nuanced, and more uncertain. Download the 2024 State of Real Estate Investing report written by Dave Meyer, to find out which strategies and tactics are best suited to win in 2024.

BiggerPockets کے ذریعے نوٹ: یہ مصنف کی طرف سے لکھی گئی آراء ہیں اور ضروری نہیں کہ BiggerPockets کی رائے کی نمائندگی کریں۔

- SEO سے چلنے والا مواد اور PR کی تقسیم۔ آج ہی بڑھا دیں۔

- پلیٹو ڈیٹا ڈاٹ نیٹ ورک ورٹیکل جنریٹو اے آئی۔ اپنے آپ کو بااختیار بنائیں۔ یہاں تک رسائی حاصل کریں۔

- پلیٹوآئ اسٹریم۔ ویب 3 انٹیلی جنس۔ علم میں اضافہ۔ یہاں تک رسائی حاصل کریں۔

- پلیٹو ای ایس جی۔ کاربن، کلین ٹیک، توانائی ، ماحولیات، شمسی، ویسٹ مینجمنٹ یہاں تک رسائی حاصل کریں۔

- پلیٹو ہیلتھ۔ بائیوٹیک اینڈ کلینیکل ٹرائلز انٹیلی جنس۔ یہاں تک رسائی حاصل کریں۔

- ماخذ: https://www.biggerpockets.com/blog/pending-home-sales-increase-as-mortgage-rates-continue-to-fall

- : ہے

- : ہے

- : نہیں

- $UP

- 1

- 11

- 15٪

- 16

- 2%

- 20

- 2022

- 2023

- 2024

- 23

- 24

- 31

- 600

- 7

- 9

- a

- ہمارے بارے میں

- کے مطابق

- کے پار

- فعال

- سرگرمی

- فائدہ

- پھر

- ایجنٹ

- پہلے

- تمام

- پہلے ہی

- بھی

- اگرچہ

- an

- تجزیاتی

- اور

- متوقع ہے

- کیا

- علاقوں

- AS

- At

- اٹلانٹا

- اگست

- آسٹن، ٹیکساس

- مصنف

- واپس

- BE

- بیچ

- رہا

- کیا جا رہا ہے

- BEST

- سب سے بڑا

- بلاک

- سرحد

- پایان

- توڑ

- لیکن

- خریدار

- by

- کیلی فورنیا

- کر سکتے ہیں

- سی ای او

- سستی

- شہر

- شہر

- واضح طور پر

- COM

- مقابلے میں

- مقابلہ

- حالات

- جاری

- سکتا ہے

- ملک

- کورس

- بحران

- موجودہ

- کٹ

- ڈلاس

- اعداد و شمار

- ڈیو

- دسمبر

- دہائی

- دسمبر

- کو رد

- کمی

- کمی

- ڈیمانڈ

- منزل

- ڈپ

- do

- کرتا

- نیچے

- ڈاؤن لوڈ، اتارنا

- چھوڑ

- گرا دیا

- چھوڑنا

- متحرک

- حرکیات

- ابتدائی

- کی حوصلہ افزائی

- حوصلہ افزا

- آخر

- ختم

- کافی

- درج

- خاص طور پر

- اسٹیٹ

- Ether (ETH)

- بھی

- امید ہے

- سامنا کرنا پڑا

- نیچےگرانا

- دور

- سازگار

- وفاقی

- فیڈرل ریزرو

- خرابی

- آخر

- مل

- پہلا

- پانچ

- فلوریڈا

- کے لئے

- بانی

- بانی اور سی ای او

- چار

- فرانسسکو

- سے

- عام طور پر

- حاصل

- حاصل کرنے

- دی

- تھا

- خوش

- ہے

- ہونے

- he

- پوشیدہ

- ہائی

- سب سے زیادہ

- ہوم پیج (-)

- ہومز

- ہاؤس

- ہاؤسنگ

- ہاؤسنگ مارکیٹ

- تاہم

- HTTP

- HTTPS

- ID

- if

- اثر

- in

- سمیت

- اضافہ

- اضافہ

- اضافہ

- انڈکس

- دلچسپی

- سود کی شرح

- میں

- سرمایہ کاری

- سرمایہ کاری

- سرمایہ

- جزائر

- IT

- میں

- جنوری

- جرسی

- رکھتے ہوئے

- LAS

- تازہ ترین

- قیادت

- چھوڑ دو

- سطح

- LG

- کی طرح

- امکان

- لسٹنگس

- لو

- کم

- اہم

- مارکیٹ

- Markets

- زیادہ سے زیادہ چوڑائی

- مطلب

- کا مطلب ہے کہ

- دریں اثناء

- اقدامات

- میٹرو

- میئر

- شاید

- معمولی

- مہینہ

- زیادہ

- رہن

- رہن

- سب سے زیادہ

- ضروری ہے

- نئی

- نیو جرسی

- کوئی بھی نہیں

- اب

- اکتوبر

- of

- on

- کھول

- رائے

- مواقع

- دیگر

- باہر

- پر

- مجموعی طور پر

- مالکان

- پام

- پیٹرک

- ادائیگی

- ادائیگی

- زیر التواء

- لوگ

- مدت

- نقطہ نظر

- فونکس

- پلاٹا

- افلاطون ڈیٹا انٹیلی جنس

- پلیٹو ڈیٹا

- مقبول

- ممکن

- پریس

- ریلیز دبائیں

- پچھلا

- قیمت

- قیمتیں

- شاید

- ممکنہ

- ڈال

- سہ ماہی

- شرح

- قیمتیں

- اصلی

- رئیل اسٹیٹ

- ریل اسٹیٹ مارکیٹ

- حال ہی میں

- Redfin

- خطوں

- رشتہ دار

- نسبتا

- جاری

- باقی

- رپورٹ

- کی نمائندگی

- درخواستوں

- ریزرو

- بالترتیب

- واپس لوٹنے

- منہاج القرآن

- کہا

- فروخت

- فروخت

- اسی

- سان

- سان فرانسسکو

- تلاش

- بیچنے والے

- سروسز

- شیطان

- منتقل کر دیا گیا

- اہم

- نشانیاں

- بعد

- سائٹ

- کچھ

- اسپانسر

- شروع کریں

- شروع

- حالت

- ابھی تک

- حکمت عملیوں

- دھوپ

- فراہمی

- حکمت عملی

- لینے

- ٹیکساس

- سے

- کہ

- ۔

- ہفتہ وار

- ان

- وہاں.

- یہ

- لگتا ہے کہ

- اس

- اس سال

- کے ذریعے

- وقت

- عنوان

- کرنے کے لئے

- بتایا

- سیاحت

- سچ

- غیر یقینی

- ہمیشہ کی طرح

- تھا

- ہفتہ وار

- مہینے

- کا خیر مقدم

- اچھا ہے

- تھے

- کیا

- جس

- جبکہ

- جیت

- ساتھ

- الفاظ

- قابل

- گا

- لکھا

- سال

- سال

- یارک

- آپ

- زیفیرنیٹ