Median asking rents are beginning to dip in many markets, according to new اعداد و شمار from Redfin, a turnaround from the skyrocketing rent prices observed last spring. The median national asking rent fell to $1,937 in March, a 0.4% year-over-year decline. Median asking rent prices are lower than they’ve been in over a year, and the days of بولی لگانے والی جنگیں for an apartment are coming to an end in many markets. It’s indicative of a correction from overinflated rent prices that resulted in part from a pandemic-driven demand for more space. But rents are still about 20% higher than they were when the pandemic began.

Why Are Rent Prices Cooling?

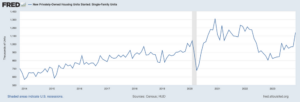

From the supply side, new housing construction has finally caught up to pandemic demand. In 2022, there were more multifamily housing starts with five units or more than in any year since 1986, according to مردم شماری بیورو کے اعداد و شمار. And the number of completed multifamily buildings with five units or more surged 72% in February, reaching one of the highest levels in decades.

Rental demand is also waning. Due to rapidly-rising rent prices in 2022 and fears of an upcoming recession, renters are discouraged from moving and incentivized to stay in their current leases. And housing affordability issues are causing more older folks to آگے چلو with their adult children, even before their health declines. More young people are renting with کمرے میں رہتے and parents as well. These factors are causing rental vacancy rates to rise, returning to their long-term average.

۔ قلیل مدتی کرائے کی مارکیٹ paints a similar picture—investors rushed to meet the demand for vacation rentals during the pandemic, and the surplus of properties is leading to increased vacancy rates. That’s true even as demand remains حیرت انگیز طور پر مضبوط amid inflation-strained budgets and recession fears.

Where Are Rent Prices Falling the Most?

- آسٹن، ٹیکساس (-11%)

- شکاگو، الینوائے (-9.2%)

- New Orleans, Louisiana (-3%)

- برمنگھم، الاباما (-2.9%)

- Cincinnati, Ohio (-2.9%)

- Sacramento, California (-2.8%)

- Las Vegas, Nevada (-2.4%)

- اٹلانٹا، جارجیا (-2.3%)

- Phoenix, Arizona (-2.1%)

- Baltimore, Maryland (-2%)

The largest declines in median asking rent prices were in Austin, where asking rents dropped 11%, and Chicago, where asking rents dropped 9.2% from the previous year. Last May, Austin had the highest year-over-year increase in rent prices, at 48%, according to ریڈفن ڈیٹا. This was a result of tech companies relocating to the area and attracting new high-earning residents at a time when mortgage rates were increasing. In the second quarter of 2022, لیڈ ڈیٹا began to show renters looking to move out of Austin. Now, rent prices are normalizing in the city due to curbed demand.

Cincinnati saw a similarly significant year-over-year rent increase last May, so rents are normalizing there as well. In Chicago, the rental supply increased during the pandemic as new landlords tried to cash in on high rents, and many chose to rent rather than sell at the tail end as homebuying demand decreased, according to Chicago Redfin real estate agent Dan Close.

Where Are Rents Rising?

- Raleigh, North Carolina (16.6%)

- Cleveland, Ohio (15.3%)

- شارلٹ، شمالی کیرولائنا (13%)

- Indianapolis, Indiana (10.5%)

- Nashville, Tennessee (9.6%)

- کولمبس، اوہائیو (9.4%)

- کنساس سٹی، مسوری (8.1%)

- Riverside, California (7.2%)

- Denver, Colorado (7%)

- St. Louis, Missouri (4.2%)

In some metros, rents just keep rising, but even the 16.6% year-over-year growth in asking rent in Raleigh doesn’t come close to the increases shown in last year’s data. A thriving tech scene in cities like Raleigh, Charlotte, and Nashville continues to bring new residents in droves, keeping rent prices inflated even as new residential buildings are erected.

At the same time, high home prices and rising interest rates turned many would-be homebuyers into renters. For example, in Denver, skyrocketing home prices in recent years have led to a growing group of high-income renters who were priced out of homeownership.

Jennifer Bowers, a Redfin real estate agent in Nashville, says asking rents are also rising in the city because a huge influx of investors bought properties in the area. This contributed to soaring demand by increasing the competition for starter homes, thereby making it possible for investors to charge top-dollar rents. Investors accounted for 26% of home sales in Tennessee during 2021, according to پیو ریسرچ.

سرمایہ کاروں کے لیے اس کا کیا مطلب ہے؟

This data doesn’t necessarily mean that investors should flock to multifamily investment opportunities in cities like Raleigh and Cleveland. After all, imagine if you had bought a home in Austin last March in an attempt to capture high rents up 38٪ سال بہ سال. A year later, you’d be lowering your asking rent and waiting for an average 16.3% decline in year-over-year home values to turn around.

Thinking one step ahead could yield better results. If you can find a market where home values are still relatively low, and rent prices are likely to rise due to projected job growth in the area or overflow from nearby hubs, you’ll be in a better position to reap the rewards of local rent increases.

Still, there’s no crystal ball foretelling the perfect strategy. Real estate and rent prices will always fluctuate, though some markets are more stable than others. Maintaining flexibility and having patience may serve you even better than nailing the perfect timing for your purchase.

منٹوں میں ایک ایجنٹ تلاش کریں۔

ایک سرمایہ کار دوست ایجنٹ سے میچ کریں جو آپ کی اگلی ڈیل تلاش کرنے، تجزیہ کرنے اور بند کرنے میں آپ کی مدد کر سکے۔

BiggerPockets کے ذریعے نوٹ: یہ مصنف کی طرف سے لکھی گئی آراء ہیں اور ضروری نہیں کہ BiggerPockets کی رائے کی نمائندگی کریں۔

- SEO سے چلنے والا مواد اور PR کی تقسیم۔ آج ہی بڑھا دیں۔

- پلیٹو بلاک چین۔ Web3 Metaverse Intelligence. علم میں اضافہ۔ یہاں تک رسائی حاصل کریں۔

- ایڈریین ایشلے کے ساتھ مستقبل کا نقشہ بنانا۔ یہاں تک رسائی حاصل کریں۔

- ماخذ: https://www.biggerpockets.com/blog/10-markets-where-rent-is-falling

- : ہے

- : ہے

- : نہیں

- $UP

- 10

- 2%

- 2021

- 2022

- 7

- 8

- 9

- a

- ہمارے بارے میں

- کے مطابق

- بالغ

- کے بعد

- ایجنٹ

- آگے

- الباما

- تمام

- بھی

- ہمیشہ

- کے ساتھ

- an

- تجزیے

- اور

- کوئی بھی

- اپارٹمنٹ

- کیا

- رقبہ

- ایریزونا

- ارد گرد

- AS

- At

- توجہ مرکوز

- آسٹن، ٹیکساس

- مصنف

- اوسط

- گیند

- BE

- کیونکہ

- رہا

- اس سے پہلے

- شروع ہوا

- شروع

- بہتر

- بہتر پوزیشن

- بلاک

- سرحد

- خریدا

- لانے

- بجٹ

- بیورو

- لیکن

- by

- کیلی فورنیا

- کر سکتے ہیں

- قبضہ

- کیش

- پکڑے

- باعث

- مردم شماری

- چارج

- شارلٹ

- شکاگو

- بچوں

- کا انتخاب کیا

- شہر

- شہر

- کلیولینڈ۔

- کلوز

- کولوراڈو

- کس طرح

- آنے والے

- کمپنیاں

- مقابلہ

- مکمل

- تعمیر

- جاری ہے

- حصہ ڈالا

- سکتا ہے

- کرسٹل

- موجودہ

- اعداد و شمار

- دن

- نمٹنے کے

- دہائیوں

- کو رد

- کمی

- ڈیمانڈ

- ڈینور

- ڈپ

- حوصلہ شکنی

- نہیں کرتا

- گرا دیا

- کے دوران

- اسٹیٹ

- بھی

- مثال کے طور پر

- عوامل

- نیچےگرانا

- خدشات

- فروری

- آخر

- مل

- پہلا

- لچک

- اتار چڑھاؤ

- کے لئے

- سرمایہ کاروں کے لئے

- پیش گوئی

- سے

- جارجیا

- گروپ

- ترقی

- ہارورڈ

- ہے

- ہونے

- صحت

- مدد

- پوشیدہ

- ہائی

- اعلی

- سب سے زیادہ

- ہوم پیج (-)

- ہومز

- ہاؤسنگ

- HTML

- HTTPS

- بھاری

- ایلی نوائے

- تصور

- in

- حوصلہ افزائی

- اضافہ

- اضافہ

- اضافہ

- اضافہ

- انڈیانا

- آمد

- دلچسپی

- سود کی شرح

- میں

- سرمایہ کاری

- سرمایہ کاری کے مواقع

- سرمایہ

- مسائل

- IT

- ایوب

- صرف

- رکھیں

- رکھتے ہوئے

- سب سے بڑا

- آخری

- معروف

- قیادت

- سطح

- LG

- کی طرح

- امکان

- مقامی

- طویل مدتی

- تلاش

- لوئیس

- لوزیانا

- لو

- گھٹانے

- بنانا

- بہت سے

- مارچ

- مارکیٹ

- Markets

- میری لینڈ

- مئی..

- کا مطلب ہے کہ

- سے ملو

- زیادہ

- رہن

- سب سے زیادہ

- منتقل

- منتقل

- نیشولی

- قومی

- ضروری ہے

- نیواڈا

- نئی

- اگلے

- شمالی

- شمالی کیرولائنا

- اب

- تعداد

- of

- اوہائیو

- on

- ایک

- رائے

- مواقع

- or

- دیگر

- پر

- وبائی

- والدین

- حصہ

- صبر

- لوگ

- کامل

- پلاٹا

- افلاطون ڈیٹا انٹیلی جنس

- پلیٹو ڈیٹا

- پوزیشن

- ممکن

- پچھلا

- قیمتیں

- متوقع

- خصوصیات

- خرید

- سہ ماہی

- تیز ترین

- raleigh

- قیمتیں

- بلکہ

- پہنچنا

- اصلی

- رئیل اسٹیٹ

- حال ہی میں

- کساد بازاری

- Redfin

- نسبتا

- کرایہ پر

- رینٹلز

- کرایہ داروں

- کی نمائندگی

- رہائشی

- رہائشی

- نتیجہ

- نتائج کی نمائش

- واپس لوٹنے

- انعامات

- اضافہ

- بڑھتی ہوئی

- منہاج القرآن

- فروخت

- اسی

- کا کہنا ہے کہ

- منظر

- دوسری

- دوسرا سہ ماہی

- فروخت

- خدمت

- ہونا چاہئے

- دکھائیں

- دکھایا گیا

- اہم

- اسی طرح

- اسی طرح

- بعد

- So

- بے پناہ اضافہ

- کچھ

- خلا

- موسم بہار

- مستحکم

- شروع ہوتا ہے

- رہنا

- مرحلہ

- ابھی تک

- حکمت عملی

- فراہمی

- اضافہ

- سرپلس

- ٹیک

- ٹیک کمپنیوں

- ٹیکساس

- سے

- کہ

- ۔

- علاقہ

- ان

- وہاں.

- اس طرح

- یہ

- وہ

- اس

- خوشگوار

- وقت

- وقت

- کرنے کے لئے

- سچ

- ٹرن

- تبدیل کر دیا

- یونٹس

- آئندہ

- چھٹی

- اقدار

- وی اے جی اے ایس

- انتظار کر رہا ہے

- تھا

- ویبپی

- اچھا ہے

- تھے

- ڈبلیو

- گے

- ساتھ

- لکھا

- WSJ

- سال

- سال

- پیداوار

- آپ

- نوجوان

- اور

- زیفیرنیٹ