Silicon Valley investing giant میفیلڈ1 has raised two funds totaling almost $1 billion targeted for early-stage investment.

The Menlo Park-based firm — known as an early backer of such startups as Lyft, Marketo اور حاضر سروس — announced its $580 million Mayfield XVII and the $375 million Mayfield Select III funds.

The firm last announced new funds in March 2020, when it raised $750 million across two funds. The firm now has $3 billion in total assets under management.

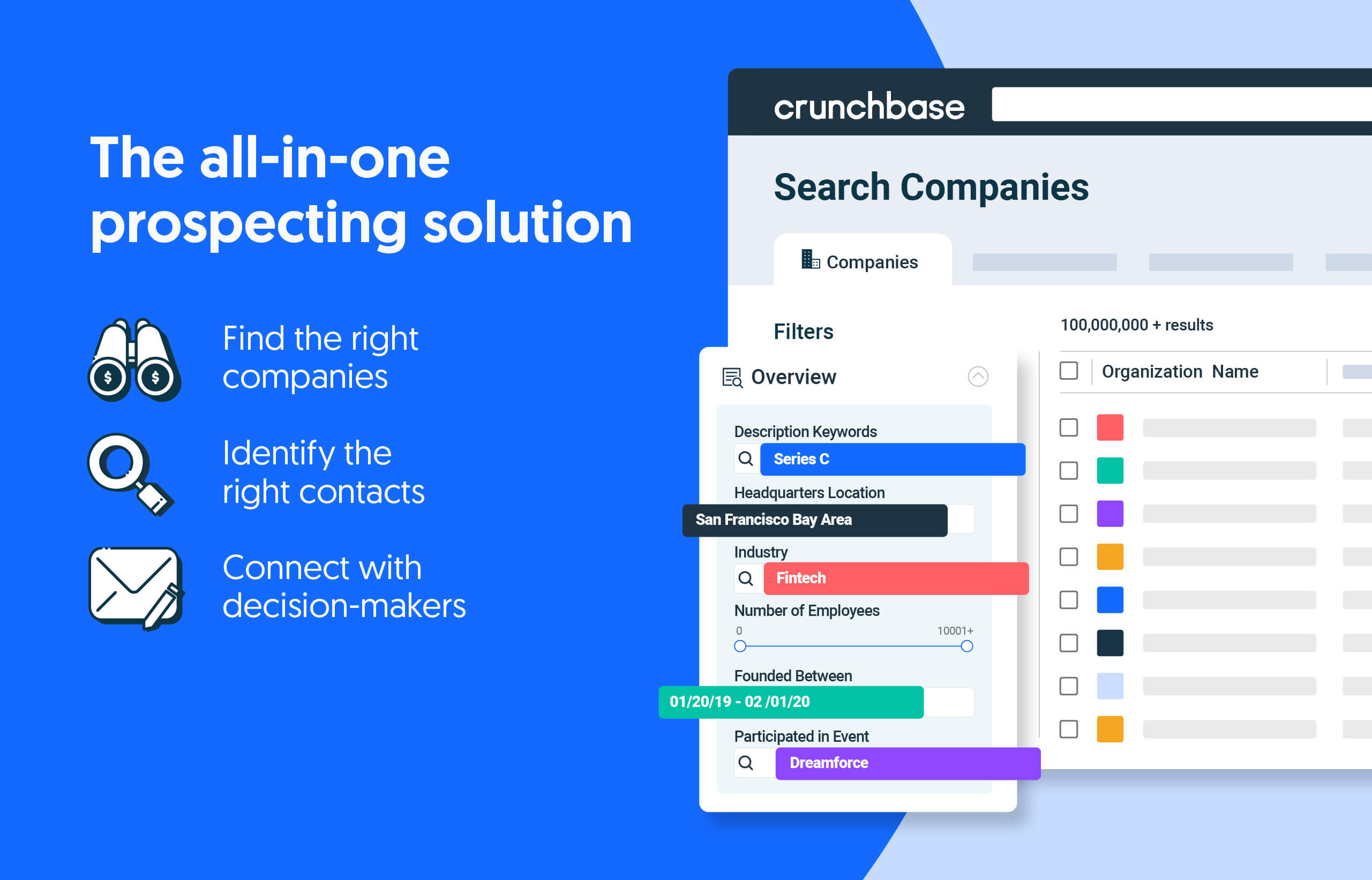

کم تلاش کریں۔ مزید بند کریں۔

پرائیویٹ کمپنی کے ڈیٹا میں رہنما کے ذریعہ طاقت کے حامل سبھی ممکنہ حل کے ساتھ اپنی آمدنی میں اضافہ کریں۔

The Mayfield XVII fund will primarily be used for early-stage investing — mainly seed and Series A rounds. The Mayfield Select III will be for follow-on rounds, as well as investments in new companies, primarily at the Series B stage.

Some themes the firm is looking to invest in include human-centered AI, the developer-first technologies, semiconductors, cybersecurity and more.

“We are grateful for the continued support of our limited partners and for the fortitude of entrepreneurs which brings us to work every day,” said Managing Partner نوین چڈھا in a statement. “We believe that the current economic uncertainty presents an opportunity for the bold and a time to lean forward into the next era of innovation. We are excited about partnering with inception and early-stage founders looking for a people-first investor to build a bright future together.”

Recent dealmaking

While some big-name firms such as ٹائیگر گلوبل, بصیرت کے ساتھی and many more significantly slowed their investment pace last year, Mayfield continued a deliberate and consistent cadence.

According to Crunchbase data, the firm completed 26 financing deals in the salad days of 2021, and 23 last year — when the venture and investing market was substantially easing.

So far this year, Mayfield’s pace has been a little slower, with just five deals announced. Those deals include participating in a $27 million Series A for India-based mobility platform Blu-Smart Mobility and a $51 million Series E for San Francisco-based database developer انفلوکس ڈیٹا.

مثال: ڈوم گوزمین

Crunchbase Daily کے ساتھ حالیہ فنڈنگ راؤنڈز، حصول اور مزید کے ساتھ تازہ ترین رہیں۔

In April 2022, 16 firms made at least 10 investments or more into U.S.-based startups — led by two firms: Y Combinator and Techstars, which combined...

قائم کھلاڑیوں کی مسلسل کامیابی ایک تنگاوالا ریوڑ کو پکڑنے کے لیے مہتواکانکشی اسٹارٹ اپس کے لیے مشکل تر بنا سکتی ہے۔

- SEO سے چلنے والا مواد اور PR کی تقسیم۔ آج ہی بڑھا دیں۔

- پلیٹوآئ اسٹریم۔ ویب 3 ڈیٹا انٹیلی جنس۔ علم میں اضافہ۔ یہاں تک رسائی حاصل کریں۔

- ایڈریین ایشلے کے ساتھ مستقبل کا نقشہ بنانا۔ یہاں تک رسائی حاصل کریں۔

- PREIPO® کے ساتھ PRE-IPO کمپنیوں میں حصص خریدیں اور بیچیں۔ یہاں تک رسائی حاصل کریں۔

- ماخذ: https://news.crunchbase.com/venture/mayfield-early-stage-funding-seed-series-a/

- : ہے

- : ہے

- ارب 1 ڈالر

- $3

- $UP

- 10

- 2020

- 2021

- 2022

- 23

- 26

- a

- ہمارے بارے میں

- حصول

- کے پار

- AI

- ایک میں تمام

- اولوالعزم، خواہش مند، حوصلہ مند

- an

- اور

- کا اعلان کیا ہے

- اپریل

- کیا

- AS

- اثاثے

- At

- BE

- رہا

- یقین ہے کہ

- ارب

- جرات مندانہ

- روشن

- لاتا ہے

- تعمیر

- by

- Cadence سے

- پکڑو

- کلوز

- مل کر

- کمپنیاں

- مکمل

- متواتر

- جاری رہی

- احاطہ

- CrunchBase

- موجودہ

- سائبر سیکیورٹی

- روزانہ

- اعداد و شمار

- ڈیٹا بیس

- تاریخ

- دن

- دن

- ڈیلز

- ڈیولپر

- e

- ابتدائی

- ابتدائی مرحلے

- نرمی

- اقتصادی

- اقتصادی غیر یقینی صورتحال

- آخر

- کاروباری افراد

- دور

- قائم

- ہر کوئی

- ہر روز

- بہت پرجوش

- دور

- فنانسنگ

- فرم

- فرم

- کے لئے

- آگے

- بانیوں

- فنڈ

- فنڈنگ

- فنڈنگ راؤنڈ

- فنڈز

- مستقبل

- وشال

- شکر گزار

- HTTPS

- in

- آغاز

- شامل

- جدت طرازی

- میں

- سرمایہ کاری

- سرمایہ کاری

- سرمایہ کاری

- سرمایہ کاری

- سرمایہ کار

- IT

- میں

- فوٹو

- صرف

- جانا جاتا ہے

- آخری

- آخری سال

- رہنما

- کم سے کم

- قیادت

- کم

- لمیٹڈ

- تھوڑا

- تلاش

- بنا

- بنیادی طور پر

- بنا

- انتظام

- مینیجنگ

- مینیجنگ پارٹنر

- بہت سے

- مارچ

- مارچ 2020

- مارکیٹ

- مئی فیلڈ

- شاید

- دس لاکھ

- موبلٹی

- زیادہ

- تقریبا

- نئی

- نئے فنڈز

- اگلے

- اب

- of

- مواقع

- or

- ہمارے

- امن

- حصہ لینے

- پارٹنر

- شراکت داری

- شراکت داروں کے

- پلیٹ فارم

- پلاٹا

- افلاطون ڈیٹا انٹیلی جنس

- پلیٹو ڈیٹا

- کھلاڑی

- طاقت

- تحفہ

- بنیادی طور پر

- اٹھایا

- اٹھاتا ہے

- حال ہی میں

- حالیہ فنڈنگ

- آمدنی

- چکر

- s

- کہا

- سان

- بیج

- Semiconductors

- سیریز

- سیریز اے

- سیریز بی

- نمایاں طور پر

- حل

- کچھ

- اسٹیج

- سترٹو

- بیان

- رہنا

- کافی

- کامیابی

- اس طرح

- حمایت

- ھدف بنائے گئے

- ٹیکنالوجی

- ٹیک اسٹارز

- کہ

- ۔

- ان

- اس

- اس سال

- ان

- وقت

- کرنے کے لئے

- مل کر

- کل

- دو

- غیر یقینی صورتحال

- کے تحت

- ایک تنگاوالا

- us

- استعمال کیا جاتا ہے

- وادی

- وینچر

- تھا

- we

- اچھا ہے

- جب

- جس

- گے

- ساتھ

- کام

- Y کنبریٹٹر

- سال

- اور

- زیفیرنیٹ