ہم نے ایک اپ ڈیٹ from the Federal Reserve on FedNow this week. There are now 400 banks participating in the instant payments network as either a sender or receiver.

They launched last July with 35 institutions and have been growing steadily since then. The last public statement that I have heard was when FedNow chief, Mark Gould, spoke at the American Fintech Council’s Policy Summit in November when they had 200 banks on the platform.

Some of the country’s largest banks such as Bank of America, Citi, Capital One and PNC have still not joined. But these banks have indicated that they will eventually join.

Most large banks are members of The Clearing House’s RTP network so can process real-time payments via that network. Then, of course, there are also real-time payment offerings from the card networks, Visa Direct and Mastercard Send, that have almost universal coverage and work internationally as well.

FedNow is run by the federal government so it can afford a slow rollout. The Fed is playing the long game and it is inevitable that most payments will move to real-time eventually.

When that happens FedNow will likely be a huge player in payments.

فیچرڈ

FedNow draws some banks, as others lag

By Lynne Marek

کرپٹو ایکسچینج ایجنسی کی نگرانی کی حکمت عملی کے مرکز میں ایک مقدمہ کو خارج کرنے کی کوشش کر رہا ہے۔

Fintech Nexus سے

> 2024 میں، قرض دہندگان کو جرم کی بہتر حکمت عملی کی ضرورت ہے۔

By Rochelle Gorey

Lenders’ delinquency strategy must be rooted in an “empathy-first” model to support customers in experiencing hardship. Customers in distress need support and resources, not shame.

> زندہ دلی کا پتہ لگانا بلی اور چوہا ہے۔

ٹونی زیروچا کے ذریعہ

The importance of liveness detection was one positive development arising from the COVID-19 pandemic. It’s an essential feature of a biometric-based security strategy, iProov chief product and innovation officer Joe Palmer said.

The tokenized funds market witnessed its issuance on public blockchains grow from $100 million to over $800 million in 2023.

Podcast

Andrew B. Morris, Chief Content Officer and Curt Persaud, Co-Founder & CTO of Fintech Islands on Caribbean fintech

فنٹیک جزائر کیریبین کا سب سے بڑا فنٹیک ایونٹ ہے، یہ بارباڈوس میں 24-26 جنوری کو ہو رہا ہے۔

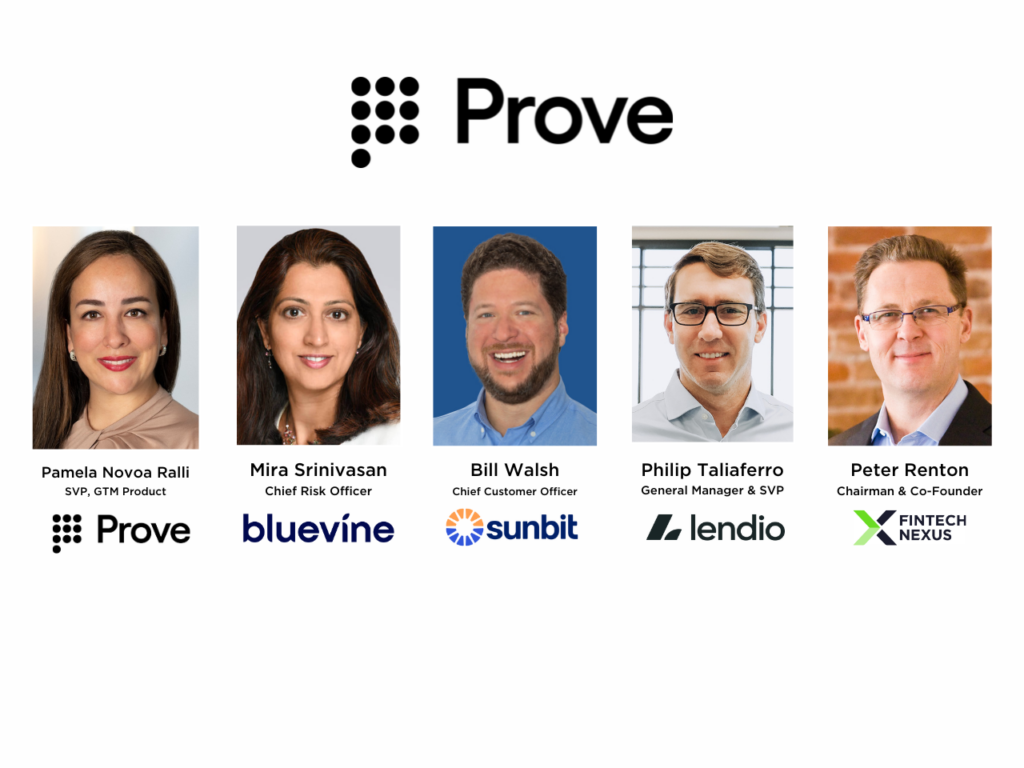

Webinar

بلڈنگ ٹرسٹ: کنزیومر اور بزنس آن بورڈنگ کے لیے قابل توسیع حکمت عملی

23 جنوری، رات 2 بجے EST

شناخت کی تصدیق مالیاتی اداروں اور بینکوں کے صارفین کے سفر کا ایک اہم حصہ ہے۔ تاہم، جاری تعمیل کے ساتھ…

خبریں بھی بنانا

- USA: LoanDepot outage drags into second week after ransomware attack

LoanDepot customers say they have been unable to make mortgage payments or access their online accounts following a suspected ransomware attack on the company last week. The mortgage and loan giant said on January 8 that it was working to “restore normal business operations as quickly as possible” following a security incident.

ہمارے نیوز لیٹرز کو سپانسر کرنے اور اپنے پیغام کے ساتھ فنٹیک کے 220,000 شائقین تک پہنچنے کے لیے، یہاں ہم سے رابطہ کریں.

.pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .box-header-title { font-size: 20px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .box-header-title { font-weight: bold !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .box-header-title { color: #000000 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-avatar img { border-style: none !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-avatar img { border-radius: 5% !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-name a { font-size: 24px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-name a { font-weight: bold !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-name a { color: #000000 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-description { font-style: none !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-description { text-align: left !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a span { font-size: 20px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a span { font-weight: normal !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta { text-align: left !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a { background-color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a { color: #ffffff !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a:hover { color: #ffffff !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-user_url-profile-data { color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data span, .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data i { font-size: 16px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data { background-color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data { border-radius: 50% !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data { text-align: center !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data span, .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data i { font-size: 16px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data { background-color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data { border-radius: 50% !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-recent-posts-title { border-bottom-style: dotted !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-multiple-authors-boxes-li { border-style: solid !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-multiple-authors-boxes-li { color: #3c434a !important; }

- SEO سے چلنے والا مواد اور PR کی تقسیم۔ آج ہی بڑھا دیں۔

- پلیٹو ڈیٹا ڈاٹ نیٹ ورک ورٹیکل جنریٹو اے آئی۔ اپنے آپ کو بااختیار بنائیں۔ یہاں تک رسائی حاصل کریں۔

- پلیٹوآئ اسٹریم۔ ویب 3 انٹیلی جنس۔ علم میں اضافہ۔ یہاں تک رسائی حاصل کریں۔

- پلیٹو ای ایس جی۔ کاربن، کلین ٹیک، توانائی ، ماحولیات، شمسی، ویسٹ مینجمنٹ یہاں تک رسائی حاصل کریں۔

- پلیٹو ہیلتھ۔ بائیوٹیک اینڈ کلینیکل ٹرائلز انٹیلی جنس۔ یہاں تک رسائی حاصل کریں۔

- ماخذ: https://www.fintechnexus.com/fintech-nexus-newsletter-january-19-2024-fednow-making-progress-but-some-big-banks-are-hesitant/

- : ہے

- : ہے

- : نہیں

- 100 ڈالر ڈالر

- 000

- 1

- 19

- 200

- 2010

- 2023

- 2024

- 220

- 23

- 250

- 35٪

- 400

- 8

- 970

- a

- ہمارے بارے میں

- تک رسائی حاصل

- اکاؤنٹس

- کے بعد

- پھر

- تقریبا

- بھی

- امریکہ

- امریکی

- an

- اور

- کیا

- AS

- At

- حملہ

- مصنف

- اوتار

- b

- بینک

- بینک آف امریکہ

- بینکوں

- بینر

- بارباڈوس

- BE

- رہا

- بہتر

- بگ

- سب سے بڑا

- بلاکس

- جرات مندانہ

- کاروبار

- کاروباری معاملات

- لیکن

- by

- کر سکتے ہیں

- دارالحکومت

- ایک سرمایہ

- کارڈ

- کیریبین

- CAT

- سینٹر

- چیئرمین

- چیف

- سٹی

- صاف کرنا

- شریک بانی

- کوڈ

- رنگ

- COM

- کمپنی کے

- صارفین

- رابطہ کریں

- مواد

- ٹھنڈی

- ملک کی

- کورس

- کوریج

- کوویڈ ۔19

- CoVID-19 وبائی

- خالق

- کرپٹو

- کرپٹو ایکسچینج

- CTO

- گاہک

- گاہکوں

- کھوج

- ترقی

- ڈیجیٹل

- ڈیجیٹل میڈیا

- براہ راست

- تکلیف

- مدد دیتی ہے

- یا تو

- اتساہی

- ضروری

- Ether (ETH)

- واقعہ

- آخر میں

- ایکسچینج

- تجربہ کرنا

- نمایاں کریں

- فیڈ

- وفاقی

- وفاقی حکومت

- فیڈرل ریزرو

- fednow

- کی مالی اعانت

- مالی

- فن ٹیک

- پہلا

- توجہ مرکوز

- کے بعد

- کے لئے

- فرینکلن

- سے

- فنڈز

- کھیل ہی کھیل میں

- وشال

- حکومت

- بڑھائیں

- بڑھتے ہوئے

- تھا

- ہوتا ہے

- مشقت

- ہے

- he

- سنا

- ہیسٹنٹ

- ہور

- تاہم

- HTTP

- HTTPS

- بھاری

- i

- اہمیت

- in

- واقعہ

- اشارہ کیا

- ناگزیر

- جدت طرازی

- فوری

- فوری ادائیگی

- اداروں

- بین الاقوامی سطح پر

- انٹرویو

- میں

- iProov

- جزائر

- جاری کرنے

- IT

- میں

- جنوری

- جوے

- میں شامل

- شامل ہو گئے

- سفر

- فوٹو

- جولائی

- کلیدی

- بڑے

- سب سے بڑا

- آخری

- شروع

- مقدمہ

- چھوڑ دیا

- قرض دہندہ

- امکان

- لنکڈ

- جیونت

- قرض

- لانگ

- لانگ گیم

- بنا

- بنانا

- نشان

- مارکیٹ

- ماسٹر

- زیادہ سے زیادہ چوڑائی

- میڈیا

- اراکین

- پیغام

- دس لاکھ

- ماڈل

- رہن

- سب سے زیادہ

- منتقل

- ضروری

- ضرورت ہے

- نیٹ ورک

- نیٹ ورک

- خبر

- نیوز لیٹر

- خبرنامے

- گٹھ جوڑ

- کوئی بھی نہیں

- عام

- نومبر

- اب

- of

- پیشکشیں

- افسر

- on

- ایک

- جاری

- آن لائن

- آپریشنز

- or

- دیگر

- ہمارے

- گزرنا

- پر

- نگرانی

- پالمر

- وبائی

- حصہ

- حصہ لینے

- ادائیگی

- ادائیگی

- پیٹر

- مقام

- پلیٹ فارم

- پلاٹا

- افلاطون ڈیٹا انٹیلی جنس

- پلیٹو ڈیٹا

- کھلاڑی

- کھیل

- PNC

- پالیسی

- مثبت

- عمل

- مصنوعات

- پیش رفت

- عوامی

- جلدی سے

- ransomware کے

- رینسم ویئر حملہ

- تک پہنچنے

- اصل وقت

- اصل وقت کی ادائیگی

- ریزرو

- وسائل

- افتتاحی

- جڑنا

- RTP

- رن

- کہا

- کا کہنا ہے کہ

- SC

- ایس سی وینچرز

- توسیع پذیر

- دوسری

- سیکورٹی

- کی تلاش

- بھیجنے

- بھیجنے والا

- سیریز

- بعد

- سست

- So

- ٹھوس

- کچھ

- دورانیہ

- اسپانسر

- بیان

- مسلسل

- ابھی تک

- حکمت عملیوں

- حکمت عملی

- اس طرح

- سربراہی کانفرنس

- حمایت

- مشتبہ

- لینے

- ٹیمپلٹن

- کہ

- ۔

- کھلایا

- ان

- تو

- وہاں.

- یہ

- وہ

- اس

- اس ہفتے

- کرنے کے لئے

- ٹوکن بنانا

- ٹوکن

- ٹونی

- سب سے اوپر

- بھروسہ رکھو

- ٹویٹر

- قابل نہیں

- یونیورسل

- us

- وینچرز

- توثیق

- کی طرف سے

- ویزا

- ویزا ڈائریکٹ

- تھا

- ہفتے

- اچھا ہے

- جب

- گے

- ساتھ

- گواہ

- کام

- کام کر

- دنیا کی

- تحریری طور پر

- اور

- زیفیرنیٹ

- زوم