- The EUR/USD pair developed a bearish pattern in the short term.

- امریکی ڈیٹا آج کے بعد فیصلہ کن ہو سکتا ہے۔

- It could test and retest the near-term resistance levels before dropping again.

The EUR/USD price rebounded in the short term trying to erase the latest losses. After its strong drop registered on Tuesday, the price was expected to come back higher as the Dollar Index remains in a corrective phase.

-کیا آپ تلاش میں ہیں خودکار ٹریڈنگ? ہماری تفصیلی گائیڈ چیک کریں-

The index is still under strong downside pressure. Yesterday, the Eurozone and US data came in mixed. The currency pair changed little after the FOMC Meeting Minutes. The Federal Reserve is expected to deliver furrher hikes in the upcoming monetary policy meetings.

The US JOLTS Job Openings came in better than expected, while ISM Manufacturing PMI, ISM Manufacturing Prices, and Wards Total Vehicle Sales came in worse than expected. Earlier today, the German Trade Balance came in at 10.8B versus 7.5B expected, the Eurozone PPI will be released later.

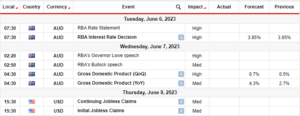

Still, the ADP Non-Farm Employment Change indicator is seen as the most important event of the day. The economic indicator is expected at 152K versus the 127K in the previous reporting period.

In addition, the Unemployment Claims could jump from 225K to 230K in the last week, Trade Balance could increase from -78.2B to -64.2B, while Final Services PMI could remain steady at 44.4 points. Tomorrow, the US NFP, Unemployment Rate, Average Hourly Earnings, and the ISM Services PMI could really shake the markets.

EUR/USD price technical analysis: Exhaustion signs

Technically, the currency pair rebounded within an up channel pattern and now it has found resistance at the weekly S1 (1.0620). The false breakouts signaled exhausted buyers.

Still, a new downside movement could be announced only by a valid breakdown below the uptrend line, through the channel’s downside line. The flag pattern is seen as a bearish formation and it could announce a new leg down.

- اگر آپ اس میں دلچسپی رکھتے ہیں۔ فاریکس ڈے ٹریڈنگ پھر شروع کرنے کے لیے ہماری گائیڈ کو پڑھیں-

Still, the descending pitchfork’s median line (ml) represents the first downside target and obstacle. After its massive drop, the rebound was natural. The EUR/USD pair could test and retest the near-term resistance levels before going down.

اب فاریکس کی تجارت کرنا چاہتے ہیں؟ ای ٹورو میں سرمایہ کاری کریں!

اس فراہم کنندہ کے ساتھ CFD کی تجارت کرتے وقت 67٪ خوردہ سرمایہ کار کھاتے پیسے کھو دیتے ہیں۔ آپ کو اس پر غور کرنا چاہئے کہ کیا آپ اپنے پیسے کھونے کا زیادہ خطرہ مول لینے کے متحمل ہوسکتے ہیں۔

- SEO سے چلنے والا مواد اور PR کی تقسیم۔ آج ہی بڑھا دیں۔

- پلیٹو بلاک چین۔ Web3 Metaverse Intelligence. علم میں اضافہ۔ یہاں تک رسائی حاصل کریں۔

- ماخذ: https://www.forexcrunch.com/eur-usd-price-rebounds-within-bearish-flag-pattern/

- 1

- 10

- 7

- a

- اکاؤنٹس

- اس کے علاوہ

- اے پی پی

- کے بعد

- تجزیہ

- اور

- اعلان کریں

- کا اعلان کیا ہے

- آٹومیٹڈ

- اوسط

- واپس

- متوازن

- bearish

- اس سے پہلے

- نیچے

- بہتر

- خرابی

- breakouts

- خریدار

- CFDs

- تبدیل

- چینل

- چیک کریں

- دعوے

- کس طرح

- غور کریں

- کنٹینر

- سکتا ہے

- کرنسی

- اعداد و شمار

- دن

- فیصلہ کن

- نجات

- تفصیلی

- ترقی یافتہ

- ڈالر

- ڈالر انڈیکس

- نیچے

- نیچے کی طرف

- چھوڑ

- چھوڑنا

- اس سے قبل

- آمدنی

- اقتصادی

- روزگار

- EUR / USD

- یوروزون

- واقعہ

- توقع

- وفاقی

- فیڈرل ریزرو

- فائنل

- پہلا

- FOMC

- فوریکس

- قیام

- ملا

- سے

- جرمن

- حاصل کرنے

- جا

- رہنمائی

- ہائی

- اعلی

- پریشان

- HTTPS

- اہم

- in

- اضافہ

- انڈکس

- اشارے

- دلچسپی

- سرمایہ کاری

- سرمایہ کار

- IT

- ایوب

- JOLTS ملازمت کے مواقع

- کودنے

- آخری

- تازہ ترین

- سطح

- لائن

- تھوڑا

- تلاش

- کھو

- کھونے

- نقصانات

- مینوفیکچرنگ

- Markets

- بڑے پیمانے پر

- زیادہ سے زیادہ چوڑائی

- اجلاس

- اجلاسوں میں

- منٹ

- مخلوط

- ML

- مالیاتی

- مانیٹری پالیسی

- قیمت

- سب سے زیادہ

- تحریک

- قدرتی

- نئی

- این ایف پی

- رکاوٹ

- سوراخ

- پاٹرن

- مدت

- مرحلہ

- پلاٹا

- افلاطون ڈیٹا انٹیلی جنس

- پلیٹو ڈیٹا

- pmi

- پوائنٹس

- پالیسی

- پیپیآئ

- دباؤ

- پچھلا

- قیمت

- قیمتیں

- فراہم کنندہ

- شرح

- پڑھیں

- بغاوت

- رجسٹرڈ

- جاری

- رہے

- باقی

- رپورٹ

- کی نمائندگی کرتا ہے

- ریزرو

- مزاحمت

- خوردہ

- رسک

- ROW

- فروخت

- سروسز

- مختصر

- ہونا چاہئے

- مستحکم

- ابھی تک

- مضبوط

- SVG

- لے لو

- ہدف

- ٹیکنیکل

- تکنیکی تجزیہ

- ٹیسٹ

- ۔

- ہفتہ وار

- کے ذریعے

- کرنے کے لئے

- آج

- کل

- کل

- تجارت

- ٹریڈنگ

- منگل

- کے تحت

- بے روزگاری

- بے روزگاری کی شرح

- آئندہ

- اوپری رحجان

- us

- US JOLTS ملازمت کے مواقع

- ہمیں NFP

- گاڑی

- بنام

- ہفتے

- ہفتہ وار

- چاہے

- جبکہ

- گے

- کے اندر

- اور

- زیفیرنیٹ