Bitcoin worth has been trapped in a tightening trading vary and has barely moved in weeks. The high cryptocurrency by market cap has been boring in comparison with its خصوصیت سے غیر مستحکم خود.

Looking again on the asset’s historic volatility, a fractal sample could possibly be forming that means the worth per BTC is about to blast off to unprecedented heights.

تحلیل اور تاریخ کتنی ہی شاعری نہیں کرتی ہے لیکن یہ اکثر دہراتا ہے

کو بطور "خواندہ" نشان تون نے کہا that “history doesn’t repeat, but if often rhymes.” The assertion finest explains the speculation behind repeating worth patterns referred to as fractals.

متعلقہ مطالعہ | بٹ کوائن ڈسپلے طاقت کے لy تیار ہے ، لیکن کون سی سمت ٹوٹ پڑے گی

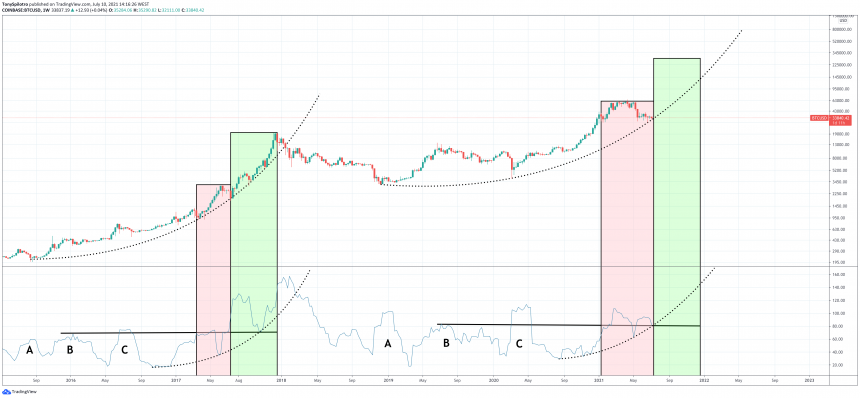

یہ fractals seem just like one other level in historic worth motion, and assist analysts to foretell and anticipate future market habits. The outcomes could be combined, as hardly ever do issues play out precisely the identical. This truth has earned fractals a damaging fame, nonetheless, even in Bitcoin there’s some particular habits that may be anticipated.

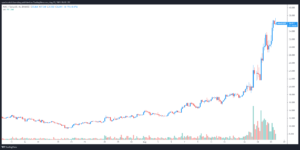

Every cycle seems to be comparable by comparability when zooming out | Source: ٹریڈنگ ویو ڈاٹ کام پر BLX

For instance, every main breakout previous all-time excessive resulted in ایک پرابولک uptrend and the visible comparisons are plain. The most up-to-date uptrend of which has come to a screeching halt, turning a stumble right into a full-on 50% or extra collapse.

While the market ponders if the bull development is kaput, even technicals have turn into combined. There is a handful of doji candles on the weekly, a decent trading vary, and volatility has dropped to an necessary degree. All of those indicators ممکنہ رد عمل کی طرف اشارہ کریں, and if “history” has something to do with it, the volatility needs to be launched to the upside.

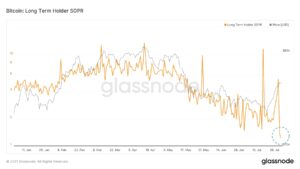

بٹ کوائن بل رن فائنل کے بارے میں تاریخی اتار چڑھاؤ کیا کہتا ہے

تمام فطرت میں there are fractal-like patterns that repeat repeatedly. Price motion in monetary property generally exhibit such repeating habits, akin to biking between ان واقعات میں سے ایک.

Mid-cycle consolidation then kicks volatility into excessive gear | Source: ٹریڈنگ ویو ڈاٹ کام پر بی ٹی سی یو ایس ڈی

During the earlier bull market, which is evident the present cycle isn’t fairly following when it comes to “only up” worth motion, after one of many largest shakeouts, volatility lastly held above a key degree and kickstarted بیل مارکیٹ کی آخری ٹانگ.

Anyone who had assumed it was the height of the cycle, would have been left within the mud as Bitcoin churned out one other 900%+ of bull market ROI and volatility went parabolic.

متعلقہ مطالعہ | بٹ کوائن ٹرینڈ مضبوطی کے اشارے سے پتہ چلتا ہے کہ بل چلانا ابھی ختم نہیں ہوا ہے

Bitcoin is again and attempting to carry above a really comparable help line, and if profitable, ought to ship volatility again alongside a parabolic curve together with worth motion. That would put the highest of the present bull cycle at دسمبر کے آس پاس, which – traditionally – has marked a major high or backside yearly since 2017.

Still assume historical past doesn’t rhyme?

پر عمل کریں ٹویٹر پرTonySpilotro یا کے ذریعے ٹونیٹریڈس ٹیلیگرام. Content is instructional and shouldn’t be thought-about funding recommendation.

آئی اسٹاک فوٹو کی نمایاں تصویر ، ٹریڈنگ ویو ڈاٹ کام کے چارٹس۔