- Traders will pay close attention to Fed Chair Jerome Powell’s news conference.

- Australian retail sales experienced their greatest decline in more than two years.

- The anticipated peak for the Reserve Bank of Australia’s cash rates dropped from 3.8% to 3.7%.

Today’s AUD/USD forecast is bullish. Before Wednesday’s highly anticipated Federal Reserve policy decision, the dollar was largely weaker than a basket of major currencies.

-کے بارے میں مزید جاننے میں دلچسپی رکھتے ہیں۔ فاریکس روبوٹ? ہماری تفصیلی گائیڈ چیک کریں-

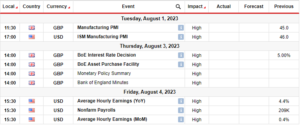

The market is almost confident that interest rates will climb by 25 basis points (bps) later on Wednesday, following a series of big rate hikes in 2022 to control inflation. However, traders will pay close attention to Fed Chair Jerome Powell’s news conference as they try to predict how long the Fed will likely remain hawkish.

As a result of sky-high inflation and rising borrowing prices, Australian retail sales experienced their greatest decline in more than two years in December. This economic shock may reduce the need for additional policy tightening.

According to Australian Bureau of Statistics statistics on Tuesday, retail sales decreased 3.9% in December from November after seeing gains for the previous 11 months. This suggests that rate hikes have been functioning as expected.

That was also the largest decline since August 2020, when the COVID-19 outbreak had parts of the nation on lockdown.

Investors responded by driving the Australian dollar from $0.7060 before the data to $0.7046 and lowering the anticipated peak for the Reserve Bank of Australia’s cash rates from 3.8% to 3.7%.

Inflation is already running at a 32-year high of 7.8%, with the trimmed mean, a closely monitored indicator of core inflation, rising to 6.9%.

AUD/USD آج کے اہم واقعات

Investors will closely monitor US data releases, such as job reports, PMI data, and the FOMC meeting. These are probably going to increase the pair’s volatility significantly.

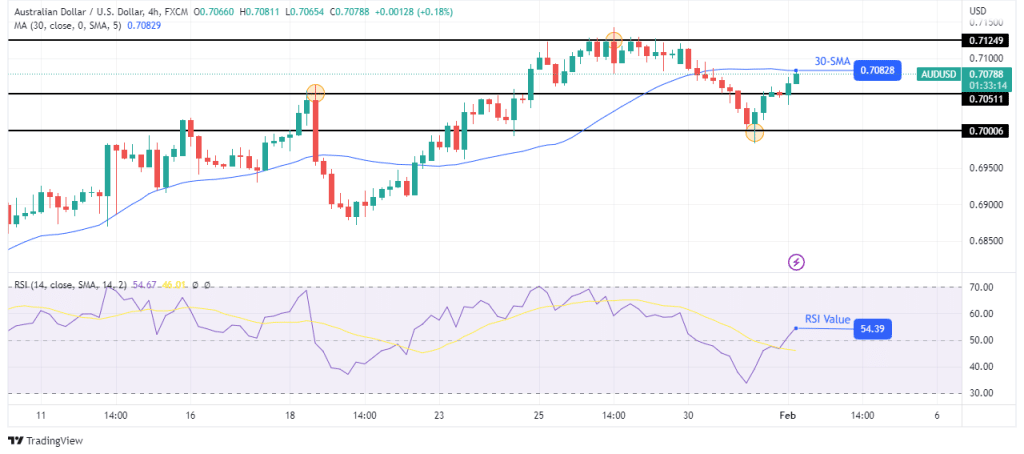

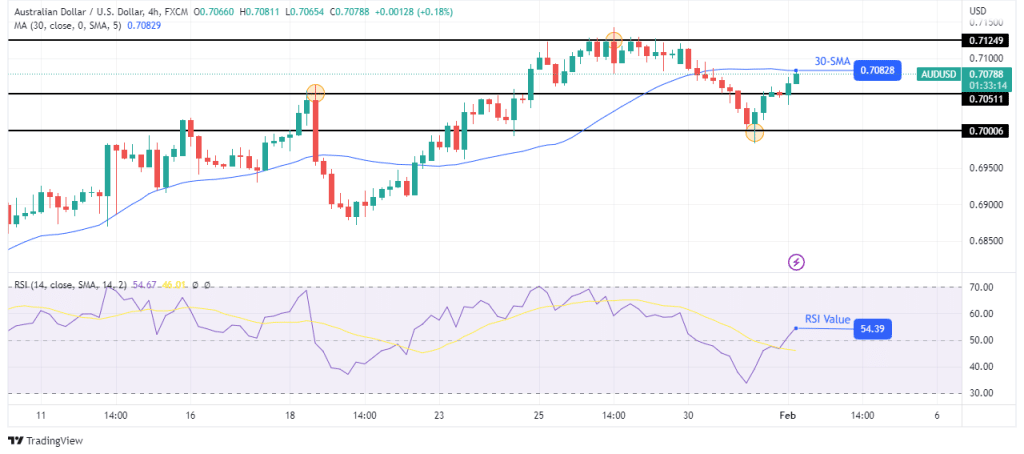

AUD/USD technical forecast: Strong bullish momentum below the 30-SMA

The 4-hour chart shows AUD/USD trading slightly below the 30-SMA while the RSI trades above 50. The RSI favors strong bullish momentum, which could see the price go above the 30-SMA.

-کے بارے میں مزید جاننے میں دلچسپی رکھتے ہیں۔ جنوبی افریقی فاریکس بروکرز? ہماری تفصیلی گائیڈ چیک کریں-

This move comes after the price found support at the 0.7000 level and broke above the 0.7051 resistance level. The bullish move will reverse if the SMA holds as resistance. However, if bulls are strong enough, we might see the price break above the SMA and retest the 0.7124 resistance level.

اب فاریکس کی تجارت کرنا چاہتے ہیں؟ ای ٹورو میں سرمایہ کاری کریں!

خوردہ سرمایہ کاری کے اکاؤنٹس کے 68٪ اس فراہم کنندہ کے ساتھ CFD ٹریڈنگ کرتے وقت پیسہ کماتے ہیں. آپ کو اس بات پر غور کرنا چاہئے کہ آیا آپ اپنے پیسے کو کھونے کے خطرے کو بڑھانے کے لۓ خرچ کر سکتے ہیں

- SEO سے چلنے والا مواد اور PR کی تقسیم۔ آج ہی بڑھا دیں۔

- پلیٹو بلاک چین۔ Web3 Metaverse Intelligence. علم میں اضافہ۔ یہاں تک رسائی حاصل کریں۔

- ماخذ: https://www.forexcrunch.com/aud-usd-forecast-australian-retail-sales-nosedive-in-december/

- 1

- 11

- 2020

- 2022

- 7

- a

- ہمارے بارے میں

- اوپر

- اکاؤنٹس

- ایڈیشنل

- افریقی

- کے بعد

- آگے

- پہلے ہی

- اور

- متوقع

- توجہ

- AUD / USD

- اگست

- آسٹریلیا

- آسٹریلیا

- آسٹریلوی ڈالر

- آسٹریلیائی خوردہ فروخت

- بینک

- بنیاد

- ٹوکری

- اس سے پہلے

- نیچے

- بگ

- قرض ادا کرنا

- توڑ

- توڑ دیا

- تیز

- بیل

- بیورو

- کیش

- CFDs

- چیئر

- چارٹ

- چیک کریں

- چڑھنے

- کلوز

- قریب سے

- کانفرنس

- اعتماد

- غور کریں

- کنٹینر

- کنٹرول

- افراط زر پر قابو پالیں

- کور

- کور افراط زر

- سکتا ہے

- کوویڈ ۔19

- کرنسیوں کے لئے منڈی کے اوقات کو واضح طور پر دیکھ پائیں گے۔

- اعداد و شمار

- دسمبر

- فیصلہ

- کو رد

- تفصیلی

- ڈالر

- ڈرائیونگ

- گرا دیا

- اقتصادی

- کافی

- واقعات

- توقع

- تجربہ کار

- اپکار

- فیڈ

- فیڈ کرسی

- فیڈ چیئر جیروم پاول

- وفاقی

- فیڈرل ریزرو

- کے بعد

- FOMC

- پیشن گوئی

- فوریکس

- ملا

- سے

- کام کرنا

- فوائد

- Go

- جا

- سب سے بڑا

- ہاکش

- ہائی

- انتہائی

- پریشان

- کی ڈگری حاصل کی

- کس طرح

- تاہم

- HTTPS

- in

- اضافہ

- اشارے

- افراط زر کی شرح

- دلچسپی

- سود کی شرح

- دلچسپی

- سرمایہ کاری

- سرمایہ کار

- جروم پاویل

- ایوب

- کلیدی

- بڑے پیمانے پر

- سب سے بڑا

- سیکھنے

- سطح

- امکان

- لاک ڈاؤن

- لانگ

- کھو

- کھونے

- اہم

- مارکیٹ

- زیادہ سے زیادہ چوڑائی

- اجلاس

- شاید

- رفتار

- قیمت

- کی نگرانی

- نگرانی کی

- ماہ

- زیادہ

- منتقل

- قوم

- ضرورت ہے

- خبر

- نومبر

- پھیلنے

- حصے

- ادا

- چوٹی

- پلاٹا

- افلاطون ڈیٹا انٹیلی جنس

- پلیٹو ڈیٹا

- pmi

- پوائنٹس

- پالیسی

- پاول

- پاول کی

- پیشن گوئی

- پچھلا

- قیمت

- قیمتیں

- شاید

- فراہم کنندہ

- شرح

- شرح میں اضافہ

- قیمتیں

- کو کم

- ریلیز

- رہے

- رپورٹیں

- ریزرو

- ریزرو بینک

- آسٹریلیا کے ریزرو بینک

- مزاحمت

- نتیجہ

- خوردہ

- پرچون سیلز

- ریورس

- بڑھتی ہوئی

- رسک

- روبوٹس

- ROW

- rsi

- چل رہا ہے

- فروخت

- دیکھ کر

- سیریز

- ہونا چاہئے

- شوز

- نمایاں طور پر

- بعد

- SMA

- کے اعداد و شمار

- مضبوط

- اس طرح

- پتہ چلتا ہے

- فراہمی

- حمایت

- SVG

- لے لو

- ٹیکنیکل

- ٹیسٹنگ

- ۔

- کھلایا

- ان

- سخت

- کرنے کے لئے

- آج کا

- تجارت

- تاجروں

- تجارت

- ٹریڈنگ

- منگل

- us

- استرتا

- بدھ کے روز

- چاہے

- جس

- جبکہ

- گے

- سال

- اور

- زیفیرنیٹ