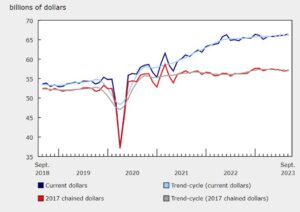

Crude Oil eventually took

off as the market started to have more tailwinds than headwinds as the supply

and demand drivers aligned. In fact, on the supply side, the tensions in the

Red Sea are still present and over the weekend three US troops got killed in

Jordan by a drone attack linked to Iran-backed militants. Moreover, yesterday

Saudi Arabia announced that it’s pausing plans to raise its crude production

kapasite.

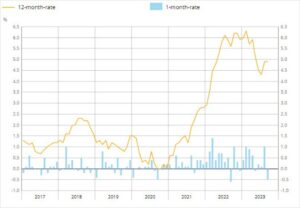

On the demand side, the

recent economic data has been showing a reacceleration in activity which is

supported by the rate cuts expectations. On top of that, the PBoC last week

decided to cut its Reserve Requirement Ratio by 50 bps and there are

expectations for more easing measures to follow given the rout in the Chinese

Borsa.

WTI Ham Petrol Teknik

Analiz – Günlük Zaman Çerçevesi

WTI Ham Petrol Günlük

On the daily chart, we can see that Crude Oil recently

broke above the swing high around the $76 level and extended the rally into the

$79 level before pulling back to retest the Direnç artık desteğe dönüştü.

buyers leant on the $76 level to position for another rally into the highs

targeting a break above the $80 level. The sellers will likely step in around

the highs to position for a drop into the major eğilim çizgisi etrafında

the $73 level and increase the bearish bets if the price were to break below

$ 76 destek.

WTI Ham Petrol Teknik

Analiz – 4 saatlik Zaman Çerçevesi

WTI Ham Petrol 4 saat

On the 4 hour chart, we can see that the price recently

pulled back and bounced from the support where we had also the trendline and

% 61.8 Fibonacci düzeltmesi seviye

için izdiham.

buyers stepped in with a defined risk below the support to position for a rally

into new highs. The sellers, on the other hand, will want to see the price

breaking below the trendline and the support to pile in and target the major

trendline around the $73 level.

WTI Ham Petrol Teknik

Analiz – 1 saatlik Zaman Çerçevesi

WTI Ham Petrol 1 saat

1 saatlik grafikte şunu görebiliriz:

latest leg higher diverged ile

the MACD hangi

genellikle zayıflayan momentumun bir işaretidir ve ardından genellikle geri çekilmeler veya

reversals. In this case, we got the pullback into the support zone where the

price bounced from. The price then rallied and broke the most recent lower low

turning the short-term trend back to bullish. We should now find buyers around

the minor support zone at the $77.30 level where we have also the red 21 hareketli ortalamalardır için

confluence. A break above the high at $78.15 should see even more bids coming

into the market. The sellers, on the other hand, can only wait for the price to

reach the $80 level or break below the support before getting back into the

pazar.

Yaklaşan Etkinlikler

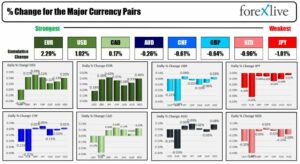

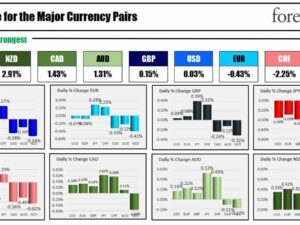

Bugün we have the US Employment Cost Index and the

ADP data before the FOMC rate decision later in the day. Tomorrow, we will see

the latest US Jobless Claims figures and the ISM Manufacturing PMI. On Friday,

we conclude the week with the US NFP report. Strong data should continue to

support oil price while weak figures are likely to weigh on the market in the

kısa vadeli.

Aşağıdaki videoya bakın

- SEO Destekli İçerik ve Halkla İlişkiler Dağıtımı. Bugün Gücünüzü Artırın.

- PlatoData.Network Dikey Üretken Yapay Zeka. Kendine güç ver. Buradan Erişin.

- PlatoAiStream. Web3 Zekası. Bilgi Genişletildi. Buradan Erişin.

- PlatoESG. karbon, temiz teknoloji, Enerji, Çevre, Güneş, Atık Yönetimi. Buradan Erişin.

- PlatoSağlık. Biyoteknoloji ve Klinik Araştırmalar Zekası. Buradan Erişin.

- Kaynak: https://www.forexlive.com/technical-analysis/wti-crude-oil-technical-analysis-20240131/

- :vardır

- :dır-dir

- :Neresi

- 1

- %15

- 30

- 50

- a

- yukarıdaki

- etkinlik

- adp

- hizalı

- Ayrıca

- analiz

- ve

- açıkladı

- Başka

- ARE

- etrafında

- AS

- At

- saldırı

- Arka

- kaba

- olmuştur

- önce

- altında

- Bahisler

- mola

- Kırma

- Broke

- Boğa gibi

- Alıcılar

- by

- CAN

- Kapasite

- dava

- Grafik

- Çince

- iddia

- gelecek

- sonucuna

- izdiham

- devam etmek

- Ücret

- ham

- Ham petrol

- kesim

- keser

- günlük

- veri

- gün

- karar

- karar

- tanımlı

- Talep

- sürücüler

- vızıldamak

- Damla

- kolaylaştırılması

- Ekonomik

- iş

- Hatta

- sonunda

- beklentileri

- genişletilmiş

- gerçek

- rakamlar

- bulmak

- takip et

- takip

- FOMC

- FOMC kuru kararı

- İçin

- Cuma

- itibaren

- genellikle

- alma

- verilmiş

- var

- vardı

- el

- Var

- karşıdan esen rüzgarlar

- Yüksek

- daha yüksek

- yüksekler

- saat

- HTTPS

- if

- in

- Artırmak

- indeks

- içine

- ONUN

- işsizlik iddiaları

- Ürdün

- jpg

- Soyad

- sonra

- son

- seviye

- Muhtemelen

- bağlantılı

- Düşük

- alt

- büyük

- üretim

- pazar

- önlemler

- küçük

- Moment

- Daha

- Dahası

- çoğu

- yeni

- nfp

- şimdi

- of

- kapalı

- sık sık

- Sıvı yağ

- petrol fiyatı

- on

- bir tek

- or

- Diğer

- tekrar

- duraklatma

- PBOC

- ağladım

- Platon

- Plato Veri Zekası

- PlatoVeri

- pmi

- pozisyon

- mevcut

- fiyat

- üretim

- geri çekmek

- çeken

- yükseltmek

- ralli

- oran

- oran

- ulaşmak

- son

- geçenlerde

- Kırmızı

- rapor

- gereklilik

- Rezerv

- Risk

- hezimet

- Suudi

- Suudi Arabistan

- DENİZ

- görmek

- Satıcılar

- kısa

- kısa dönem

- meli

- gösterme

- yan

- işaret

- başladı

- adım

- Yine

- Stok

- Borsa

- güçlü

- arz

- destek

- destekli

- salıncak

- Hedef

- hedefleme

- Teknik

- Teknik Analiz

- gerginlikler

- dönem

- göre

- o

- The

- sonra

- Orada.

- Re-Tweet

- üç

- için

- yarın

- aldı

- üst

- eğilim

- Dönük

- Dönüş

- us

- ABD İşsizlik İddiaları

- bize NFP

- Video

- beklemek

- istemek

- we

- hafta

- hafta sonu

- tartmak

- vardı

- hangi

- süre

- irade

- ile

- WTI

- WTI Ham

- dün

- zefirnet

- bölge