Tüketici Finansmanının Sonraki Yinelemesini Güçlendirmek

Medium, JC Bahr-de Stefano | 31 Mart 2023

Building the next decade of consumer finance

- Last week in Las Vegas, I had the great pleasure of moderating a panel at Fintech Meetup re: building the next decade of consumer finance by leveraging real-time data and cash flow forecasting. I wanted to share some of the key insights shared during the session by our amazing panelists, Jose Bethancourt (Co-Founder of Method Financial), Ema Rouf (Co-Founder of Pave.dev), and Zane Salim (Co-Founder of Atlas)!

Bakınız: CFPB, "Veri simsarları" Hakkında Bilgi Talebi Yayınladı

- 1/ Alternative data augments FICO across the entire credit spectrum — this is about FICO+ NOT replacing FICO.

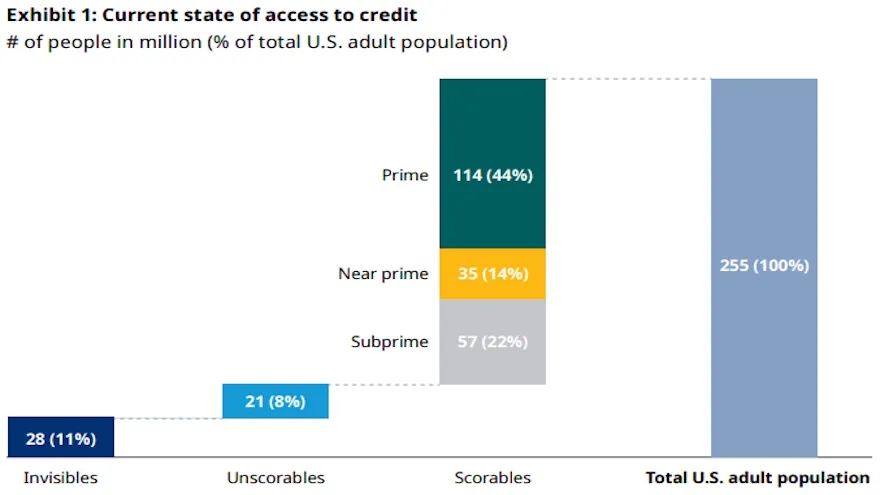

- The problem of credit invisibility in the US is growing, with an estimated 28 million adult Americans credit invisible and 21 million unscorable. To make decisions about these consumers and offer them financial services and products, alternative data, such as income and employment, can be used. This data can also help lenders make better risk-weighted decisions for many segments of users, not just credit invisible ones, and is particularly important during periods of economic stress.

- 2/ Real time data powers better products and outcomes by enabling greater access and improving the quality of risk management.

- Credit bureaus can take up to 45 days to report data, so lenders may not have the most up-to-date information on a borrower’s behavior. Atlas, a payroll-powered credit card, uses real-time data to monitor users’ financial health and adjust credit limits, allowing for better risk management and loss prevention.

- 3/ The movement to make alternative data mainstream has to happen outside of the credit bureaus.

- Credit reports do not provide a complete view of a consumer’s debt obligations as there is a lot of data that is not furnished to the credit bureaus, including most BNPL loans. However, companies like Method collect data from over 60k institutions to provide lenders with a more comprehensive view of a person’s debt obligations, combining data from credit bureaus with financial institutions’ core banking systems.

Bakınız: Kanada'nın Açık Bankacılık Yolculuğu: Fintech Galaxy Baş Ürün Sorumlusu Abe Karar ile Röportaj

- 4/ Recent innovation in infrastructure has made this data far more accessible than it has been in the past.

- Recent advancements in infrastructure and tools have made it easier to access and enrich the data. Companies such as Method and Pave are providing infrastructure that helps fintechs and banks adopt and use this data, leading to accelerated adoption.

- 5/ Mature lenders don’t want scores, they want raw data or attributes.

- Understanding the data is crucial for them to explain it to originating banks or capital providers, and the use of attribute generation can speed up model development. Pave is an example of a company offering transaction cleaning, enrichment, and their own attributes toolbox for lenders to use in their proprietary models.

Tam makaleye devam edin -> buradan

The Ulusal Kitle Fonlaması ve Fintech Derneği (NCFA Kanada) binlerce topluluk üyesine eğitim, pazar istihbaratı, endüstri yönetimi, ağ oluşturma ve finansman fırsatları ve hizmetleri sağlayan ve canlı ve yenilikçi bir fintech ve finansman oluşturmak için endüstri, hükümet, ortaklar ve bağlı kuruluşlarla yakın çalışan bir finansal yenilik ekosistemidir. Kanada'da sanayi. Merkezi olmayan ve dağıtılan NCFA, küresel paydaşlarla ilgilenmektedir ve fintech, alternatif finans, kitle fonlaması, eşler arası finans, ödemeler, dijital varlıklar ve tokenler, blockchain, kripto para birimi, regtech ve insurtech sektörlerindeki projelerin ve yatırımların kuluçkalanmasına yardımcı olmaktadır. Kaydol Kanada'nın Fintech ve Finansman Topluluğu bugün ÜCRETSİZ! Veya bir katkıda bulunan üye ve avantajlar elde edin. Daha fazla bilgi için lütfen ziyaret edin: www.ncfacanada.org

The Ulusal Kitle Fonlaması ve Fintech Derneği (NCFA Kanada) binlerce topluluk üyesine eğitim, pazar istihbaratı, endüstri yönetimi, ağ oluşturma ve finansman fırsatları ve hizmetleri sağlayan ve canlı ve yenilikçi bir fintech ve finansman oluşturmak için endüstri, hükümet, ortaklar ve bağlı kuruluşlarla yakın çalışan bir finansal yenilik ekosistemidir. Kanada'da sanayi. Merkezi olmayan ve dağıtılan NCFA, küresel paydaşlarla ilgilenmektedir ve fintech, alternatif finans, kitle fonlaması, eşler arası finans, ödemeler, dijital varlıklar ve tokenler, blockchain, kripto para birimi, regtech ve insurtech sektörlerindeki projelerin ve yatırımların kuluçkalanmasına yardımcı olmaktadır. Kaydol Kanada'nın Fintech ve Finansman Topluluğu bugün ÜCRETSİZ! Veya bir katkıda bulunan üye ve avantajlar elde edin. Daha fazla bilgi için lütfen ziyaret edin: www.ncfacanada.org

#fintech'te meydana gelen en yenilikçi gelişmelerden bazılarına içeriden erişim elde etmek istiyorsunuz. #FFCON23'e kaydolun ve küresel düşünce liderlerinden sırada ne olduğunu öğrenin! FFCON23'ten tüm sanal programlama ve isteğe bağlı içeriğe Açık Erişim biletleri için aşağıya tıklayın.Bizi Twitter'da takip ederek NCFA'yı destekleyin! |

İlgili Mesajlar

- SEO Destekli İçerik ve Halkla İlişkiler Dağıtımı. Bugün Gücünüzü Artırın.

- Plato blok zinciri. Web3 Metaverse Zekası. Bilgi Güçlendirildi. Buradan Erişin.

- Kaynak: https://ncfacanada.org/empowering-the-next-iteration-of-consumer-finance/

- :dır-dir

- $UP

- 10

- 100

- 2018

- 28

- 39

- a

- Hakkımızda

- hızlandırılmış

- erişim

- ulaşılabilir

- karşısında

- benimsemek

- Benimseme

- Yetişkin

- gelişmeler

- gelişmeler

- bağlı

- AI / ML

- Türkiye

- Izin

- alternatif

- alternatif finansman

- şaşırtıcı

- Amerikalılar

- ve

- Nisan

- ARE

- göre

- AS

- Varlıklar

- At

- ipekli kumaş

- öznitelikleri

- Bankacılık

- Bankacılık sistemleri

- Bankalar

- BD

- BE

- müşterimiz

- altında

- Daha iyi

- blockchain

- BNPL uzantısı

- borçlu

- bina

- by

- önbellek

- CAN

- Kanada

- Başkent

- kart

- Nakit

- nakit akımı

- Kategoriler

- CFPB

- baş

- baş ürün sorumlusu

- Temizlik

- tıklayın

- yakından

- Kurucu

- toplamak

- COM

- birleştirme

- topluluk

- Şirketler

- şirket

- tamamlamak

- kapsamlı

- tüketici

- tüketici finansmanı

- Tüketiciler

- içerik

- çekirdek

- Ana bankacılık

- yaratmak

- kredi

- kredi kartı

- Crowdfunding

- cryptocurrency

- veri

- Günler

- Borç

- onyıl

- Merkezi olmayan

- kararlar

- Talep

- gelişme

- dijital

- Dijital Varlıklar

- dağıtıldı

- Dont

- sırasında

- kolay

- Ekonomik

- ekosistem

- Eğitim

- EMA

- iş

- güçlendirici

- etkinleştirme

- nişanlı

- zenginleştirmek

- Tüm

- giriş

- tahmini

- Eter (ETH)

- olaylar

- örnek

- Açıklamak

- Fico

- maliye

- mali

- finansal Sağlık

- finansal katılım

- Finansal yenilik

- Finansal Kurumlar

- finansal hizmetler

- fintech

- Fintech Galaksisi

- fintechs

- akış

- takip etme

- İçin

- itibaren

- tam

- finansman

- fon fırsatları

- Gökada

- nesil

- almak

- Küresel

- Hükümet

- harika

- büyük

- GV

- olmak

- olay

- Var

- Sağlık

- duymak

- yardım et

- yardımcı olur

- hi

- Ancak

- HP

- hr

- http

- HTTPS

- i

- önemli

- geliştirme

- in

- Dahil olmak üzere

- içerme

- Gelir

- sanayi

- bilgi

- Altyapı

- Yenilikçilik

- yenilikçi

- içerideki

- anlayışlar

- kurumları

- Insurtech

- İstihbarat

- görüşme

- yatırım

- sorunlar

- IT

- tekrarlama

- Ara

- kaydol

- seyahat

- jpg

- anahtar

- büyük

- LAS

- Las Vegas

- liderleri

- önemli

- kredi

- borç verme

- kaldıraç

- sevmek

- sınırları

- yaşamak

- Canlı etkinlikler

- Krediler

- kayıp

- Çok

- yapılmış

- ana akım

- yapmak

- yönetim

- çok

- Mart

- pazar

- olgun

- maksimum genişlik

- Mayıs..

- Meetup

- üye

- Üyeler

- yöntem

- milyon

- model

- modelleri

- izlemek

- Daha

- çoğu

- hareket

- NEO

- ağ

- Kaydolun

- sonraki

- tahviller

- of

- teklif

- teklif

- Subay

- on

- On-Demand

- Online

- açık

- açık bankacılık

- Fırsatlar

- dışında

- kendi

- panel

- özellikle

- ortaklar

- geçmiş

- ödemeler

- eşler arası

- dönemleri

- Perks

- kişi

- Platon

- Plato Veri Zekası

- PlatoVeri

- Lütfen

- Zevk

- güçler

- Önleme

- PLATFORM

- Ürünler

- Programlama

- Projeler

- özel

- sağlamak

- sağlar

- sağlama

- kalite

- Çiğ

- işlenmemiş veri

- RE

- gerçek

- gerçek zaman

- gerçek zamanlı veri

- son

- kayıt olmak

- Regtech

- rapor

- Raporlar

- talep

- Risk

- risk yönetimi

- s

- Sektörler

- segmentler

- Hizmetler

- Oturum

- paylaş

- Paylaşılan

- işaret

- So

- biraz

- hız

- paydaşlar

- idare

- stres

- böyle

- sürdürülebilir

- Sistemler

- TAG

- Bizi daha iyi tanımak için

- o

- The

- ve bazı Asya

- Onları

- Bunlar

- düşünce

- düşünce liderleri

- Binlerce

- bilet

- zaman

- Başlık

- için

- bugün

- Jeton

- Araç Kutusu

- araçlar

- işlem

- gerçek

- aktüel

- us

- kullanım

- kullanıcılar

- VEGAS

- canlı

- Görüntüle

- Sanal

- Türkiye Dental Sosyal Medya Hesaplarından bizi takip edebilirsiniz.

- aranan

- hafta

- ile

- çalışır

- zefirnet