Många företag som skulle dra nytta av blockkedjan har undvikit det. Dess koldioxidavtryck, kostnader och kopplingar till flyktiga kryptovalutor bidrog till att blockchain hade ett giftigt rykte som det inte kunde skaka, och företagen inte skulle röra.

That was until ‘the Merge’. This – now widely used – term references the restructure of the world’s largest programmable blockchain: Ethereum. Put simply, this September the cryptography driving the system has been switched from proof of work (PoW) to proof of stake (PoS). This essentially replaced the huge, energy-intensive computers that were the network’s core validators, with individuals and companies. It is expected to reduce the energy consumption of Ethereum by 99% and reduce the global use of energy by 0.02%, enligt Vitalik Buterin, vilket avsevärt förbättrar dess hållbarhet. The Surge, epilogen till Merge, kommer så småningom att öka kapaciteten och sänka avgifterna på nätverket.

Det är helt klart ett viktigt steg mot att föra in Ethereum i mainstream och det markerar en utveckling av blockchain-teknologin. Men vad gör blockchains förbättrade rykte verkligen menas för institutionellt bruk?

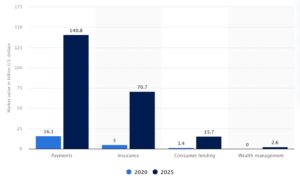

Press coverage has focused on more widespread crypto usage; however, the real impact will be on the institutional side – particularly within financial services. Now the stage is set for innovations, it is likely that parts of the industry may turn towards decentralised infrastructure. Blockchain can offer safe and secure transaction processing at a fraction of the cost, particularly when compared to the enormous expense and burden of today’s systems.

This has never been more relevant. The digital asset market is maturing significantly just as its traditional counterpart enters a period of turmoil and uncertainty. As the world hurtles towards another recession, businesses will be examining how to save money and cut costs. A greener, more cost-efficient blockchain could form part of the answer and reduce the institution’s huge IT expenditures.

If implemented correctly, blockchain could save billions in infrastructure and associated IT costs. Rather than paying for service level agreements, data centres, cloud hosting and other services, financial institutions can and will leverage blockchain infrastructure at a fraction of the cost of running the same transactions in-house. Cost efficiencies aside, tokenisation could improve several areas within asset management specifically, such as issuance, exchange and servicing as well as simplify processes involving a host of intermediaries. Potential benefits include improved access to, and personalisation of, investment solutions.

För private equity kan blockchain möjliggöra delägande och decentraliserade fonder, vilket inte bara kommer att öka transparensen, utan skapa mer flexibilitet kring likviditet för vad som tidigare bara kunde vara långsiktiga, låsta investeringar.

However, there is still a missing piece of the puzzle to be considered: interoperability. For true mainstream adoption of blockchain to occur within businesses, users need to be able to transact across multiple networks. Currently, it is not particularly easy to share information from one blockchain to another. To put this into context, if interoperability within email communication had never been achieved, Outlook users wouldn’t be able to send messages to Gmail accounts and vice versa.

Även om en utbredd användning inträffade som ett resultat av sammanslagningen, tills olika blockkedjor – inklusive Ethereum – kan kommunicera med varandra effektivt, kommer de fulla fördelarna med tekniken för företag inte att låsas upp.

- myra finansiellt

- blockchain

- blockchain konferens fintech

- chime fintech

- coinbase

- coingenius

- kryptokonferens fintech

- fintech

- fintech-app

- fintech-innovation

- Fintextra

- OpenSea

- PayPal

- paytech

- payway

- plato

- plato ai

- Platon Data Intelligence

- PlatonData

- platogaming

- razorpay

- Revolut

- Ripple

- fyrkantig fintech

- rand

- tencent fintech

- Xero

- zephyrnet