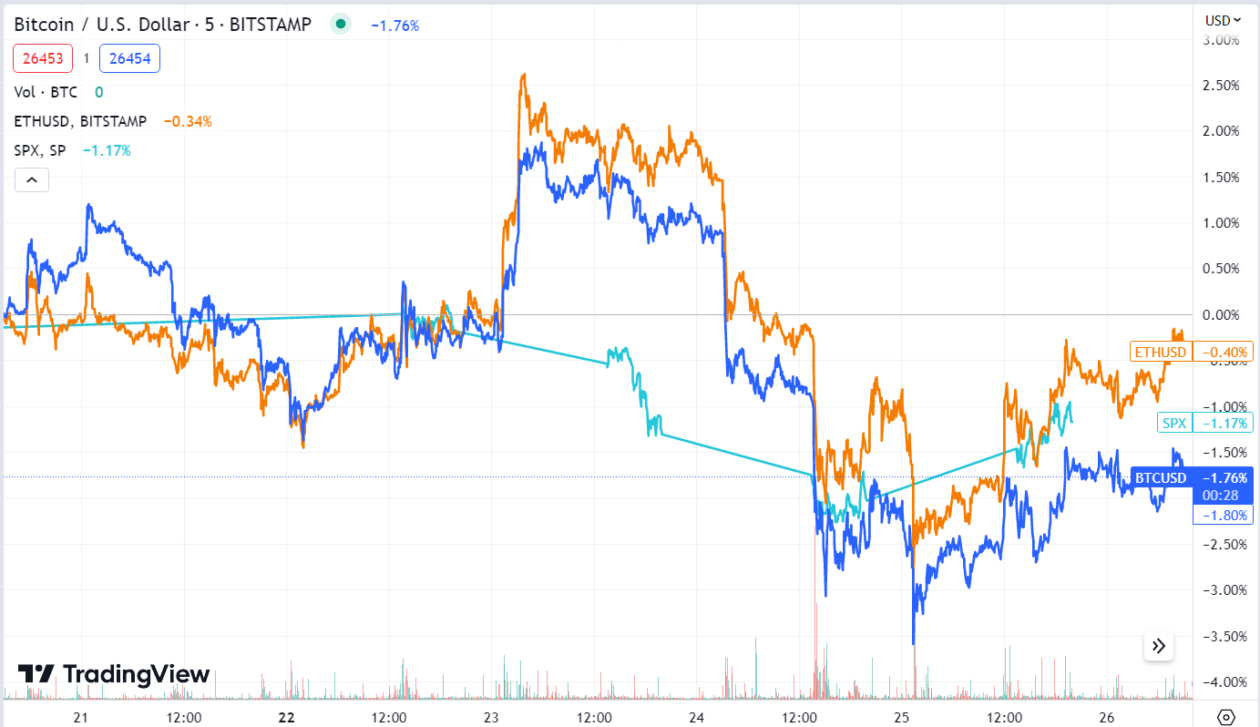

Bitcoin fell 1.40% from May 19 to May 26 to trade at US$26,451 at 7:00 p.m. Friday in Hong Kong. The world’s largest cryptocurrency by market capitalization has been trading under US$30,000 since April 19. Ether rose 0.34% over the week to US$1,813 recapturing US$1,800 on Thursday.

The lack of progress in U.S. debt ceiling negotiations continued to erode risk appetite as the June 1 deadline neared. On Wednesday, Fitch Ratings placed the U.S.’ AAA rating on a negative rating watch, saying that debt ceiling negotiations raised the risks of the government missing payments on some of its obligations.

“Bitcoin and Ether have shrugged off the U.S. debt ceiling negotiations and the potential ripple effects for crypto. President Biden has already declared the country will not default on its debt,” Lucas Kiely, the chief investment officer of digital asset platform Yield App , said . “With liquidity tight, the crypto market doesn’t seem to be too concerned over these macro events. It will take something much more substantial to move these markets.”

Johnny Louey, a crypto research analyst at trading platform LiquidityTech Protocol , disagreed, saying that the debt ceiling negotiations are the main factors weighing down Bitcoin price.

“Although the debt ceiling has been raised and revised 78 times since 1960, investors are aware of the default risk if negotiations fail. This is the first time Bitcoin encountered such an economic incident and it’s reasonable to assume a risk-off approach would be appropriate,” said Louey .

The global crypto market capitalization stood at US$1.11 trillion on Friday at 7:00 p.m. in Hong Kong, down 0.89% from US$1.12 trillion a week ago, according to CoinMarketCap data. With a market cap of US$512 billion, Bitcoin represented 46.1% of the market, while Ether, valued at US$218 billion, accounted for 19.6%.

"Celotna tržna kapitalizacija kriptovalut je v bistvu ostala nespremenjena eno leto," je dejal Kiely. »Tetherjev načrt za razširitev svojih imetij bitcoinov lahko začasno zviša cene, vendar na splošno verjetno ne bo imel velikega vpliva. Prepolovitev bitcoina leta 2024 bi lahko privedla do dviga cene, a učinkov tega še nismo opazili.«

On May 17, Tether , the company behind the world’s largest stablecoin USDT, revealed its plans to “regularly allocate” as much as 15% of its net operational profits to buy Bitcoin, aiming to boost its reserves portfolio. Tether held approximately US$1.5 billion in Bitcoin reserves, at the time of the announcement.

Neaktivni bitcoin je dosegel najvišjo vrednost vseh časov

The amount of Bitcoin that has been inactive for at least a year rose to an all-time high of 68.46% on Wednesday, according to data aggregator MacroMicro .

“It could mean short-term selling pressure decreases if the Bitcoin holdings in short-term holdings shift to longer-term holders. However, we will not be able to tell whether the addresses belong to institutional investors or not,” Tom Wan, a research analyst at 21.co , the parent company of 21Shares, an issuer of crypto exchange-traded products, said.

Po besedah Kielyja iz Yield App to nakazuje, da vse več vlagateljev po vsem svetu namerava svoje bitcoine obdržati dolgoročno.

"Ta trend se bo verjetno nadaljeval in celo pospešil - celo potencialno do točke hiperbitcoinizacije - glede na negotovost, povezano z razvijajočo se regulativno pokrajino in vse večjim prepoznavanjem Bitcoina kot hranilnika vrednosti," je dejal Kiely.

»Hiperbitcoinizacija« je koncept, ki špekulira o morebitnem vzponu bitcoina, da bi postal vseprisotna oblika denarja na svetu.

Pomembni akterji: RNDR & KAVA

The Render Network’s native cryptocurrency was this week’s biggest gainer among the top 100 coins by market capitalization listed on CoinMarketCap, rallying 16.55% to US$2.83. The token started picking up momentum last Saturday, after the announcement of the new Render Foundation website. This is Render’s second consecutive week as the biggest gainer in the top 100 cryptos.

The Render Network leverages idle graphics processing units for digital rendering purposes, catering to areas such as 3D modeling, gaming imagery, and virtual reality.

Kava, the governance token of a layer-1 blockchain of the same name, was this week’s second-biggest gainer, rising 10.70% to US$1.09. The coin started picking up momentum on Monday, following the launch of the Kava mainnet last week.

Naslednji teden: Ali bi lahko posel z zgornjo mejo dolga prekinil Bitcoinov sprehod rakov?

U.S. President Joe Biden and House Speaker Kevin McCarthy are reportedly closing in on a deal that would raise the government’s debt ceiling for two years while capping spending on most items. Yet, the June 1 deadline is fast approaching, causing investor concerns about a potential default.

Po mnenju Kenjaeva iz WuuTrade bo negotovost okoli pogajanj o zgornji meji dolga obremenjevala kripto trg, dokler ne bo dosežen dogovor.

“The sideways [movement] of Bitcoin is very much related to the current market risks and the fear. Investors’ activity during any economic risk talks is rather cautious. Hence the sideways in US$26,000 – US$30,000,” wrote Kenjaev, adding that positive news surrounding the U.S. economy will break the crab walk .

Vlagatelji naslednji teden čakajo na objavo poročila o zaposlovanju v ZDA za maj, ki vključuje ključne podatke o plačah v nekmetiji. Te informacije pogosto služijo kot barometer za napovedovanje naslednjih korakov Federal Reserve glede prilagajanja obrestnih mer. ING Economics je za maj predvidel povečanje plač v nekmetiji za 195,000. Poleg tega za maj pričakujejo rahel dvig stopnje brezposelnosti na 3.5 % v primerjavi s 3.4 % v prejšnjem mesecu.

V kriptoprostoru Optimism, omrežje Ethereum layer-2, načrtuje povečanje obtočne ponudbe svojega žetona upravljanja (OP) naslednjo sredo, eno leto po lansiranju kovanca. Širitev je del Optimismove strategije za povečanje skupine glasovalnih žetonov znotraj Token House, njene skupine imetnikov OP, odgovornih za predlaganje in glasovanje o vprašanjih upravljanja.

See related article: Big buys fail to lift NFT markets as regulatory uncertainty weighs heavy on crypto

- Distribucija vsebine in PR s pomočjo SEO. Okrepite se še danes.

- PlatoAiStream. Podatkovna inteligenca Web3. Razširjeno znanje. Dostopite tukaj.

- Kovanje prihodnosti z Adryenn Ashley. Dostopite tukaj.

- Kupujte in prodajajte delnice podjetij pred IPO s PREIPO®. Dostopite tukaj.

- vir: https://bitrss.com/news/309885/weekly-market-wrap-bitcoin-weighed-down-by-debt-ceiling-uncertainty

- :ima

- : je

- :ne

- ][str

- $GOR

- 000

- 1

- 10

- 100

- 11

- 12

- 15%

- 17

- 195

- 2024

- 21 Delnice

- 26

- 3d

- 3D modeliranje

- 7

- a

- AAA

- Sposobna

- O meni

- Po

- dejavnost

- dodajanje

- Poleg tega

- naslovi

- Popravki

- po

- Združevalec

- Avgust

- Usmerjanje

- že

- med

- znesek

- an

- Analitik

- in

- Objava

- pričakujte

- kaj

- aplikacija

- apetit

- pristop

- približuje se

- primerno

- približno

- april

- SE

- območja

- okoli

- članek

- AS

- sredstvo

- At

- čaka

- zaveda

- BE

- postanejo

- bilo

- zadaj

- Bidena

- Big

- največji

- Billion

- Bitcoin

- Bitcoin Cena

- rezerve bitcoin

- blockchain

- povečanje

- Break

- vendar

- nakup

- Kupi bitkoin

- Kupi

- by

- cap

- Kapitalizacija

- povzroča

- previden

- strop

- šef

- krožijo

- zapiranje

- CO

- Coin

- CoinMarketCap

- Kovanci

- podjetje

- v primerjavi z letom

- Koncept

- zaskrbljen

- Skrbi

- zaporedna

- naprej

- naprej

- bi

- država

- ključnega pomena

- kripto

- Kripto tržnica

- kripto prostor

- cryptocurrencies

- cryptocurrency

- kripto

- Trenutna

- datum

- ponudba

- Dolg

- zmanjšuje

- privzeto

- digitalni

- Digitalno sredstvo

- Ne

- navzdol

- med

- Gospodarska

- Economics

- Gospodarstvo

- Učinki

- Celotna

- v bistvu

- Eter

- Eter (ETH)

- ethereum

- Tudi

- dogodki

- morebitne

- razvija

- s katerimi se trguje na borzi

- Razširi

- Širitev

- dejavniki

- FAIL

- FAST

- strah

- Zvezna

- Zvezne rezerve

- prva

- prvič

- Fitch

- po

- za

- obrazec

- Fundacija

- Petek

- iz

- igre na srečo

- dana

- Globalno

- Global Crypto

- upravljanje

- vlada

- grafika

- skupina

- Pridelovanje

- Razpolovitev

- Imajo

- težka

- Hero

- zato

- visoka

- Hits

- držite

- imetniki

- Holdings

- Hong

- Hong Kong

- Hiša

- Vendar

- HTTPS

- Hiperbitkonizacija

- Mirovanje

- if

- vpliv

- in

- neaktiven

- nesreča

- vključuje

- Povečajte

- vedno

- Podatki

- ING

- Institucionalna

- institucionalni vlagatelji

- nameravajo

- obresti

- OBRESTNA MERA

- v

- naložbe

- Investitor

- Vlagatelji

- Izdajatelj

- Vprašanja

- IT

- Izdelkov

- ITS

- Delovna mesta

- poročilo o delovnih mestih

- Joe Biden

- junij

- KAVA

- Imejte

- Kong

- Pomanjkanje

- Pokrajina

- velika

- Največji

- Zadnja

- kosilo

- vodi

- vsaj

- Leverages

- Verjeten

- likvidnostno

- Navedeno

- Long

- Makro

- Glavne

- glavno omrežje

- Tržna

- Market Cap

- Tržna kapitalizacija

- tržni zavitek

- Prisotnost

- Maj ..

- pomeni

- manjka

- modeliranje

- Momentum

- Ponedeljek

- Denar

- mesec

- več

- Najbolj

- premikanje

- Gibanje

- Movers

- veliko

- Ime

- materni

- negativna

- Pogajanja

- net

- mreža

- Novo

- novice

- Naslednja

- NFT

- Trgi NFT

- Nekmetija

- Nonfarm Payrolls

- obveznice

- of

- off

- Častnik

- pogosto

- on

- OP

- operativno

- Optimizem

- or

- več

- Splošni

- matično podjetje

- del

- Plačila

- Plačilne liste

- Načrt

- načrtovanje

- načrti

- platforma

- platon

- Platonova podatkovna inteligenca

- PlatoData

- Točka

- bazen

- Portfelj

- pozitiven

- potencial

- potencialno

- napovedovanje

- Predsednik

- predsednik biden

- predsednik joe biden

- tlak

- Cena

- Cene

- obravnavati

- Izdelki

- dobiček

- Napredek

- napovedane

- protokol

- namene

- dvigniti

- postavljeno

- Oceniti

- precej

- ocena

- ocen

- dosegel

- Reality

- razumno

- Priznanje

- o

- regulatorni

- regulativno pokrajino

- povezane

- sprostitev

- ostalo

- upodabljanje

- poročilo

- zastopan

- Raziskave

- rezerve

- odgovorna

- Razkrito

- Ripple

- Rise

- narašča

- Tveganje

- apetit po tveganju

- tveganja

- ROSE

- s

- Je dejal

- Enako

- sobota

- rek

- drugi

- videnje

- zdi se

- Prodaja

- služi

- premik

- kratkoročno

- vstran

- saj

- nekaj

- Nekaj

- Vesolje

- Zvočniki

- Poraba

- stabilno

- stabilni coin USDT

- Začetek

- začel

- Koraki

- trgovina

- skladišče vrednosti

- Strategija

- precejšen

- taka

- Predlaga

- dobavi

- Okolica

- Bodite

- pogovori

- povej

- Izraz

- Tether

- da

- O

- njihove

- te

- jih

- ta

- četrtek

- čas

- krat

- do

- žeton

- Boni

- tudi

- vrh

- trgovini

- Trgovanje

- Trgovalna platforma

- Trend

- Bilijona

- dva

- nas

- Ameriško gospodarstvo

- povsod

- Negotovost

- pod

- brezposelnosti

- Stopnja brezposelnosti

- enote

- dokler

- USDT

- vrednost

- vrednoti

- zelo

- Virtual

- Navidezna resničnost

- Glasovanje

- je

- Watch

- we

- Spletna stran

- Sreda

- teden

- Tedenski

- tehtanje

- tehta

- ali

- ki

- medtem

- bo

- z

- v

- svetu

- po vsem svetu

- bi

- zaviti

- leto

- let

- še

- donos

- Donosna aplikacija

- zefirnet