- The BoJ decided to maintain its ultra-easy monetary settings.

- There is a growing likelihood of Japan achieving the bank’s 2% inflation target sustainably.

- Japan’s spring wage increases might exceed last year’s 30-year high of 3.58%.

The USD/JPY price analysis on Tuesday displayed a bearish tone as the Japanese yen changed its course, gaining strength. The momentum was fueled by hints suggesting that the Bank of Japan could make policy adjustments in its upcoming meeting.

- Vas zanima učenje o forex signals telegram skupina? Kliknite tukaj za podrobnosti -

Earlier, the yen had weakened following the central bank’s policy decision. Notably, the Bank of Japan held its ultra-easy monetary policy. However, it indicated an increasing belief that the conditions for gradually withdrawing its extensive stimulus were aligning. Therefore, the prospect of ending negative interest rates is approaching.

BOJ Governor Kazuo Ueda mentioned that many businesses had already set wages, and labor unions were advocating for higher pay. Moreover, he expressed a growing likelihood of Japan achieving the bank’s 2% inflation target sustainably. This is due to recent steady increases in service prices.

Market players expect the Bank of Japan to end negative rates sometime this year. Meanwhile, a Reuters poll indicates that such a move might come in April. However, Ueda emphasized the importance of delaying rate hikes until there is evidence that inflation will stay around 2% and there will be robust wage growth.

Surveys and statements from business lobbies show a growing likelihood that Japan’s spring wage increases will exceed last year’s 30-year high of 3.58% for major firms. This is what the BoJ needs to start transitioning away from ultra-loose monetary policy.

USD/JPY ključni dogodki danes

- The BOJ Press Conference

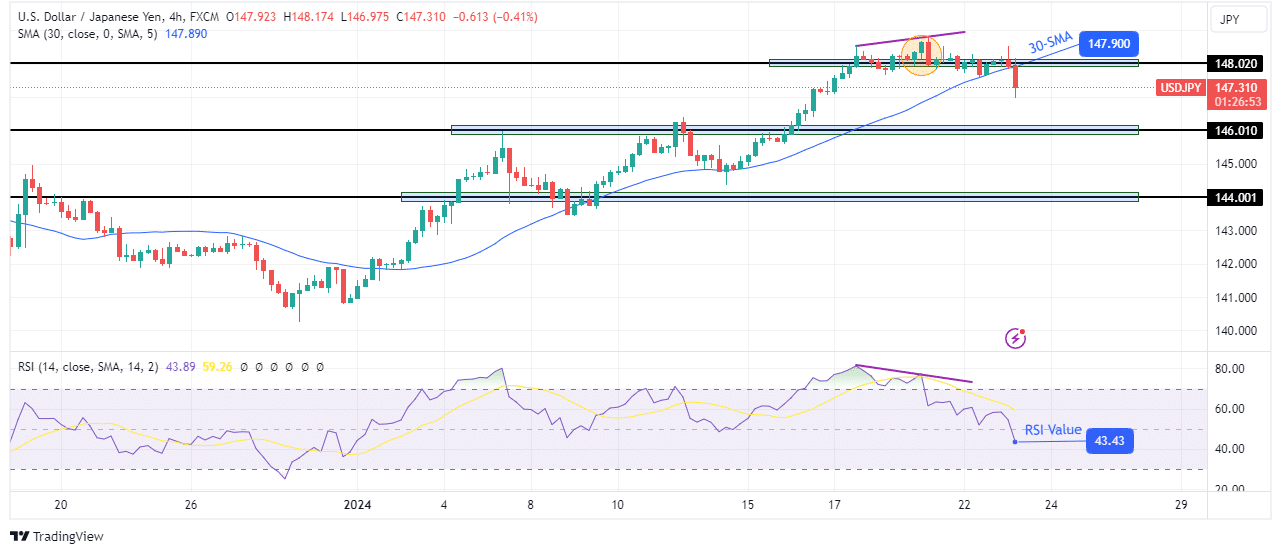

USD/JPY technical price analysis: 30-SMA breach marks shift in sentiment

On the charts, there has been a shift in sentiment from bullish to bearish as the price has broken below the 30-SMA. At the same time, the RSI has crossed into bearish territory. However, to confirm this shift, the price must close below the SMA.

-Vas zanima, če želite izvedeti več o tem zaslužek z forexom? Preverite naš podroben vodnik-

The first sign that bulls were ready to give up control came when the RSI made a bearish divergence. The price made a new high above the 148.02 resistance level, but bullish momentum was weaker. At the same time, bears showed strength when they made an engulfing candle, pushing the price back below 148.02. A reversal will allow bears to retest support levels at 146.01 and 144.00.

Ali zdaj želite trgovati na forexu? Investirajte v eToro!

67% računov malih vlagateljev izgubi denar pri trgovanju s CFD-ji pri tem ponudniku. Razmislite, ali si lahko privoščite, da tvegate izgubo denarja.

- Distribucija vsebine in PR s pomočjo SEO. Okrepite se še danes.

- PlatoData.Network Vertical Generative Ai. Opolnomočite se. Dostopite tukaj.

- PlatoAiStream. Web3 Intelligence. Razširjeno znanje. Dostopite tukaj.

- PlatoESG. Ogljik, CleanTech, Energija, Okolje, sončna energija, Ravnanje z odpadki. Dostopite tukaj.

- PlatoHealth. Obveščanje o biotehnologiji in kliničnih preskušanjih. Dostopite tukaj.

- vir: https://www.forexcrunch.com/blog/2024/01/23/usd-jpy-price-analysis-yen-gains-amid-bojs-policy-shift/

- :ima

- : je

- $GOR

- 01

- 1

- 2%

- 2% inflacija

- a

- O meni

- nad

- računi

- doseganju

- Popravki

- zagovarjanje

- poravnava

- omogočajo

- že

- Sredi

- an

- Analiza

- in

- približuje se

- april

- okoli

- AS

- At

- stran

- nazaj

- Banka

- banka Japonske

- BE

- Medvjedast

- razhajanje medvedov

- Medvedi

- bilo

- prepričanje

- spodaj

- boj

- kršitev

- Broken

- Bikovski

- Biki

- poslovni

- podjetja

- vendar

- by

- prišel

- CAN

- Osrednji

- CFD-ji

- spremenilo

- Charts

- preveriti

- klik

- Zapri

- kako

- Pogoji

- Potrdi

- Razmislite

- nadzor

- bi

- Tečaj

- Crossed

- odločil

- Odločitev

- odlašanje

- podrobno

- prikazano

- Razhajanja

- 2

- je poudaril,

- konec

- konec

- dogodki

- dokazi

- presega

- pričakovati

- izražena

- obsežen

- podjetja

- prva

- po

- za

- forex

- iz

- gorivo

- pridobivanje

- zaslužek

- Daj

- Guverner

- postopoma

- Pridelovanje

- Rast

- imel

- he

- Hero

- tukaj

- visoka

- več

- Pohodi

- nasveti

- Vendar

- HTTPS

- Pomembnost

- in

- Poveča

- narašča

- naveden

- označuje

- inflacija

- obresti

- Obrestne mere

- zainteresirani

- v

- Invest

- Investitor

- IT

- ITS

- Japonska

- Na Japonskem

- Japonski

- Japonski jen

- Ključne

- dela

- Zadnja

- učenje

- Stopnja

- ravni

- verjetnost

- izgubiti

- izgube

- je

- vzdrževati

- velika

- Znamka

- več

- max širine

- Medtem

- srečanja

- omenjeno

- morda

- Momentum

- Denarno

- Monetarna politika

- Denar

- več

- Poleg tega

- premikanje

- morajo

- potrebe

- negativna

- negativne obrestne mere

- Novo

- predvsem

- zdaj

- of

- on

- naši

- Plačajte

- platon

- Platonova podatkovna inteligenca

- PlatoData

- igralci

- politika

- Anketa

- pritisnite

- Cena

- Analiza cen

- Cene

- možnosti

- Ponudnik

- Potiskanje

- Oceniti

- stopnje povišanj

- Cene

- pripravljen

- nedavno

- Odpornost

- Trgovina na drobno

- Reuters

- Razveljavitev

- Tveganje

- robusten

- RSI

- s

- Enako

- sentiment

- Storitev

- nastavite

- nastavitve

- premik

- shouldnt

- Prikaži

- je pokazala,

- podpisati

- signali

- GURS

- pomlad

- Začetek

- Izjave

- bivanje

- dinamičnega ravnovesja

- dražljaj

- moč

- taka

- podpora

- ravni podpore

- trajnostno

- Bodite

- ciljna

- tehnični

- Telegram

- Ozemlje

- da

- O

- Tukaj.

- zato

- jih

- ta

- letos

- čas

- do

- TONE

- trgovini

- Trgovanje

- prehod

- Torek

- Sindikati

- dokler

- prihajajoče

- USD / JPY

- plača

- Plače

- je

- šibkejši

- so bili

- Kaj

- kdaj

- ali

- bo

- z

- umik

- leto

- Yen

- jo

- Vaša rutina za

- zefirnet