- Goldman Sachs no longer expects the Fed to raise interest rates this month.

- The market is pricing in a nearly 18% chance of the Fed maintaining its current rate.

- The Canadian economy outperformed expectations in February by creating 21,800 new jobs.

Today’s USD/CAD outlook is bearish. The dollar index, which measures the dollar’s value in relation to six other currencies, reached its lowest level in a month. This came after Goldman Sachs said it no longer expects the Fed to raise interest rates at its meeting on March 22. Initially, it had anticipated an increase of 25 basis points.

-Vas zanima, če želite izvedeti več o tem zaslužek z forexom? Preverite naš podroben vodnik-

Investors believe that because of the Silicon Valley Bank (SVB) collapse, the Fed will now be hesitant to move by a staggering 50bps this month. Investors will now be eagerly observing Tuesday’s inflation data to try and estimate how aggressive the Fed will likely be.

Currently, the market is pricing in an 82% chance of a 25 basis point rise and a nearly 18% chance of the Fed maintaining its current rate. Before the SVB collapse, however, the market had a 70% possibility of a 50 basis point increase priced in.

The Bank of Canada declared it planned to finish its year-long tightening campaign. However, it was under pressure after the Canadian economy outperformed expectations in February by creating 21,800 new jobs.

The BoC has stated that it will maintain rates as long as inflation declines in line with its January forecasts. But Senior Deputy Governor Carolyn Rogers stated on Thursday that the labor market was “extremely tight” and the economy was still experiencing excess demand.

Ključni dogodki USD/CAD danes

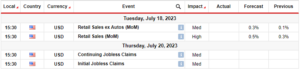

Investors are not expecting important economic releases from Canada or the US. Therefore, the price will likely consolidate.

USD/CAD technical outlook: Possible shift in sentiment as bears break below the 30-SMA

The 4-hour chart shows USD/CAD trading slightly below the 30-SMA and the RSI below 50. Bears have taken over by breaking below the 30-SMA and pushing the RSI below 50. The price has also fallen below the 1.3750 support level.

-Vas zanima, če želite izvedeti več o tem MT5 posredniki? Preverite naš podroben vodnik-

Bulls weakened and failed to push beyond the 1.3850 resistance level. If the price stays below the SMA, it will likely fall to the next support at 1.3650.

Ali zdaj želite trgovati na forexu? Investirajte v eToro!

68% računov malih vlagateljev izgubi denar pri trgovanju s CFD-ji pri tem ponudniku. Premislite, ali si lahko privoščite, da tvegate izgubo denarja

- Distribucija vsebine in PR s pomočjo SEO. Okrepite se še danes.

- Platoblockchain. Web3 Metaverse Intelligence. Razširjeno znanje. Dostopite tukaj.

- vir: https://www.forexcrunch.com/usd-cad-outlook-svb-collapse-weighing-on-the-greenback/

- : je

- 1

- 50 bps

- a

- O meni

- računi

- po

- agresivni

- naprej

- in

- Predvideno

- SE

- AS

- At

- Banka

- banka Kanade

- Osnova

- BE

- Medvjedast

- Medvedi

- ker

- pred

- Verjemite

- spodaj

- Poleg

- BoC

- Break

- Breaking

- by

- Akcija

- CAN

- Kanada

- Kanadski

- CFD-ji

- priložnost

- Graf

- preveriti

- Collapse

- Razmislite

- Konsolidirati

- Posoda

- Ustvarjanje

- plačila

- Trenutna

- datum

- Pade

- Povpraševanje

- namestnik

- podrobno

- Dollar

- indeks dolar

- Gospodarska

- Gospodarstvo

- oceniti

- dogodki

- pričakovanja

- pričakovati

- pričakuje

- doživlja

- ni uspelo

- Padec

- Fallen

- februar

- Fed

- konča

- Napoved

- forex

- iz

- goldinar

- Goldman Sachs

- Guverner

- Greenback

- Imajo

- Oklevajoča

- visoka

- Kako

- Vendar

- HTTPS

- Pomembno

- in

- Povečajte

- Indeks

- inflacija

- na začetku

- obresti

- Obrestne mere

- zainteresirani

- Invest

- Investitor

- Vlagatelji

- IT

- ITS

- januar

- Delovna mesta

- jpg

- Ključne

- dela

- trg dela

- učenje

- Stopnja

- Verjeten

- vrstica

- Long

- več

- izgubiti

- izgube

- najnižji nivo

- vzdrževati

- marec

- Tržna

- max širine

- ukrepe

- srečanja

- Denar

- mesec

- več

- premikanje

- skoraj

- Novo

- Naslednja

- of

- on

- Ostalo

- Outlook

- načrtovano

- platon

- Platonova podatkovna inteligenca

- PlatoData

- Točka

- točke

- možnost

- mogoče

- tlak

- Cena

- cenitev

- Ponudnik

- Push

- Potiskanje

- dvigniti

- Oceniti

- Cene

- dosegel

- Razmerje

- Izpusti

- Odpornost

- Trgovina na drobno

- Rise

- Tveganje

- Rogers

- ROW

- RSI

- s

- Sachs

- Je dejal

- višji

- sentiment

- premik

- shouldnt

- Razstave

- Silicij

- Silicon Valley

- breg silicijeve doline

- SIX

- GURS

- navedla

- Še vedno

- podpora

- ravni podpore

- SVG

- Bodite

- tehnični

- da

- O

- Fed

- zato

- zategovanje

- do

- današnje

- trgovini

- Trgovanje

- pod

- us

- USD / CAD

- Valley

- vrednost

- tehtanje

- ali

- ki

- bo

- z

- Vaša rutina za

- zefirnet