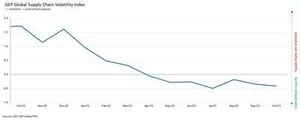

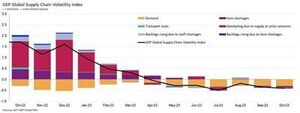

The GEP Global Supply Chain Volatility Index — the indicator tracking demand conditions, shortages, transportation costs, inventories and backlogs based on a monthly survey of 27,000 businesses — decreased again in October to -0.41, from -0.35 in September, indicating a 7th successive month of rising spare capacity across the world’s supply chains.

Additionally, the extent to which supplier capacity went underutilised was even greater than in September and August. Coupled with October’s downturn in demand for raw materials, components and commodities, this shows rising slack in global supply chains.

“While the shrinking of global suppliers’ order books is not worsening, there are no signs of improvement,” explained Jamie Ogilvie-Smals, vice president, consulting, GEP. “The notable increase in supplier capacity in Asia, which was driven by China, provides global manufacturers with greater leverage to drive down prices and inventories in 2024.”

A key finding from October’s report was the strongest rise in excess capacity across Asian supply chains since June 2020. Sustained weakness in demand, coupled with falling pressures on factories in Asia, indicates that the global manufacturing recession has further to run. With the exception of India, which continues to perform strongly, large economies in the region, such as Japan and China, are losing momentum.

Suppliers in Europe continue to report the largest level of spare capacity. In fact, the lower levels in GEP’s supply chain index for the continent have only been seen during the global financial crisis between 2008 and 2009. They highlight sustained weakness in economic conditions across the continent. Western Europe, particularly Germany’s manufacturing industry, is a key driver behind the region’s deterioration.

Relativno svetla točka je Severna Amerika, kjer imajo dobavne verige presežne zmogljivosti, vendar v veliko manjšem obsegu kot drugod, saj ameriško gospodarstvo še naprej kaže svojo odpornost, v popolnem nasprotju z Evropo.

Oktober 2023 Ključne ugotovitve

Demand: Demand for raw materials, components and commodities remains depressed, although the downturn seems to have stabilised. There are still no signs of conditions improving, however, as global purchasing activity fell again in October at a pace similar to what we’ve seen since around mid-year.

Demand: Demand for raw materials, components and commodities remains depressed, although the downturn seems to have stabilised. There are still no signs of conditions improving, however, as global purchasing activity fell again in October at a pace similar to what we’ve seen since around mid-year.- Zaloge: ob padajočem povpraševanju naši podatki kažejo še en mesec praznjenja zalog v globalnih podjetjih, kar kaže na prizadevanja za ohranitev denarnega toka.

- Pomanjkanje materiala: Poročila o pomanjkanju artiklov ostajajo na najnižji ravni od januarja 2020.

- Labour shortages: Shortages of workers are not impacting global manufacturers’ capacity to produce, with reports of backlogs due to inadequate labour supply running at historically typical levels.

- Transportation: Global transportation costs held steady with September’s level, although oil prices have declined in recent weeks.

Nestanovitnost regionalne dobavne verige

-

Severna Amerika: Indeks je padel na -0.34 z -0.30. To ostaja precej mehkejše od svetovnega povprečja in še naprej kaže na ZDA. gospodarstvo je pripravljeno na mehak pristanek.

- Evropa: Indeks se je z -0.90 dvignil na -1.01, vendar še vedno ostaja na ravni, ki kaže na precejšnjo gospodarsko krhkost.

- UK: Indeks se je z -0.93 nekoliko dvignil na -0.98. Kljub temu podatki kažejo na znatno povečanje presežne zmogljivosti pri dobaviteljih na trgih Združenega kraljestva.

- Asia: Notably, the index dropped to -0.38, from -0.20, highlighting the biggest rise in spare supplier capacity in Asia since June 2020 as the region’s resilience fades.

- Distribucija vsebine in PR s pomočjo SEO. Okrepite se še danes.

- PlatoData.Network Vertical Generative Ai. Opolnomočite se. Dostopite tukaj.

- PlatoAiStream. Web3 Intelligence. Razširjeno znanje. Dostopite tukaj.

- PlatoESG. Ogljik, CleanTech, Energija, Okolje, sončna energija, Ravnanje z odpadki. Dostopite tukaj.

- PlatoHealth. Obveščanje o biotehnologiji in kliničnih preskušanjih. Dostopite tukaj.

- vir: https://www.logisticsit.com/articles/2023/11/21/supply-chains-worldwide-remain-significantly-underutilised-gep-global-supply-chain-volatility-index

- :ima

- : je

- :ne

- :kje

- 000

- 01

- 121

- 20

- 2008

- 2020

- 2023

- 2024

- 27

- 30

- 300

- 35%

- 41

- 7.

- 90

- 98

- a

- čez

- dejavnost

- spet

- Čeprav

- Amerika

- in

- Še ena

- SE

- okoli

- AS

- asia

- asian

- At

- Avgust

- povprečno

- temeljijo

- bilo

- zadaj

- med

- največji

- knjige

- Bright

- podjetja

- vendar

- by

- kapaciteta

- verige

- verige

- Kitajska

- Blago

- deli

- Pogoji

- velika

- svetovanje

- celina

- naprej

- se nadaljuje

- kontrast

- stroški

- skupaj

- kriza

- datum

- zmanjšala

- Povpraševanje

- zaslon

- navzdol

- PADAJ

- pogon

- vozi

- voznik

- padla

- 2

- med

- Gospodarska

- Gospodarski pogoji

- gospodarstev

- Gospodarstvo

- prizadevanja

- drugje

- Eter (ETH)

- Evropa

- Tudi

- izjema

- presežek

- razložiti

- obseg

- Dejstvo

- tovarn

- Zbledi

- Falling

- finančna

- finančna kriza

- iskanje

- za

- krhkost

- iz

- nadalje

- Nemčija

- Globalno

- svetovni finančni

- Globalna finančna kriza

- več

- Imajo

- Hero

- več

- Označite

- poudarjanje

- Zgodovinsko

- Vendar

- HTTPS

- udarne

- Izboljšanje

- izboljšanju

- in

- Povečajte

- Indeks

- india

- označuje

- označuje

- okvirno

- Kazalec

- Industrija

- ITS

- Jamie

- januar

- Japonska

- jpg

- junij

- Ključne

- Dela

- pristanek

- velika

- Največji

- manj

- Stopnja

- ravni

- Vzvod

- izgube

- nižje

- najnižja

- Proizvajalci

- proizvodnja

- predelovalne industrije

- Prisotnost

- materiali

- Momentum

- mesec

- mesečno

- veliko

- št

- sever

- North America

- opazen

- predvsem

- oktober

- of

- Olje

- on

- samo

- Da

- naročite knjige

- naši

- Pace

- zlasti

- opravlja

- platon

- Platonova podatkovna inteligenca

- PlatoData

- Točka

- pripravljen

- ohranjanje

- Predsednik

- Cene

- proizvodnjo

- zagotavlja

- nakup

- Surovi

- nedavno

- recesija

- okolica

- relativna

- ostajajo

- ostanki

- poročilo

- Poročila

- odpornost

- Rise

- narašča

- ROSE

- Run

- tek

- s

- Zdi se,

- videl

- september

- pomanjkanja

- Razstave

- bistveno

- Znaki

- Podoben

- saj

- Slack

- Soft

- Komercialni

- stark

- dinamičnega ravnovesja

- Še vedno

- najmočnejši

- Močno

- precejšen

- taka

- predlagajte

- dobavitelj

- dobavitelji

- dobavi

- dobavne verige

- Napajalne verige

- Anketa

- trajno

- kot

- da

- O

- svet

- njihove

- Tukaj.

- jih

- ta

- do

- Sledenje

- Prevoz

- tipičen

- Uk

- us

- Ameriško gospodarstvo

- Ve

- vice

- Podpredsednica

- Volatilnost

- je

- we

- šibkost

- Weeks

- šla

- Zahodna

- Zahodna Evropa

- Kaj

- ki

- medtem

- z

- delavci

- svet

- po vsem svetu

- zefirnet