EUR/USD has extended its impressive rally and is trading at 1.0019, up 0.60% on the day. The US dollar was broadly lower on Friday after the nonfarm payroll report and the euro rocketed 2.1%.

German industrial orders rebound

The week started on a high note in Germany, as Industrial Production for September rose for the first time in two months, up 0.6% MoM. This followed a -1.2% reading in August and beat the forecast of 0.2%. The reading was surprisingly strong, given that industrial companies continue to complain about bottlenecks and a shortage of products. Last week, German Factory Orders fell by 4.0% and the war in Ukraine and the energy crisis remain significant headwinds for German industry and the economy as a whole.

The grim economic outlook is a major headache for ECB policymakers, who must maneuver delicately between soaring inflation and a weak eurozone economy. The ECB joined the rate-hiking dance late and finds itself well behind the inflation curve, as headline inflation in the eurozone jumped to 10.7% in October, up from 9.9% in September. The ECB will have to double down on its rate hikes in order lower double-digit inflation and ECB President Lagarde has said that she will use “all the tools” available to bring inflation back to the ECB’s 2% target.

The US dollar retreated against all the major currencies on Friday, and the euro took full advantage, with gains above 2%. Investors were looking for any excuse to plow into equities after a dreadful spell, and the employment report provided the opportunity, as nonfarm payrolls fell to 200,000, down from 315,000, the lowest level since December 2020. As well, unemployment rose from 3.5% to 3.7%, while the increase in wage growth was conveniently ignored. The likelihood of the next rate hike being 0.50%, rather than 0.75%, has risen since the NFP release, which sent the dollar sharply lower. Still, the rate forecasts are sure to change, with another NFP release and two inflation reports still to come before the meeting.

.

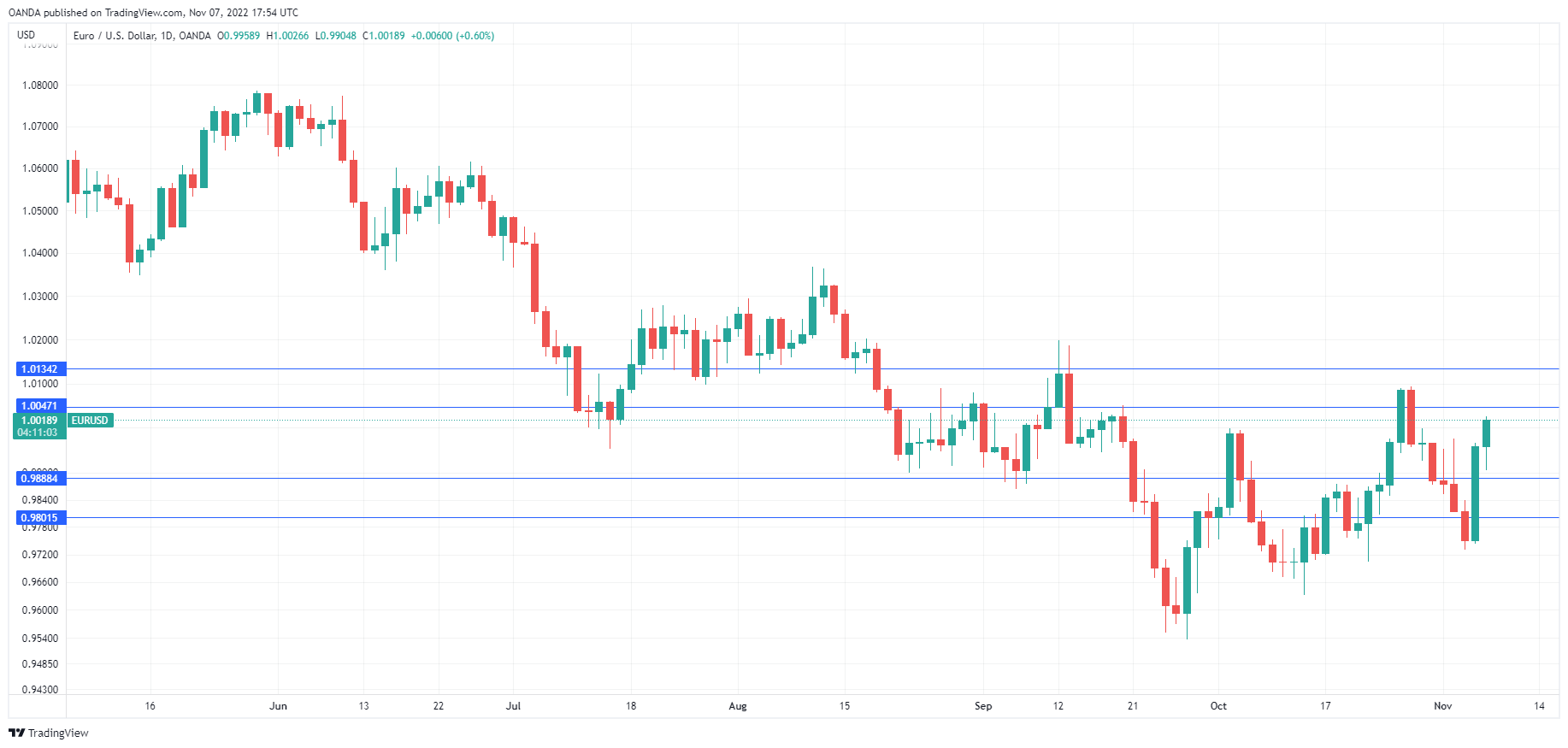

EUR / USD Tehnični

- EUR/USD se sooča z odporom pri 1.0047 in 1.0134

- Podpora je na 0.9888 in 0.9801

Ta članek je samo za splošne informacije. To ni naložbeni nasvet ali rešitev za nakup ali prodajo vrednostnih papirjev. Mnenja so avtorji; ne nujno korporacije OANDA Corporation ali katere koli njene podružnice, hčerinske družbe, uradnikov ali direktorjev. Trgovanje z vzvodom je visoko tveganje in ni primerno za vse. Lahko izgubite vsa vložena sredstva.

- Bitcoin

- blockchain

- skladnost z verigo blokov

- konferenca blockchain

- Centralne banke

- coinbase

- coingenius

- Soglasje

- kripto konferenca

- kripto rudarstvo

- cryptocurrency

- Decentralizirano

- Defi

- Digitalna sredstva

- ECB

- ethereum

- EUR

- EUR / USD

- inflacija v evroobmočju

- FX

- Nemška tovarniška naročila

- Nemška industrijska proizvodnja

- strojno učenje

- MarketPulse

- Novice dogodkov

- Novice

- nezamenljiv žeton

- Plačilne liste nekmetij

- platon

- platon ai

- Platonova podatkovna inteligenca

- Platoblockchain

- PlatoData

- platogaming

- poligon

- dokazilo o vložku

- Tehnična analiza

- US nofarm payrolls report

- ameriški dolar

- W3

- zefirnet