Obrnjeni hipotekarni dolg med kanadskimi starejšimi skokovito narašča za 31 % na letni ravni

Boljše stanovanje | Daniel Wong | Feb 6, 2023

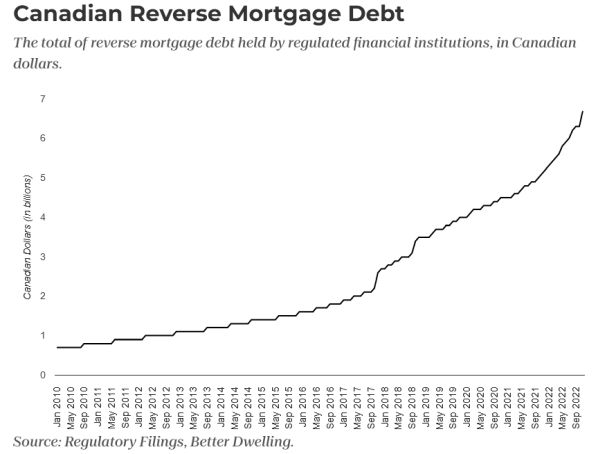

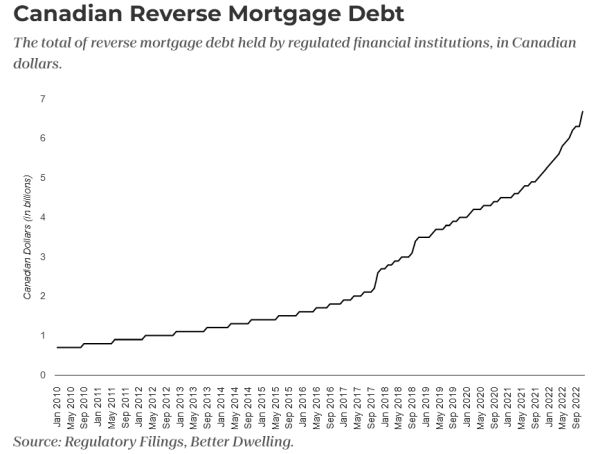

Reverse mortgage debt has recently surged in growth, with the debt rising at an unusual fast rate for any credit segment.

- Canadian homeowners aren’t shy about cashing in on their windfall, especially seniors. Regulatory filings with OSFI, Canada’s bank regulator, show reverse mortgage debt surged novembra.

- The outstanding balance rose 5.9% (+$370 million) to $6.7 billion in November.

- The balance is now 31.0% (+$1.6 billion) higher than a year before.

Glej: Kanadski posojilojemalci, obremenjeni z naraščajočimi obrestnimi merami in dolgom, iščejo hipotekarne alternative

- Povratne hipoteke are loans disbursed as lump sum or regular payments, secured by your home equity. It’s similar to a home equity line of credit (HELOC), but the big difference is in repayment—you don’t have to make regular payments or prove you have the debt service capacity.

- The catch is interest accumulates in the background, eroding the home equity you’ve built up. These loans generally have higher interest rates than traditional HELOCs or mortgage refinancing.

- The sudden boom for reverse mortgage debt is due to a combination of monetary and demographic factors. Since repayment isn’t required, rising rates are likely allowing the debt to accumulate faster for those without fixed terms.

Nadaljujte s celotnim člankom -> tukaj

O National Crowdfunding & Fintech Association (NCFA Canada) je ekosistem finančnih inovacij, ki ponuja izobraževanje, tržno inteligenco, vodenje industrije, možnosti povezovanja in financiranja ter storitve za tisoče članov skupnosti in tesno sodeluje z industrijo, vlado, partnerji in podružnicami, da bi ustvaril živahen in inovativen fintech in financiranje industrija v Kanadi. Decentralizirana in distribuirana NCFA sodeluje z globalnimi zainteresiranimi stranmi in pomaga pri inkubiranju projektov in naložb v fintech, alternativne finance, crowdfunding, medsebojno financiranje, plačila, digitalna sredstva in žetone, blockchain, kripto valute, regtech in insurtech sektorje. pridruži se Kanadska skupnost Fintech & Funding danes BREZPLAČNO! Ali pa postanite prispeva član in dobiš perke. Za več informacij obiščite: www.ncfacanada.org

O National Crowdfunding & Fintech Association (NCFA Canada) je ekosistem finančnih inovacij, ki ponuja izobraževanje, tržno inteligenco, vodenje industrije, možnosti povezovanja in financiranja ter storitve za tisoče članov skupnosti in tesno sodeluje z industrijo, vlado, partnerji in podružnicami, da bi ustvaril živahen in inovativen fintech in financiranje industrija v Kanadi. Decentralizirana in distribuirana NCFA sodeluje z globalnimi zainteresiranimi stranmi in pomaga pri inkubiranju projektov in naložb v fintech, alternativne finance, crowdfunding, medsebojno financiranje, plačila, digitalna sredstva in žetone, blockchain, kripto valute, regtech in insurtech sektorje. pridruži se Kanadska skupnost Fintech & Funding danes BREZPLAČNO! Ali pa postanite prispeva član in dobiš perke. Za več informacij obiščite: www.ncfacanada.org

Podobni Posts

- Distribucija vsebine in PR s pomočjo SEO. Okrepite se še danes.

- Platoblockchain. Web3 Metaverse Intelligence. Razširjeno znanje. Dostopite tukaj.

- vir: https://ncfacanada.org/reverse-mortgage-debt-skyrockets-31-yoy-among-canadian-seniors/

- $ 6.7 milijarde

- 2018

- 7

- a

- O meni

- Akumulirajte

- podružnice

- Dovoli

- alternativa

- alternative

- med

- in

- članek

- Sredstva

- ozadje

- Ravnovesje

- Banka

- postanejo

- pred

- Big

- Billion

- blockchain

- boom

- posojilojemalci

- zgrajena

- predpomnilnik

- Kanada

- Kanadski

- kapaciteta

- wrestling

- tesno

- kombinacija

- skupnost

- ustvarjajo

- kredit

- Crowdfunding

- cryptocurrency

- Daniel

- Dolg

- Decentralizirano

- demografske

- Razlika

- digitalni

- Digitalna sredstva

- porazdeljena

- dont

- ekosistem

- Izobraževanje

- , ki se ukvarjajo

- Vpis

- pravičnost

- zlasti

- Eter (ETH)

- FAST

- hitreje

- financiranje

- finančna

- FINTECH

- Všita

- iz

- polno

- Financiranje

- splošno

- dobili

- Globalno

- vlada

- Rast

- Pomaga

- več

- Domov

- HTTPS

- in

- Industrija

- Podatki

- Inovacije

- inovativne

- Insurtech

- Intelligence

- obresti

- Obrestne mere

- naložbe

- John

- Verjeten

- vrstica

- Posojila

- Znamka

- Tržna

- max širine

- član

- člani

- milijonov

- več

- Hipotekarni

- mreženje

- november

- Priložnosti

- Neporavnani

- partnerji

- Plačila

- peer to peer

- perks

- platon

- Platonova podatkovna inteligenca

- PlatoData

- prosim

- projekti

- Dokaži

- zagotavlja

- Oceniti

- Cene

- Pred kratkim

- Regtech

- redni

- regulator

- regulatorni

- odplačilo

- obvezna

- nazaj

- narašča

- ROSE

- Sektorji

- Zavarovano

- Seek

- Segment

- upokojenci

- Storitev

- Storitve

- Prikaži

- Podoben

- saj

- Nebesne rakete

- interesne skupine

- Upravljanje

- nenadoma

- povečal

- Pogoji

- O

- njihove

- tisoče

- Naslov

- do

- danes

- Boni

- tradicionalna

- nenavadno

- živahno

- brez

- deluje

- leto

- Vaša rutina za

- zefirnet