- XAU/USD retreated, but the bias remains bullish in the short term.

- Nov višji vrh aktivira nadaljnjo rast.

- Gold could only test and retest the immediate support levels before jumping higher.

The gold price dropped during the New York session on Wednesday. However, this could be corrective in nature. The metal climbed as high as $1,844 yesterday.

-Vas zanima več o Posredniki ECN? Preverite naš podroben vodnik-

However, now it has turned to the downside, trading at $1,831 at the time of writing. After its strong growth, XAU/USD could retreat a little trying to accumulate more bullish energy before developing a new leg higher.

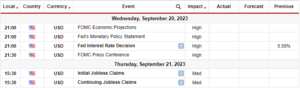

In the short term, gold rallied after the US CB Consumer Confidence came in worse than expected. Surprisingly or not, the XAU/USD retreated a little, even though the ISM Manufacturing PMI came in worse than expected yesterday.

Today, the Eurozone CPI Flash Estimate may report an 8.3% growth versus 8.6% growth in the previous reporting period, while Core CPI Flash Estimate rose by 5.3%. In addition, the Eurozone Unemployment Rate is expected to remain steady at 6.6%.

The US Unemployment Claims should have an impact as well. The indicator may increase from 192K to 196K last week. Revised Nonfarm Productivity and Revised Unit, Labor Costs data will also be released. Tomorrow, the US ISM Services PMI is seen as a high-impact event.

Tehnična analiza cene zlata: Korektivna slabost

Technically, the XAU/USD turned to the downside after reaching the supply zone. Its failure to hit $1,847 former highs signaled exhausted buyers. Still, the price could try to develop a new bullish momentum as long as it stays above the $1,823 – 1,818 area.

-Vas zanima več o zaslužiti v forexu? Preverite naš podroben vodnik-

The price could retest the immediate support levels and the demand zone before returning higher. The retreat could bring us new long opportunities. The $1,847 former high represents the first major target. A larger growth could be activated only after a valid breakout through this level.

Breaking out from the down channel pattern, XAU/USD signaled that the leg down ended and that the buyers should take it higher again. Jumping and stabilizing above the 23.6% retracement level may announce an upside continuation.

Ali zdaj želite trgovati na forexu? Investirajte v eToro!

67% računov malih vlagateljev izgubi denar pri trgovanju s CFD-ji pri tem ponudniku. Razmislite, ali si lahko privoščite, da tvegate izgubo denarja.

- Distribucija vsebine in PR s pomočjo SEO. Okrepite se še danes.

- Platoblockchain. Web3 Metaverse Intelligence. Razširjeno znanje. Dostopite tukaj.

- vir: https://www.forexcrunch.com/gold-price-tempting-more-buyers-all-eyes-on-us-nfp/

- 1

- a

- O meni

- nad

- računi

- Akumulirajte

- Poleg tega

- po

- vsi

- Analiza

- in

- Objavi

- OBMOČJE

- pred

- pristranskosti

- zlom

- prinašajo

- Bikovski

- kupci

- CFD-ji

- Channel

- preveriti

- terjatve

- Plezal

- zaupanje

- Razmislite

- Potrošnik

- Posoda

- nadaljevanje

- Core

- stroški

- bi

- CPI

- datum

- Povpraševanje

- podrobno

- Razvoj

- razvoju

- navzdol

- slaba stran

- padla

- med

- energija

- oceniti

- Evroobmočje

- CPI v euroobmočju

- Tudi

- Event

- Pričakuje

- oči

- Napaka

- prva

- Flash

- forex

- Nekdanji

- iz

- nadalje

- Gold

- cena zlata

- Rast

- visoka

- več

- Najvišje

- hit

- Vendar

- HTTPS

- Takojšen

- vpliv

- in

- Povečajte

- Kazalec

- zainteresirani

- Invest

- Investitor

- IT

- dela

- večja

- Zadnja

- UČITE

- Stopnja

- ravni

- malo

- Long

- izgubiti

- izgube

- velika

- proizvodnja

- max širine

- kovinski

- Momentum

- Denar

- več

- Narava

- Novo

- NY

- nfp

- Nekmetija

- Priložnosti

- Vzorec

- Obdobje

- platon

- Platonova podatkovna inteligenca

- PlatoData

- pmi

- prejšnja

- Cena

- produktivnost

- Ponudnik

- Oceniti

- dosegli

- sprosti

- ostajajo

- ostanki

- poročilo

- Poročanje

- predstavlja

- Trgovina na drobno

- . \ t

- vrnitev

- Tveganje

- ROSE

- ROW

- Storitve

- Zasedanje

- Kratke Hlače

- shouldnt

- dinamičnega ravnovesja

- Še vedno

- močna

- dobavi

- podpora

- ravni podpore

- SVG

- Bodite

- ciljna

- tehnični

- Tehnična analiza

- Test

- O

- skozi

- čas

- do

- jutri

- trgovini

- Trgovanje

- Obrnjen

- brezposelnosti

- Stopnja brezposelnosti

- Enota

- Upside

- us

- Zaupanje potrošnikov US CB

- US ISM Services PMI

- nas NFP

- Zahtevki za brezposelnost v ZDA

- Proti

- Sreda

- teden

- ali

- medtem

- bo

- pisanje

- XAU / USD

- Vaša rutina za

- zefirnet