- The XAU/USD should develop a larger rebound only after taking out the resistance levels.

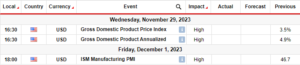

- The economic data could shake the markets tomorrow.

- Nova nižja najnižja vrednost aktivira več padcev.

The gold price maintained a choppy price action during the earlier London session. The metal is trading at $1,877 at the time of writing.

-Če vas zanima forex demo računi, preverite naš podroben vodnik-

Fundamentally, the Fed Chair Powell Speaks and FOMC Member Williams Speaks failed to bring a clear direction. Today, the UK Monetary Policy Report Hearings and the EU Economic Forecasts could bring some volatility in XAU/USD. Furthermore, the US Unemployment Claims is expected at 191K in the last week versus 183K in the previous reporting period.

Tomorrow, the economic calendar is filled with high-impact events. The UK Gross Domestic Product may report a 0.3% drop versus the 0.1% growth in the previous reporting period. The Prelim GDP, Goods Trade Balance, Construction Output, Index of Services, Manufacturing Production, and Industrial Production data will also be released.

Moreover, the US Prelim UoM Consumer Sentiment is expected at 65.0 points above 64.9 points in the previous reporting period. The Canadian Unemployment Rate could climb from 5.0% to 5.1%, while Employment Change is forecasted to drop from 104.0K to 15.0K. All these are seen as high-impact events and could shake the markets.

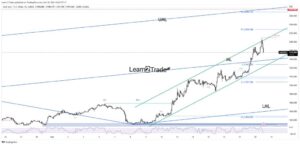

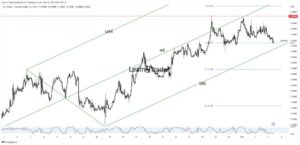

Gold price technical analysis: Upside correction

From the technical point of view, the price is located within an up-channel pattern. It continues to move sideways between the $1,886 and $1,861 levels.

-Če vas zanima Islamski forex posredniki, preverite naš podroben vodnik-

The price action signaled that the downside movement ended, and buyers could take the lead. Still, the yellow metal could extend its sideways movement if it stays under the 23.6% ($1,884) retracement level. Only breaking above the $1,886 and above the channel’s upside line may announce further growth.

On the contrary, false breakouts through the near-term resistance levels may announce a new sell-off. Still, a downside continuation could be activated by a valid breakdown below the former lows. Dropping and closing below $1,861 activates more declines ahead, confirming the current channel as a downside continuation formation.

Ali zdaj želite trgovati na forexu? Investirajte v eToro!

67% računov malih vlagateljev izgubi denar pri trgovanju s CFD-ji pri tem ponudniku. Razmislite, ali si lahko privoščite, da tvegate izgubo denarja.

- Distribucija vsebine in PR s pomočjo SEO. Okrepite se še danes.

- Platoblockchain. Web3 Metaverse Intelligence. Razširjeno znanje. Dostopite tukaj.

- vir: https://www.forexcrunch.com/gold-price-extending-the-upside-range-eying-key-us-uk-data/

- 202

- 9

- a

- nad

- računi

- Ukrep

- po

- naprej

- vsi

- Analiza

- in

- Objavi

- Ravnovesje

- spodaj

- med

- Razčlenitev

- Breaking

- breakouts

- prinašajo

- kupci

- Koledar

- klic

- Kanadski

- CFD-ji

- Stol

- spremenite

- Channel

- preveriti

- terjatve

- jasno

- plezanje

- zapiranje

- Razmislite

- Gradbeništvo

- Potrošnik

- potrošnikov

- Posoda

- nadaljevanje

- se nadaljuje

- nasprotno

- bi

- Trenutna

- datum

- Pade

- Predstavitev

- podrobno

- Razvoj

- smer

- Domače

- slaba stran

- Drop

- Spuščanje

- med

- prej

- ECB

- Gospodarska

- zaposlovanja

- EU

- dogodki

- Pričakuje

- razširiti

- razširitev

- ni uspelo

- Fed

- Fed predsednik

- Predsednik Fed Powell

- napolnjena

- FOMC

- forex

- Oblikovanje

- Nekdanji

- iz

- v osnovi

- nadalje

- Poleg tega

- BDP

- Gold

- cena zlata

- blago

- bruto

- Rast

- visoka

- Pohodi

- HTTPS

- in

- Indeks

- industrijske

- Industrijska proizvodnja

- zainteresirani

- Invest

- Investitor

- IT

- Ključne

- večja

- Zadnja

- vodi

- Stopnja

- ravni

- vrstica

- nahaja

- London

- izgubiti

- izgube

- nizka

- Najnižje

- proizvodnja

- Prisotnost

- max širine

- član

- kovinski

- Denarno

- Monetarna politika

- Denar

- več

- premikanje

- Gibanje

- Novo

- Outlook

- Vzorec

- Obdobje

- platon

- Platonova podatkovna inteligenca

- PlatoData

- Točka

- Pogled na točko

- točke

- politika

- Powell

- prejšnja

- Cena

- CENA AKCIJA

- Analiza cen

- Izdelek

- proizvodnja

- Ponudnik

- območje

- Oceniti

- odboj

- sprosti

- poročilo

- Poročanje

- Odpornost

- Trgovina na drobno

- . \ t

- Tveganje

- ROW

- razprodaja

- sentiment

- Storitve

- Zasedanje

- shouldnt

- vstran

- nekaj

- Govori

- Še vedno

- SVG

- Bodite

- ob

- tehnični

- Tehnična analiza

- O

- Fed

- UK

- skozi

- čas

- do

- danes

- jutri

- trgovini

- Trgovanje

- Uk

- pod

- brezposelnosti

- Stopnja brezposelnosti

- Razpoloženje potrošnikov UoM

- Upside

- us

- Zahtevki za brezposelnost v ZDA

- Proti

- Poglej

- Volatilnost

- teden

- ali

- medtem

- bo

- v

- pisanje

- XAU / USD

- Vaša rutina za

- zefirnet