Beseda "FINTECH” has become such a hype and such a widely used term, that it can actually mean anything today. Therefore when people ask for trends in the Fintech industry, this becomes harder and harder to answer, as anything even remotely

associated with financial services can be linked to Fintech.

Additionally traditional financial players (like banks, insurers, brokers, stock exchanges, but also traditional financial software vendors like Temenos, Sopra, Fiserv…) have also caught up in their digitalization and modernization roadmaps and have launched

Fintech innovation labs, meaning they can just as well be categorized under Fintech.

Lahko bi torej rekli, da:

-

As tehnologija je postala tako ključna v industriji finančnih storitev, lahko celoten sektor finančnih storitev kategoriziramo kot Fintech.

-

Zaradi vzpon ekosistemov in vgrajenih financ, financial services companies start to offer more and more services in adjacent sectors (like HR Tech, MarketingTech/MadTech, EdTech, AccountingTech…) and also players from other industries

start to offer more and more financial services. E.g. big tech players like Apple (offering Apple Pay, Apple Pay Later and a credit card together with Goldman Sachs), Uber (offering Uber Wallet and Uber Debit and Credit card), Alibaba (with AliPay) or Grab

(with GrabFin and products like Earn+), but also eCommerce players like Shopify (offering Shopify Capital to give fast business loans and cash advances) or TelCo players (like Safaricom’s M-Pesa, Turkcell’s Paycell, Telefónica Movistar Money or Orange Bank)

have all entered the financial services sector. As a result, Fintech meje se celo zabrišejo v druge sektorje.

Vse to pomeni, da postane zelo težko govoriti o Fintechu kot celoti.

Ko stvari postanejo tako neurejene, kategorizacija je tipičen človeški refleks.

Unfortunately categorization is not that easy as you can categorize across multiples axes (based on product offering, type of customers serviced, region…) and obviously many players cannot be put in 1 category, as they provide different products and services

in different markets.

Kljub temu lahko kategorizacija še vedno daje nekaj zanimivih vpogledov v celoten trg, zaradi česar je še vedno zelo zanimiva in uporabna vaja.

Ko gledate različne osi kategorizacije, sem identificiral naslednje osi (čeprav ta seznam zagotovo ni popoln):

sekira 1: kategorizirajte glede na ciljno skupino strank

To omogoča kategorizacijo Fintech industrije v 3 velike skupine:

-

Neposredni ponudniki finančnih storitev, which will target (end-) customers directly. This group can be split in B2C (e.g. neobanks like Revolut and Monzo), B2B (e.g. neobanks like Starling Bank) or even B2B2C players (i.e. offering a service

to a private customer, but via a business paying for this service, e.g. Klarna) players. Often Fintech players will also target a specific customer niche, which is underserved or not sufficiently and personally addressed, e.g. freelancers (e.g. Lili), immigrants

(e.g. Majority), women (e.g. Herconomy), the LGBTQ+ community (e.g. Pride bank or Daylight), specific professions (lawyers, doctors, artists…)… -

Ponudniki storitev in produktov za (druga) podjetja za finančne storitve (like incumbent banks and insurers, but also other new (disruptive Fintech) players). This group can be split according to which companies they offer services to,

i.e. services to incumbent banks, incumbent insurers, incumbent infrastructure players or new (Fintech) players. Examples in this group are the traditional financial software vendors like Temenos, Fiserv, SOPRA…, but also new players like e.g. ComplyAdvantage. -

Ponudniki storitev in izdelkov podjetjem v drugih sektorjih(podjetja, ki potrebujejo finančne podatke ali storitve za zagotavljanje boljše uporabniške izkušnje za svoje stranke) narediti most (integrirati) do finančnih storitev.

Obviously this group can be split depending on which other sector they offer financial service integration services to, e.g. eCommerce, HR & Payroll Tech, MobilityTech, AccountingTech, MadTech, Real Estate Tech… Examples in this group are PSPs like Stripe,

Paypal and Adyen.

sekira 2: kategorizirajte glede na moteče narave družbe

-

Fintechs, ki ponujajo obstoječe finančne storitve in produkte. These are players that are typically challenging existing players by offering similar services and products but cheaper, more digital and/or with a better user experience. Often

they target also specific groups which are excluded or underserved (e.g. products and services not adapted to their specific needs and desires) in the traditional financial landscape (i.e. financial inclusion). In this category, you can find the typical neo-banks

or challenger banks (e.g. Revolut, Monzo, N26…), which still sell mainly traditional banking products, like current and saving accounts, credits, investments and/or debit and credit cards.

V tej kategoriji lahko najdemo tudi trgovalne/naložbene platforme, kot je npr. Robinhood. -

Fintechs, ki ponujajo vidne storitve z dodano vrednostjo poleg obstoječih produktov finančnih storitev, typically offering a more guided advise and more embedded experiences. Typical examples are robo-advisors and personal financial management tools,

but also financial marketplaces (e.g. Raisin for deposits) and price comparators (e.g. Financer.com). -

Fintechs, ki delujejo kot nevidni zadnji dobavitelj tradicionalnim finančnim akterjem. Ta kategorija ponuja zunanje izvajanje programske opreme in poslovne obdelave finančnim akterjem.

-

Fintechs, ki ponujajo alternativne finančne storitve in produkte, i.e. products and services which challenge the existing landscape in a more fundamental way, by redesigning the intermediation function of banks and insurers. Typical examples

in this category are P2P lenders, crowdfunding, DeFi…

Ta kategorizacija bo tudi določila, ali igralec Fintech deluje kot konkurent, partner ali dobavitelj obstoječih prvotnih igralcev.

Often Fintechs start in the first category (disrupting the market with large ambitions), but soon notice the difficulties and costs to attack the market directly and therefore pivot into partnering with existing players to profit from their existing reputation,

expertise, financial means and customer basis. For the incumbent player, they offer a very quick and low risk way to offer additional innovative services to their customers.

sekira 3: kategorizirajte glede na vrsto in obseg ponujenih storitev s strani podjetja

Očitno je programska oprema vedno sestavni del ponudbe storitev vsakega podjetja Fintech, vendar je ta programska oprema lahko glavni izdelek ali podporno orodje za ponujanje druge storitve.

Delimo lahko na podlagi:

-

Je podjetje ki ponuja samo 1 določen izdelek ali celotno paleto, e.g. a specific product could be a RegTech vendor (e.g. Chainalysis), while BaaS players (Banking as a Service, e.g. solarisBank, MangoPay, Marqeta…) typically offer a whole

range of products? -

Je poudarek na prodaja programske opreme ali programska oprema omogoča prodajo drugih storitev, i.e. financial services, business process outsourcing, legal/compliance/risk management…? E.g. traditional financial software providers (e.g. Temenos,

SOPRA, FiServ, Infosys..) are still offering solutions deployed on-premise (or in private cloud) and via a licensing model, but more and more companies (including those traditional players) are offering their software in a SaaS (software as a service) model

or even a BaaS model (Business/Banking as a Service). -

Je tudi podjetje z uporabo njegovih licenc pridobljeno od finančnih regulatorjev (npr. dovoljenje za bančno poslovanje, dovoljenje za plačilno institucijo, dovoljenje za izdajo elektronskega denarja, dovoljenje za kreditno institucijo …) kot komercialni predlog?

sekira 4: kategorizirajte glede na vrsta ponujene storitve in/ali izdelka

To je vrsta kategorizacije, ki se zelo pogosto uporablja in ima celo posebno terminologijo, kot nadaljevanje izraza Fintech, kot so WealthTech, RegTech ...

Tipične kategorije tukaj so:

-

BankTech (Digital banking). This group contains on the one hand the disruptive neobanks like Chime, Nubank, Revolut, Monzo, Atom, N26 or Starling and on the other hand the BaaS (Banking as a Service) platforms like solarisBank, Bankable

or Cambr. We could also include in this category (although often also put as a separate category) the PFM companies (Personal Financial Management), that offer advice and help with budgeting, e.g. Mint, Acorns, PocketGuard, Level Money, YNAB (You Need A Budget),

Intuit, Wally… -

WealthTech (Digital Wealth Management): this contains a whole group of Fintech offerings to invest money in financial assets (like stocks, bonds…) in a better way (more user friendly, cheaper, more automated…). This category can be split-up

in 2 sub-blocks, i.e.:-

RoboAdvisors, ki ponuja tehnologijo pametnega algoritma za zagotavljanje investicijskih nasvetov in priporočil. Npr. Wealthfront, Acorns, Betterment, Wealthsimple, Charles Schwab, Vanguard…

-

Maloprodajne naložbene platforme, npr. Robinhood, Tradier, E*Trade, Interactive Brokers, iCapital…

-

-

LendingTech ali LendTech (Credits): providing all types of new digital solutions to consumers and businesses (usually small businesses) for lending money in a more efficient and faster way (often using new technologies like AI/ML, digital

identity management…). This space is enormous as well, going from P2P Lending (like LendingClub, Prosper or OnDeck) and Crowdlending platforms (like Indiegogo, Kickstarter, GoFundMe or Patreon), over BNPL (Buy Now Pay Later, like Affirm, Klarna or AfterPay)

all the way to digital lenders (like Funding Circle, Kabbage, Lendio, Lending Club, SoFi or Better Mortgage), credits based on new collaterals like invoicing factoring (e.g. Bluevine, Resolve, altLine…) and alternative credit (scoring) systems (e.g. micro-lending)

allowing to offer credits to the unbanked and underbanked (like Credit Karma, Nova Credit, Quizzle, Credit Sesame or Tala). -

RegTech: this group of companies helps financial service firms via innovative technology to meet regulatory compliance and security rules, with a strong focus on AML (Anti-Money Laundering), KYC (Know Your Customer protocols) and all financial

directives like Basel II/III/IV, FATCA, MiFID, Solvency II… Often those companies provide also access to large amounts of financial research and data, used to verify compliance of customers and transactions. Examples are companies like Alyne, Suade, DataGuard,

ComplyAdvantage, Fenergo, Onfido, Chainalysis, Ascent Regtech, Hummingbird… -

Insurtech: these companies seek to use technical innovation to simplify and streamline the insurance business model. Typically they focus on delivering insurance quotes online in a matter of minutes , digitize the whole claim management

process and provide alternative insurance underwriting (using new data sources), e.g. Usage Based Insurance (UBI). Examples are companies like Oscar Health, Gusto, Clover Health, Lemonade, Qover, Digit Insurance, Policy Bazaar… -

PayTech (Payment technology): these companies provide different tools to make payment transactions as secure and efficient (frictionless) as possible. A lot of well-known (Fintech) names are in this space, like Paypal, VISA, MasterCard,

Stripe, Venmo, AliPay, Adyen, Mollie, Square, Wise, Ripple, iZettle… This category can be split in players that-

Olajšajte plačila tako fizičnim trgovcem prek naprav na prodajnem mestu kot tudi prek spleta (npr. Stripe, Paypal, VIVA Wallet, Adyen, Mollie, SumUp…),

-

Zagotovite nove rešitve za mobilno plačevanje (P2P in pri trgovcih), kot so Venmo, Payconiq, AliPay…

-

Omogočite mednarodne prenose denarja, kot sta Wise ali Ripple

-

-

Infrastrukturni igralci who provide the underlying gateways and connectivity to other players in the industry (other banks, stock exchanges, data providers, regulatory instances…). Important in this group are the players offering services

to enable and consume Open Banking, like Tink, Plaid or TrueLayer. -

Infrastrukturni igralci who provide the underlying gateways and connectivity to other players in the industry (other banks, stock exchanges, data providers, regulatory instances…). Important in this group are the players offering services

to enable and consume Open Banking, like Tink, Plaid or TrueLayer. -

Igralci kripto, blokovne verige in DeFi: this group contains all companies building a new financial (eco)system, based on a distributed ledger technology (blockchain). This ecosystem is very disruptive, as it challenges the ground rules of our

financial system. Companies like Coinbase, Alchemy, Ava Labs, Circle, Kraken, Binance, Gemini Cryptocurrency are most known in this space. Obviously this space can be split-up in multiple sub-categories like crypto-currency exchanges/trading platforms, crypto-wallet

providers, NFT marketplaces, crypto-saving and crypto-lending players, players offering tooling to setup new blockchains…

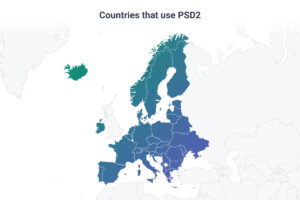

sekira 5: kategorizirajte glede na državo in/ali regijo kjer podjetje pretežno deluje (ustvarja svoje prihodke).

Očitno se lahko razdelimo glede na celine, regije in/ali posamezne države, vendar pogosto vidimo mešanico, ki temelji na skupnih značilnostih v ureditvi in kulturi.

Najprej jih je nekaj države which due to their size (both in population and general economy, but often also more specifically due to their size of their financial services sector) and specifics. In the first place we identify here the US (main

hubs in Silicon Valley, e.g. Stripe, Coinbase, Chime, Plaid, Paypal or Robinhood and New York, e.g. Better.com, Oscar, Chainalysis or Betterment), China (main hub: Beijing, e.g. Waterdrop, Ant Financial, Tencent or Lufax), India (main hub: Bengaluru, e.g.

Razorpay, Digit Insurance or CRED) and Russia (main hub: Moscow, e.g. Tinkoff, Sber Bank or Yandex.Money), but we can also include Canada (main hub: Toronto, e.g. Wealthsimple, FreshBooks or Clearco), Australia (main hub: Melbourne, e.g. Afterpay or Airwallex),

the UK (main hub: London, e.g. Checkout.com, Revolut, OakNorth or Blockchain.com) and even Israel(main hub: Tel Aviv, e.g. eToro) in this list.

Potem so tu še regije, with a lot of commonalities, where often Fintechs active in one country will quite fast expand to other countries in that same region, e.g. South-East Asia (main hubs in Singapore, e.g. Arttha, Go-Jek or Coda Payments, Hong

Kong, e.g. Amber Group or Babel Finance and Jakarta in Indonesia, e.g. OVO, Mandiri or Linkaja), the Middle East(main hubs in Dubai, e.g. Souqalmal.com or Beehive and Abu Dhabi, e.g. NymCard), LatAm (main hub: São Paulo Brasil, e.g. Nubank, C6 Bank or Creditas),

the European Union (main hubs in Paris, e.g. Qonto, Sorare, Alan or Ledger, Amsterdam/The Hague, e.g. Adyen, Mollie, Mambu or Bunq, Berlin, e.g. N26, wefox or Trade Republic, Dublin, e.g. Stripeo or WordRemit and Vilnius Lithuania, e.g. Kevin, Nordigen or

Bankera), Scandinavia (main hub: Stockholm, e.g. Klarna) or Africa (main hubs in Johannesburg South Africa, e.g. Prosperian Capital or Pineapple, LagosNigeria, e.g. Opay, Flutterwave or Paga and Nairobi Kenia, e.g. Abacus or CarePay).

Upam, da bo to lahko dalo idejo o tem, kako bi lahko kategorizirali industrijo Fintech. Kot Fintech start-up je pomembno je vedeti, v katero kategorijo se uvrščate danes in katerim (sosednjim) kategorijam si prizadevate srednje- in dolgoročno.

Opportunistic pivoting might also be required. E.g. many Fintechs start in a disruptive model (competing against incumbents), but gradually transform to a partner/supplier model with incumbents. E.g. A lot of neobanks are focusing strongly on a BaaS model (e.g.

Starling bank “Starling as a Service” or Fidor bank) or certain PFM apps have switched in offering infrastructure and value-added services directly to banks (e.g. Tink or Cake). But the opposite can exist as well, i.e. Fintechs offering value-added services

can become so successful, that they can start expanding to all banking services and products.

Očitno vsaka kategorija ima svojo zapletenost. A business model based on an improving of existing products and services means a lot of competition and thus a lot of upfront investment to stand out of all other players (cfr. neobanks),

while alternative or innovative products mean less competition, but require a challenging and pioneering journey (on technology, marketing and legal/regulatory domains) of convincing customers of the need of the product (shaping a new market).

Oglejte si vse moje bloge https://bankloch.blogspot.com/

- ant finančni

- blockchain

- blockchain konferenca fintech

- chime fintech

- coinbase

- coingenius

- kripto konferenca fintech

- FINTECH

- fintech aplikacija

- fintech inovacije

- Fintextra

- OpenSea

- PayPal

- paytech

- plačilna pot

- platon

- platon ai

- Platonova podatkovna inteligenca

- PlatoData

- platogaming

- razorpay

- Revolut

- Ripple

- square fintech

- trak

- tencent fintech

- fotokopirni stroj

- zefirnet