Ocena IPO (1.75 od 5.0 zvezdic)

Copyright@http://lchipo.blogspot.com/

Sledite nam na Facebooku: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Datum

Odprto za prijavo: 27. 02. 2020

Konec prijave: 06

Datum objave: 18

Osnovni kapital

Tržna kapitalizacija: 84 milijonov RM

Total Shares: 300mil shares (Public :15 mil, Company Insider/Miti/Private Placement: 43 mil)

ŽELITE POSTATI PARTNER

Distribution of electrical products and accessories.

Industrial User: 74.46%

Reseller: 25.54%

Temeljni

Trg: Ace Market

Cena: 0.28 RM (EPS: 0.0247)

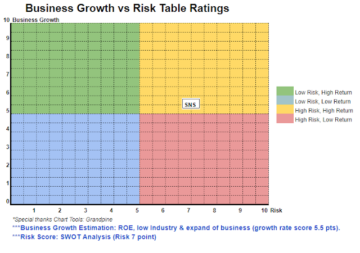

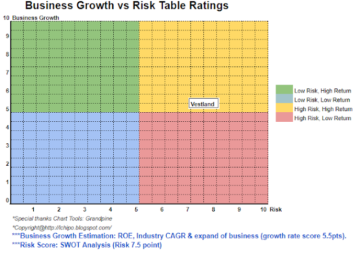

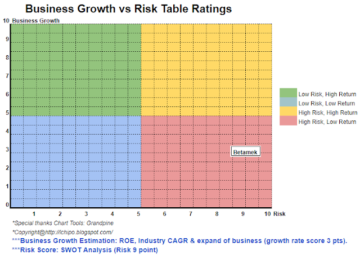

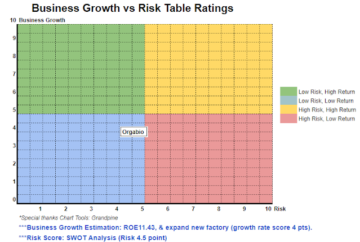

P/E & ROE: PE11.34 (Prospectus book is) ROE13%

Gotovina in vezani depozit po IPO: 0.05 RM na delnico

NA po IPO: RM0.19

Total debt to current asset after IPO: 1.644 (Debt: 63.657 mil, Non-Current Asset: 38.712 mil, Current asset: 81.368mil)

Politika dividend: Politika dividend ni fiksna.

Finančno razmerje

Terjatev do kupca: 80 dni

Obveznost do trgovanja: 103 dni

Obrat zalog: 105 dni

Pretekla finančna uspešnost (prihodek, EPS)

2019 (until Nov): RM104.084 mil (EPS: 0.0237)

2019: 134.373 milijona RM (EPS: 0.0275)

2018: 124.193 milijona RM (EPS: 0.0173)

2017: 114.509 milijona RM (EPS: 0.0153)

Marža čistega dobička

2019: 5.52%

2018: 4.03%

2017: 3.89%

Po IPO Delničarstvo

Ir. Tang Pee Tee @ Tan Chang Kim: 62.79%

Jin Siew Yen: 7.85%

Tan Yushan: 7.85%

Prejemki direktorjev za poslovno leto 2021 (od bruto dobička 2019)

Ir.Tang Pee Tee: RM0.502 mil

Tan Yushan: RM0.437 mil

Chai Poh Choo: RM0.218 mil

Yap Koon Roy: RM68k

Dr.Tee Chee Ghee: RM68k

Ir. Dr.Ng Kok Chiang: RM56k

Skupni prejemki direktorja iz bruto dobička: 1.349 milijona RM ali 6.07 %

Prejemki ključnega vodstva za poslovno leto 2021 (od bruto dobička 2019)

Ooi Gin Hui: RM250k-300k

Chong Su Yee: RM150k-200k

Lim Lee Hua: RM150k-200k

Low Swee Ching: RM150k-200k

Foong Kah Hong: RM150k-200k

key management remuneration from gross profit: RM0.85mil-RM1.1 mil or 3.83%-4.95%

Uporaba sklada

New Sales Outlet: RM4.2 mil (25.86%)

New head office & distribution in Johor: RM2.5 mil (15.39%)

Purchase new trucks & upgrade IT system: RM2 mil (12.32%)

Working Capital: RM4.24 mil (26.11%)

Listing expenses: RM3.3 mil (20.32%)

% CAGR v industriji

Cables & wires CAGR: 0.4% (2015-2019)

Electrical Distribution, Protection, & Control Devices: 16.5% (2015-2019, *2019 drop -5.8%)

Lighting Equipment: -0.6% (2015-2019)

Sklepi

Dobra stvar je:

1. PE11.34 & ROE13% is reasonable.

2. Set up new sales outlet & office will impove sales but will not have fast impact on revenue.

Slabe stvari:

1. Debt to currnet asset ratio is high.

2. No fix dividend policy.

3. Revenue grwoing around 8% per year, but after deduct inflation will have only little improvement.

3. Net profit margin is low than 10%.

4. Director fee is expensive.

5. CAGR% of their industry grow rate is not at healthy level.

6. Listing expenses 20.32% is too expensive.

7. Doesn’t explain more on how to improve business line with online sales, because business should not too depend on normal distribution method.

Sklepi

Is not a attractive IPO. Unable to expect high grow in the company revenue in 1-2 year.

IPO cena: 0.28 RM

Dober čas: 0.32 RM (13 PE)

Slab čas: 0.19 RM (PE8)

*Valuation only valid until new quarter result release. Reader should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.

Source: http://lchipo.blogspot.com/2020/03/aco-group-berhad.html

- dodatna oprema

- okoli

- sredstvo

- BP

- poslovni

- CAGR

- Kapital

- podjetje

- Trenutna

- Dolg

- naprave

- Direktor

- dividenda

- Drop

- oprema

- Stroški

- FAST

- finančna

- fiksna

- sledi

- skupina

- Grow

- Glava

- visoka

- domače naloge

- Kako

- Kako

- HTTPS

- vpliv

- Industrija

- inflacija

- IPO

- IT

- Stopnja

- vrstica

- seznam

- upravljanje

- net

- na spletu

- spletna prodaja

- politika

- Cena

- Izdelki

- Dobiček

- zaščita

- javnega

- Bralec

- prihodki

- prodaja

- nastavite

- Delnice

- sistem

- čas

- Tovornjaki

- us

- vrednost

- leto

- Yen