On-chain information exhibits the Bitcoin alternate whale ratio has remained at a excessive worth just lately, an indication that could possibly be bearish for the crypto’s worth.

Raportul de balene de schimb Bitcoin pe punctul de a intra în zona de „risc foarte ridicat”.

După cum este definit de un analist într-un CryptoQuant post, the 72-hour MA whale ratio is close to 0.90, the very excessive threat zone.

"raportul de schimb de balene” is an indicator that’s outlined because the sum of high ten inflows to exchanges divided by the full inflows.

In easier phrases, this metric tells us what a part of the full inflows are contributed by the ten largest transactions, which usually belong to the whales.

When the worth of this indicator is above 0.85, it means whales occupy a really massive share of alternate inflows proper now.

As traders often switch their Bitcoin to exchanges for promoting functions, such a development could be a signal that whales are dumping între timp.

The indicator’s worth often stays above this threshold throughout BTC bear markets, or faux bull for mass dumping.

Citire asemănătoare Volumul de tranzacționare cu Bitcoin scade din partea de sus recent

On the opposite hand, values beneath the 0.85 mark often signify that whale inflows are at the moment in a more healthy steadiness with the remainder of the market. The ratio’s worth often stays on this area throughout bull runs.

Now, here’s a chart that exhibits the development within the Bitcoin alternate whale ratio (72-hour MA) over the previous couple of months:

It seems just like the indicator has been at a excessive worth just lately | Source: CryptoQuantity

As you may see within the above graph, the Bitcoin alternate whale ratio has a price of about 0.89 proper now, above the 0.85 threshold.

According to the quant within the submit, values above 0.90 could also be thought-about the “very high risk” zone. So, the present worth of the indicator may be very near that.

Citire asemănătoare Investitorii se pot aștepta la un dezavantaj pentru piața Bitcoin și Ethereum pentru următoarele 3 luni

In this month thus far, the ratio’s worth has virtually at all times remained above the 0.85 line, with a few spikes above the 0.90 stage.

The analyst believes whales are lively proper now because of the FED May Meeting Minutes, and if the ratio stays excessive within the close to future, then it might spell hassle for Bitcoin.

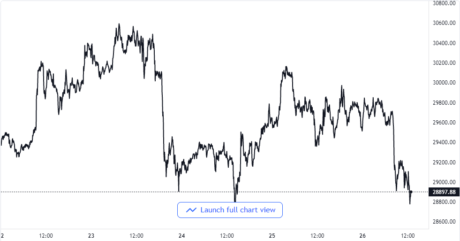

Prețul BTC

La momentul scrisului, Prețul lui Bitcoin floats round $28.8k, down 2% within the final seven days. Over the previous thirty days, the crypto has misplaced 30% in worth.

The beneath chart exhibits the development within the worth of the coin during the last 5 days.

Seems like the value of the coin has plunged down during the last couple of days | Source: BTCUSD pe TradingView

Imagine prezentată de pe Unsplash.com, diagrame de pe TradingView.com, CryptoQuant.com

Mesaj Raportul de balene continuă să rămână la o valoare ridicată a apărut în primul rând pe Încărcare Bitcoin.

- 8k

- Despre Noi

- TOATE

- analist

- ZONĂ

- de urs

- consideră că

- Bitcoin

- Prețul Bitcoin

- BTC

- Grafice

- Monedă

- continuă

- Contribuit

- ar putea

- Cuplu

- cripto

- Dezvoltare

- jos

- în timpul

- ethereum

- schimb

- Platforme de tranzacţionare

- Exponatele

- aștepta

- fed-

- First

- Complet

- funcții

- viitor

- Înalt

- HTTPS

- informații

- IT

- cea mai mare

- Linie

- LINK

- marca

- Piață

- pieţe

- masiv

- mijloace

- Reuniunea

- ar putea

- nepotrivit

- Lună

- luni

- mai mult

- În apropiere

- parte

- Expresii

- imagine

- prezenta

- precedent

- preţ

- Citind

- a ramas

- rotund

- Distribuie

- So

- Etapă

- şedere

- Intrerupator

- spune

- prag

- de-a lungul

- timp

- ori

- Comercianti

- Trading

- Tranzacții

- Unsplash

- us

- obișnuit

- valoare

- volum

- balene

- Ce

- în

- valoare

- scris