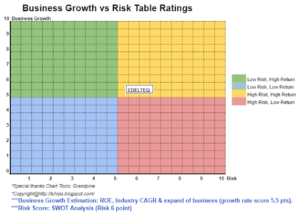

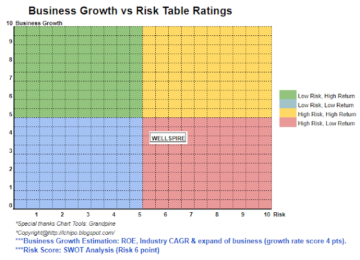

IPO Rating (1.75/5.0 Stars)

Copyright@http://lchipo.blogspot.com/

Urmărește-ne pe facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Data

Deschis pentru aplicare: 29

Aproape de aplicare: 10

Data afisarii: 23/07/2020

Capitalul social

Capitalizare de piață: 46.944 milioane RM

Total Shares: mil shares (Public apply:10.8 mil, Company Insider/Miti/Private Placement/other: 97.2mil)

Industrie

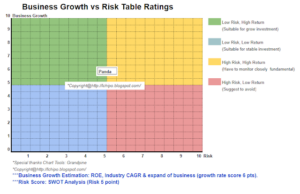

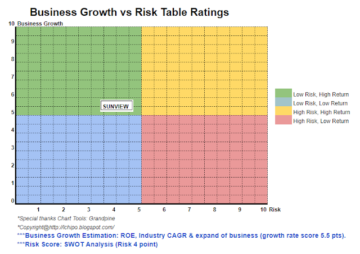

Property & construction segment have been in slow growth phase in Malaysia for this few years. However it still cannot category as sunset industry. I will be in temporary sleeping mode for industry growth.

**CAGR posted in Prospectus book using forecase 2019-2024, we decided do not take this as reference as it did not reflect true CAGR 5 year average of previous year result.

Competitor (Profit before tax margin)

TCS: 6.1% (PE5.75)

Gagasan: 15.2% (PE9.31)

GDB: 11.7% (PE12.92)

Inta Bina: 7.2% (PE5.9)

Afaceri

Construction services for buildings, infrastructure, civil and structural works in Malaysia.

Fundamental

Piața: Ace Market

Preț: 0.23 RM (EPS: 0.04)

P/E: PE5.75

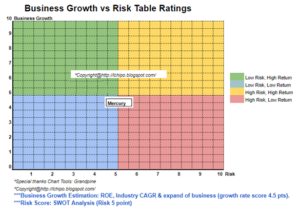

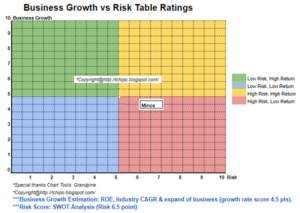

ROE: 26.5 (IPO pro Forma III)

ROE: 26.5 (2019), 16.6 (2018), 10.5(2017), 8.6 (2016)

Numerar și depozit fix după IPO: 0.0899 RM per acțiune

NA după IPO: 0.16 RM

Total debt to current asset after IPO: 0.86 (Debt:119.484 mil, Non-Current Asset: 39.607mil, Current asset: 138.962mil)

Politica de dividende: Nicio politică de dividende fixă.

Performanțe financiare anterioare (venituri, EPS)

2019: 358.424 milioane RM (EPS: 0.0435)

2018: 146.266 milioane RM (EPS: 0.0269)

2017: 71.718 milioane RM (EPS: 0.0172)

2016: 103.628 milioane RM (EPS: 0.0141)

Marja de profit net

2019: 4.37%

2018: 6.71%

2017: 8.63%

2016: 4.91%

După IPO Participarea

Dato’ Ir Tee Chai Seng: 59.07%

Datin Koh Ah Nee: 10.42%

Remunerarea directorilor pentru exercițiul financiar 2021 (din profitul brut 2019)

Dato’ Ir Tee Chai Seng: RM1.004 mil

Datin Koh Ah Nee: RM367k

Tan Sri Dato’ Sri Izzuddin bin Dali: RM75k

Dato’ Seri Ir Mohamad Othman Bin Zainal Azim: RM63k

Ooi Guan Hoe: RM63k

Remunerația totală a directorilor din profitul brut: 1.572 milioane RM sau 4.17%

Recurarea managementului cheie pentru FYE2021 (din profitul brut 2019)

Ooi Kee An: RM200k-250k

Yap Choo Cheng: RM200k-250k

Liew Kok Yoong: RM100k-150k

Ho Chee Woei: RM150k-200k

Koo Yoke Ping: RM50k-100k

Ng Lee Foong: RM50k-100k

key management remuneration from gross profit: RM1.05 mil or 2.78%

Utilizarea fondului

Purchase of new construction machinery and equipment: 62.80%

Capital de rulment: 20.29%

Cheltuieli de listare: 16.91%

Lucrul bun este:

1. Low PE, ROE26.5

2. ROE increase over pass few years.

3. Use 83.09% IPO fund to expand business.

4. Revenue have growth for pass 4 year.

5. Low interest environment will encourage property industry.

Lucrurile rele:

1. Compare to other competitor, profit margin not high & net profit margin less than 10%.

2. Direcrtor fee have a bit expensive.

3. Listing Expenses is expensive.

4. Unable to know the true industry CAGR for past 5 years.

5. Fără politică de dividende fixe.

Conclusions (Blogger is not wrote any recommedation & suggestion. All is personal opinion)

The industry of their business is on sleeping mode. As property & construction is growing slow in Malaysia for past few years. We still have many other good opportunities to allocate properly our capital for investment.

Preț IPO: 0.23 RM

Timp bun: 0.32 RM (PE8)

Timp prost: 0.16 RM (PE4)

*Evaluarea este doar opinie și viziune personală. Percepția și prognoza se vor schimba în cazul apariției unui nou rezultat trimestrial. Cititorul își asumă propriul risc și ar trebui să își facă temele pentru a urmări fiecare rezultat trimestrial pentru a ajusta prognoza valorii fundamentale a companiei.

Source: http://lchipo.blogspot.com/2020/07/tcs-group-holdings-berhad.html

- activ

- Pic

- BP

- afaceri

- CAGR

- capital

- Schimbare

- companie

- construcţie

- Curent

- Datorie

- FĂCUT

- Director

- dividend

- Mediu inconjurator

- echipament

- Extinde

- cheltuieli

- financiar

- Repara

- urma

- fond

- bine

- grup

- În creştere

- Creștere

- Înalt

- teme pentru acasă

- HTTPS

- Crește

- industrie

- Infrastructură

- interes

- investiţie

- IPO

- IT

- listare

- Malaezia

- administrare

- net

- Opinie

- Altele

- P&E

- performanță

- ping

- Politica

- preţ

- Pro

- Profit

- proprietate

- public

- Cititor

- venituri

- Risc

- Servicii

- Acțiuni

- Apus

- impozit

- temporar

- timp

- us

- valoare

- Vizualizare

- fabrică

- an

- ani