Payments unicorn Stripe has cut its internal validation by 11% to $63 billion, Informația raportată, citând o sursă familiarizată cu problema.

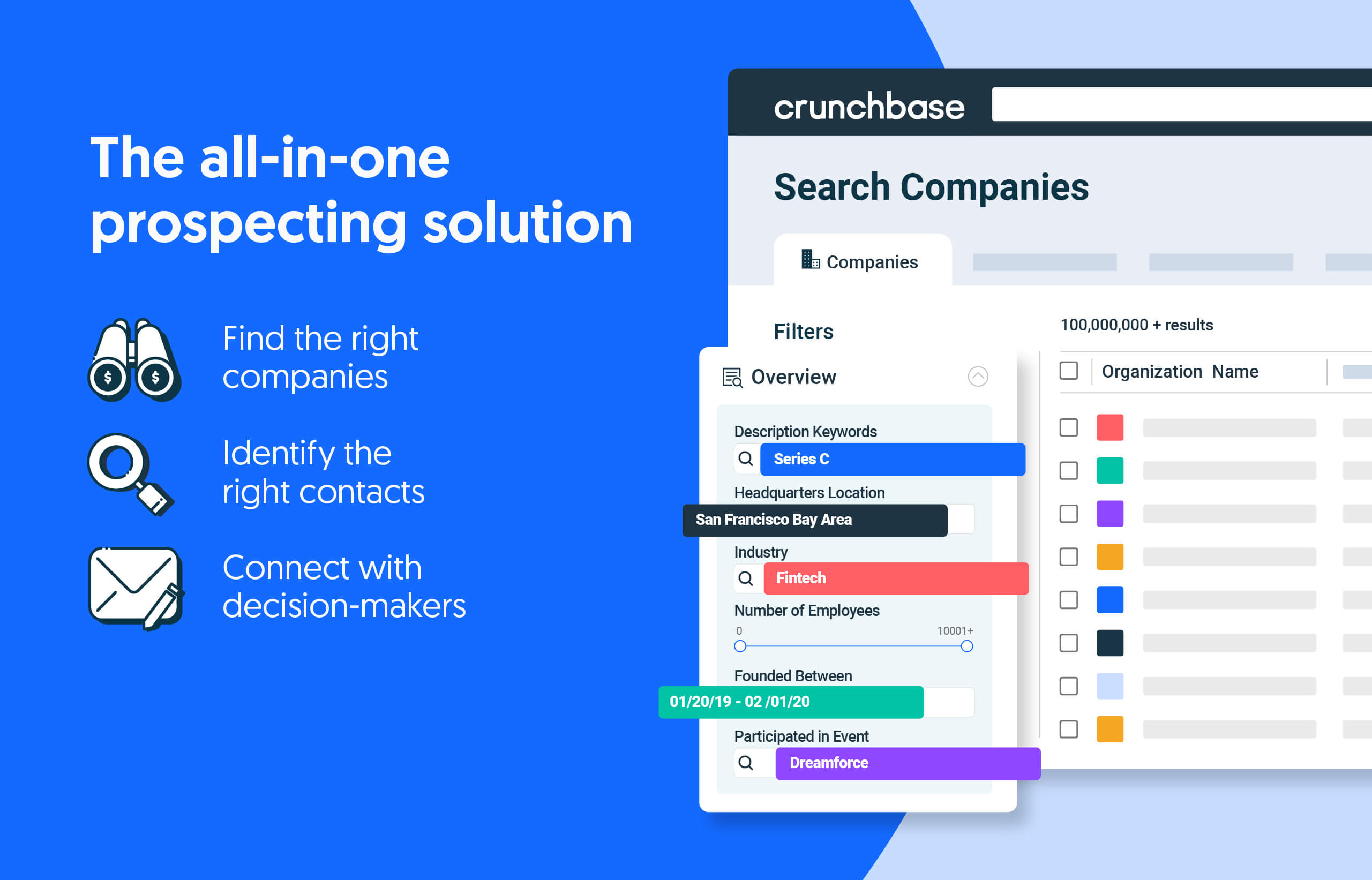

Caută mai puțin. Închideți mai mult.

Creșteți-vă veniturile cu soluții de prospectare all-in-one, susținute de liderul în datele companiei private.

Even at that valuation, the San Francisco-based company remains one of the most highly valued private companies in the world. But its latest price cut is indicative of the falling valuations for unicorn startups over the past year as companies and investors reset their expectations.

Global venture funding in 2022 fell 35% year over year (though still topped 2020 and every other year before). Late-stage startups have been particularly hard hit as public market turmoil stalls the IPO pipeline.

Stripe’s latest cut comes after it already trimmed its internal valuation last year by 28%, from $95 billion. Competitor Checkout.com slashed its internal valuation by 70% to $11 billion last year. Other unicorns, including cybersecurity startup Snyk and AI/ML platform developer Dataiku, have raised new money but at lower valuations, in what’s known as a down round. In one of the more dramatic examples, fintech unicorn Klarna last year saw its valuation plummet 86% to $6.7 billion in a new funding round.

Citire conexă

Ilustrare: Dom Guzman

Fiți la curent cu rundele de finanțare recente, achizițiile și multe altele cu Crunchbase Daily.

- Distribuție de conținut bazat pe SEO și PR. Amplifică-te astăzi.

- Platoblockchain. Web3 Metaverse Intelligence. Cunoștințe amplificate. Accesați Aici.

- Sursa: https://news.crunchbase.com/fintech-ecommerce/stripe-cuts-valuation-unicorn-shares/

- $ 6.7 de miliarde de

- 2020

- 2022

- 35%

- 7

- a

- achiziții

- După

- AI / ML

- toate intr-unul

- deja

- și

- înainte

- Miliard

- Închide

- Companii

- companie

- concurent

- acoperi

- CrunchBase

- Tăiat

- Securitate cibernetică

- zilnic

- de date

- Data

- Dezvoltator

- jos

- dramatic

- exemple

- aşteptări

- Cădere

- familiar

- FinTech

- din

- de finanțare

- runde de finanțare

- Greu

- extrem de

- Lovit

- HTTPS

- in

- Inclusiv

- informații

- intern

- Investitori

- IPO

- IT

- cunoscut

- Nume

- Anul trecut

- Ultimele

- lider

- Piață

- materie

- bani

- mai mult

- Nou

- Finanțare nouă

- ONE

- Altele

- în special

- trecut

- conducte

- platformă

- Plato

- Informații despre date Platon

- PlatoData

- fir cu plumb

- alimentat

- preţ

- Prețuri

- privat

- Companii private

- public

- Piața publică

- ridicat

- recent

- Finanțare recentă

- rămășițe

- venituri

- rotund

- runde

- San

- Distribuie

- prețurile acțiunilor

- soluţii

- Sursă

- lansare

- Startup-urile

- şedere

- Încă

- dungă

- lor

- la

- depasit

- inorog

- unicorni

- validare

- Evaluare

- Valuations

- prețuit

- aventura

- an

- Ta

- zephyrnet