- Traders increased expectations of an ECB rate cut in April.

- The dollar remained stable on Friday as traders assessed the impact of unexpectedly strong economic growth data.

- The dollar has seen a 2% increase this year due to declining Fed rate cut expectations.

On Friday, the EUR/USD outlook was bearish as traders increased their bets for an April rate cut, spurred by the ECB’s monetary policy meeting on Thursday. Despite maintaining interest rates at a record high of 4%, the ECB hinted at forthcoming discussions about rate cuts.

-Ești interesat să afli mai multe despre tranzacționarea opțiunilor valutare? Consultați ghidul nostru detaliat -

Policymakers, speaking after the meeting, indicated openness to a shift in stance at the next meeting. This paves the way for an early interest rate cut if upcoming data confirms inflation has eased. At the same time, traders have raised bets on a rate cut in April due to the recent remarks by policymakers. The ECB’s stance has boosted rate cut expectations. Moreover, it supports a bearish outlook for the euro.

On the other hand, the US dollar remained stable on Friday. Traders assessed the impact of unexpectedly strong economic growth data on the Fed’s rate trajectory. Additionally, they expect a key inflation gauge for further insights.

Official data on the advance GDP estimate revealed a 3.3% annual growth rate in the last quarter, beating the forecast of 2%. Furthermore, the report indicated a further easing of inflation pressures.

The dollar has seen a 2% increase year-to-date, reflecting a decrease in rate cut expectations compared to the end of last year. According to the CME FedWatch tool, there is a 50% probability of a rate cut in March, down from 75.6% one month ago.

Evenimente cheie EUR/USD astăzi

- Indicele prețurilor PCE de bază din SUA l/l

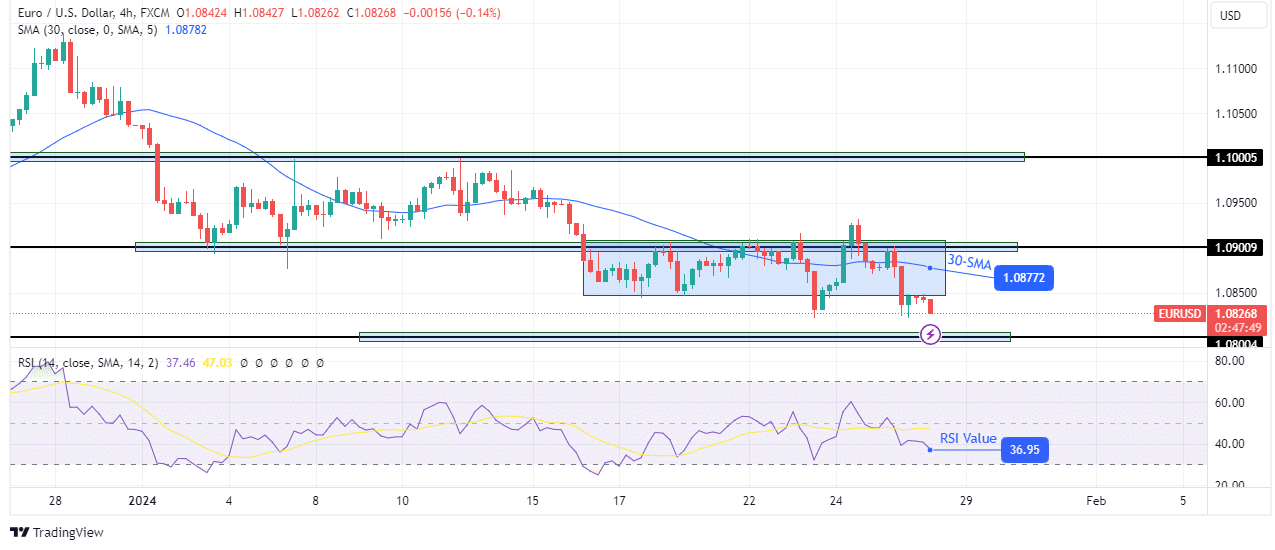

EUR/USD technical outlook: Bears break free from consolidation

On the technical side, EUR/USD has broken out of its consolidation area, retested the range support as resistance, and is now continuing its decline. The bearish bias has strengthened as the price has swung far below the 30-SMA. At the same time, the RSI has dipped further into bearish territory, nearing the oversold region.

-Dacă sunteți interesat să aflați despre scalping brokeri forex, apoi citiți instrucțiunile noastre pentru a începe-

Bears are currently targeting the nearest support at 1.0800. This level might trigger a pause or pullback to retest the 30-SMA before the downtrend continues. However, the price might breach 1.0800 without pausing if bears are strong enough.

Doriți să tranzacționați forex acum? Investește la eToro!

68% din conturile de investitori cu amănuntul pierd bani atunci când tranzacționează CFD-uri cu acest furnizor. Ar trebui să vă gândiți dacă vă puteți permite să vă asumați riscul ridicat de a vă pierde banii.

- Distribuție de conținut bazat pe SEO și PR. Amplifică-te astăzi.

- PlatoData.Network Vertical Generative Ai. Împuterniciți-vă. Accesați Aici.

- PlatoAiStream. Web3 Intelligence. Cunoștințe amplificate. Accesați Aici.

- PlatoESG. carbon, CleanTech, Energie, Mediu inconjurator, Solar, Managementul deșeurilor. Accesați Aici.

- PlatoHealth. Biotehnologie și Inteligență pentru studii clinice. Accesați Aici.

- Sursa: https://www.forexcrunch.com/blog/2024/01/26/eur-usd-outlook-traders-bet-on-ecb-rate-cut-in-april/

- :are

- :este

- 1

- 2%

- 75

- a

- Despre Noi

- Conform

- Conturi

- În plus,

- avansa

- După

- în urmă

- an

- și

- anual

- Aprilie

- SUNT

- ZONĂ

- AS

- evaluat

- At

- de urs

- Urșii

- înainte

- de mai jos

- Pariu

- pariuri

- părtinire

- amplificat

- încălcarea

- Pauză

- Spart

- by

- CAN

- CFD-uri

- verifica

- extensia CM

- comparație

- Lua în considerare

- consolidare

- continuă

- continuarea

- Nucleu

- În prezent

- Tăiat

- reduceri

- de date

- Refuzați

- Declinarea

- scădea

- În ciuda

- detaliat

- discuții

- Dolar

- jos

- două

- Devreme

- easing

- BCE

- Economic

- Crestere economica

- capăt

- suficient de

- estima

- EUR / USD

- Euro

- evenimente

- aștepta

- aşteptări

- departe

- fed-

- Pentru

- Prognoză

- Forex

- viitor

- Gratuit

- Vineri

- din

- mai mult

- În plus

- ecartament

- PIB-ul

- obține

- Creștere

- orientări

- mână

- Avea

- Înalt

- lăsat să se înțeleagă

- Totuși

- HTTPS

- if

- Impactul

- in

- Crește

- a crescut

- index

- indicată

- inflaţiei

- perspective

- interes

- RATA DOBÂNZII

- Ratele dobânzilor

- interesat

- în

- Investi

- investitor

- IT

- ESTE

- Cheie

- Cunoaștere

- Nume

- Anul trecut

- AFLAȚI

- Nivel

- pierde

- care pierde

- mentine

- Martie

- max-width

- Reuniunea

- ar putea

- Monetar

- Politică monetară

- bani

- Lună

- mai mult

- În plus

- Nearing

- următor

- acum

- of

- on

- ONE

- Sinceritate

- Opţiuni

- or

- Altele

- al nostru

- afară

- Perspectivă

- pauză

- pauză

- Paves

- pc

- Plato

- Informații despre date Platon

- PlatoData

- Politica

- factorii de decizie politică

- preţ

- probabilitate

- furnizorul

- trage

- Trimestru

- ridicat

- gamă

- rată

- tarife

- Citeste

- recent

- record

- reflectând

- regiune

- a ramas

- raportează

- Rezistență

- cu amănuntul

- Dezvăluit

- Risc

- RSI

- acelaşi

- văzut

- schimbare

- să

- parte

- vorbire

- stabil

- atitudine

- întărit

- puternic

- a sustine

- Sprijină

- Lua

- direcționare

- Tehnic

- teritoriu

- lor

- apoi

- Acolo.

- ei

- acest

- în acest an

- joi

- timp

- la

- instrument

- comerţului

- Comercianti

- Trading

- traiectorie

- declanşa

- viitoare

- us

- Dolar american

- a fost

- Cale..

- cand

- dacă

- cu

- fără

- an

- tu

- Ta

- zephyrnet