- China Big Tech is leading the current momentum-driven rally in China stock market.

- Supported by a weaker USD/CNH that broke below key near-term support of 7.2160.

- Further hints from China’s top policymakers that the prior 3-year of stringent regulatory crackdowns on China’s leading technology companies have ended.

- Current momentum-driven rally of China Big Tech may still see a bumpy ride due to a weak external demand environment.

Prior to yesterday’s release of the key US consumer inflation data for June that came out cooler than expected, China’s proxies stock indices have crept up higher since the start of this week; from Monday, 10 July to Wednesday, 12 July, the Index Seng Hang recorded a gain of 2.06%, Hang Seng Tech Index (+3.45%), Hang Seng China Enterprises Index (+2.3%).

A higher positive momentum intensity is being seen in the Hang Seng TECH Index which comprises China’s Big Tech firms that reintegrated back above its 50 and 200-day moving averages.

Also, a significant price action development in terms of relative momentum has taken shape on China’s Big Tech equities listed in the US stock exchanges (the ADRs) that have continued their outperformance over its peers, the US Big Tech since last week.

Relative positive momentum seen in China Big Tech

The KraneShares CSI China Internet exchange-traded fund (ETF) has recorded an accumulated gain of 8% since the week of 3 July 2023 till yesterday, 12 July over a return of +0.86% seen in the Nasdaq 100 over the same period.

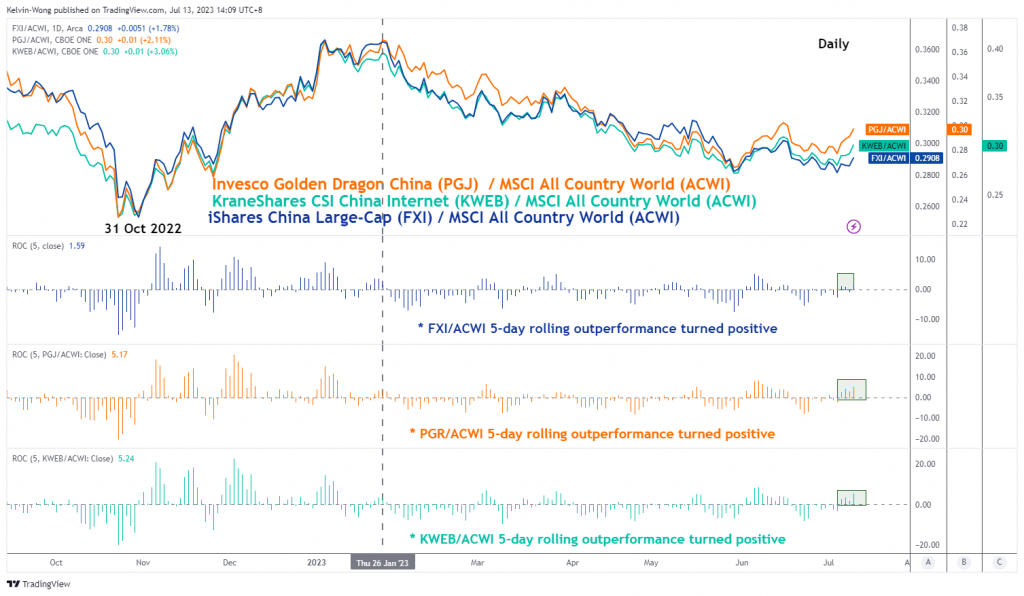

Fig 1: Relative momentum trends of KraneShares CSI China Internet ETF & other China equities ETFs as of 12 Jul 2023 (Source: TradingView, click to enlarge chart)

Also, positive relative momentum can also be seen against global equities, the ratio of the KranShares CSI China Internet ETF over the MSCI All Country World Index ETF has notched up four consecutive sessions of positive momentum readings based on a five-day rolling basis.

Inter-market and sentiment are likely the factors that are the key catalysts for the ongoing short-term outperformance since in China Big Tech that is driving the momentum-induced rally in the Hang Seng benchmark stock indices.

USD/CNH broke below 7.2160 support triggering a positive feedback loop into China equities

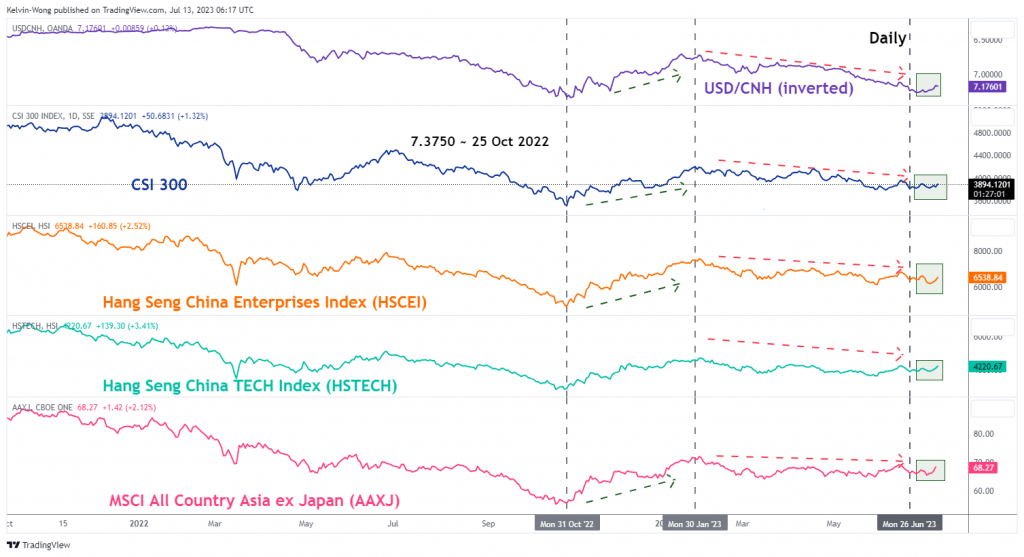

Fig 2: USD/CNH short & medium-term trends as of 13 Jul 2023 (Source: TradingView, click to enlarge chart)

Fig 3: USD/CNH correlation with HSCEI & HSCTECH as of 13 Jul 2023 (Source: TradingView, click to enlarge chart)

USD / CNH (offshore yuan) foreign exchange rate has a high degree of inverse correlation with the Hang Seng benchmark stock indices and China Big Tech theme play ETF; a rise in the USD/CNH (a weaker yuan) tends to see a fall the above-mentioned indices and ETF, and vice versa.

In the past five days, the USD/CNH has inched lower since its seven-month high of 7.2745 printed on 6 July and broke below key near-term support of 7.2160 (also the 20-day moving average that price actions have traded above it since 19 April 2023) on the onset of yesterday’s US CPI data release.

Also, reinforced by the narrowing of the premium of the US Treasury 2-year yield over China’s 2-year sovereign bond yield. These observations suggest a potential short-term downtrend phase is in progress for USD/CNH which triggers a positive feedback loop into the Hang Seng bench stock indices and China Big Tech equities.

More hints pointing towards the end of regulatory crackdowns for China’s Big Tech

In addition, Chinese Premier Li Qiang held a meeting yesterday, 12 July with senior management executives from China’s leading technology companies such as Alibaba Group, Meituan, ByteDance, and Xiaohongshu Technology to discuss how the business operations of the technology sector can help to promote growth in the current lacklustre internal demand environment seen in China.

During the meeting, Premier Li urged local governments to provide more support to these technology firms, labelling them as the “trailblazers of the era” and in turn, urged these technology firms to support the real economy through innovation. He added that the government will create a fair environment and reduce compliance costs in order to promote the sound development of the platform economy.

Hence, yesterday’s Premier Li meeting has solidified China’s top policymakers’ current stance since last Friday of a more hands-off approach towards China’s Big Tech especially in the e-commerce, fintech, and platform sectors, and an indication the prior three-year of stringent regulatory crackdowns on their business operations have ended.

A weak external environment may still put downside pressure on China’s growth

This latest rhetoric from the top man of China’s State Council is likely to boost positive animal spirits in the short-term at least. From a medium-term perspective, the external environment also needs to be taken into consideration when global interest rates are likely to stay at a higher level for at least till the second half of 2024 given the latest hawkish monetary policy guidance from major developed countries’ central banks, the Fed, ECB, and BoE.

Therefore, a higher cost of global funding environment is likely to be persistent throughout 2023 and stretch into early 2024 which may continue to put downside pressure on China’s economic growth which is evident in the latest exports data for June which has continued to contract deeper to -12.4% year-on-year from -7.5% recorded in May, its steepest drop since February 2020 and came in below expectations of -9.5%.

Hence, the current momentum-driven rally seen in the China Big Tech equities and Hang Seng benchmark stock indices may not oscillate in a smooth trajectory path.

Conținutul are doar scop informativ general. Nu este un sfat de investiții sau o soluție de cumpărare sau vânzare de valori mobiliare. Opiniile sunt autorii; nu neapărat cel al OANDA Business Information & Services, Inc. sau al oricăruia dintre afiliații, filialele, funcționarii sau directorii săi. Dacă doriți să reproduceți sau să redistribuiți orice conținut găsit pe MarketPulse, un serviciu premiat de analiză valutară, mărfuri și indici globali și site de știri, produs de OANDA Business Information & Services, Inc., vă rugăm să accesați fluxul RSS sau să ne contactați la info@marketpulse.com. Vizita https://www.marketpulse.com/ pentru a afla mai multe despre ritmul piețelor globale. © 2023 OANDA Business Information & Services Inc.

- Distribuție de conținut bazat pe SEO și PR. Amplifică-te astăzi.

- PlatoData.Network Vertical Generative Ai. Împuterniciți-vă. Accesați Aici.

- PlatoAiStream. Web3 Intelligence. Cunoștințe amplificate. Accesați Aici.

- PlatoESG. Automobile/VE-uri, carbon, CleanTech, Energie, Mediu inconjurator, Solar, Managementul deșeurilor. Accesați Aici.

- BlockOffsets. Modernizarea proprietății de compensare a mediului. Accesați Aici.

- Sursa: https://www.marketpulse.com/indices/china-stock-markets-momentum-driven-rally-watch-out-for-chinas-big-tech/kwong

- :are

- :este

- :nu

- $UP

- 1

- 10

- 100

- 12

- 13

- ani 15

- 15%

- 19

- 2020

- 2023

- 2024

- 50

- 7

- a

- Despre Noi

- mai sus

- acces

- acumulate

- Acțiune

- acțiuni

- adăugat

- plus

- ADR-uri

- sfat

- afiliate

- împotriva

- Alibaba

- TOATE

- de asemenea

- an

- analiză

- și

- animal

- Orice

- abordare

- Aprilie

- SUNT

- în jurul

- AS

- At

- autor

- Autorii

- Avatar

- in medie

- acordare

- înapoi

- Băncile

- bazat

- bază

- BE

- fiind

- de mai jos

- Benchmark

- Mare

- tehnologie mare

- BoE

- legătură

- a stimula

- Cutie

- Rupt

- accidentat

- afaceri

- operatiuni de afaceri

- cumpăra

- by

- bytedance

- a venit

- CAN

- catalizatorii

- central

- Băncilor Centrale

- Diagramă

- China

- Din China

- chinez

- clic

- COM

- combinaţie

- Mărfuri

- Companii

- conformitate

- cuprinde

- efectuat

- Conectarea

- consecutiv

- considerare

- consumator

- contactați-ne

- conţinut

- continua

- a continuat

- contract

- Corelație

- A costat

- Cheltuieli

- Consiliu

- ţară

- cursuri

- IPC

- date IPC

- reprimări

- crea

- CSI

- Curent

- de date

- Zi

- Mai adânc

- Grad

- Cerere

- dezvoltat

- Dezvoltare

- Directorii

- discuta

- dezavantaj

- conducere

- Picătură

- două

- e-commerce

- Devreme

- BCE

- Economic

- Crestere economica

- economie

- Elliott

- capăt

- mări

- Companii

- Mediu inconjurator

- aciunile

- mai ales

- ETF

- ETF-uri

- Eter (ETH)

- evident

- schimb

- Rata de schimb

- tranzacționat la bursă

- fond tranzacționat la schimb (ETF)

- Platforme de tranzacţionare

- directori

- aşteptări

- de aşteptat

- experienţă

- expert

- exporturile

- extern

- factori

- echitabil

- Cădea

- februarie

- februarie 2020

- fed-

- feedback-ul

- financiar

- Găsi

- FinTech

- firme

- cinci

- debit

- Pentru

- străin

- devize

- Forex

- găsit

- patru

- Vineri

- din

- fond

- fundamental

- de finanțare

- Câştig

- General

- dat

- Caritate

- interes global

- piețele globale

- Guvern

- guvernele

- grup

- Creștere

- îndrumare

- Jumătate

- Atârna

- Hang Seng

- Avea

- ulii

- he

- Held

- ajutor

- Înalt

- superior

- sugestii

- Cum

- HTTPS

- if

- in

- Inc

- index

- indicaţie

- Indici

- inflaţiei

- informații

- Inovaţie

- interes

- Ratele dobânzilor

- intern

- Internet

- în

- investiţie

- IT

- ESTE

- iulie

- iunie

- Kelvin

- Cheie

- etichetare

- Nume

- Ultimele

- conducere

- cel mai puțin

- Nivel

- nivelurile de

- li

- ca

- Probabil

- listat

- local

- LOWER

- Macro

- major

- om

- administrare

- Piață

- perspective de piață

- de cercetare de piață

- MarketPulse

- pieţe

- max-width

- Mai..

- Reuniunea

- Meituan

- Impuls

- luni

- Monetar

- Politică monetară

- mai mult

- în mişcare

- media mobilă

- medii mobile

- MSCI

- Nasdaq

- Nasdaq 100

- în mod necesar

- nevoilor

- ştiri

- numeroși

- of

- ofițerii

- on

- în curs de desfășurare

- afară

- Operațiuni

- Avize

- or

- comandă

- Altele

- afară

- Perspectivă

- peste

- pasionat

- trecut

- cale

- perioadă

- perspectivă

- perspective

- fază

- platformă

- Plato

- Informații despre date Platon

- PlatoData

- Joaca

- "vă rog"

- Politica

- factorii de decizie politică

- poziţionare

- pozitiv

- postări

- potenţial

- premier

- Premium

- presiune

- preţ

- ACȚIUNEA ACȚIUNII

- anterior

- Produs

- Progres

- promova

- furniza

- furnizarea

- scopuri

- pune

- raliu

- rată

- tarife

- raport

- real

- inregistrata

- reduce

- autoritățile de reglementare

- relativ

- eliberaţi

- cercetare

- cu amănuntul

- reveni

- Inversare

- Călări

- Ridica

- Rulare

- RSS

- acelaşi

- Al doilea

- sector

- sectoare

- Titluri de valoare

- vedea

- văzut

- vinde

- senior

- sentiment

- serviciu

- Servicii

- Sesiunile

- Modela

- partajarea

- Pantaloni scurți

- Pe termen scurt

- semnificativ

- întrucât

- Singapore

- teren

- netezi

- soluţie

- Suna

- Sursă

- suveran

- specializata

- Începe

- Stat

- şedere

- Încă

- stoc

- burse

- bursa de valori

- Piețele de acțiuni

- Strateg

- astfel de

- sugera

- a sustine

- luate

- tech

- Tehnic

- Analiza Tehnica

- Tehnologia

- companii de tehnologie

- Sectorul tehnologiei

- zece

- termeni

- decât

- acea

- Fed

- lor

- Lor

- temă

- Acestea

- acest

- în această săptămână

- mii

- Prin

- de-a lungul

- la

- la

- top

- față de

- firmei

- Comercianti

- Trading

- TradingView

- Pregătire

- traiectorie

- trezorerie

- Tendinţe

- declanșând

- ÎNTORCĂ

- unic

- us

- IPC din SUA

- Trezoreria SUA

- folosind

- v1

- viciu

- Vizita

- Ceas

- Val

- miercuri

- săptămână

- BINE

- cand

- care

- voi

- câștigător

- cu

- wong

- lume

- ar

- ani

- ieri

- Randament

- tu

- Yuan

- zephyrnet